As gold price trends upwards what ETFs offer a simple, cost-effective exposure to the precious metal?

Experts

Experts

A regional Victorian gold prospector picked a good time to uncover a 2.6kg specimen of quartz and gold while prospecting in what is known as “the Golden Triangle” between Bendigo, Ballarat, and St Arnaud.

Continuing economic uncertainty along with recent fears of a global banking crisis following the collapse of banks in the US and Swiss bank Credit Suisse has seen demand for safe haven assets like gold rise.

In turn the price of gold has been trending closer to the US$2000/ounce mark. The prospector’s nugget has been valued at ~$250k.

Global X investment analyst David Tuckwell told Stockhead as they have done during the latest banking crisis, gold and silver (up 4.69% for six months to $23.08/ounce) are also benefiting from an ongoing weakening of the US dollar.

“Gold and silver mostly trade in USD, yet most buyers are outside the US so as such a weakening US dollar can make it easier for them to buy gold and silver, supporting demand and therefore prices.”

Furthermore, Tuckwell said weakening yields on US government bonds have provided further support still for gold and silver prices, as lower government bond yields translate directly into a lower opportunity cost of capital.

“Like other assets, the value of gold and silver are determined heavily by the opportunity cost of capital,” he said.

“When that falls, the value of gold and silver rises.

“Any serious model of precious metals prices looks closely at real yields on US treasury securities.”

The price of gold has risen ~500% in the past 30 years.

CFD and forex trading platform Eightcap’s APAC head of sales Zoran Kresovic said that as Credit Suisse went under and UBS stepped in to purchase the banking giant, they saw investors flock to gold.

“The price of gold is now 11.31% higher than its recorded recent low on March 8 and was close to approaching its all-time high which it hit back in August 2020, when investors fled to the precious metal amidst the shattering of the global economy due to COVID-19,” he said.

Recent assistance of the US government in the latest banking crisis and UBS takeover of Credit Suisse is providing some sense of security and comfort.

“We are seeing traders liquidate long positions and the short sellers are running the show currently,” he said.

He said the US dollar demand appreciation since Monday’s open has also seen the price of gold ease slightly.

“However, while gold is having a cool-off period and retracing, overall the market risk is still in a fragile state as regional banks in the US remain under threat,” he said.

Tuckwell said traders in the US are increasingly making bullish bets on the gold price.

“This is reflected in the greater open interest on call options on the GLD ETF in the US, and increasing inflows into gold ETFs around the world,” he said.

According to the World Gold Council, gold ETFs saw their biggest inflows in a year on the week ending March 17.

“Central banks have also been buying gold in record volumes, led by China, Turkey and Russia,” he said.

“All in all, this is a very strong market for gold and investment banks across the board are raising their price targets.”

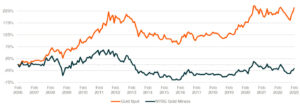

Tuckwell said gold miners provide geared exposure to the gold price — rising more than the price of gold in bull markets, and falling more in bear markets.

“However miners have underperformed the spot price of gold the past 20 years,” he said.

“The higher volatility and long-term underperformance have meant gold miners ETFs are less popular globally than gold bullion ETFs.”

He said when gold prices are high, there’s usually greater capital markets activity because gold miners can sell forward their gold production in the futures markets.

So thinking about investing in gold? Online investment advisor Stockspot reckons one of the simplest and cost effective approaches to owning gold is through exchange traded funds (ETFs).

Senior manager of investments and business initiatives Marc Jocum said ETFs are designed to offer investors a simple, cost efficient, and secure way to access physical gold by providing a return equivalent to the movement of the gold price, without the inconvenience and costs involve for transport, storage and insurance.

There are four physical gold ETFs listed on the ASX including:

GOLD was the first gold bullion ETF in the world and this week celebrated its 20th anniversary, having been launched by Tuckwell’s father Graham in 2003.

“Gold ETFs are an Australian invention, with GOLD the first gold ETF in the world,” Tuckwell said.

“It has spawned copycats and emulators around the world, and there are now gold ETFs of various kinds on every major exchange from the US and Europe, Egypt through to India.

“There is now over US$200 billion in gold ETFs around the world.”

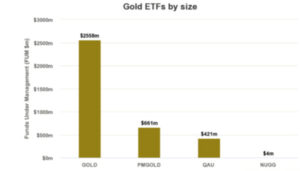

It is also the largest gold ETF in the Aussie market with more than $2.6 billion in funds under management (FUM).

“Despite the renewed interest in the precious yellow metal amidst market volatility, over the past year to February 2023 it has seen $34 million of outflows,” Jocum said.

“QAU has seen over $114 million of net inflows as investors may want to hedge their exposure to the US dollar with its recent weakness.”

Jocum said PMGOLD is a quarter of the size of GOLD, while QAU has grown to $421 million.

“NUGG is the newest gold ETF in the market, launching in December 2022, and only has $4 million in size,” he said.

Jocum said the major difference to watch out for is whether the ASX Gold ETF uses allocated or unallocated gold.

“Allocated gold means you hold the physical gold,” he said.

“Unallocated gold is similar to an IOU, where you only have the right to acquire it.”

He said PMGOLD is an example of unallocated gold as the Perth Mint holds the gold on your behalf.

“Despite being backed by the WA government, if there was a default of the custodian bank, you would have to get in line with other angry investors to get your gold back,” he said.

Jocum said investors have no ownership over the gold and additionally, the bars can also be lent to third parties without consent of the individual investor.

“This is why PMGOLD has a lower management fee – they have smaller running costs given they don’t have to pay for physical storage,” he said.

“GOLD, QAU and NUGG are physically backed by gold bullion which are stored by fund managers in a vault on behalf of investors.

“Investors are unit holders of the funds and can redeem their investment at any time for cash or in exchange for gold bars.”

For investors who want exposure to companies that explore or mine for gold, there are two ASX gold mining ETFs available including:

GDX provides exposure to ~50 companies involved in mining gold and silver. It is unhedged with a large focus on North America charging 0.53% per year management fee and has ~$490 million in assets.

MNRS is a hedged version that invests in over 50 companies engaged in gold, silver or other metal mining. It is slightly more expensive because of the hedging protection, charging 0.57% per year, and is much smaller than GDX, accumulating ~$61 million in AUM since launching in July 2016.

“There is a large overlap of holdings between the two with half of the companies in both ETFs, although GDX has more Australian gold mining companies,” he said.

Jocum said lastly one of the key advantages of using an ETF to gain exposure to gold is the ability to quickly buy and sell your investments.

He said GDX has tighter spreads than MNRS (0.21% vs 0.43% respectively).

NOW READ: Emma Davies’ article on who takes the cake for the best gold discoveries in the last five years.

ALSO WORTH READING: Tim Boreham’s latest article on gold miners takeover bids.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article