Global X marks 20 years of GOLD ETF as price of precious metal inches closer to US$2000 mark

Pic: Getty Images

- Global X Physical Gold ETF (ASX:GOLD) celebrates its 20th anniversary since launch today

- GOLD was the first gold ETF launched in the world revolutionising trade of precious metal

- Gold performs well during economic volatility, and has risen ~20% in the past six months

Firstly, a little gold history lesson. Since ancient times the precious metal has fascinated humanity and been a sign of wealth, luxury, and power.

In the modern world use of gold in jewellery, electronics and by central banks and investors, gold plays a key role at different stages of the global economic cycle, none more than during a downturn.

On April 5, 1933, during the Great Depression and a banking crisis, US President Franklin Roosevelt signed Executive Order 6102 “forbidding the hoarding of gold coin, gold bullion, and gold certificates within the continental United States.”

Citizens could own up to $100 in gold, equivalent to 5 troy ounces (160g) and were forced to turn in quantities above this figure to the US Federal Reserve before May 1, 1933 for what many argued was much lower than the market rate.

Reasoning for the confiscation was that the difficult economic times had caused a hoarding of gold, which in turn stalled economic growth and worsened the Depression as the US was then using the gold standard to fix the value of the nation’s currency to the price of gold.

The government set a new official rate for gold that was much higher as part of the Gold Reserve Act 1934 and turned it from more of a currency to commodity.

The Australian government similarly nationalised gold. Part IV Sections 40-46 of the Banking Act in 1959 allowed gold seizures of private citizens if the Governor determined it was “expedient so to do, for the protection of the currency or of the public credit of the Commonwealth.”

Essentially, the act made it legal to seize gold from private citizens and exchange it for currency. In January 30, 1976, this part of the act was suspended.

Australia launches first gold bullion ETF

Moving on, did you know that Australia was the first country to launch a gold bullion ETF?

Global X investment analyst David Tuckwell has been given the honour of talking about the Global X Physical Gold (ASX:GOLD) because it was 20 years ago today on March 28, 2003 that his father Graham first launched the ETF.

“When my father launched GOLD it was the first gold ETF in the world and a lot of people thought he was nuts because ETFs were only just coming onto the market and weren’t mainstream,” Tuckwell told Stockhead.

He said furthermore the GOLD standard had only ended 30 years ago and the price of gold had done terribly since.

“People weren’t sold on ETFs as a concept and weren’t sold on gold as an investment either so the GOLD ETF was met with skepticism,” he said.

However, Tuckwell said since then gold bullion ETFs have become very much a global phenomenon and not just important for traders and investors to invest in the gold price long term.

“These days they’ve become so big and influential they even help determine the gold price,” he said.

“Money moving in and out of gold in Australia and around the world also determine whether the gold price will go up and down, they’ve become that powerful.”

Tuckwell said the World Gold Council run a model on which way the gold price is heading with inflows and outflows of gold ETFs one of the key variables considered.

“Gold ETFs are very much an Australian invention with gold bullion ETFs now worth $200 billion worldwide.”

More broadly Tuckwell said gold miners ETFs have US$18 billion under management.

Originally named Gold Bullion Securities, the product itself hasn’t changed, but the name has switched to ETFS Physical GOLD and most recently Global X Physical Gold ETF.

The latest iteration follows the acquisition of ETF Securities in June 2022 by South Korea’s Mirae Asset Management and its New York based subsidiary Global X ETFs.

“It remains a way to trade gold physical bars trading on exchange and it’s now one of the largest and most heavily traded ETFs in Australia,” he said.

“On Wednesday, March 22, it was the most traded ETF in Australia.”

Why gold ETFs are significant

Before gold ETFs were invented investors wanting to invest in gold had two choices.

- Buy a bullion or gold coin then arrange security

- Buy shares in gold mining companies

The problem with buying gold is you would have to find a seller and then organise security, which was difficult. The late Media tycoon Kerry Packer, then Australia’s richest man, had $5 million of bullion stolen in 1995.

“Even someone as powerful and mighty as Packer struggled to provide safe keeping for gold and then when you want to sell your gold you’ve got to find a buyer,” Tuckwell said.

“Gold miner shares are correlated to the gold price like mining of any other commodity.

“When you buy a gold miner you’re not just buying gold but competence of the management team, balance sheet and all other variables that go into the price of a stock.”

What Tuckwell’s father did was enable gold bullion to trade on an exchange like shares.

“It got rid of the risk of buying gold yourself with it backed by physical gold bars held in a vault by JP Morgan who run an ultra secure underground bank vault,” he said.

In what sounds like it’s straight out of a movie, the largest investment plays like Global X execs could visit the vault (after all they have ~$2.8 billion in AUM in the GOLD ETF) but there would be a process.

“You’d get put in a car blindfolded so even we don’t know the location of the vault,” Tuckwell said.

“You get this type of institutional grade security at a low cost and get to buy and sell on a stock exchange rather than having to find your own buyer or seller so it has simplified the process.”

Gold like an insurance policy

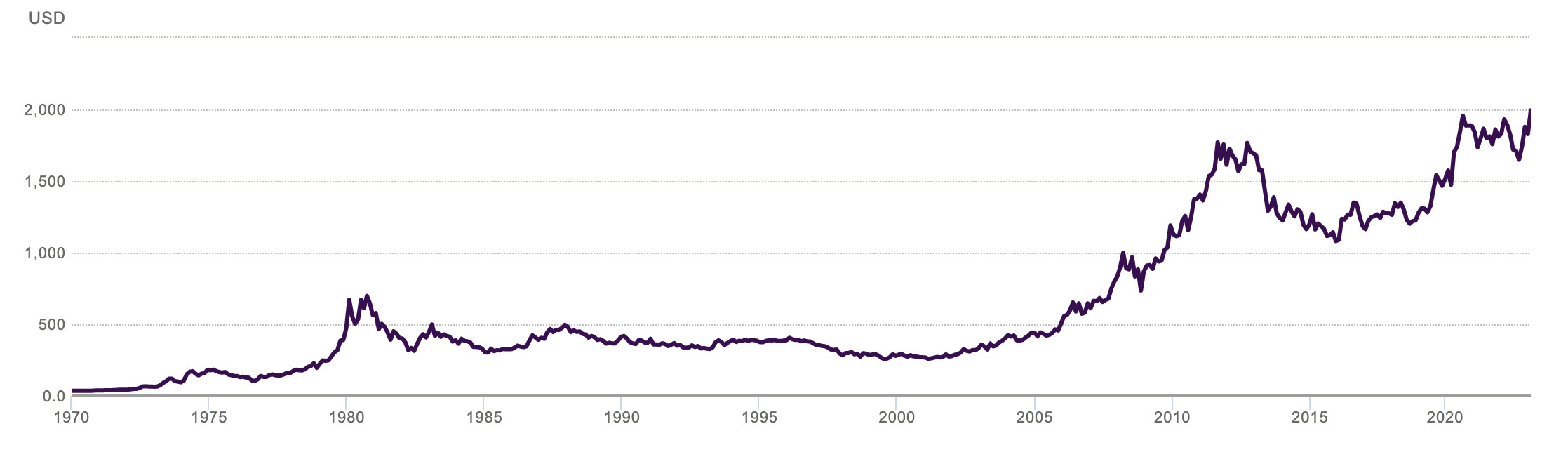

Tuckwell said when it first launched the ETF was selling for ~$5.70 and is now worth ~$27. Adjusted for inflation, it has risen about four-fold over the 20 years in line with the gold price.

GOLD ETF price over 20 years

“Gold is one of the assets people turn to when they are scared and the way we talk about it is as an insurance policy,” he said.

“When you pay your premium, you’re making a bet against your house and you don’t want something to happen to your house but if an unfortunate event was to occur, your insurance policy would pay out and be worth something.”

Tuckwell said insurance is highly unusual in that you don’t want it to pay out or succeed but you also understand that the growing value of your house will more than offset the premium amount.

“Gold is very similar in that investors will put a small amount of their portfolio into gold, around 5%, and hope for the large part that it doesn’t perform well,” he said.

“Over longer periods of time what you want to perform best is your property, shares, bonds because that tends to suggest the world is good place and the Australian economy is growing and your wealth is growing with it.”

Gold shines during economic volatility

Tuckwell said in contrast gold tends to shine during times of economic volatility such as now. Gold has risen ~20% in the past six months and as Stockhead’s Josh Chiat noted, closer to US$2000/oz than at any point in 2023’s yellow metal rally.

“So gold has been one of the best major asset classes in the past year as inflation wreaks havoc, banks are collapsing, there’s a war in Eastern Europe,” he said.

“That tends to be the geopolitic and economic context in which the gold price does well.

“We saw the gold price was also one of the best performing assets again during 9/11, the 2008 financial crisis, the pandemic because gold does well when the world does badly.”

He said investors tend to treat gold as an insurance premium, thinking it will do badly a lot of the time but thinking if it does then chances are the rest of their portfolio is going well.

“The big bang moment for gold ETFs was the 2008 global financial crisis as gold outperformed and investors desperately sought a way to hedge against financial instability,” he said.

Gold prices 1970-2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.