FREE WHELAN: Could a ‘reasonable person’ have known the RBA would raise rates two years before promised?

Experts

Experts

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets.

From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Firstly – and foremosterly – one cannot stress enough how much one needs to be paying attention to what’s going on in Holland. Or the Netherlands, or Les Pays-Bas (The Low Countries, as the unimaginitive French will insist)… or whateva.

Les Dutch farmers blockade, in the haute cuisine of my opinion, is one of the most important events of 2022 and should not be discounted as bored paysans looking for a park. It’s the culmination of years being locked up and called upon to provide and provide and provide and then eventually being asked to do it all differently just to meet EU regulations.

I’m not allowed to have a view on what is or isn’t right. My job is to try (TRY) to be objective and weigh up the investment case. You look at Holland, people have had enough. Sri Lanka, enough.

Albania, enough.

Watch what happens in Germany too. Reduction in heating use on the wrong side of summer. It’s going to be a nightmare.

Little pockets of nations all over the world are now rising up after years being forced to stay-in while printing presses worked overtime and are now discovering the price for all of that is that everything is much more expensive.

One sees headlines like this in UPPER CASE and one thinks that we are simply physically incapable of getting ourselves out of this mess.

David Cameron has a lot to answer for. (ed- WTF?)*

*ED – WTF?

(In fact, James, we concur. Please see: Cameron, D “Regrets, I have a few”)

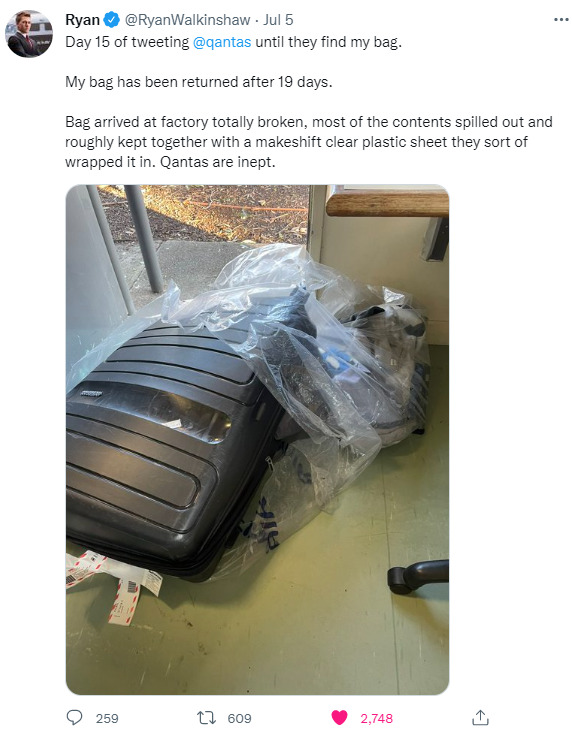

Actually do start me on airlines:

Airline in 2019: You want to sit with your family? LOL that’ll be $200 and we probably won’t do it. Also your luggage is 400 grams over so that’ll be $100 extra.

Airline in 2020: Please remember we’re all in this together? We just need a few million dollars to get us through a pandemic we weren’t in any way prepped for. Please don’t let us suffer.

Airline in 2022: Welcome back to the skies! We’ve overbooked your flight which is four hours late. We lost your bags… and your family… and we sacked our call centre.

Trade accordingly.

Qantas (ASX:QAN) is teetering on breaking support as well.

Short if that happens.

The BIP Show podcast last week was red hot. I had two mortgage brokers on and AMP Senior Economist Diana Mousina explaining what’s actually going on at ground level in the Aussie mortgage market.

Whilst I’m meant to be all big picture global things, I’ve had so much feedback on housing and lending that I had to run a show that was more than an economist telling us what RBA messaging means for borrowers. Most of the time that’s BS anyway (please don’t tell them that.)

These guys know what’s actually getting questioned by banks and what people’s capacity is like in a very peculiar housing market. Diana is also unafraid to make a call on direction. She is legend.

Key takeaways:

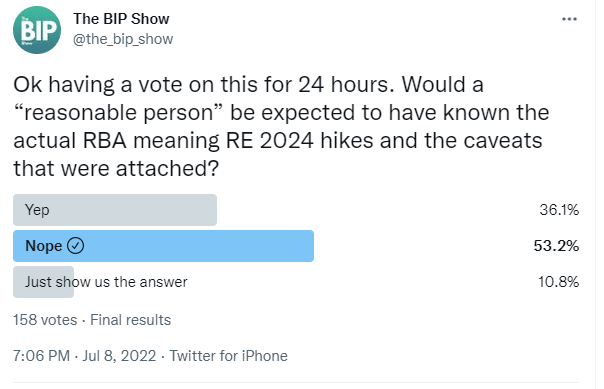

This last point really caused some division. Should people have known that the RBA was probably going to raise rates in 2022?

For fans of the BIP, I put it to a vote.

The “reasonable person test” is one we use to determine insider trading.

For example, would a “reasonable person” be expected to have access to some company information?

Would a “reasonable person” have known that “no rate hike this year” came with caveats everyone in markets knew were going to be triggered?

My constituency is mostly finance types and in our opinion the message wasn’t broadcast correctly to “Joe Punchclock”.

And Mr Punchclock has every right to be upset.

It’s not like there’s a shortage of microphones at the RBA.

It’s also on all of us in financial commentary for not yelling this loud enough.

But we’re all in this jam together and the mortgage guys give a few great tips for what sort of things we have ahead and Diana gives some amazing predictions into what the next RBA moves will be.

No one has the excuse of not being prepared now.

All eyes on US inflation numbers at the end of the week and if they’re as punchy as NFP was on Friday night then expect the market to respond negatively. Inflation is the story this year.

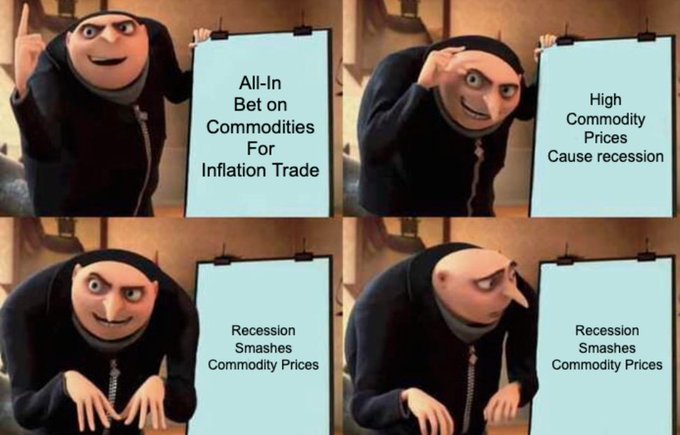

Confusing enough that oil is not only the tail being wagged but is also the tail wagging the dog on recessionary fears. Claude Walker posted this and it’s lovely.

Everything you need to know is explained in this image.

Stay safe and all the best,

James

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.