The Explorers: Chalice Gold Mines’ Alex Dorsch on making millions from drilling… and when they might actually mine

Pic: Schroptschop / E+ via Getty Images

The Explorers is Stockhead’s in-depth look at the people behind some of Australia’s most innovative and courageous junior mining companies. This week, resources reporter Reuben Adams chats with managing director of Chalice Gold Mines, Alex Dorsch.

How can one company keep making so much money without actually mining anything?

For Chalice Gold Mines (ASX:CHN), the secret is multiple, well-timed asset sales.

Chalice currently holds about $34 million in cash and investments; it also hasn’t raised any capital since about 2011. Not your standard look for an early stage explorer.

It is this strong financial position that allows Chalice to chase certified company makers at Pyramid Hill in Victoria, and King Leopold in the Kimberley region of WA.

Dorsch tells us why Chalice’s Tier 1 greenfields focus is “bucking the trend”.

What’s so special about Chalice?

“Chalice floated in 2006 on the back of its namesake gold mine near Norseman in Western Australia. The mine was sold to Avoca Resources in 2007 — but that’s where the name comes from,” Dorsch says.

“Chalice’s real claim to fame came in 2012, when it sold its Zara gold project in Eretria, Africa, to a Chinese-Eritrean consortium for about $US115m.

“This was a good profit on an initial $8m acquisition, and it really helped capitalise the business.

“Since then, about a third of the proceeds from asset sales have been returned it shareholders, which is pretty unique in the exploration space.

“But we’ve also been able to preserve a very strong balance sheet, which is also very important.”

And you’ve acquired and sold other projects for a profit since then.

“Exactly. After Eritrea, we went into a gold project in Ontario, Canada called Cameron Lake. We generated about $15m profit from that transaction when we sold it.

“Then about a month ago we sold our project in Quebec for $12m CAD ($13.6m) in shares in Osisko Mining spin-off O3 Mining.

“We haven’t realised a profit there yet. But we are retaining upside exposure to that asset which could, in theory, help replenish our balance sheet again.”

That’s a lot of success in a short amount of time. What drives your project selection?

“We are only interested in making a Tier 1 discoveries. We aren’t interested in low margin operations with zero company making potential.

“Ultimately, we want to make a discovery that we can build a big, solid and profitable company on. That’s the mentality we use for project selection.”

Tell us about your Pyramid Hill project in Victoria.

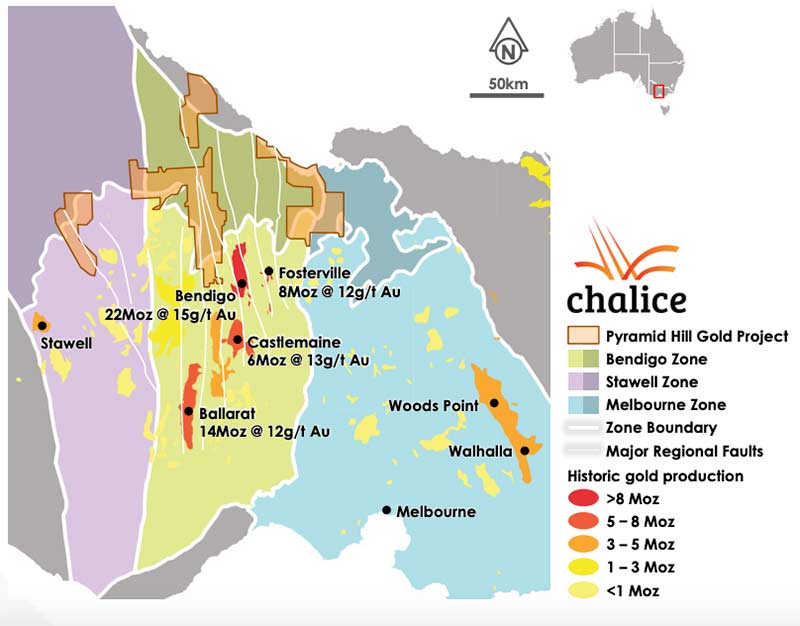

“We pegged about 1300sqkm to the north of the 18moz Bendigo gold field after the Swan Zone [532,000oz at 58.8g/t] at Kirkland’s world class Fosterville mine became well defined in 2017.

“And it was vacant. It was the most amazing thing; so much vacant ground in a province so well endowed with high grade gold.

“It was unbelievable.

“We assessed community aspects, geology, the mineability if we made a discovery and thought: ‘the prospects of finding something are pretty good’. That’s why we went in in such a big way.”

Was this untouched ground?

“Where we are drilling our two targets, Karrie and Ironbark, it’s very much virgin terrain. The blue-sky potential is very good.

“You don’t really get the opportunity to uncover a large high-grade gold system under shallow cover in Australia anymore. These opportunities are rare.”

Is it living up to your expectations so far?

“Absolutely. We’ve been working the ground for about 12 months. We initially set out to scout a huge area using very wide-spaced drilling.

“We are very happy with what we have seen. We did almost 40km of drilling in about six months. And we are starting to see anomalous gold readings over kilometres of strike, which is really satisfying our ‘large scale potential’ threshold.”

What does that anomalous gold tell you? That you’re on top of something big deeper down?

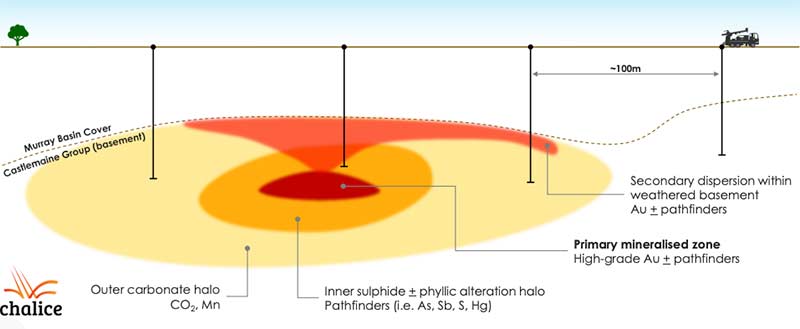

“Typically, the gold systems in the in the bedrock give off secondary dispersions into the weathered, top part of the bedrock.

“As well as that secondary dispersion you get a sort of ‘plume’ of gold and associated pathfinder metals which are found quite far from the actual gold lodes.

“This is exactly what we are looking for; the anomalous gold intervals over consecutive holes, many kilometres apart. We are really pleased we achieved that in our first phase of drilling.”

How do you go about zeroing in on the primary mineralisation?

“We do tighter spaced grid drilling in the areas where we see continuous anomalism over many kilometres of strike. In theory, that should outline the areas where we can go deeper with the drill bit.”

Does success at Fosterville tell you anything about the geology at Pyramid Hill?

“I have had lots of conversations about that with people. All the gold deposits in Victoria are similar in some ways, but different in others.

“The common thread is that they are all structurally controlled by these big, big, regional faults.

“Fosterville is stacked between two parallel westerly dipping faults. We may have instances where we find a similar type of structural setting, but at the moment we don’t use a specific model to predict what we’re going to find — we keep an open mind.

“It’s too early to say whether we have a discovery on our hands, but we are seeing exactly what we wanted to see at this point.

“This project is no longer just a conceptual play. We’re making progress.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

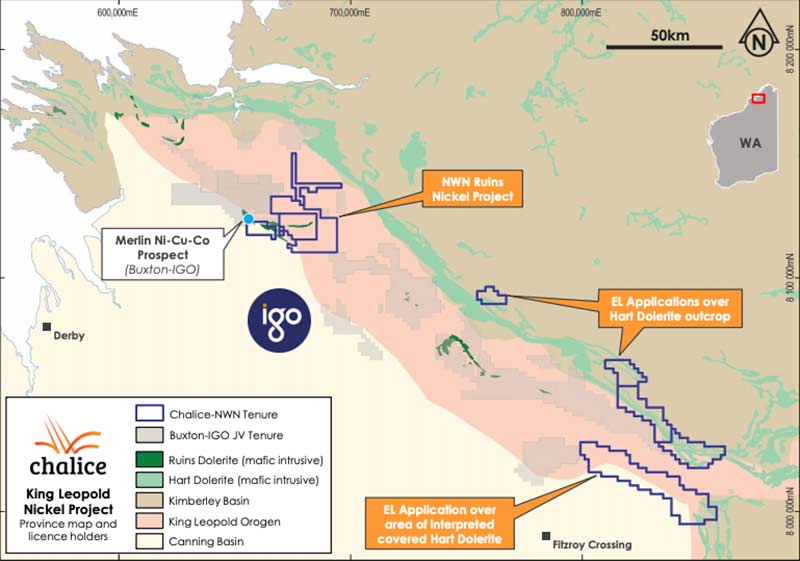

And you’ve recently moved up into another frontier region through the King Leopold nickel project acquisition. What excites you about this area of the Kimberley?

“King Leopold was a conceptual play, but we also knew that Buxton Resources had made the Merlin nickel discovery in 2015 — so it’s not like people didn’t know about the district’s potential.

“But around the same time major miner IGO made a more definitive move into the province we saw an opportunity to move in right next door to Merlin.

“We see the King Leopold Oregon — that part of the world — as another Albany Fraser [home to IGO’s Nova nickel-copper-cobalt mine].

“Conceptually that’s what we think, and it’s what IGO are thinking — that it could be another magmatic nickel sulphide province.”

in the frontier and largely

unexplored King Leopold Orogen of the west Kimberley.

What’s the exploration history of the King Leopold project?

“It’s completely greenfields. The private company we purchased completed a partial EM survey, but the other areas are essentially completely untouched.

“One of the main reasons for that is that it’s within a military training area called Yampi Sound, which has been off-limits to explorers for decades. Now, we have an access agreement we can do the first-ever bit of geophysics on that ground.

“Other than what Buxton have achieved at Merlin there has been limited work done in the region. On our ground, there has been no modern-day exploration looking for nickel sulphides.

“Our drilling at Leopold in September will be first pass, RC drill holes into the better EM targets.”

For you personally – is this sort of early stage exploration exciting?

“Absolutely. I think they are both bloody exciting projects.

“I think what we’re doing is bucking the trend a bit. There’s been a real saturation of the brownfields [previously mined] exploration space.

“We really feel the need to go to new provinces, break new ground, and make these big new discoveries; as clichéd as that sounds.”

And you’re in the enviable position of having a lot of cash, which means you can comfortably focus on those massive, conceptual targets.

“We can do things that the typical junior can’t — that’s for sure.”

Do you ever want to mine, or are you happy proving up a big project and selling it off?

“We get asked that quite a bit. Ultimately, it comes down to the project. Our niche is the ‘incubator’ model of exploration.

“But if we make a monster, company-making discovery we may consider mining it. It comes down to getting the best return for our shareholders.”

Where would you like to be this time next year at Pyramid Hill and King Leopold?

“I’d love to have a discovery hole in Victoria to talk about. When I say discovery hole, I mean economic grade gold mineralisation over decent width.

“And exactly the same for King Leopold – I’d love to have a high-grade nickel intercept to talk about.

“But who knows – you have to be a bit lucky in the exploration game. We don’t want to get ahead of ourselves, we have to wait for the results. The results will do the talking.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.