You might be interested in

Mining

Explorers Podcast: Arizona Lithium optimistic on bountiful brine

TSX

Canada Unearthed: TSX targets ASX companies for dual-listings in conviction mining juniors can prosper in Canada

Mining

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

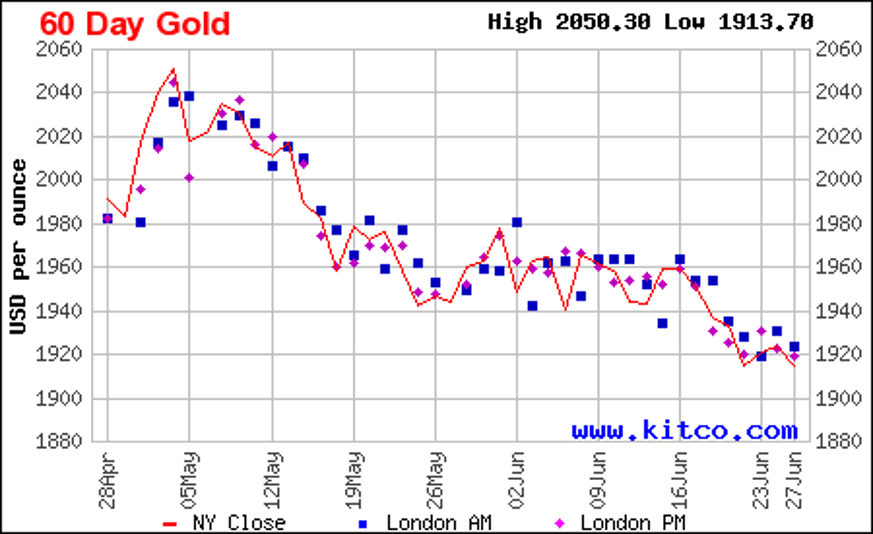

Gold (figure 1) was weaker overnight with spot prices hovering around US$1,910 per ounce with August gold delivery down US$11.20 to US$1,922.70 per ounce and July silver up US$11 to US$22.95/ounce. Rising US Treasury yields are putting pressure on gold as it continues its six-week downtrend.

On the domestic front, inflation appears to be easing with May coming in at 5.6% compared to 6.1% in April. This appears to be coincident with more of a “risk-on” appetite in junior resources which has been in a bear market from mid-April 2022.

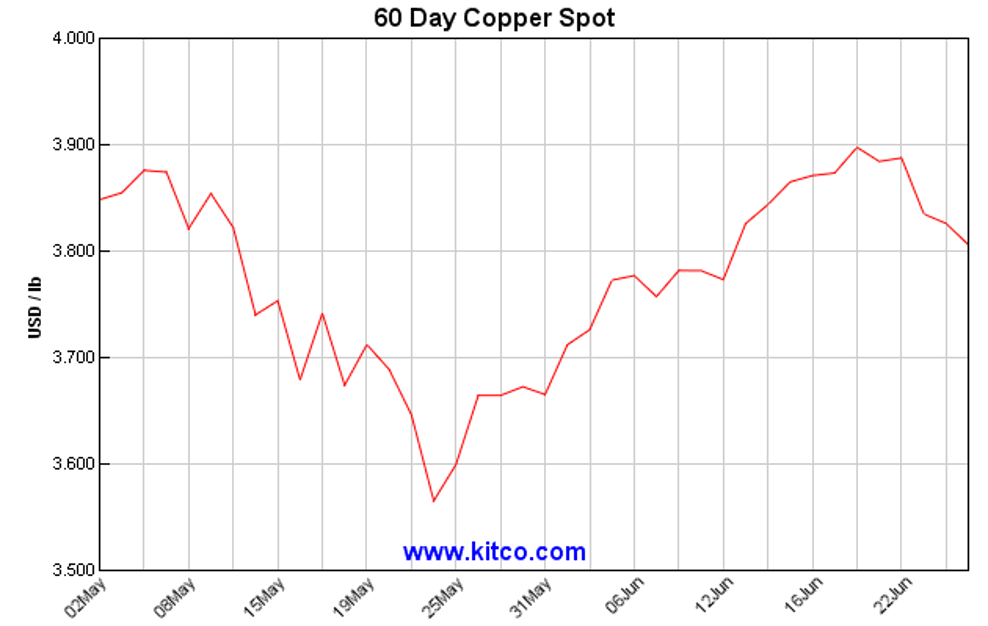

Base metals have continued to show weakness with July copper closing down 130 basis points to US$3.77/lb (figure 2) as economic news out of China continues to disappoint.

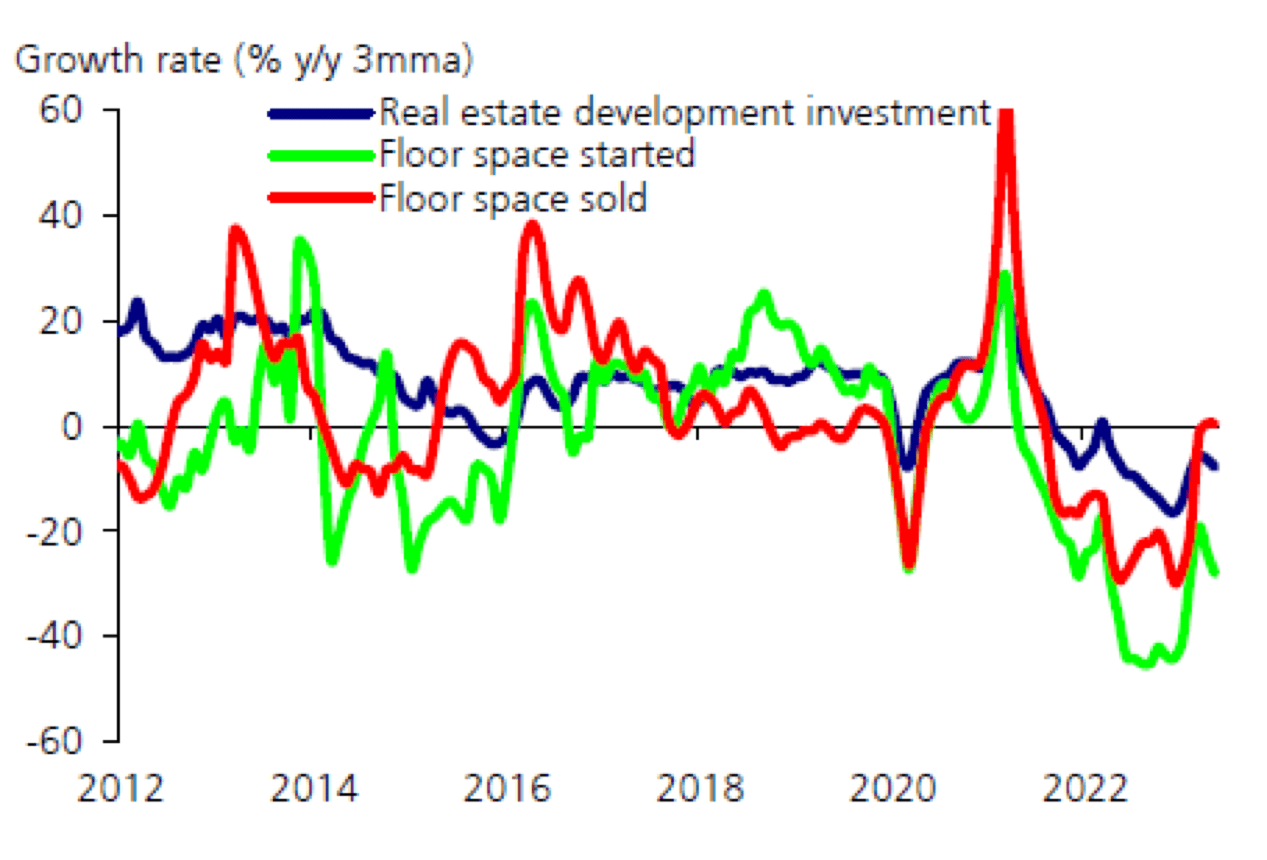

According to UBS (UBS Global Economic Perspectives, 26 June 2023) Chinese growth improved/stabilised in May after a month-on-month slowdown in April, with year-on-year indicators broadly lower across key indicators.

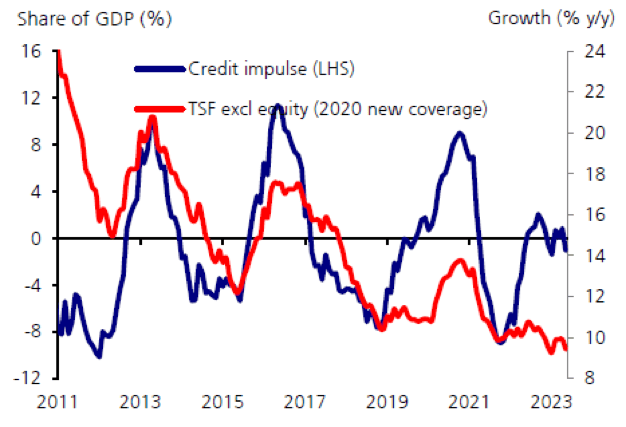

Property sales (figure 3) fell -3% y/y with new starts off 27% y/y and credit growth continued to retract (figure 4).

Exports also dipped back to 7.5% y/y contraction.

CPI inflation year to date however has been lower than consensus expectations due to declines in pork prices and fuel and oil prices, and consumer goods prices.

Among other measures, more property policy easing fiscal stimulus, particularly in infrastructure, is highly likely at the next Politburo meeting.

It appears Americans however, despite all the warning signs of a recession, are feeling somewhat more optimistic with the consumer confidence index rising to 109.7 (highest in 1.5 years) in June compared to May’s reading at 102.5.

This compares with market expectations, according to Kitco contributor Jim Wyckoff, of 103.9.

EV demand got a boost last week with Macquarie (23 June 2023) reporting that the Chinese Government announced an extension of tax breaks for NEVs until 2027, estimated to be worth over US$70b.

This commitment comes despite competition from internal combustion engine vehicles, or ICEs, and higher raw material prices.

EV penetration is, according to Macquarie, anticipated to exceed 60% by 2030. If the attitudes towards EV here in the West are anything to go by, this is optimistic in the extreme.

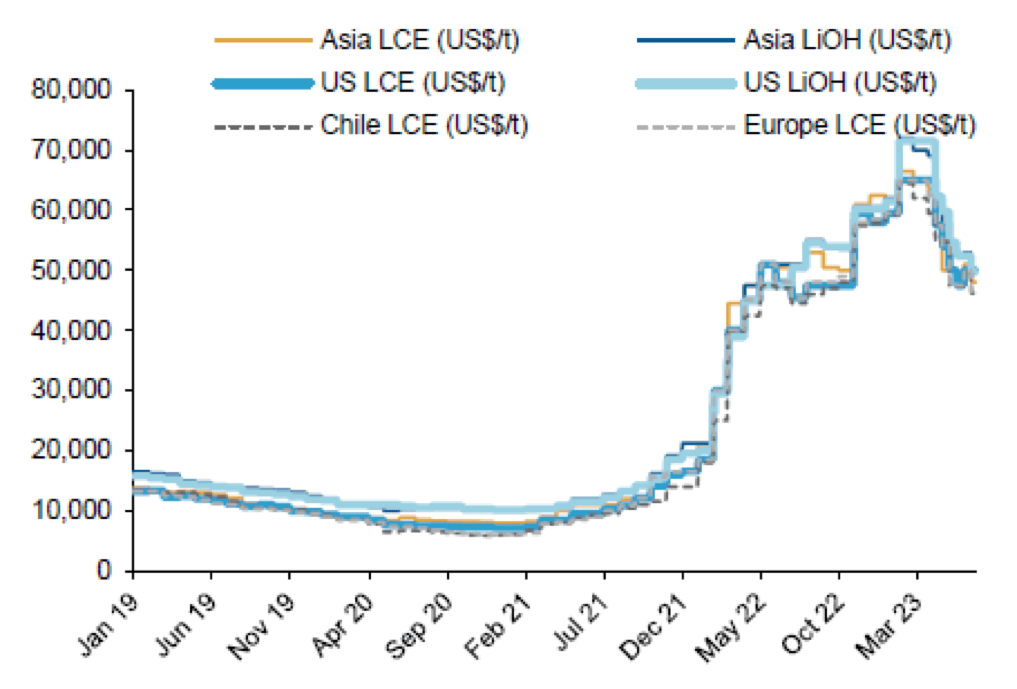

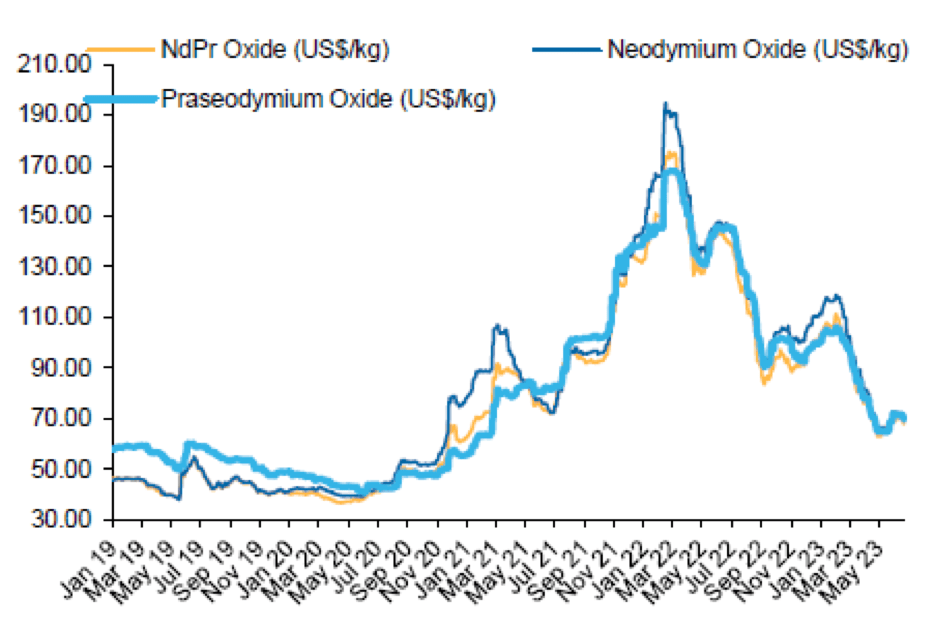

Despite a sharp correction this year, lithium and rare earth prices appear to have stabilised (figure 5, 6) with Macquarie lowering its CY 2023 prices by 9-15%. Interest is certainly re-emerging in the junior lithium space on ASX after a tough 1H CY2023.

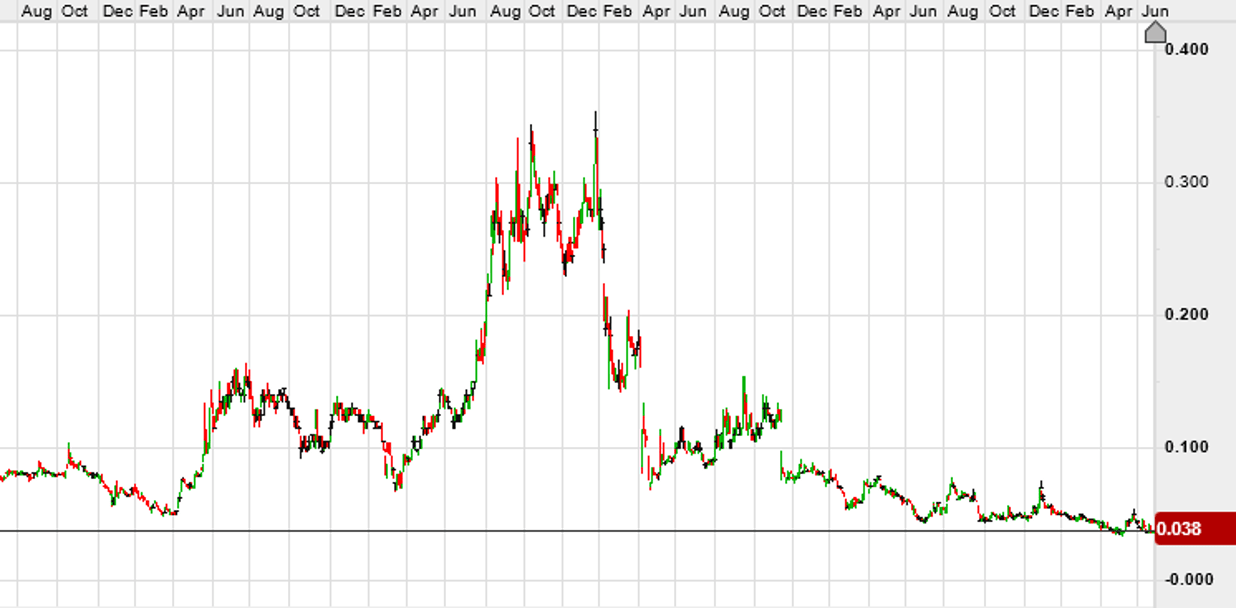

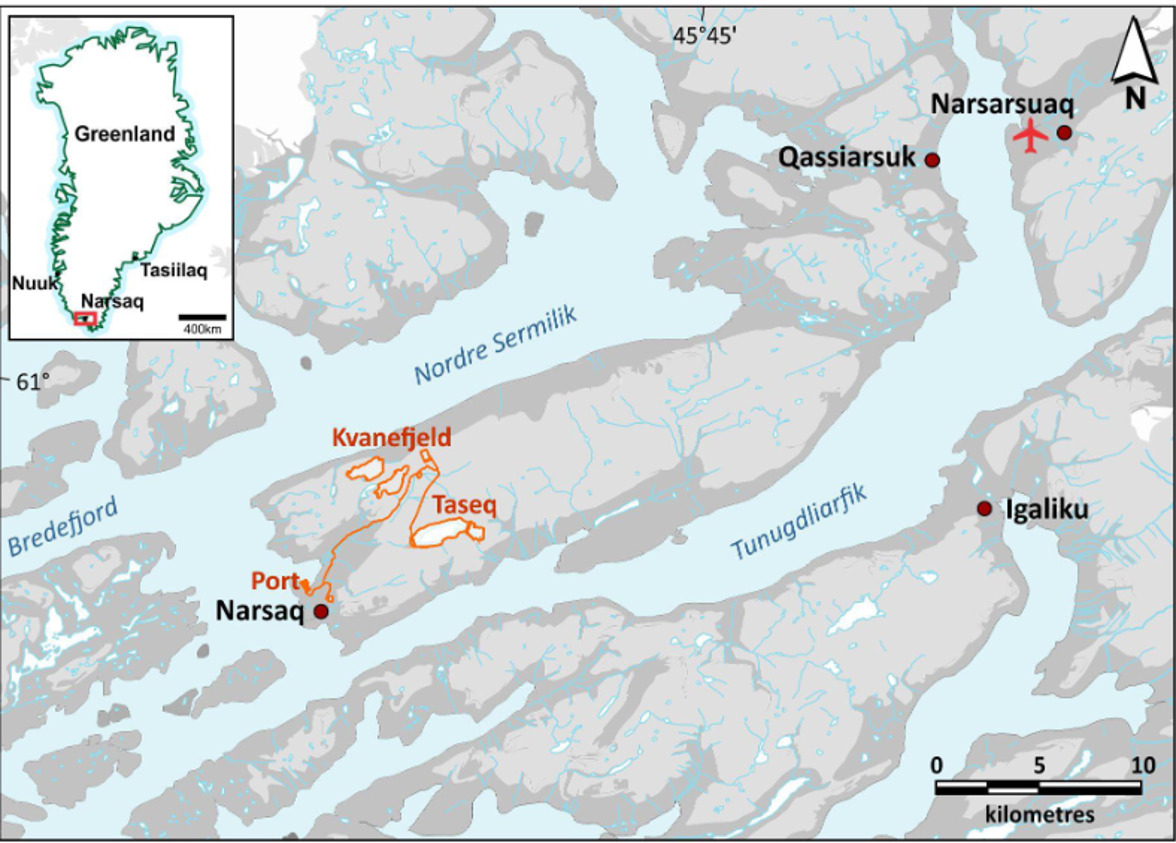

Many of the Stockhead faithful would remember Energy Transition Metals (ASX:ETM) as Greenland Minerals (ASX: GGG) which is the would-be developer of the giant Kvanefjeld REE-U deposit (figure 8) in southern Greenland, one of the world’s largest under-developed REE-U deposits (11.1 million tonnes of rare earth oxide, 593 million pounds U3O8).

In its most recent presentation (May 2023), it claims output could supply 15% of the world’s REE requirements and 100% of the EU’s requirements.

The company has since embarked on lithium exploration on its Villasrubias lithium project in Salamanca, Western Spain while it battles on with the Greenland government.

As you will recall, the company completed a fairly compelling feasibility study back in 2015 however the Greenland government has refused its application for an exploitation licence.

A statement of claim is due to be lodged with the arbitration tribunal in Copenhagen by July 19th, 2023. After 15 years and $130 million of expenditure you can sense an element of frustration among the board and shareholders.

In June of last year, the company entered into a litigation funding agreement with Woolridge Investments LLC, a subsidiary of Burford Capital Limited, to fully fund the arbitration costs in the dispute with the Government of Greenland and the Government of the Kingdom of Denmark.

While I only made it to second year law, I am thinking that this is going all the way to The Hague if arbitration fails.

ETM may see some sort of outcome at arbitration which could see a pathway to granting the exploitation licence (maybe on the back of a revised flow sheet that excludes uranium processing?) or a financial settlement.

Arbitration could go nowhere, and in The Hague for that matter, with an adverse finding for ETM.

I have a feeling that a monster damages claim could be in the wings and if The Hague finds in favour of ETM, this could well and truly empty the coffers of the Greenland government, and a reasonable chunk of the Danish government for that matter. For those with an interest in history, Denmark appointed itself as Greenland’s sugar daddy back in 1814 and writes a cheque for just north of US$500 million per annum to keep the lights on.

Given any damages claim on Kvanefjeld could run into the billions, the locals might be rounding up every whale, narwhal, seal, polar bear, arctic fox as well as a few stranded tourists to pay the toll to ETM and its erstwhile litigation funders if the decision goes the wrong way.

Given the Cigar Social Climate Change Sceptic Committee has a stronger balance sheet than the Greenland government, there is some cause for concern here.

At an enterprise value of around $20 million at 3.9 cents I am thinking any sniff of victory in Greenland could put a rocket under the ETM share price. This may take some time to play out, however the clock is ticking.

So as a lover of hedge fund managers, going long ETM and short Greenland wildlife might present an interesting trade…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.