Guy on Rocks: Gold bulls predicted a stellar 2023. Smart money is already starting to reposition in gold equities

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

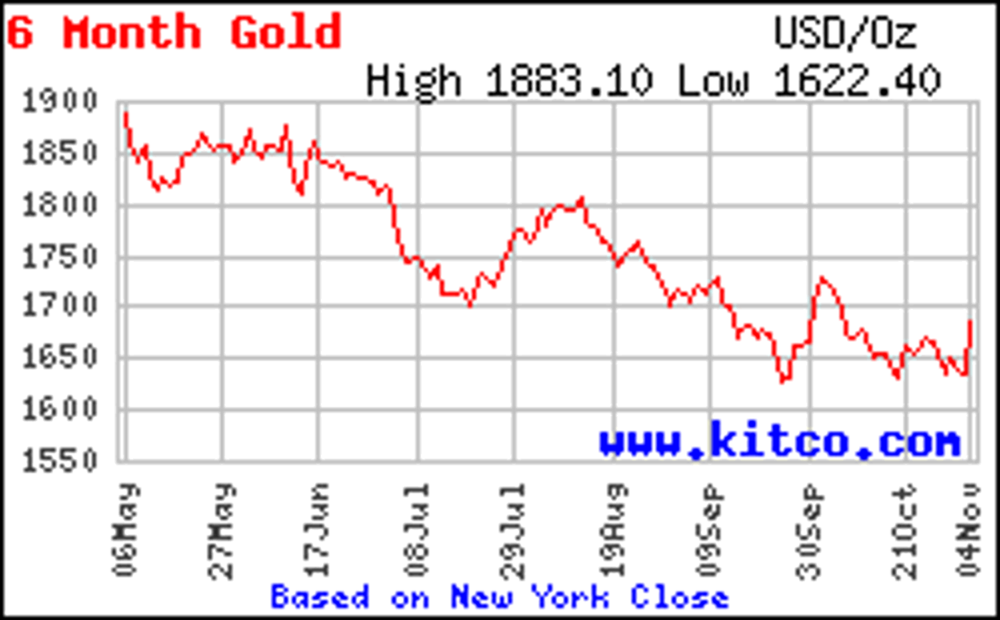

A big move in gold late last week, up US$50/oz to close at US$1682.70 (figure 1) after seven months of consecutive losses. This losing streak represented the worst performance of the yellow metal over the last five years.

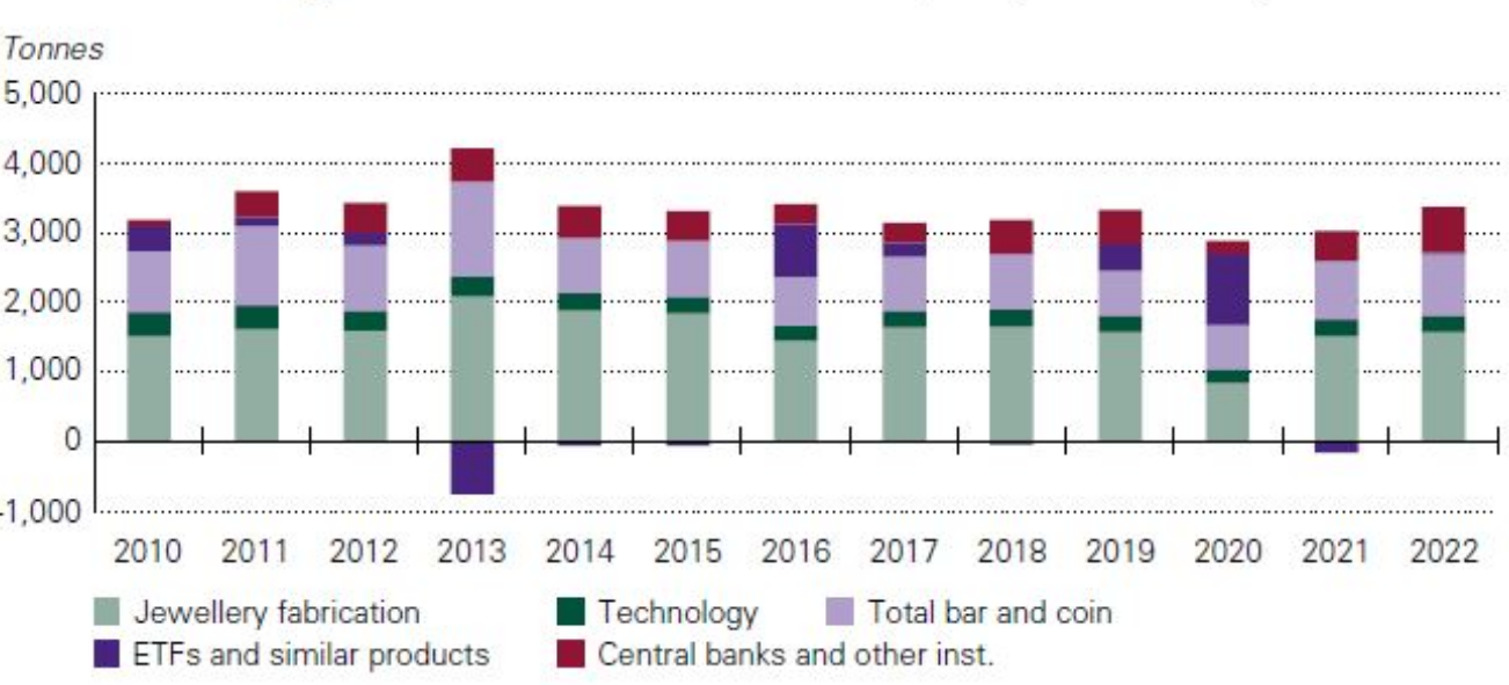

Last week the World Gold Council (WGC) reported that central banks purchased around 399 tonnes of gold (US$420 billion) in Q3 2022 (figure 2), 300% higher than the corresponding period last year.

In the year to September 2022, banks have purchased around 672 tonnes of gold, representing the biggest year in central bank activity since 1967. Exchange Traded Funds offloaded around 8% of their holdings over the same period.

Central banks from Turkey, Uzbekistan, Qatar, and India appeared to be the most active buyers, however a large amount of gold was purchased by unknown central banks; it was speculated that China and Russia could have been the unknown purchasers given they tend to not publish information on gold reserves.

Mercenary geologist Micky Fulp speculated that the sharp rise in the gold price could have been attributed to short selling. Anyway, we will need to see a few more weeks trading ahead of us before we get too excited about the short to medium term direction of the gold price as the S&P/ASX Gold Index threatens to breach its 2016 lows (figure 3).

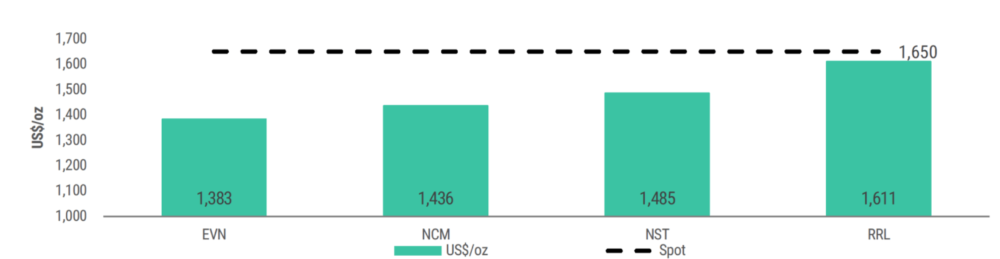

Morgan Stanley has taken another approach and demonstrated that the implied valuations of a number of the larger Australian gold producers are factoring in very low US$ gold prices (figure 4) which would imply they are, in the most part, significantly undervalued or the gold price is likely to drop.

Morgan Stanley (26 November 2022) clearly think the space is undervalued with valuations well below current share prices.

Evolution Mining (ASX: EVN) is trading around $2.15/share with a base case valuation of $2.55/share.

I think some of the smart money is starting to reposition in gold equities and it was no surprise that we are seeing the launch of a gold fund by Perth Stockbroker Argonaut Securities which in late October announced it was seeking $50 million as a “unique counter cyclical opportunity’. The fund will be weighted 50% towards Australian gold stocks.

M&A activity is hotting up in the gold sector with Yamana Gold, which had agreed to a takeover by Gold Fields in the spring, receiving a new bid from Agnico Eagle Mines and Pan American Silver.

Under the new offer Yamana would get $1 billion in cash and 153.5 million common shares of Pan American and approximately 36.1 million common shares of Agnico.

The Yamana board said the bid from Agnico and Pan American is superior, and Yamana supports the new bid.

In other metals, silver also had a strong week up 2.2% to close at US$20.89/ounce with platinum also up 2.2% to close the week at US$963/ounce. Palladium finished the week down 1.5% to close at US$1,807/ounce.

Copper also had a strong week closing up 13% to US$3.60/lb on hopes of an increase in Chinese demand as lockdowns are (hopefully) lifted. Three-month futures however remain in backwardation. Supply still looks very tight with Chile now expected to produce 3% less copper year-on-year.

The uranium price backed off a little from its recent highs closing the week at US$50.60/lb off 4.6% for the week with low utility bids, however Sprott was back in the market after a quiet six months purchasing 100,000lb.

Oil had a strong week finishing at US$92.59/bbl, a high since late August 2022 with US stockpiles down 3.1MBBLS. Diesel and gasoline stocks are also at very low levels.

Plenty of important economic data coming out this week with mid-term elections on Tuesday, CPI on Thursday and consumer sentiment on Friday.

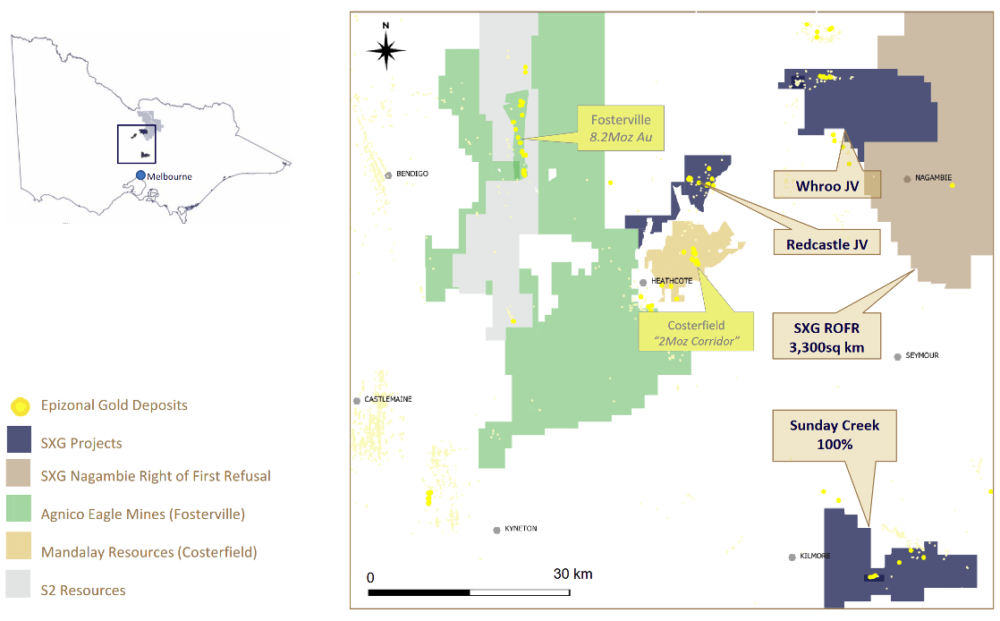

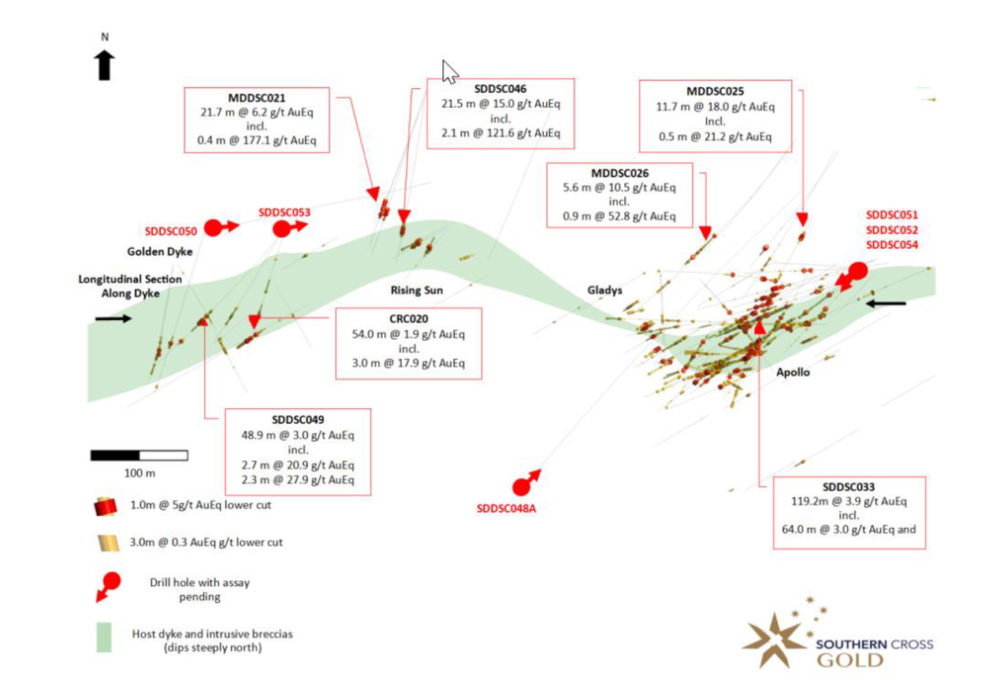

I first brought Southern Cross Gold (ASX: SXG) to the attention of the Stockhead faithful back in May 2022 on the back of some promising hits at its 100% owned Sunday Creek (figure 6) including 119.2m downhole @ 3.9 g/t Au equiv (gold and antinomy).

Former North Flinders colleague and geologist Lisa Gibbons is pulling the levers here; as you may recall she was out working in the baking sun while I took a well-earned rest in the Toyota 4WD. All about efficient allocation of resources back then.

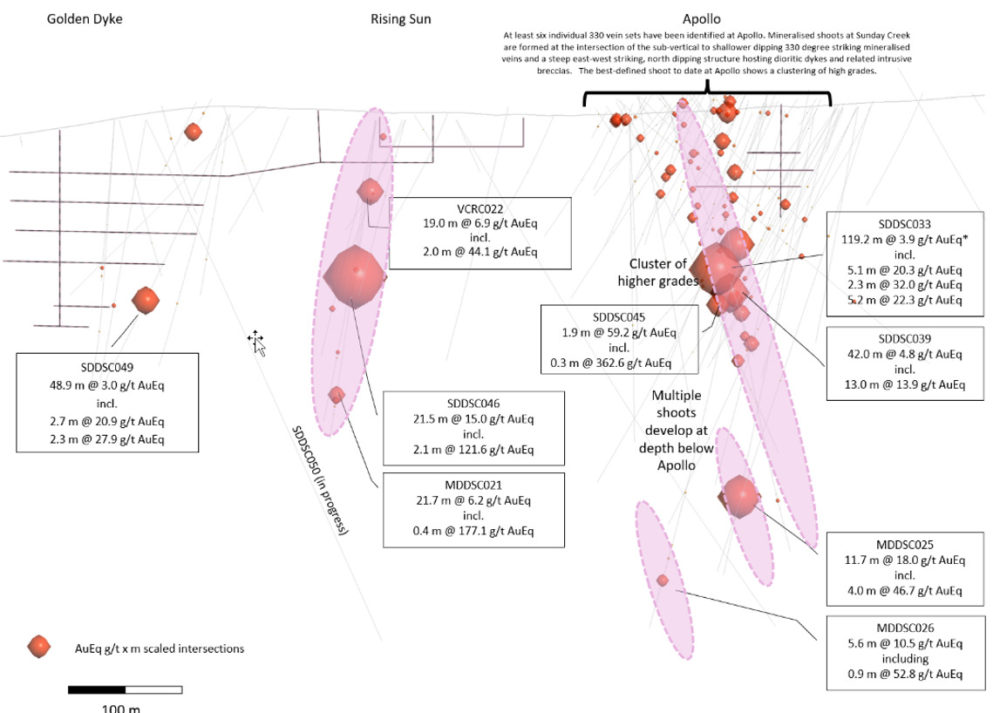

Since May 2022, drilling along 1km of strike and down to 400m depth has returned some impressive intersections (figure 7). High-grade broad gold-antimony intercepts with plenty of depth potential.

So, there is a lot to like about this project and as Gibbons pointed out to me today, intercepts at depth (figure 8) are returning “Fosterville-like grades”.

Fosterville, located in Victoria, as the Stockhead faithful know, is one of the highest-grade gold mines in the world (23.78Mt @ 7.9g/t gold for 6 Moz producing +600Koz at a head grade just under 20g/t gold) and is owned by TSX listed Kirkland Lake Gold.

Sunday Creek looks like something with resource potential upwards of 750Koz at high grades and good widths. At a market capitalisation of around $70 million this could be a standout play, particularly as many gold bulls are projecting 2023 to be a stellar year.

So, what do I think is a reasonable target? Longer term if they can outline JORC Resources of +750Koz at anywhere around 6-8g/t Au equiv, we could see something worth $100 to $200/JORC Resource ounce as a reasonable in-ground value or somewhere between $0.60 and $1.20/SXG share, or slightly less on a fully diluted basis. No doubt a production/pre-production scenario would likely see a significantly higher share price than this assuming similar grades and widths continue with no nasty surprises in the feasibility study.

The Melbourne Mining Club presentation promises a pipeline of assays from high grade shoots (with cream on top); I am thinking this project could take us all the way to the promised land and should give the Victorian gold industry a real shot in the arm. Victoria “the golden state” certainly sounds better than “the garden state”.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.