Who’s hunting for the next big NWS oil and gas discovery?

Energy

Australia’s North West Shelf is the country’s premier oil and gas destination, home to some of world’s largest gas fields that feed major liquefied natural gas (LNG) projects and large oil fields.

You would think, then, that given the large-scale of these resources along with the high cost of drilling offshore wells — particularly deepwater wells — that only major oil and gas players would be active in the North West Shelf.

Well if you did, you would be wrong.

As amply demonstrated by Carnarvon Petroleum (ASX:CVN), there is still very much a role for smaller oil and gas companies to play.

The recent oil flows from the Dorado-3 appraisal well near Port Hedland, which operating partner Santos (ASX:STO) described as among the highest of any oil appraisal well in the region, provided some real validation to the company’s belief that there were still big finds lurking in the region.

Carnarvon managing director Adrian Cook told Stockhead that the Dorado-3 showed strong positive results were still out there in the North West Shelf.

“Hopefully it increases exploration activity; there has been a dearth of activity in the last five years or so.”

So who are some of the intrepid players looking for the next big discovery in the North West Shelf?

Karoon Gas (ASX:KAR) has narrowed its Australian focus to the Carnarvon Basin where the eastern part of its exploration permit is located close to the Dorado discovery.

Operating partner Santos has lodged an application to renew the permit and plans to carry out seismic reprocessing and other studies to review its potential to host another Dorado.

3D Oil (ASX:TDO) also holds a permit within close proximity to the Dorado find and is preparing to lodge an application to carry out about 510km2 of 3D seismic that it is required to do.

This is a considerably lighter burden than the multiple well commitments that accompanied bids for adjacent acreage during the recent offshore acreage round.

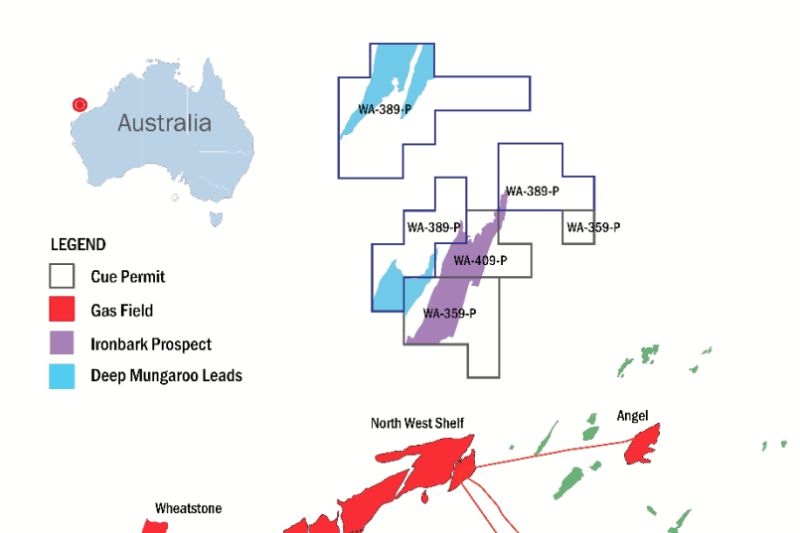

Stepping away from Dorado, Cue Energy (ASX:CUE) is participating in the drilling of the Ironbark-1 exploration well in the Carnarvon Basin to the west.

The company is carried through the drilling of this well, which is currently scheduled to be start in late 2020, by giant oil and gas company BP, which farmed into the permit during the 2018-19 financial year.

Any discovery at Ironbark-1 — particularly gas — could be quickly developed given its proximity to the North West Shelf LNG infrastructure.

Over to east in the Browse Basin, IPB Petroleum (ASX:IPB) has moved to relinquish its less mature permits to focus on appraising the existing Gwydion oil discovery.

Besides seeking a farm-in partner that could carry IPB through the drilling of the Idris appraisal well, the company is also investigating the potential to seek debt funding to drill the well, establish whether it is commercial and proceed with early development of the oil already discovered at Gwydion.

Octanex (ASX:OXX) is currently on the lookout for a joint venture partner to help appraise the Ascalon gas discovery in the Bonaparte Basin that was discovered in 1995.

Ascalon is located close to existing infrastructure as well as resources such as the Petrel and Tern gas discoveries.

Melbana Energy’s (ASX:MAY) permit in the Bonaparte Basin is the subject of a farm-in option agreement with Santos and Total.

The two majors had secured the option to acquire up to 80 per cent of the permit by carrying out 3D seismic over the Beehive prospect, which could host about 388 million barrels of oil.

Here are how these companies have performed over the past week and year respectively:

| Code | Company Name | Share Price | 1 week return | 1 year return | Market Cap [$AU] |

|---|---|---|---|---|---|

| KAR | Karoon Energy | 1.14 | -3% | 4.50% | $280.8M |

| CVN | Carnarvon Petroleum | 0.41 | 5.25% | 2.56% | $640.6M |

| IPB | IPB Petroleum | 0.026 | 8.33% | -31.60% | $5.5M |

| TDO | 3D Oil | 0.083 | 3.75% | -34.65% | $22M |

| OXX | Octanex | 0.008 | 0% | -13% | $2.2M |

| CUE | Cue Energy Resources | 0.115 | 0% | 66.60% | $83.8M |

| MAY | Melbana Energy | 0.009 | 0% | 77.77% | $16.9M |