Guy on Rocks: Why this uranium IPO looks like the pick of the bunch in a bullish market

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Invasion day in the Ukraine (24 February 2022), like the GFC that commenced on 10 October 2008, will be ringing in the ears of commodity analysts for years to come.

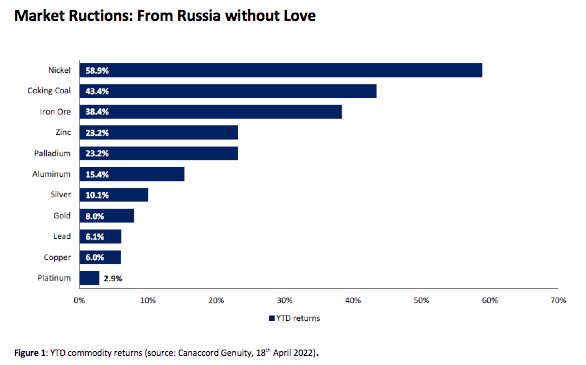

As figure 1 demonstrates, the commodity performance has been nothing short of spectacular over CY 2022 across a range of commodities whose supply-demand metric was already on the up.

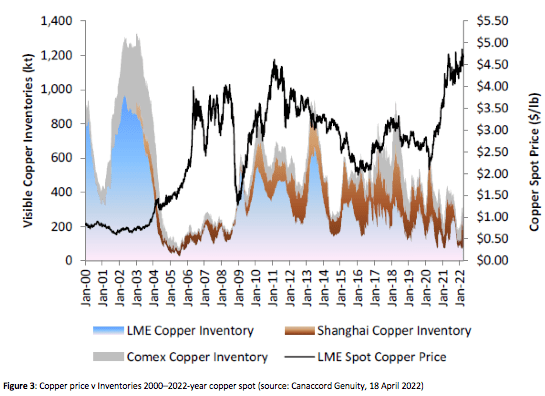

LME stocks were at critical levels for copper and nickel in particular, as many end users moved to restock amid growing demand — which in many instances was driven by significant infrastructure spending.

Indeed, the US bipartisan $1 trillion infrastructure package will prove to be a hungry beast to feed as it kicks into gear.

The desire for non-conflict metals and a strong ESG agenda has also been a key driver.

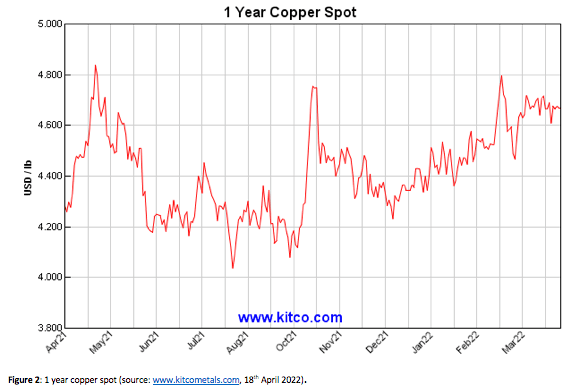

The obvious laggard here is copper (figures 2 and 3) which had already had a strong performance over CY 2021 with stockpiles at historically low levels.

Canaccord Genuity (April 2022) believe we are in for a decade-long period of elevated commodity prices as countries seek to shore up supply chains, increase stockpiles and inflation continues un-relented.

There has been a reluctance by the West to go for the jugular on Russia and ban imports of fossil fuels, nickel and palladium.

However, there certainly appears to be a greater emphasis on sourcing alternative supplies.

The Oil and Gas sector, together with Coal looks like they are well and truly back in favour as even the most altruistic of the ESG believers cannot do without power.

The short-term losers however have been smelters whose rising energy inputs have forced many to shut down.

As we all know, there are winners and loses in wartime and it comes as no surprise that India is looking to secure Russian coal at an appropriate discount, with Bloomberg reporting that India has purchased 5,500Kcal/kg NAR coal from Russia at US$160-165/tonne CFR India, representing a US$65/mt discount to the same grade coal ex-Newcastle.

While much of the recent market attention in the junior end has been on lithium and rare earths, uranium (figure 4) — one of the more obvious alternatives for those with a leaning toward green energy — is not far off hitting the magical US$70/lb.

At that price, I reckon many of those deposits sitting in the middle of the grade tonnage curve might be close to being economically viable.

In a recent podcast, Sprott pointed out that the 400 reactors currently operating consume around 180mlbs of uranium every year with the balance made up from secondary sources that appear to be drying up.

Much of the recent buying (around 50M pounds in the last six months) has been from non-utility participants (hedge funds, Sprott etc).

Another interesting observation was that the listed uranium sector represents only US$37 billion by market capitalisation, a mere fraction of the oil and gas market.

Expect more uranium listings both in Australia and North America!

This is all good news for the Ozzie battlers here in the West that are involved in the resources sector.

After re-reading the Canaccord Genuity note I’m feeling so bullish, I am going ahead with our January 2023 North American ski holiday booking right now.

Normal rules apply of course; parents in business class and kids in premium economy.

I think there is a good chance this section is going to be dominated by uranium stories, with uranium IPOs very likely to come on at a premium given the metal’s strong performance which has been responsible for driving up producers and developers such as Paladin Energy (ASX:PDN) and Deep Yellow (ASX:DYL) over 120% and 75% respectively in the last 12 months.

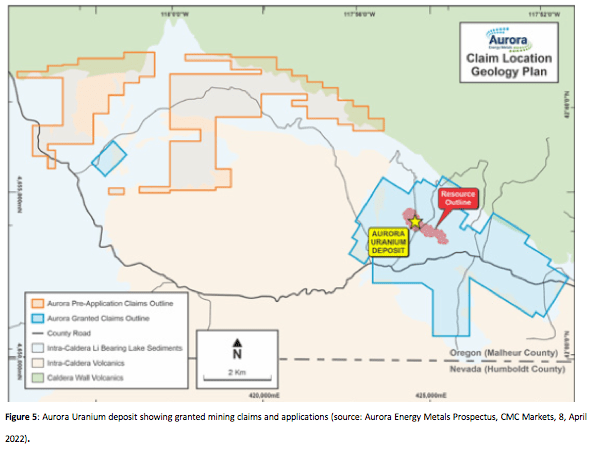

Aurora Energy Metals is due to hit the boards in mid-May 2022, and was put together by West Perth-based project generator Mitchell River Group with ex-Deep Yellow MD Greg Cochran at the helm.

The primary asset is the Oregon Project (figure 5) which comprises 36.7 million pounds of uranium.

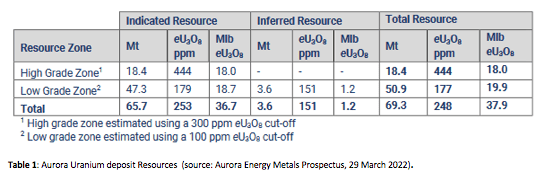

The project is around 120km from the nearest population centre (Winnemucca, Nevada) and covers 207 granted mining claims. The Aurora Energy Metals Project contains Indicated JORC Resources of 65.7 Mt @ 253 ppm eU3O8 (36.7 Mlb eU3O8) and an Inferred Resource of 3.6 Mt @ 151 ppm eU3O8 (1.2 Mlb eU3O8), for a total of 37.9 Mlb eU3O8.

This includes a high-grade core of 18.4 Mt @ 444 ppm eU3O8 based on 300 ppm eU3O8 cut-off grade (table 1).

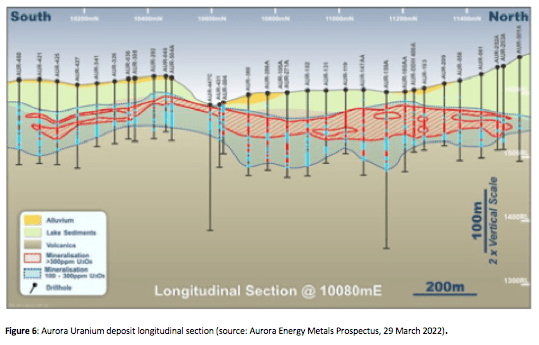

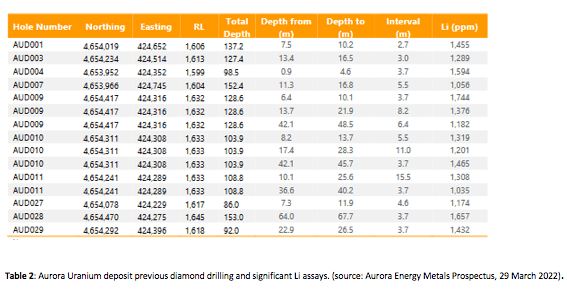

While the uranium resources are not high-grade, continuity looks good (figure 6) and there appears to be a reasonable possibility that overlying lithium mineralisation (table 2) contained within hectorite clay minerals may be recoverable, given that the nearby Rhyolite Ridge which is targeting commencement of construction prior to the end of 2022.

With a junior market littered with overpriced explorers (a few have passed through our office in recent months) I think this is a real goer as far as market appeal goes.

With an EV of under $9.0 million and an experienced board chaired by mining engineer Peter Lester, demand for this IPO is likely to be strong… and more than likely a strong after-market stock.

Having a genuine lithium and uranium play in the one deposit is almost as good as having a Balvenie Scotch in one hand and a Plasencia Late Hour cigar in the other.

My office overlooks the Mitchell River Group’s office so I should go and knock on the door and see what they are up to.

I didn’t think there was any intelligent life in that building by virtue of the dull exterior (and some of the creatures seen entering the building), but I may be wrong….

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.