FREE WHELAN: AIeeeee! Take the money and bunker down! *drink*

Picture: Getty Images

Good afternoon and a happy Monday!

First, a note: Hosting a Global Outlook in a few weeks. Book a spot now and catch all of my views in a little more detail.

Debt ceiling is solved, GET INVOLVED!! Is the theme of the tail end of the Memorial Day weekend in the US and as I go through the final prep for my “Novice to Nationals” journey to compete in the +40 years category in speed skipping jump rope.

The good thing about training more is that you get a lot more time to focus on podcasts and can pick up a variety of views to assist with the investment journey. Sore legs, back and feet but a determination to not let the team down with less than two weeks to go.

We lean into the storm

I can also say that if you are playing the “financial buzzword drinking game” and had “artificial intelligence” on your card then maybe taking June off the booze is the best way to recover from an insane few weeks of US chatter. Every man and his dog is talking about Nvidia’s extraordinary week, which held the market together in a week when by all rights things were looking grim. (More on breadth below.)

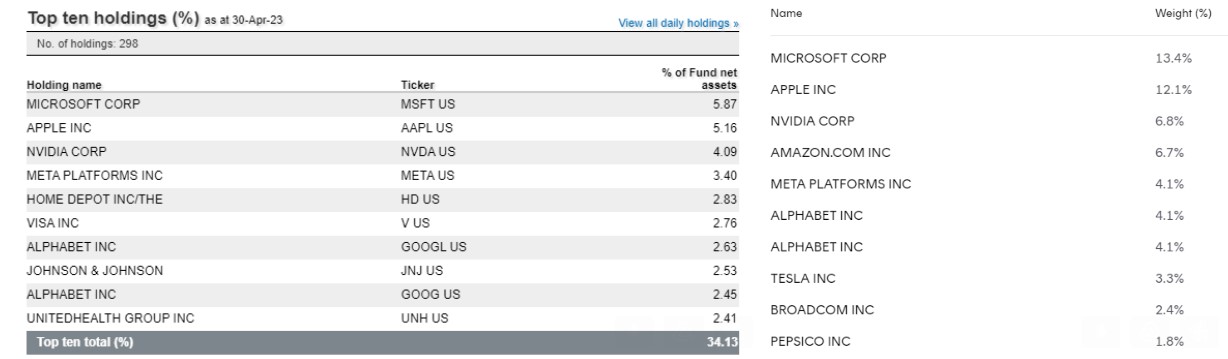

Not holding Nvidia directly on accounts is okay when you look at the US exposure and see the exposure is in Quality and Nasdaq (QHAL & HNDQ) with holdings like this:

So we look back on a week in which the market saw some panic overall but the holding of a small cluster of stocks showed resilient.

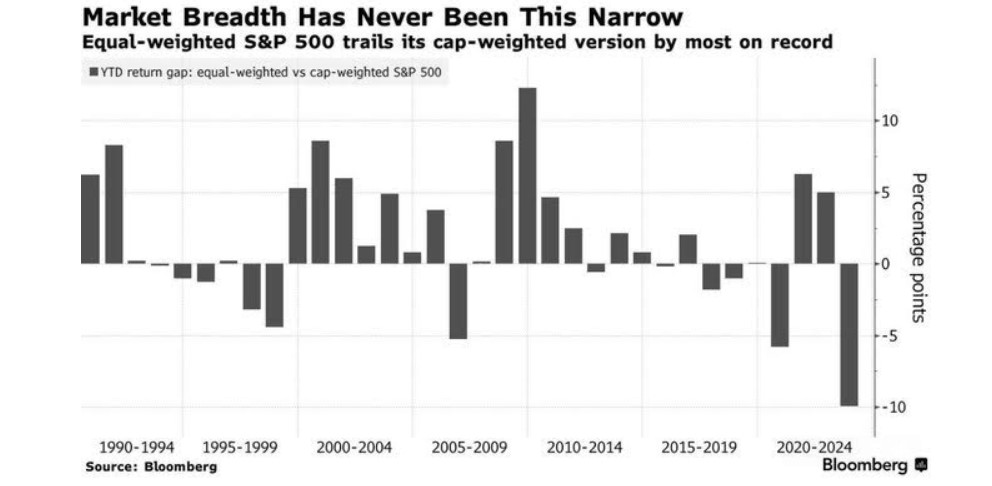

Beware markets that look like this:

As a description, investing in the S&P500 on an equal weighted basis has so far, this year, returned 10% LESS than investing in the index-weighted counterpart.

Simply, the market is being held up by a few names.

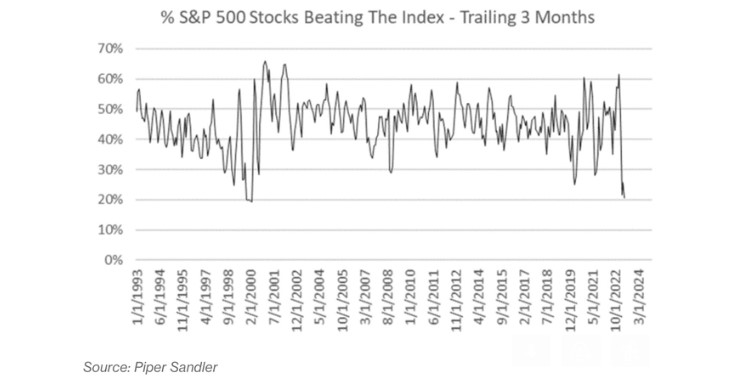

In February, the number of companies in the 500 above their 200-day moving average was twice what it is now. There’s an old expression “nothing good happens under the 200 day” and more companies are slipping under there.

Still with the 500, only 20% of companies are outperforming the overall index. That’s the lowest since the start of the century (I’m really feeling my 42 years when I say something like that).

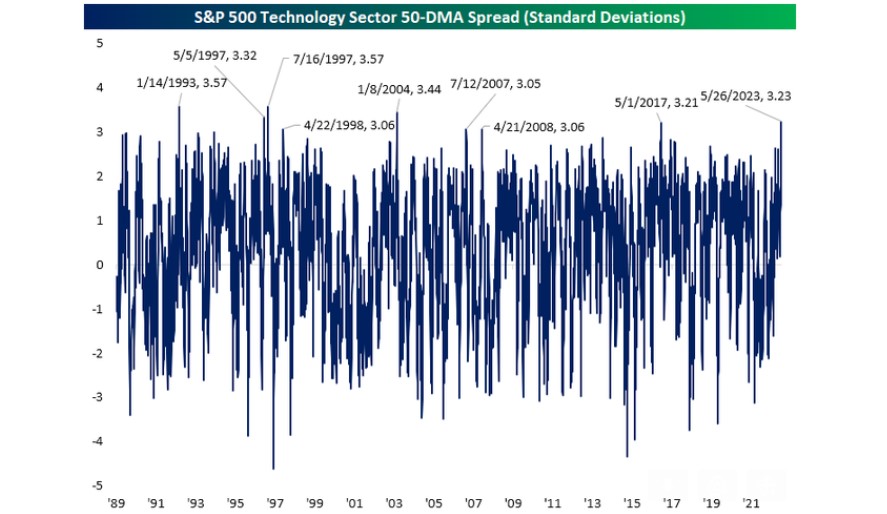

So yes, it’s only NVDA and tech that are holding this whole show together. And I don’t know how you feel about stats but if you see anything +3 standard deviations then you know it’s an anomaly.

The Tech Sector is trading +3 SDs above it’s 50 Day Moving Average. The most overbought it’s been since January 2004. That simply cannot hold.

I will be rotating out of some tech and going overweight global aggregate bonds this week. Locking gains and playing safe for a while.

Because…

My feet are killing me but the extra time dedicated to listening to economists and fund managers talk their book I can tell you with all certainty that the market is loving the fact a compromise seems to have been reached in Washington. The big however that looms is the amount of money that now needs to move to the hyper-safety of US short term T-bills. It’s a simple market mechanics thing and one I won’t (*can’t) explain very well.

That’s why we had Pepperstone’s Chris Weston on the podcast on Thursday. If you want an explainer then this is it.

If you want a few words then Bloomberg’s Garfield Reynolds has it too:

“But such gains could be fragile thanks to short- and long-term headwinds. In the immediate future, it’s likely the US will catch up with its funding needs by selling some $1 trillion of T-bills — sucking liquidity out of markets.”

I’ll do my best: the basic rule of investing is to maximise return while minimising risk. If the US treasury issues the safest asset in the world to extend their debt and pay the bills and you can invest in it, then you absolutely do, taking it out of equally risked but lesser returning assets or equally returning but higher risk assets.

That’s the best I can do. Hope that helps.

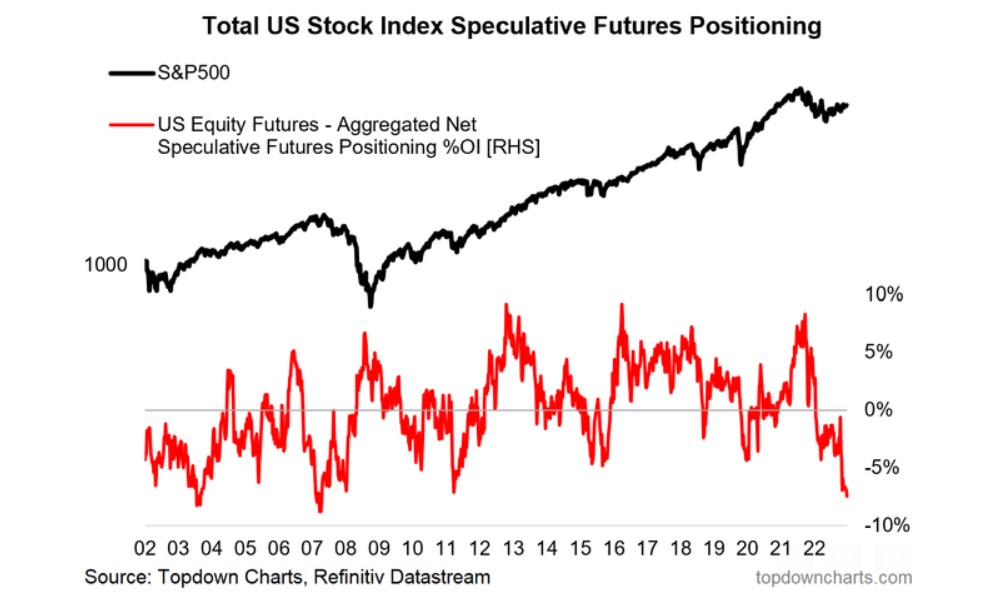

In other news and thanks to the Topdown Charts team shorts are increasing in the market…

Also this, when can I pack it in and go on holiday? *drink*

Finally, because it’s amazingly interesting, there is a global search that’s been going on for a certain type of steel. It’s all related to nuclear testing but it’s the most interesting thing I’ve read all week.

A Chinese salvage ship has been caught red-handed trying to tear apart World War 2 shipwrecks for scrap. But why would they desecrate these underwater graveyards which are protected by UN treaties? The reason: Low Background Steel. pic.twitter.com/2cIMSlI8dc

— Hernan Cortes (@CyberPunkCortes) May 26, 2023

And so ends the month of rhyme-based investing, which I’ve always hated, which was saved by a few of the best stocks in history.

I’ll take it.

Stay safe and all the best,

James

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.