Actually it’ll be Indian Intelligence that dominates the next-gen of big tech

Indian technology: Older, wiser and more patient. Via Getty

From April to February of this financial year, India’s IT exports jumped by some 30%, with the segment likely to crack the $US300 billion mark for the first time.

By 2022, India’s total service sector accounts for over 38% of the total exports by the entire country. India’s IT exports currently account for 79% of the total revenue generated by the sector.

For the Aussie investor, India’s tech industry remains full of secrets and surprises. Exclusive to Stockhead, every month or so the team at India Avenue, led by Mugunthan Siva will look to uncover the choicest nuggets, providing insight into some of the fastest growing companies in the fastest growing sectors around the world.

Reporting on ANZAC Day on the National Stock Exchange in Delhi is Persistent Systems (NSE:PERSISTENT).

&nbps;

Take it away Mugunthan

It’s no secret that India is one of the largest tech exporters in today’s world. But that might not mean what it did 10 years ago.

It’s widely known that a few years ago, reaching out to call centres for any of your technology related products would most likely end you up on the phone with an Indian call centre. With over 350,000 workers in call centres in 2015, this stereotype of India’s IT potential is certainly not misplaced.

However, as the current largest exporter in IT services in the whole world, India is beginning to change what this actually means.

As of 2023, it employs a total of 5 million people, with experts predicting that the sector can reach $350bn by 2026, at an expected maintained rate of growth between 11%-14%. As it stands, India’s sector generates around $227 billion worth of annual revenue.

By 2022, India’s total service sector accounted for over 38% of India’s total exports and within that IT exports currently make up almost 80% of the total revenue generated by the sector.

Following the COVID-19 pandemic, India’s IT sector grew at a rate of 15.5% in the FY21-22 year, compared to 2.1% during the FY20-21 period. At the moment, India’s IT sector accounted for 7.4% of India’s GDP while it’s expected to grow to around 10% by FY25.

So why does India have such a dominant IT service sector? Among its huge population, much like China, India has access to a diverse talent pool as well as strong market dynamics. A primary focus upon providing service to predominantly international businesses has ultimately provided India’s IT sector with huge success.

India currently holds the largest English-speaking population in the world. Compared to China, its ability to provide services to the rest of the world is an incredibly strong tool, which they are currently using as one of their strongest resources.

The combined reality of the international world outsourcing their technological needs with the Indian government’s investment and support of the IT sector, has attracted further levels of FDI into the country. The low barriers to entry for the market has allowed India to transform its IT service sector into one of the strongest in the world.

The persistent performer

To really emphasise the success of India’s tech sector, we’ll be providing insight into one of the faster growing companies in the industry, who has seen great success following the COVID-19 period due to their business model and the resources available to them.

This company is Persistent Systems.

Persistent Systems is a software engineering and digital transformation focused company based in India. Their primary focus relied upon providing their clients with:

- Product and platform engineering,

- CX and design-led transformation;

- Data and artificial intelligence; and

- Cloud-enabled enterprise modernisation.

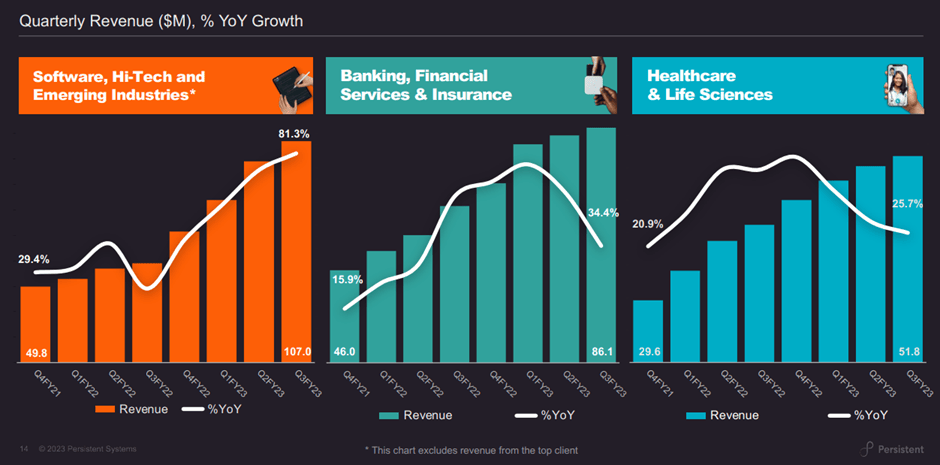

Persistent Systems utilises its expertise to provide high-quality services to a diverse range of both domestic and global companies. Their specialised skills are particularly focused on industries related to emerging high-tech industries, banking and financial services and healthcare and life sciences sectors.

For some 32 years Persistent has been boosting their clients into the digital age – accelerating time to market, enabling greater business agility, thereby unlocking growth and maximising the potential to create value.

For the more mature businesses, the focus can also be on enterprise simplification.

Due to drop FY23, a few hours from the time of writing, Persistent clocked a 45.4% increase in the revenue from operations at Rs 2,169.3 crore ($396.7m) during the October-December 2022 quarter.

Its operating EBITDA stood at 401.5 crore ($73.4m) in Q3FY23, up 59.9% YoY.

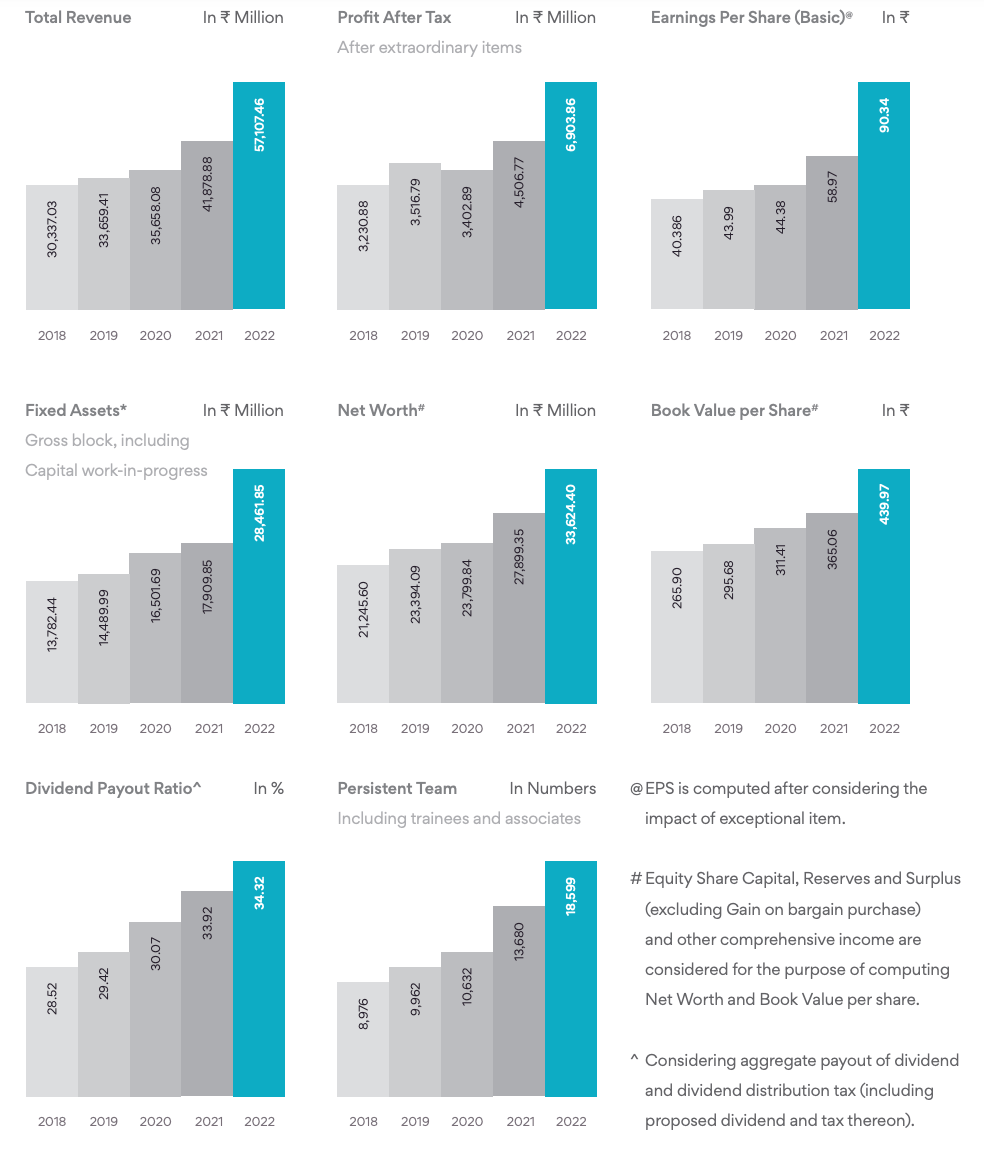

Fiscal highlights FY22

The company has 22,500 team members based in India (19,862), Americas (2,177), Europe (377) and Rest of the World (182). However, the outsourcing story is clear when you look at the revenue split of the company, with 77% coming from the Americas and 9% from Europe, whilst only 12.3% comes from India.

Persistent Systems is involved with 14 of the 30 most innovative US companies as labelled by Boston Consulting Group, as well as 45+ Global Fortune 500 companies. On top of this, Persistent Systems boasts a 28-year relationship with Microsoft and over 25 years with IBM.

They also have as clients 8 of the 10 largest banks across the US and India, 6 of 10 top medical device companies and 5 of the top 10 pharma companies, plus over 25 global fintech companies.

Persistent revenue (via segment)

Persistent Systems has managed to generate 16.1% annualised revenue growth from IPO in FY10 to FY22, which has more recently taken a step up to 23.5% during the period of FY20 to FY22.

This has been driven by the pandemic and lagging capex on technology which every business is now focused on to:

- Improve last-mile connectivity

- Build digital platforms

- Maintain data integrity and address cybersecurity concerns; and

- Migrate to the cloud infrastructure

All this as the focus remains – growth, efficiency, cost and advancement (and most importantly) keeping up with global developments in an industry which defines rapid growth.

Persistent margins

From a margin perspective the company is benefitting from growing sales and operating leverage. EBIT margins are now over 15%. Additionally, as the company grows it is adding diversity which means the Top 10 clients as a percentage of revenue have dropped to 35% (from 46% two years ago) and the number of large clients with over US$5m in revenue have increased.

However, Persistent Systems services aimed to assist companies in their digital transformation were heavily required and entirely necessary during this period, with businesses around the world recognising the importance of migrating to the cloud to not only improve their business efficiency, but to access a broader client base at a lower cost as well as maintain data integrity and a cyber secure network.

Persistent scale

Indian firms – like Persistent Systems – are benefitting from the structurally lower cost of labour, but also from greater infrastructure for outsourcing which then creates further scale benefits.

Most Indian universities now build specific programs for advancement in the industry. Given the industry is 30 years in the making in India, it now increases the moat for companies operating and growing successfully within the ecosystem.

For example the average cost of a university graduate in India is somewhere between A$10-15k p.a. Indian IT firms are loading up on talent straight out of university with a significant advantage to their global peers given the size of the pool, level of education etc.

Persistent leadership

The success of Persistent Systems has been linked to the appointment of Sandeep Kalra as CEO in 2020.

Under Kalra’s leadership, Persistent is transforming from a niche technology player into a multifaceted, new age digital transformation partner and a strong global brand. After graduating from one of India’s best MBA programs, Sandeep acquired 16 years of experience at one of India’s leading IT outsourcing firms in HCL Technologies, which also involved establishing their America’s business and leading their pharma vertical.

Sandeep’s role is critical as winning deals and adding contracts in the industry is very much seen as a networking exercise rather than purely on cost or through tender.

But the whole Board of Directors makes for envious reading.

Persistent Systems alongside another growing firm, LTI Mindtree, are chasing down the established leaders with strategy, growth and enormous ambition, to grow and move from being niche players within India’s IT industry to emerging as global giants.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.