Guy on Rocks: This ASX coal stock needs a bigger bucket for the cash it’s making

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Macro-economic news dominated the week with precious metals mostly declining following Jerome Powell, chairman of the Federal Reserve, projecting that it was likely the US economy will have to endure some pain in the form of higher-than-expected interest rate hikes even at the risk of recession.

I wouldn’t disagree with either of these statements, even though more aggressive action was warranted earlier.

The US dollar index closed near 20 years highs at 108.80 for a 73-basis point lift for the week while 10-year treasuries were steady and the 2-year treasury rising sharply to 3.4%. The Treasury Bond curve remains inverted from six months to seven years, a reliable predictor of recession/pending recession according to many economic commentators.

The major indices reacted negatively to Powell’s speech with the Dow off 3.0% on Friday to 32,283 and the Nasdaq down 3.94% to 12,141. Next week’s economic data will be watched carefully including consumer confidence (last month at a 50-year low), manufacturing PMI then the US August jobs report (Friday).

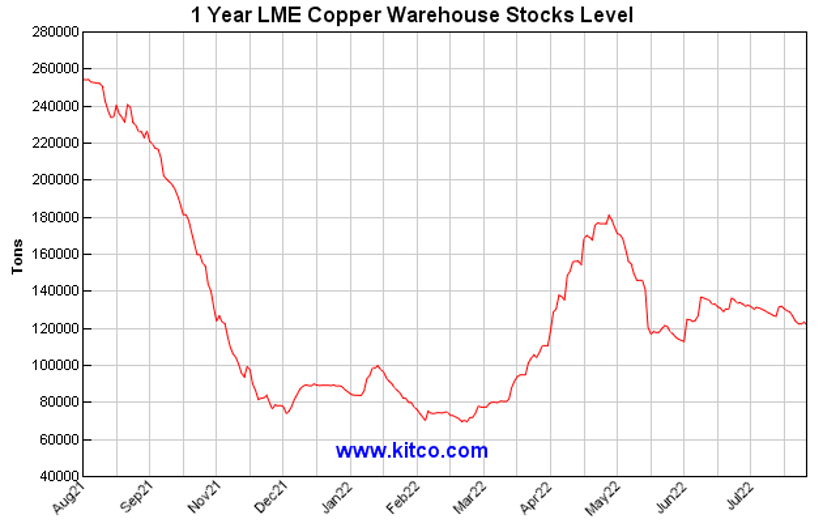

While most precious metals were broadly lower in line with the stronger US dollar (gold was more or less steady while silver was down 0.5% to US$18.84/ounce and platinum was off 3% to US$862/ounce), copper appeared to go against the trend closing at US$3.72/lb, even though the forward market remains in backwardation.

This was partly attributable to low inventories (figure 1) and the announcement of a Chinese infrastructure stimulus.

Interestingly, China’s copper consumption growth in July of this year was 1.7% according to Bloomberg (compared to modest negative growth in April and May), so this may be a sign of a near term recovery in the copper price which remains only 40-50 cents off the marginal cost of production for the majority of global producers.

Copper supply looks dismal with the likes of Chile, with its proposed wealth tax and new mining royalty and tougher environmental restrictions, not helping the confidence of Western producers such as Teck Resources who may be reconsidering the Quebrada Blanca phase 2 (QB2) expansion.

It appears Indonesia is also looking to move the goal posts with President Joko Widodo looking to impose a tax on nickel exports sometime this year according to an interview with editor in chief John Micklethwait (Bloomberg, 19 August 2022).

Last week China’s State Council announced an additional 300 billion yuan ($44 billion) in quotas for infrastructure spending and investments by banks, in addition to the 300 billion yuan that was committed in June of this year.

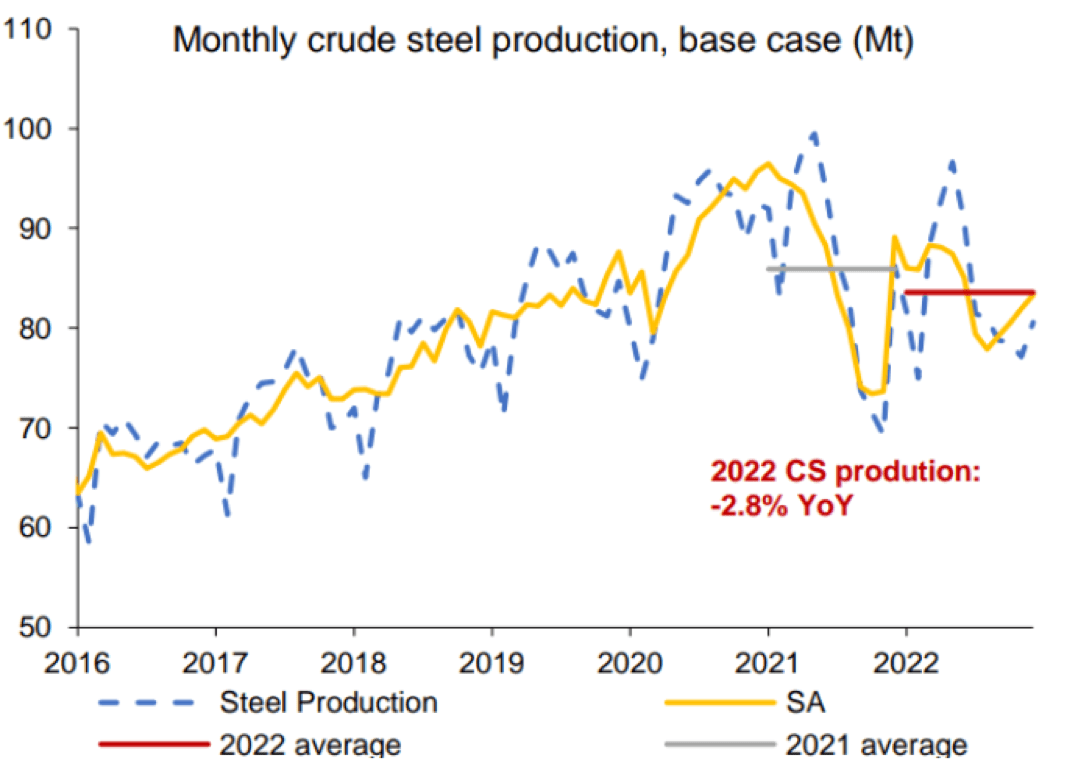

Managing director of Navigate Commodities Atilla Widnell, in an interview with CNBC on Friday, believes this highlighted just how poor construction steel demand was in China.

While iron ore and steel (in addition to copper) are the logical beneficiaries of the Chinese stimulus measures, we have seen little movement in prices with iron ore finishing the week at US$106/tonne (62% fines).

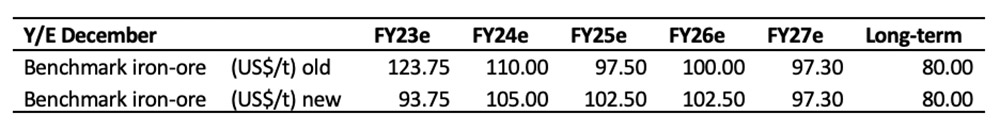

Macquarie believes the soft demand for steel in China (as evidenced by slowing production -figure 2), mostly attributable to the slowing property market, will see the iron ore market tip into surplus with a forecast of +25mt in 3Q CY22 and growing to 35mt by 4Q CY22.

They do however see a return to balanced market by 2H CY23. As a consequence, Macquarie is forecasting iron ore to average US$93.75/t over CY 2023 (table 1).

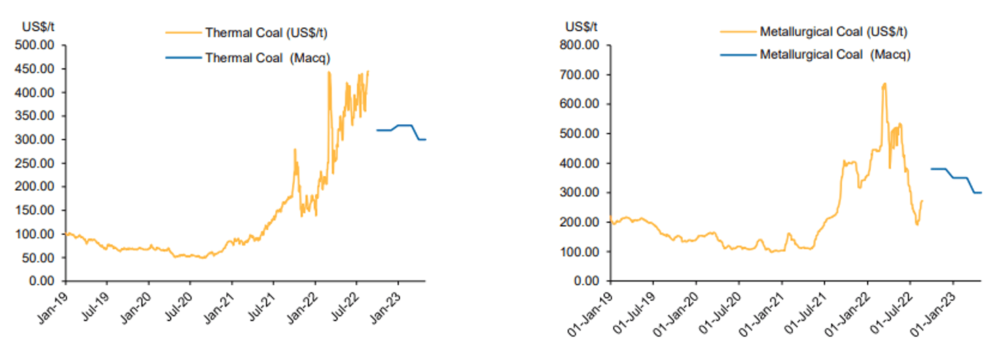

The coal market has been a hot topic of discussion in recent week with prices reaching all-time highs; Newcastle Coal currently trading at US$427/t.

The coal market is so stretched that thermal coal is now trading at a premium to metallurgical (steelmaking) coal.

This is historic, theoretically producers should be able to shift certain brands of coking coal to the thermal market. However, this has not been able to occur fast enough, in part due to the displacement of Russian thermal coal exports to Europe, Japan and South Korea.

Short-term supply for commodities is typically price inelastic.

However, coal is particularly strained due to growing ESG concerns. I have previously stated on this column that ESG stands for Energy Sapping Governance. What the ESG crowd has misunderstood to date is that renewable technologies do not yet represent a satisfactory substitute for the reliable baseload power that coal produces.

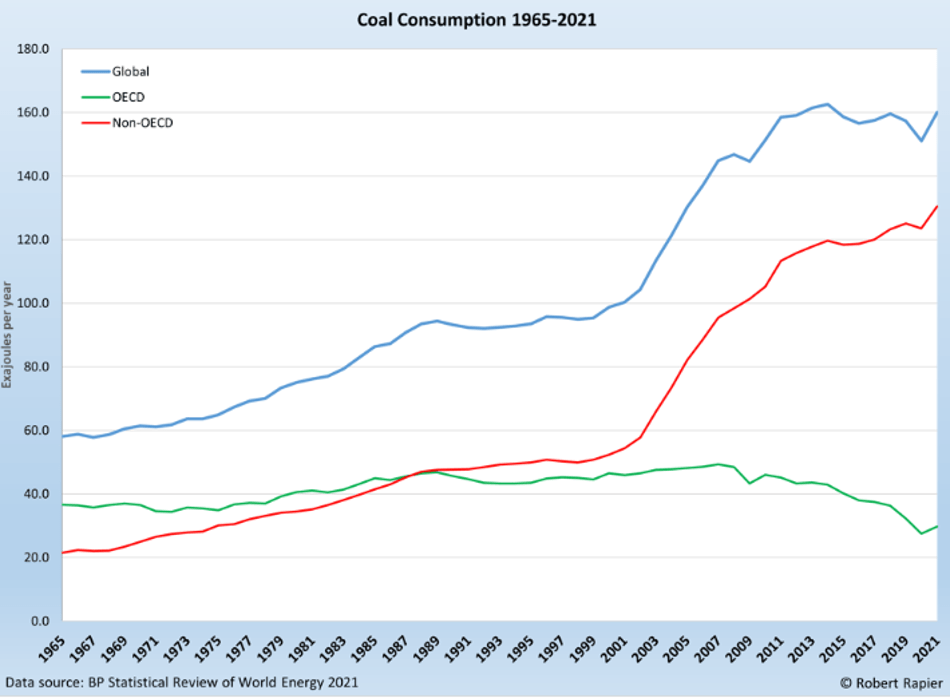

Consequently, coal consumption has continued to increase, especially on the back of non-OECD growth (figure 4).

Hunter Valley coal producer Whitehaven Coal (ASX: WHC) (figure 5) is a standout among the listed mid-tiers.

Given WHC’s higher unit production cost, the company offers more torque to higher-than-expected coal prices.

According to Macquarie, on a spot basis, WHC is currently trading on FCF yields of >45% and an EV/EBITDA of just 0.9x assuming a coal price of $80/t from FY26 for the basis of their price target.

However, the Stockhead faithful would be pleased to know coal futures are currently trading at >$250/t over the same period. Even with this conservative price assumption, Macquarie still arrive at a valuation of $9.20/share (16.5% upside). Coincidentally Barrenjoey (25 August 2022) have also pegged the valuation at $9.20/share.

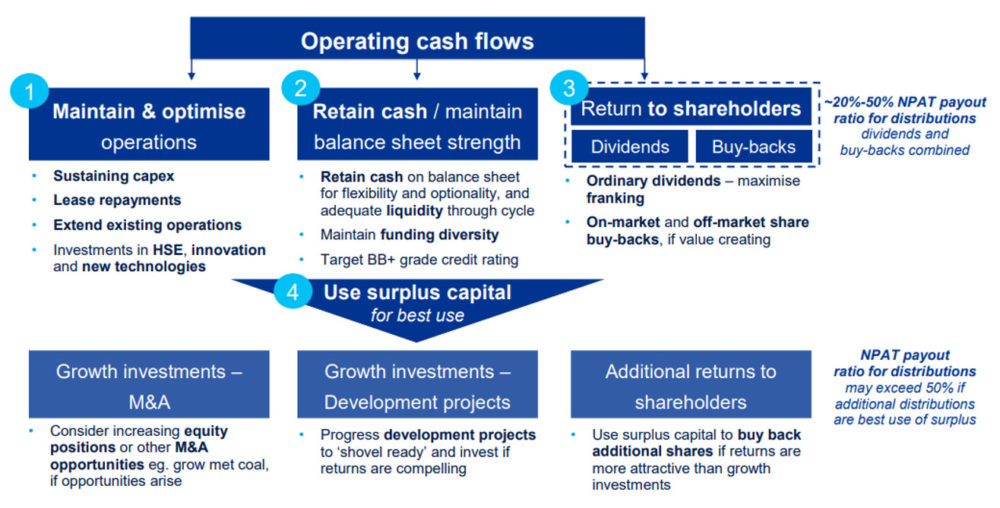

WHC is particularly attractive because of its limited downside by function of its shareholder-friendly capital allocation policy (figure 6).

History is littered with resource companies that generate exceptional operational cash flow, only to destroy shareholder value by investing in the next fad to build out management’s empire.

All good Orwellian thought criminals (Nineteen Eighty-four, George Orwell, 1949), consider the narrative around climate change as complete crap.

To show your support why not go out and buy some well managed fossil fuel companies; after all, they all qualify as “renewable” as new coal, oil and gas deposits are being formed as we speak.

Looks like the Macquarie target of $9.20/share may be on the conservative side…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.