The Explorers: Encounter’s Will Robinson on how to find those big Tier 1 discoveries

Pic: Tyler Stableford / Stone via Getty Images

The Explorers is Stockhead’s in-depth look at the people behind some of Australia’s most innovative and courageous junior mining companies. This week, resources reporter Reuben Adams chats with managing director of Encounter Resources, Will Robinson.

Encounter Resources (ASX:ENR) is a small cap looking for massive, Tier 1 discoveries in Western Australia.

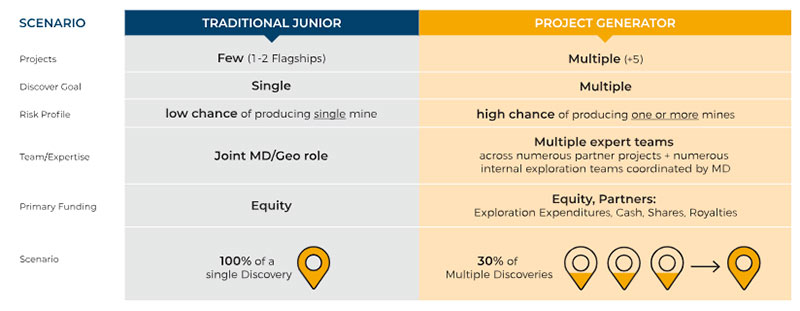

Encounter is a project generator – which means it partners with cashed-up miners who fund much of the expensive project exploration and development costs.

These guys have joint ventures with $20 billion market cap Newcrest (ASX:NCM) in the Tanami-West Arunta region, and $2.88 billion market cap Independence Group (ASX:IGO) in the super-hot Paterson Province.

This is where Rio Tinto recently revealed its big Winu copper discovery.

In the Tanami-West Arunta project alliance with Newcrest, five joint venture projects will be the subject of exploration work later this year.

Three of these – Selby, Watts and Lewis – are being fast-tracked.

Here’s what Will Robinson told us about the company’s big plans.

What’s the Encounter strategy?

“Encounter Resources has been a dedicated greenfields explorer and project generator listed on the ASX for over 10 years.

“We are a small, really high calibre team focused on cutting-edge greenfields exploration to potentially uncover large, intergenerational mines.

“To do that Encounter is focused on developing partnerships with major miners to share risk and maximise the exploration dollar for our shareholders.

“These joint ventures give us both the technical expertise and the balance sheet capabilities to tackle the frontier, undercover-type exploration.

“This is where you find the kind of deposits that make a difference to major miners.

“And if they make a difference to the majors, then they are going to very good for our shareholders.”

Why is prospect generation a better model for exploration?

“You get to go after the really major targets, you can have a stake in a major discovery.

“But without a big balance sheet behind you that is a difficult thing to do as a junior explorer.

“For explorers, raising money from the market usually means lowering your eyes a bit and focusing on things that are a bit smaller scale.

How many active projects do you have on the go?

“At the moment we have five joint ventures with Newcrest in the Tanami and West Arunta, covering almost 6000sqkm. In the Paterson we have copper partnership with Independence Group which covers just under 1000sqkm.

“We also have a pipeline of earlier stage opportunities, and we will actively talk with parties about bringing them on when the time is right.”

Do prospect generators require more technical approach to exploration?

“Having a technical approach to exploration is key, whether you’re focussing on brownfields or greenfields. But prospect generating does give you an ability to apply new technologies to new areas where people haven’t been before.”

“We apply new thinking and new technologies in areas where previous prospecting or geochemical methods may not have worked.”

“If you look at the history of Australian mining, 90 per cent of discoveries have been made through prospecting or [surface] geochemistry.

“The next wave of big discoveries is going to be under cover. These are the discoveries that are being made at the moment.

“I think we are going to see a a period of exploration success for the whole industry — success probably not seen since the late 1980s or early 1990s.”

Has there been a real uptick in joint venture deals between pure explorers and the mining majors?

“There’s no doubt that major companies are looking to restock their pipeline with new opportunities. For several years they scoured the world for acquisitions; now they are moving back into greenfields exploration in a big way.

“We have seen partnerships between South32 and AusQuest, Oz Minerals and Red Metal, and Encounter with Newcrest and Independence, amongst others.

“At the moment, if a junior has a project with scale there are majors looking to joint venture.”

Encounter was exploring the Paterson before it was cool. What attracted you to that region?

“We were looking for copper opportunities as part of a project generation exercise in 2008-2009.

“Why were we attracted to the area? There’s a 30-million-ounce gold-copper deposit at Telfer and 2 million tonne copper deposit at Nifty – both were discovered as an outcrop, meaning the mineralised rocks were visible at surface.

“But 95 per cent of this region is dominated by vast areas of sand, which can effectively conceal the next major intergenerational mine.”

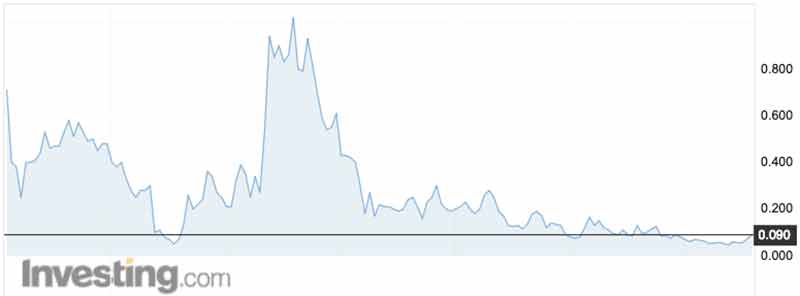

The Encounter share price spiked in 2010 when you discovered high grade copper in the Paterson, but then nothing really came of it. What happened?

“We went out to a new area and found some pretty spectacular high-grade copper intersections early on in the piece. For all intents and purposes, it was going to be a pretty exciting discovery. The anomaly itself stretches over 14km, it has the footprint of a world class mineral belt.”

“But then we went on to find areas of high grade without any thickness, or thickness without grade. It’s a big body of metal that we just haven’t figured out yet.

“We are still trying to pull it apart, which is why having a partner like Independence Group on board, both there and further north, is so important.

“We have some new ideas and geophysical methods we are applying to really try and understand the basin and where the best opportunities lie.”

How does the Project Generation Alliance with Newcrest work?

“If we identify a project in a certain area – an area that we can’t disclose — we bring it to the Newcrest, and they make a decision to be involved or not.

“It was an idea that happened over a cup of coffee between Peter Berwick and the head of Asia Pacific for Newcrest at an explorers conference two years ago. At the time, I never thought we would still be here two years later with 4500sqkm of granted tenure, five joint ventures and another 1500sqkm in application.

“It’s been an amazingly fast exercise in identifying and securing opportunities and then putting together the exploration plans.

“That’s why I’m so excited about this year. It will be the first on ground expenditure at these projects, and there are some pretty high-quality targets there. We are right amongst it.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

As a prospect generator what is your ideal endgame?

“To have stakes in a suite of major discoveries, where the majors are funding mine developments or buying out our remaining interest.

“When big discoveries happen, like at Doolgunna or Nova, a lot of the values accretes to the company that was involved in the early discovery stage. Once it becomes clear that there is going to be a mine built these explorers are already seeing value in an increasing share price.

“There is so much demand in the mid-tier and major mining space for large projects that you could easily fund your own position [through to production]. Or you could sell out and go find the next one.

“We are in two of the hottest jurisdictions in Australia right now, the Paterson and the Tanami. The chance of finding being another big deposit is very real.”

NOW WATCH:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.