FREE WHELAN: This US rally hasn’t hit top speed yet… ahead of the inevitable

Experts

Experts

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine money manager and national jump rope professional.

Firstly, now that we’re marginally underweight all I can see is split market calls. Then you see something like this and you really know the probable direction of the market:

The best reverse indicator out there. Thanks, Jim.

Interesting close to the week that was with a rally on good news re: the jobs numbers.

Good news being good US economic news causing a rally when usually it should force the Fed to extend their rate hikes. However it seems that the market is aware of this and still pushed on, bolstered by the unlimited debt ceiling cash bonanza relief.

Apparently that’s really inflationary; The amount of T-Bills Treasury now issues is money that comes out of other places in the financial system. And those places are really important.

Read: James’ note for more deets on same last week!

There’s a decent theory that the Fed doesn’t actually need to raise because of the existing credit crunchiness along with increased burdens felt by the banking system to restrict lending. The trouble in financial markets is enough to simulate a rate hike. Interesting thesis, held by some serious names.

General feeling is that with the US market ripping along like this and volatility so low we’re in for a blow off top before a pull back.

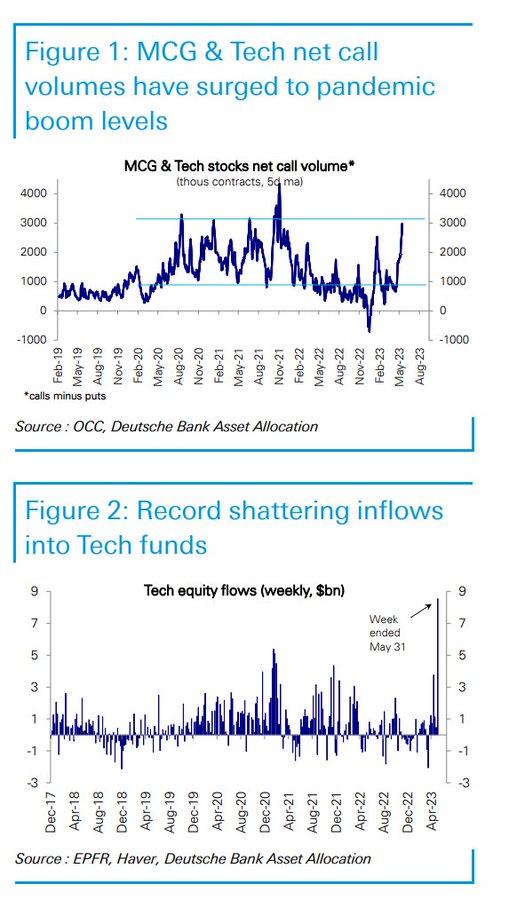

We also have one of those gamma squeeze situations like we did in the pandemic when the Robinhood kids were buying call options which means market makers have to hedge them which pushes stocks further up, meaning more have to be bought etc. We all know what happened next.

I won’t go into skew and June options expiry but it’s definitely in a “take some risk of the table” mood right now.

Also the US market is now exactly flat on a total return basis since the first rate hike by the Fed in March last year.

In the face of rates putting on 5% from nothing.

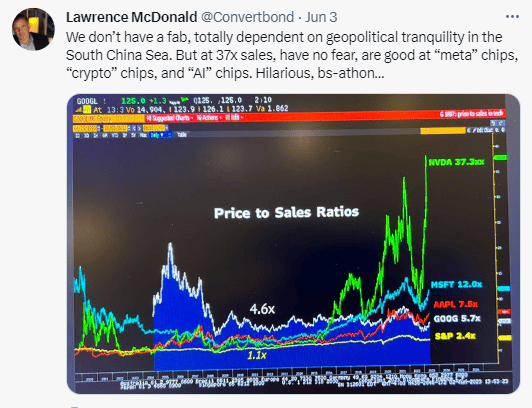

I do not believe that whatever the Fed was trying to break hasn’t actually broken yet. When it does it won’t be as bad as the media says but there’ll be jitters and the companies that ran the hardest will feel it the most.

*Not that I love the NVDA story but they do have a tendency to be on the ready with whatever fad thing their chips can be used for.

*”Fab” is a semiconductor fabrication plant.

Locally, China is solved, get involved. Here’s is the only quote you need:

“We also expect policymakers to step up easing measures around late June/early July and a consumption-led recovery to broaden out in the second half as the job market and income levels recover,” wrote strategists led by Laura Wang at Morgan Stanley in a report on Sunday.

“These upcoming developments should help earnings cuts bottom out before reaccelerating in the third quarter this year. Early signs of US/China resuming direct communication are also emerging, pointing to a rising chance of a stabilisation trend in the second half.”

That’s taken from the South China Morning Post and is the reason for the boost to Asian stocks, including iron ore related stocks that we know and love.

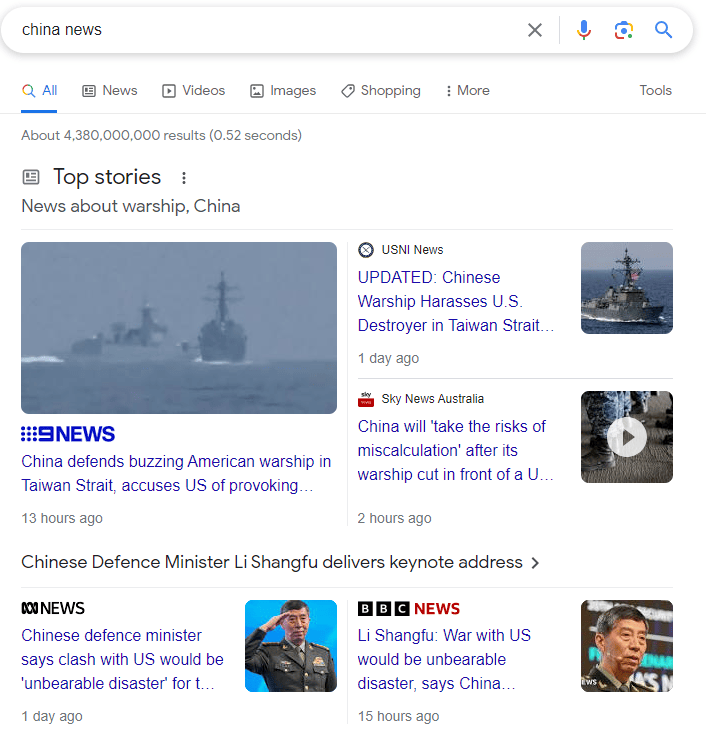

However when you search for “China news” in the Google you get this… funny that.

As if there’s an effort to focus on the conflict.

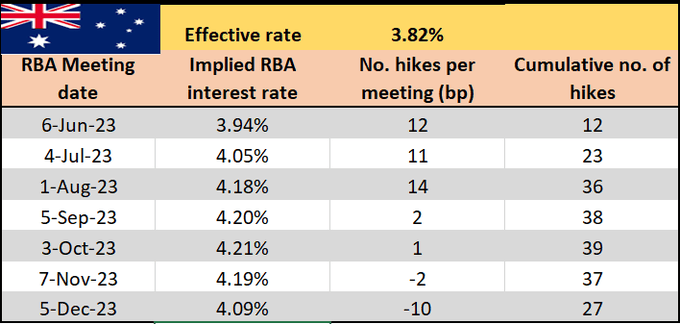

Locally our RBA meeting tomorrow “is Live” again, according to CBA:

CBA Chief Economist Gareth Aird on Friday:

■ We expect the RBA to leave the cash rate on hold at 3.85% at the June Board meeting. But we consider the meeting now ‘live’.

■ We ascribe a 70% chance to no change and a 30% probability to a 25bp rate increase to 4.10% (we consider the risk of any other move immaterial).

■ The economic data released since the May Board meeting does not support another rate hike in June.

■ Indeed key economic data that the RBA forecast has come in softer than their most recent updated forecasts.

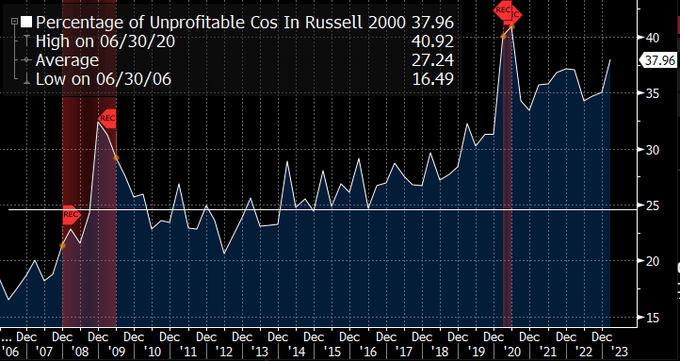

Finally, here is an updated chart on unprofitable companies in the Small Cap Russell 2000. Looks to be on its way back to Covid highs.

That’s not a great sign for me.

Happy to be a part of the resource uptick while remaining underweight the overbought US tech and ex-consumer discretionary locally as things really start to bite by the RBA.

Nb: Am hosting a Global Outlook in a few weeks. Come for the hors d’oeuvres, stay for my cunning views in a little more detail.

Thanks and all the best,

James

P.S. Final days leading up to the Jump Rope Nationals and I’m ready. Next update will be hero or better for the experience.

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.