Hard landing? New winners will always emerge, and how to position your portfolio in any scenario

Experts

Experts

While recessions have obvious downsides, new research shows that recessions actually make people live longer.

A team led by MIT’s Amy Finkelstein found that the mortality rate for Americans dropped by 0.5% for every 1% rise in the unemployment rate.

The question, of course, is why.

The research paper postulated that a recession extends people’s lifetimes mostly by decreasing air pollution.

As we saw in 2020, air quality went up as people stopped driving to work. With more people out of work, offices also use less power and factories slow down output, substantially reducing deaths associated with air pollution.

What about the health of investors?

In the stock market, recessions could also bring benefits as new winners will always emerge.

Reece Birtles, chief investment officer at Martin Currie Australia, believes the consensus view in Australia is still that of a ‘Goldilocks’ soft landing (ie; no recession).

But he gave investors this warning.

“Our analysis of the data and management commentary is that there is more pain ahead, and the path is edging closer to a hard landing.”

Dividend stocks

For some time now, dividends from Australian stocks have been under pressure from falling cashflows.

The earnings environment and capex requirements in resources stocks (in particular) has led to a substantial reduction in dividend payout ratios across the board.

“In the current environment we believe that investors need to be very selective in the types of stocks that they rely on for producing income,” noted Birtles.

Commodities acting like recession

In resources space, we’ve seen a significant negative skew in revisions and prices.

“Much of this can be attributed to the notable changes to commodity price forecasts for coal, iron ore and Electric Vehicle (EV) materials during the period,” explained Birtles.

The slowing demand for EVs, pivot to hybrids in Europe, and excess build-out of battery and solar capacity in China, has also put pressure on the lithium price.

“Iron ore and steel are also under pressure from China demand and infrastructure spend question marks,” he said.

Artificial intelligence

Despite only modest earnings revisions, tech stock prices have continued to rise.

“Artificial Intelligence (AI) is obviously a big topic globally, and Australia’s ‘fabulous four’ are riding on the coattails,” said Birtles.

“Next DC (ASX:NXT) and Goodman Group (ASX:GMG) have genuine exposure to the AI theme with their data centre businesses.

“Xero (ASX:XRO) and WiseTech Global (ASX:WTC) are also doing quite well in terms of integrating AI into their businesses, creating bots that can automate processes,” he added.

Outside of so-called tech companies, AI is a driver that can improve operations. For example, usage scenarios include network optimisations for telecom companies, and improved efficiencies in travel companies and healthcare.

“Sonic Healthcare (ASX:SHL) talked about using AI for reducing human interaction for radiology and pathology. Brambles (ASX:BXB) talked about using AI in terms of tracking their pallets and knowing where things are,” said Birtles.

M&A buzz

We are seeing more M&A activity than normal. Inflation has made it cheaper to buy other companies than to build one from scratch.

“Replacement cost economics for things like new buildings, better shopping centres or offices, are just so expensive at today’s price. The Australian dollar is quite low, so Australian companies are looking quite attractive to offshore buyers,” Birtles said.

Examples of the recent M&A activity includes Alcoa bidding for Alumina (at a price that is well below replacement value), French company St Gobain bidding for CSR, and Seven Group taking out the minorities in Boral.

“There is also a bid for Altium from Japan’s Renesas Electronics, and Reliance Worldwide’s acquisition of Holman Industries in a bid to expand their market,” he added.

Heading into the earnings season in February, the market consensus looked to be betting on the soft-landing scenario, but after getting through the full season, and holding 100+ meetings, the investment team at Martin Currie Australia are not so sure.

“We feel that the relief that things were ‘not as bad as feared’ in the results has masked the deteriorating state of consumer health and the poor growth outlook, and now the cards in favour of a hard landing are starting to mount up,” says Birtles.

“This environment can be navigated, however, it is as important for investors to be discerning in their stock picking, focussing on the companies which have pricing power, resilient volumes, and capacity to manage margins, while avoiding stocks with valuation risk.

“We believe that now is the time for investors to evaluate the balance in their portfolios,” said Birtles.

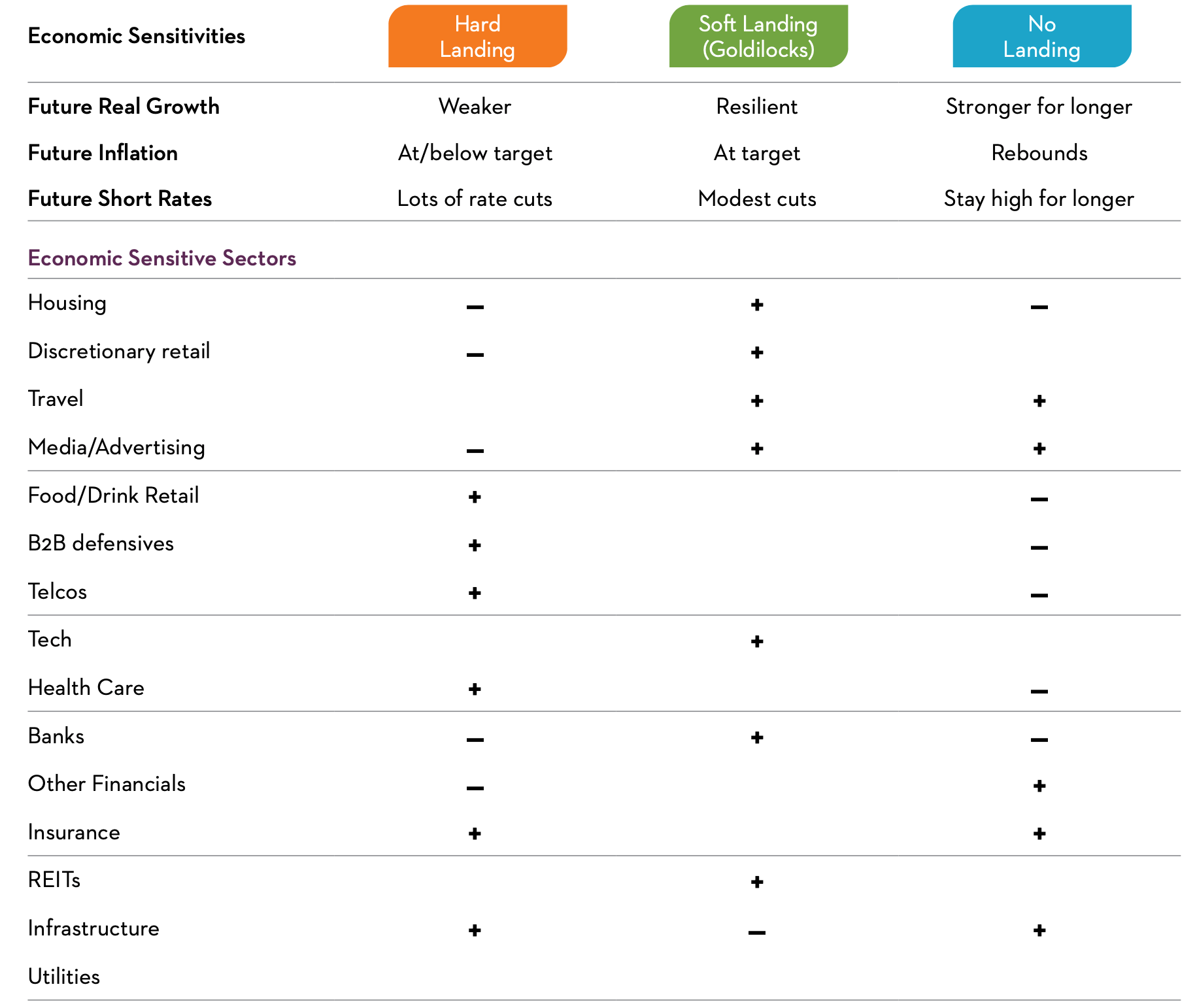

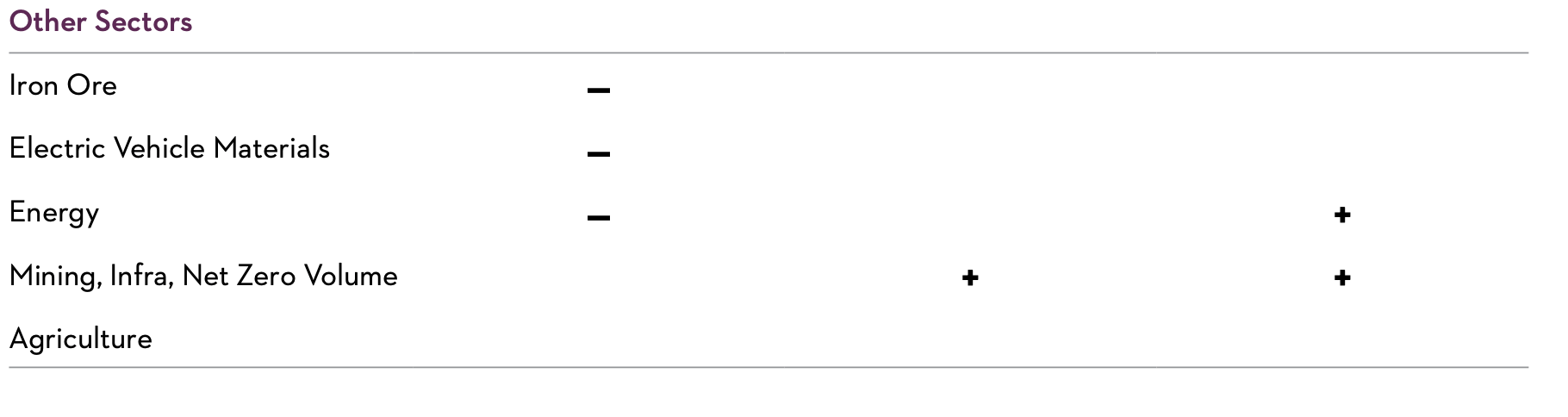

The table below highlights the key ASX sectors that Martin Currie believes would be the winners (+) and losers (-) in each scenario.

Probable winners and losers under each scenario

For the hard landing scenario, Birtles says Martin Currie is focused on companies that can grow earnings and dividends and have lower valuation risk.

“Medibank Private (ASX:MPL) is a good example of this, with earnings stability and resilience from a superior industry position, light capital intensity and high cash flow resulting in consistently strong profit margins.”

“We think that defensive inflation protection or stagflation protection is going to be quite important in a hard or soft-landing scenario.

“Stocks like Telstra (ASX:TLS), an essential service, and Aurizon (ASX:AZJ) excel in that protection with very resilient volumes and good pricing power, and in the case of Aurizon, inflation-linked returns.

“Under a no-landing, stronger for longer growth theme with higher rates, exposures to insurance stocks such as QBE Insurance (ASX:QBE) and Suncorp (ASX:SUN) do offer positive leverage.

“In all scenarios we also want to own names such as Worley, which we think has a compelling exposure to the energy transition, with 80% of their new business now in sustainability-type work in resources,” Birtles said.

The views, information, or opinions expressed in the interview in this article are solely those of the fund manager and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.