You might be interested in

Mining

Explorers Podcast: Arizona Lithium optimistic on bountiful brine

TSX

Canada Unearthed: TSX targets ASX companies for dual-listings in conviction mining juniors can prosper in Canada

Mining

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

I thought I would take some time out and talk lithium given the unprecedented activity on ASX over the last few months with four players, namely Abermarle, SQM, Mineral Resources and Gina Rhinehart aggressively bidding up companies while lithium prices remain in retreat (figure 1).

Pilbara Minerals (ASX:PLS) (figure 2) is also off 38% from its October 2022 highs with Morgan Stanley (30 October 2023) revising their base case valuation back to $2.75/sh and the bear case to US$1.80/sh on the back of declining spodumene prices and upcoming CAPEX commitments.

A recent CNBC bulletin pointed out that while auto manufacturers committed US$400 billion in 2022 with around US$616 billion committed over 2023-2024, EV sales are slowing with EVs taking longer to sell than ICEs. In the US, from January to August this year, EV sales slowed from 80 to 100 days while SUVs only slowed from 52 to 57 days.

While around half of potential buyers are “on board” with the idea of EVs, only a third of dealers appeared to share the same view.

Prices of EVs are down 22% year-over-year and that’s mainly driven by Tesla. About two thirds of total EVs sold are from Tesla.

Tesla CEO Elon Musk commented last week in respect to slowing down plans for a Mexico factory: “I am worried about the high interest rate environment that we’re …as I just can’t emphasize this enough that the vast majority of people buying a car is about the monthly payment. If interest rates remain high or if they go even higher, it’s that much harder for people to buy the car.”

In response to lagging sales, Tesla has been aggressively discounting prices down from an average of US$65,000 to US$53,000 over the last 12 months.

Volkswagen reduced its profit forecast for the year, citing negative effects for raw material hedges at the end of the third quarter, some of which are used in EV batteries.

Ford also commented earlier this month it was cutting one of three shifts at the plant building the F-150 Lightning (EV) pickup truck. In May 2021, Ford went on an aggressive marketing campaign for the F150 Lightning, however by 2023, the company appears to be ramping up the hybrid model of the F150 due to slow sales.

One Mercedes Benz dealership based in the US pointed out that sales of hybrids were growing and in hindsight the EV roll-out was far too aggressive. As he pointed out, ICEs have been in continuous development for over 120 years with EVs still in their infancy, so many of the more astute buyers are sitting on the sidelines and watching.

While range anxiety, cost and charging time remain an issue, two large lithium fires in Australia, one in the Sydney airport car park and another one at the Bouldercombe battery storage site in Queensland have highlighted potential dangers. Talking to some of my learned colleagues at the Cigar Social Climate Change Sceptic Committee (CSCGSC) they pointed out that in many apartment complexes in Europe, insurers have opted out if EV charging stations are installed in underground car parks. The intensity of the fires together with their toxicity appear to make apartment complexes that install charging stations uninsurable.

In a recent Morgan Stanley report (7 November 2023), former automotive executive Annie Liu confirmed the macroenvironment was putting pressure on EV sales, pointing to the effects of high interest rates and price differentials between EVs and ICEs. She also believed that solid state batteries are likely not to be competitive from a cost or cycling life standpoint.

She also pointed out the inventory build-up that would take at least six months for the entire (EVs, batteries, raw materials, etc) supply chain to draw down current inventory levels.

While supplies of graphite and to a lesser extent nickel were likely to face some challenges she considers that lithium is seen to face the least amount of challenges from an IRA-compliance standpoint with increasing battery efficiencies allowing for smaller batteries (and less inputs).

Finally, lithium prices, according to Liu, need to remain below US$20/kg in order for EVs to breakeven.

So, if we overlay what many believe is a macro recessionary environment (with the full effects of monetary policy likely to be felt next year) with current trends in EV sales, is the ASX lithium space a giant bubble with overblown valuations driven by a handful of aggressive buyers?

The world’s largest lithium producer Albemarle recently commented that “last year, electric vehicle makers said sky-high lithium prices risked destroying demand”. Now, after prices collapsed, the world’s biggest lithium producer is warning that supply is under threat. Some producers already have started to rein in operations as prices fall below reinvestment economics.

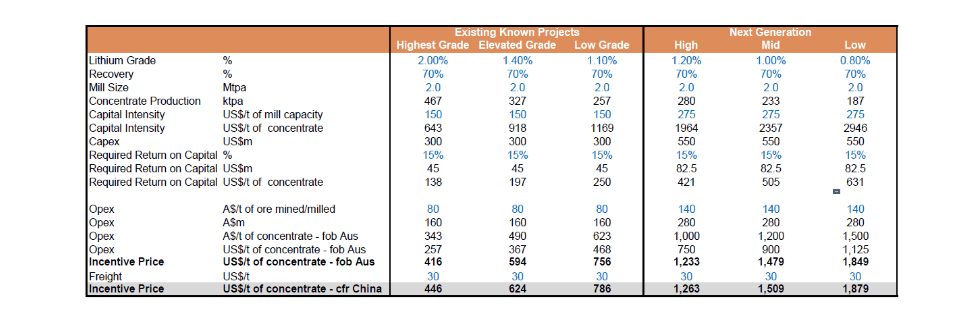

So far lithium prices around US$2,400 are holding up above what Barrenjoey consider are reasonable incentive prices for the high, low and mid case scenarios for the next generation of lithium developments (figure 3)

It appears that the aggressive bids for Liontown Resources (ASX:LTR) by Chile’s SQM and Azure Minerals (ASX:AZS) by Abermarle must be driven by permitting concerns in other jurisdictions (such as Canada and Brazil) as the TSX-V is not seeing this takeover activity.

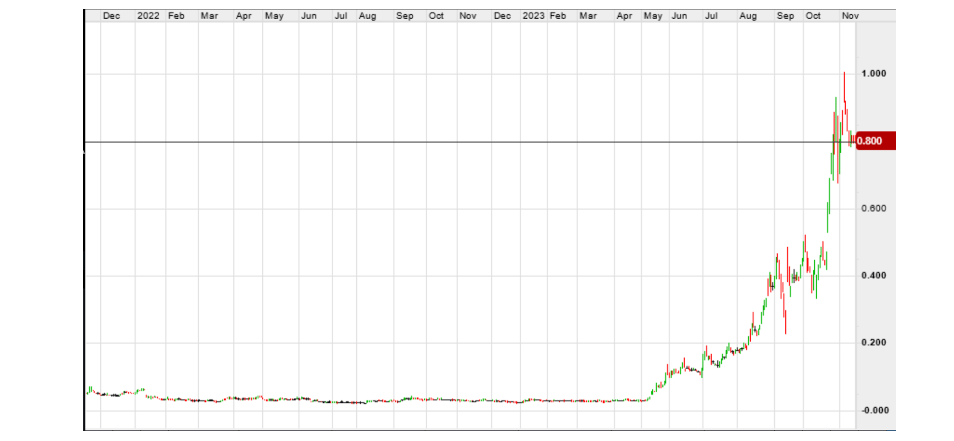

Other juniors such as Wildcat Resources (ASX:WCE) (figure 3) have reached eye-watering enterprise value of over $800 million despite not having published resources with Minerals Resources (ASX:MIN) recently splashing over $170 million and is now sitting on 19.85% of the issued capital.

Some impressive intersections including 85m @ 1.5% Li2O and 180m @ 1.1% Li2O have the markets’ full attention. The company last week raised $100m at 76 cents per share and remains trading at 80 cents on Friday.

Other juniors such as Industrial Minerals (ASX: IND) have also seen their share prices double in recent weeks.

If hybrid sales gain significantly in popularity, which appears the current trend, then lithium demand could wane significantly as most hybrids use nickel-metal hydride batteries (NiMH).

Clearly the lithium market will take time to normalise where I anticipate prices will revert to longer term prices that will enable reasonable incentive prices. According to Barrenjoey, these lithium prices may lie between US$1,300 and US$1,900 per tonne for spodumene concentrates CFR China which would suggest lithium prices may have further to fall in the short to medium term.

While graphite prices are off over 30% this year with synthetic graphite flooding the market, China’s decision to impose export constraints on graphite concentrates (including spherical and expandable graphite), effective 1 December 2023, has given natural graphite developers/producers a much need shot in the arm.

End users are also taking more interest in the provenance of EV inputs which bodes well for natural graphite given the production of synthetic graphite is more expensive and emits larger quantities of CO2. Not that I or the CSCGSC have a problem with this, but the rest of the world seems to…

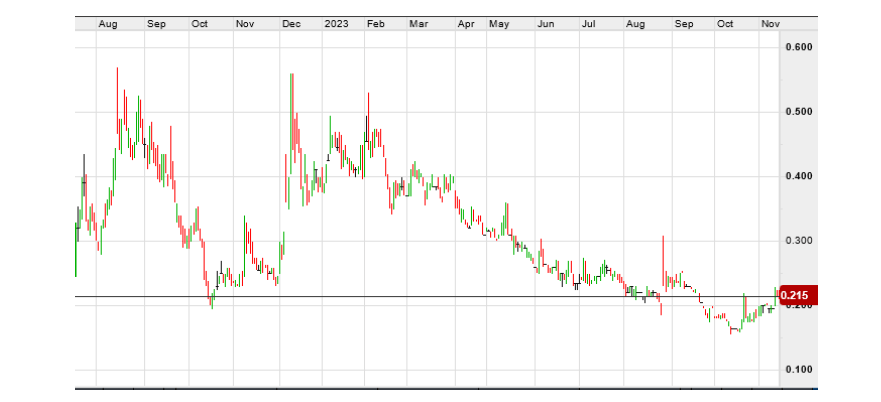

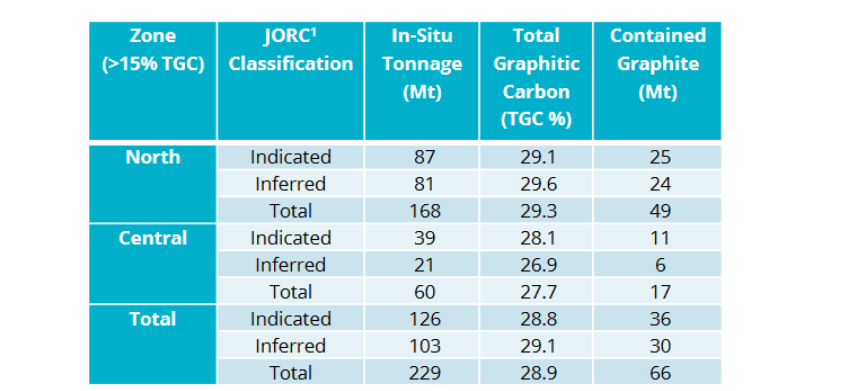

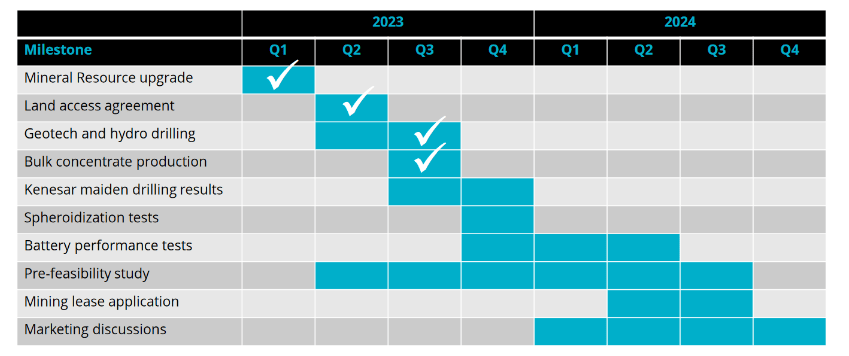

Sarytogan graphite (ASX:SGA) has been making steady progress (table 2) at its 100% owned Sarytogan Graphite project (229Mt @ 28.9% TGC – table 1) in Kazakhstan and appears on track for the completion of a Pre-Feasibility Study by the middle of next year.

The most recent announcements have gone a long way to de-risking the project. In late August this year SGA reported a 99.999% purity achieved by flotation, alkaline roasting and thermal purification.

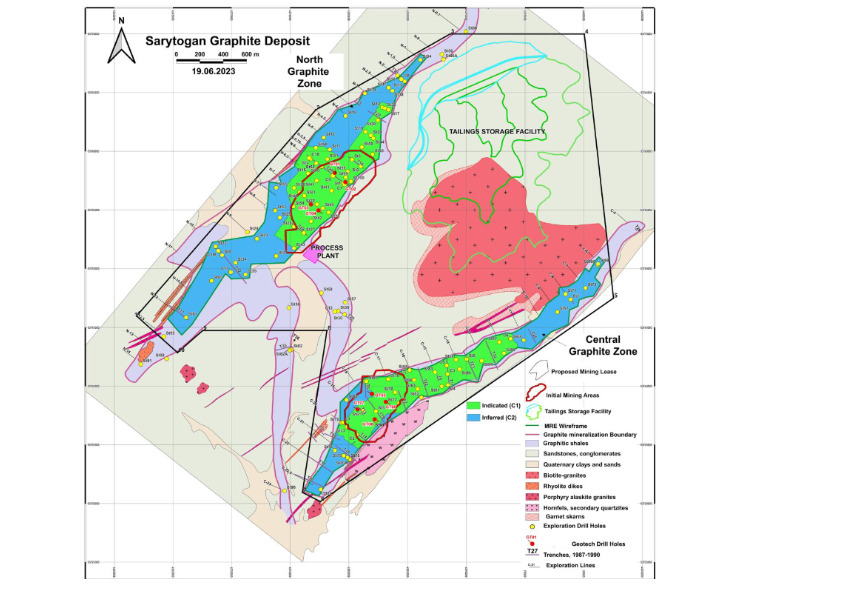

This far exceeds battery grade requirements. Last week (13/11/2023) the company reported favourable results from a bulk concentrate taken from eight representative diamond holes from the north and central graphite zones (NGZ and CGZ-figure 5) with a head grade of 32.5% TGC that achieved a concentrate grade of 81.4% Total Graphitic Carbon (TGC) at 84.4% metal recovery.

While there was never any question about the size and very high grade of the Sarytogan Project, there had been questions raised about the metallurgical characteristics, however these recent announcements have certainly allayed these fears.

With excellent infrastructure, low power costs, a very large and high-grade resource with potentially very low mining and processing costs, I am feeling a little more optimistic about the outcome of next year’s PFS. The company remains funded to the completion of the PFS and with over $6.0 million in cash and an enterprise value of $24 million, there is plenty of upside left in the share price.

As the great Molly Meldrum used to say, “do yourself a favour and get some…”.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.