FREE WHELAN: What’s love got to do with IT?

Experts

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Top of the arvo/morning to you all and it’s a short and sweet one to stay ahead of a week with lots of noise.

Here’s something to start you off in an auditorial sense – the latest Theory of Thing podcast (formerly BIP Show).

We’re keeping the format tighter now so it’s just the facts and some chat on our views, which are right more often than not!

We discuss the traditional playbook of what happens once the Fed stops hiking. Also Heath goes over some great things on lithium.

Last week we initiated the long on the Global X India ETF.

There’s a lot to love. In the digital and renewable space one should allow the juices of excitement to percolate.

I’m starting to bang the drum on the trade into India. We have a lot to digest on that front.

The more I look at it the more I see it as being something that should have been in portfolios long ago and should stay for a long time to come. Chart looks good too.

A few notes for your perusal on India which continues to appear positively everywhere I look.

Christian and his partner in crime Mugunthan Siva from India Avenue have been exploring this… er, avenue in the pages of Stockhead.

Eastspring Investments put out a lengthy report off the back of a survey they do of local business leaders. The key takeaway reinforces what I’ve been saying with regards the transfer from China to India as the market with the most upside.

I’ll put the easy part in front of you…

And here’s the link to the report. It’s very good.

Fascinating stat I loved to read is how much India’s tech talent continues to rally. A few years back the tech pool there at 3.8 million, was behind both China and the US. With a growing, younger population and a strong digital education focus, you’d reckon that’d be changing fast.

India has the need, the capability and the determination to shift very quickly into another tier of economic superpower, particularly in digital and renewable.

Further to this the FT is running at least one “wow that’s happening fast in India” style articles every other week. Recently was one on the southern state of Karanataka, growing at 8% p.a. for the last decade and doubling average income through the last decade to US$3800.

That growth adds to money in wallets (digital or otherwise) which adds to the growth in Systematic Investment Plans regular savings plans investing in Indian managed Funds (like our superannuation system but optional) and that then adds to continued equity growth in Indian stocks.

It just makes too much sense…

The other side of the coin is in the recent positioning of the Fed, with a slight rug pull in the Uni of Michigan Consumer Sentiment data coming in weaker than expected.

It was extraordinary weak and adds fuel to the theory that the US consumer can just seize up at the drop of a very expensive hat (or car or mortgage payment).

If this continues then we go through the real earnings recession in the US, rates then drop and the end of 2023 really looks to the big tech players to carry them through to the end of the year, the same way they’ve made everything look relatively rosy so far this year.

There’s also been flows into the USD on global recession fears (it’s the left side of the USD ‘smile’) so unfortunately that means commodities will be affected. Anything you have that is hedged for currency might do well to open up to be exposed to the USD upside.

Currency is a powerful thing.

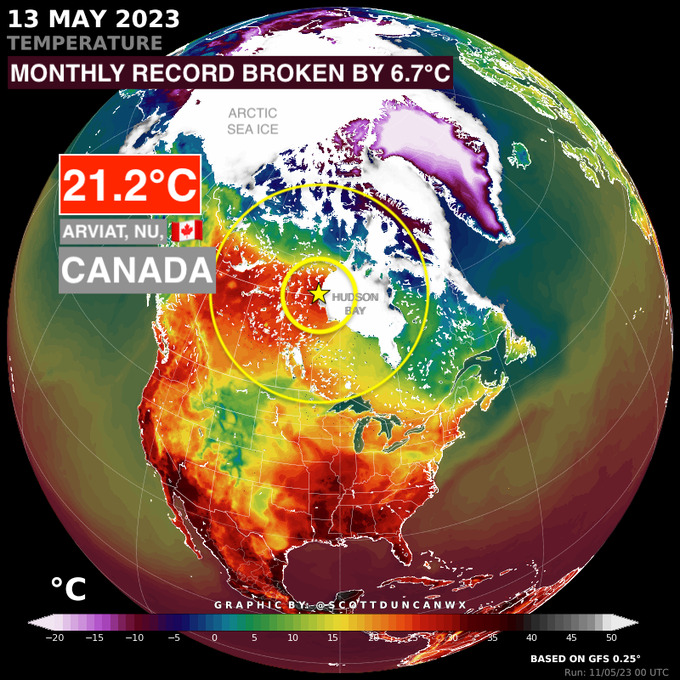

You know how much I love a weather chart but this had me stopped in my tracks.

Courtesy @ScottDuncanWX via Twitter.

That’s a 7 degree beat of previous May record and is 22 degrees warmer than average.

I’ll remind you that this is Northern Canada.

Singapore just posted its highest temp in 40 years, Vietnam just had a 44.2.

El Nino here we are. Act accordingly.

All the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.