Gold: EganStreet jumps 26pc on big Silver Lake takeover offer

Nathan Vardy of the Geelong Cats leaps the pack (Photo by Michael Dodge/Getty Images)

This morning, $1.22 billion market cap gold miner Silver Lake Resources (ASX:SLR) lobbed an attractive takeover bid at high grade success story EganStreet Resources (ASX:EGA).

Silver Lake acquired fellow miner Doray Minerals earlier this year to create a bigger, multi-asset producer, and now expects to produce up to 230,000oz gold equivalent in FY20.

The miner also has $131.1m in the bank and no debt, which leaves it well positioned to “efficiently fund the next generation of high-grade mines and new opportunities”.

Which is where EganStreet comes in. Today’s deal values EganStreet at 40c per share or $52.2 million market cap.

This is a 28.9 per cent premium on the lasting closing price of 31c, and a 43.4 premium on to EganStreet’s 30-day volume weighted average share price (VWAP) of 27.9c.

It would also be its highest share price since listing, just under three years ago.

The EganStreet board and major shareholder Lion Selection (16.2 per cent) unanimously recommended the offer.

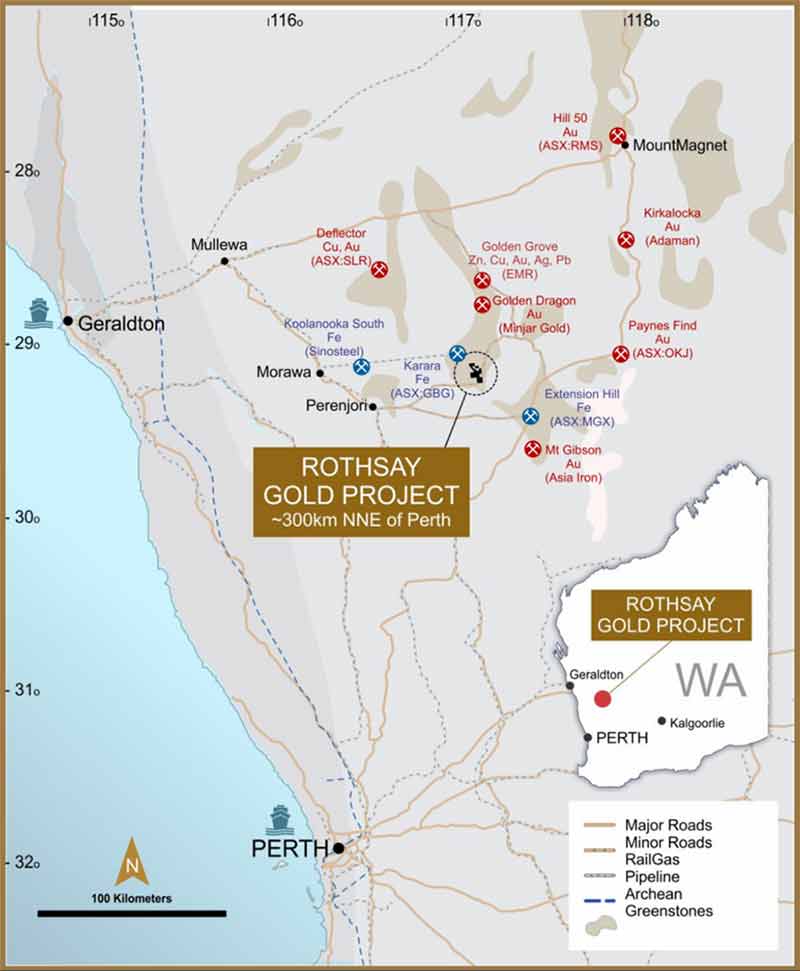

Since listing at 20c per share, EganStreet has focussed on its Rothsay project; a high-grade, underground development just 85km south-east of Silver Lake’s Deflector mine and processing hub in WA.

The small but very high grade Rothsay currently has a 454,000oz resource (1.5 million tonnes grading 9.2 g/t) and JORC reserves of 200,000oz (1.4 million tonnes grading 4.4 g/t).

Project studies estimated low start-up capex of around $55m for an initial 64,000oz operation, which would tip about $32m free cashflow each year into EganStreet’s coffers.

For Silver Lake, this acquisition means a new high-grade ore source for the Deflector processing facility. And for EganStreet shareholders the deal is an appealing one, says managing director Marc Ducler.

“After taking into consideration a range of factors including the current challenges in securing development funding for new projects in the junior gold sector and the risk profile involved with taking an asset into production, the board has resolved that the opportunity to combine with a substantial multi-asset gold producer with a strong operational track record in Silver Lake represents an attractive outcome,” Ducler says.

“This transaction will reward our shareholders for the progress achieved at Rothsay to date, while giving them exposure to a successful ASX-300 gold producer with a strong balance sheet, diversified production profile, mine development expertise, established systems and practices and installed infrastructure.

“This will significantly mitigate the development risk at Rothsay and provide exposure to a much larger and highly liquid Australian gold producer with the ability to attract an investment premium in the current strong Australian dollar gold market.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.