Guy on Rocks: Has Dundas definitely drilled a dazzling discovery?

Experts

Guy on Rocks is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

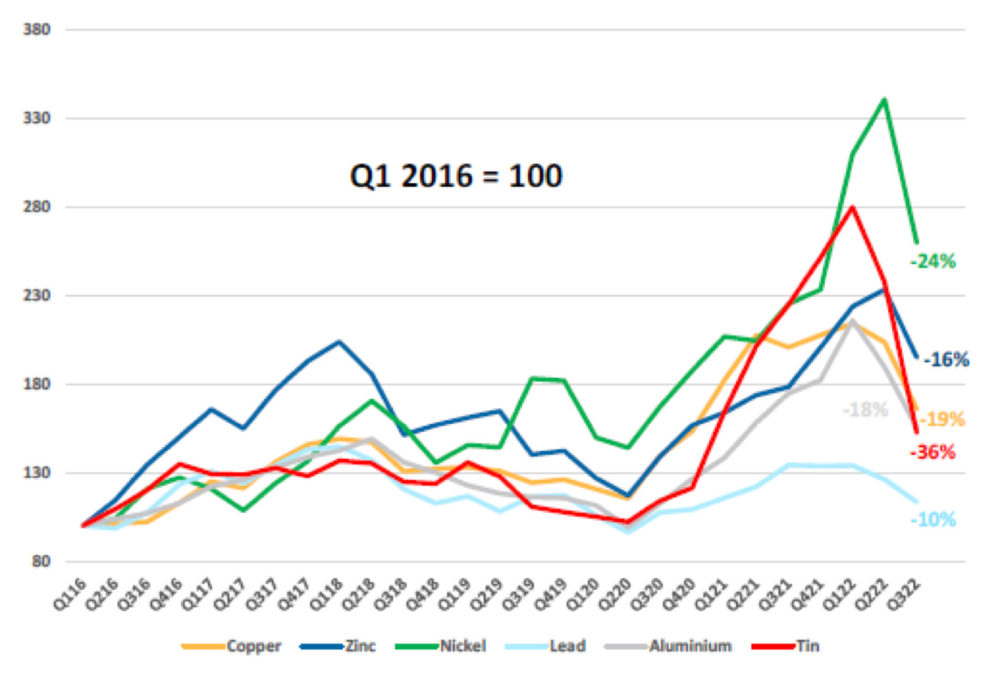

Is no surprise that the last quarter was a tough one for base metals (figure 1) with lead being the least affected, at 10% down, and tin off 36% as recessionary fears took hold and the US dollar surged through another 20-year high through 115 before settling at 112.77 late last week.

US 10-year treasuries flattened out at 3.89%, up 6 basis points for the week.

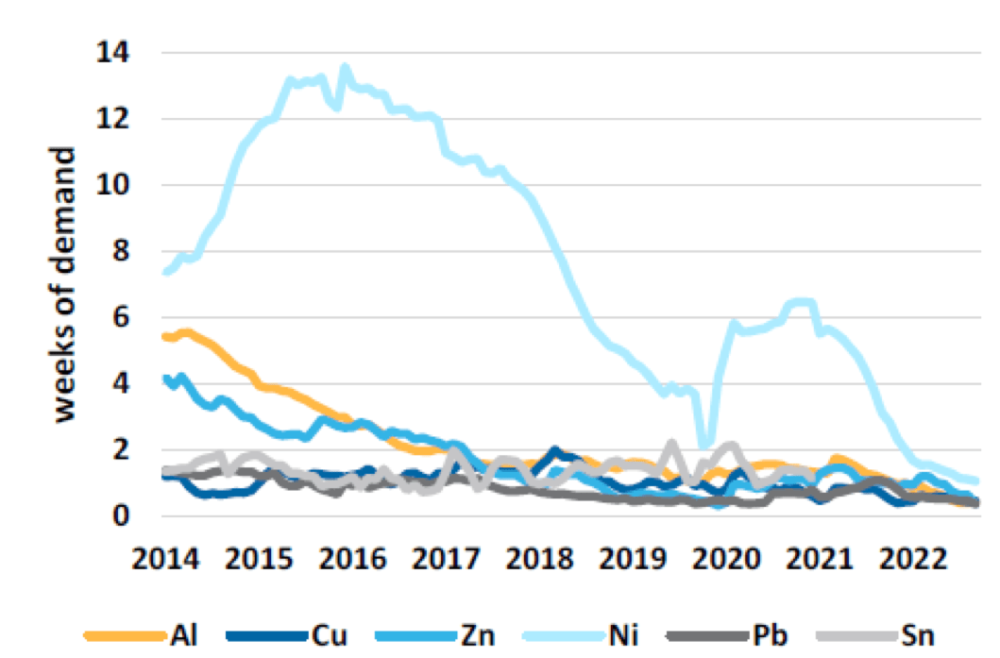

While end user inventories increased across the board, metal supply and inventories still look dismal (figure 2) so I am thinking that further downward risks are limited from here.

I see Liz Truss graduated from Oxford University having read Philosophy, Politics and Economics at Merton College in Oxford.

Given her government has committed to personal income tax cuts while buying its own debt, I was wondering if Liz was holding the fiscal stimulus graphs upside down.

Fortunately, some genius flipped the chart and they decided to do away with the tax cuts…

Mind you, the UK isn’t the only one heading off the fiscal cliff with the Bank of Japan defending the Yen which is at a 31-year low to the USD (figure 3).

Gold showed a little more strength and closed up US$34 for the week to US$1,695 with silver up 5.5% to US$20.07/oz, platinum up 6% at US$914/oz and palladium up 1% to close at US$2,120/oz.

Copper remained flat at US$3.45/lb up 1 cent for the week but still strongly in backwardation going out three months.

Uranium has been down five weeks in a row, closing at US$48.10. At these levels there is no incentive for new production.

The big news, of course, was that OPEC cut supply by 2 million BOPD to offset weakening global demand.

This is just what the doctor ordered in the middle of global energy crisis.

Uncle Joe Biden (who as Ronnie Corbet would say is doing the job of two men, “Laurel and Hardy”) is now presiding over strategic oil reserves sitting at 38-year lows. Doesn’t look like there will be any olive branch coming from Venezuela any time soon given the existing sanctions on their oil. Meanwhile US gasoline inventories are 18 million gallons lower YoY.

Adam Rozencwajg (Goehring & Rozencwajg Resources fund) claims more than $2 trillion has been diverted from the energy industry over the last 10 years with energy now accounting for only 5% of the S&P against a long-term average of 10% and a peak approaching 20%.

Goehring & Rozencwajg believes a measure of energy efficiency is the Energy Return on Energy Invested (“EROEI”) or the quantum of energy required to generate a unit of power.

Oil and natural gas are on the high end at 30 times back what you put in, compared to coal driven steam power at ~10:1 and burning wood at 5:1. Wind and Solar is 3.5: 1. So if I am not mistaken fossil fuels look like the preferred option…

As a counter, the US Strategic Reserve (SPR) has been releasing approximately 1 million BOPD but has chewed through almost half its stockpile. Uncle Sam is now looking to lift sanctions with Venezuela and re-engage with Iran.

Well knock me down with a feather! Maybe Joe could buy some enriched uranium from our Persian friends. They might even throw in a few free rugs…

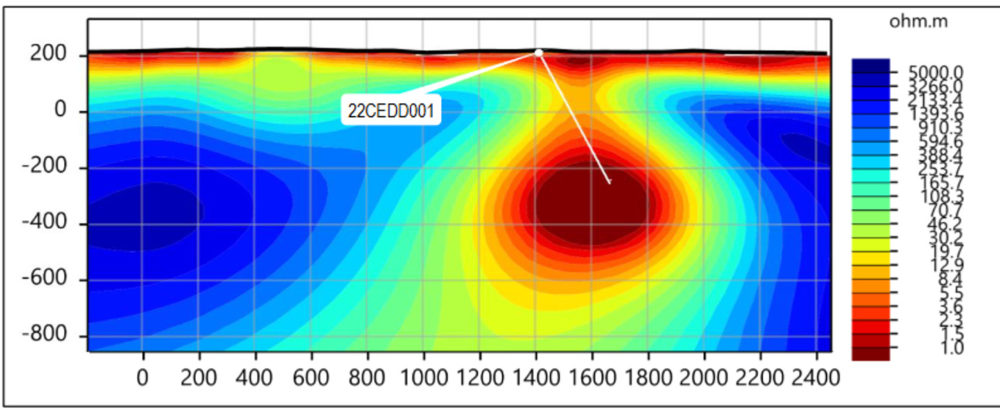

Dundas Minerals (ASX:DUN) followed up the AMT anomaly we discussed here in this column last week.

Looks like the AMT anomaly is real with 22CEDD001 (figure 5) at the Central exploration target returning visible sulphides over 358 metres down hole including some zones of massive and semi-massive sulphides (figure 6).

The hole encountered a large mafic-ultramafic intrusive complex, including altered gabbros interspersed with sulphidic quartz veins and stockwork.

A porphyry was intersected at around 154 metres.

If I went to the relevant geology lectures at University I would no doubt have a better idea of what I am looking at, however at first glance there is a view that this is Archaean age (not Proterozoic like most of the Albany Fraser Range province).

So, we probably aren’t looking at a Silver Knight (Mark Creasy) or Nova Bollinger (Independence Group) Ni-Cu-Co story.

It could be a polymetallic volcanogenic massive sulphide/vein hosted polymetallic. There appear to be stockworks that could be prospective for gold-silver. Looks like there is more than one phase of mineralisation present.

Very hard to tell other than the pXRF did return elevated copper, cobalt, zinc, molybdenum, and silver with some fairly modest nickel values.

I am not holding my breath for any spectacular results on this one, but you never know. There is no doubt something lurking down there, and assays (on the entire hole) will no doubt be fast tracked to keep the hungry punters satisfied.

Those thinking of breaching the soft dollar threshold of $300 by sending me a bottle of bubbly need not look any further than the 1996 Louis Roeder Cristal Brut Rose Millesime (circa $1,570).

For those that left the building too late (or too early) on the run up could also look at a 17-year old Balvenie Doublewood coming in at a very modest $989/bottle. All gifts greatly received via the rear entrance to the building.

Those that didn’t buy the stock need to see their therapist…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.