Closing Bell: Buyers ambush benchmark setting new benchmark

Guy Ritchie buys the ASX. Via Getty

- Local markets started slow before ripping into an all-time intraday high

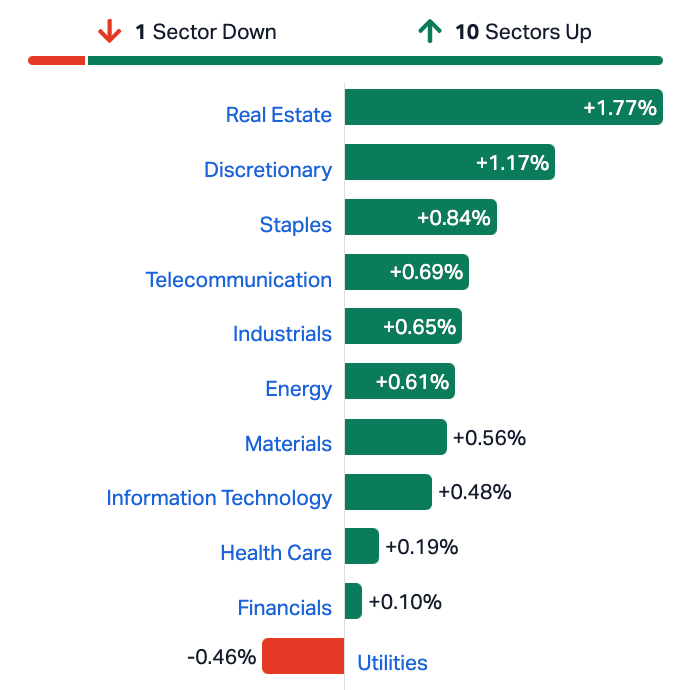

- 10 of 11 sectors higher, benchmark closes 0.50pc up

- Small Caps led by Motio, Cue Energy and Sierra Rutile

Some strong earnings on the last day of February and a few equity-enabling economic indicators have boosted local stocks into a surprise winning mood on Thursday.

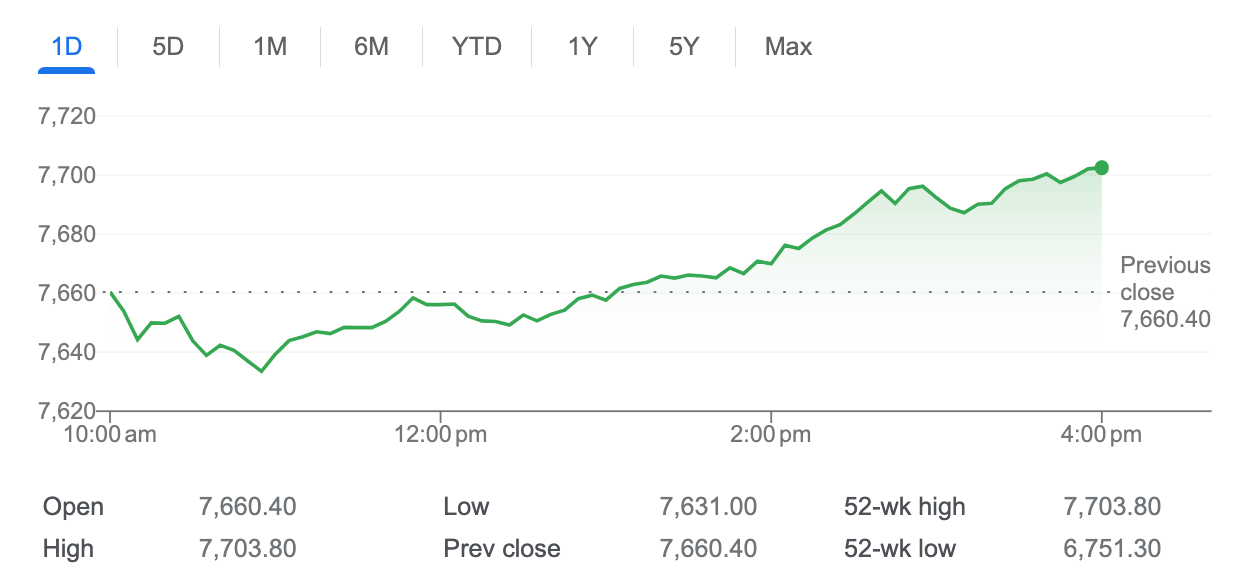

At 4.15pm on February 28, the S&P/ASX200 was up 38.30 points or 0.50% to 7,698.70

The final day of February has seen some fevered buying into the arvo, as the ASX200 Index clocked a new intraday high

On a day when even I’ve gone ex-dividend in Sydney, the Aussie benchmark began proceedings with familiar timidity before early positive corporate earnings and some quality downbeat data like weak retail sales added strength to the argument that the Reserve Bank of Australia should sharpen the cutting tools.

Sparking an unlikely rally were some of the best ASX anti-heroes.

Star Entertainment chief executive Robbie Cooke is probably crying tears of relief, joy, pain, exhaustion, terror, guilt and pride as his dead-to-the-rest-of-us Star Entertainment Group surged this morning after dropping a handy net profit of well over $9mn for the half to December.

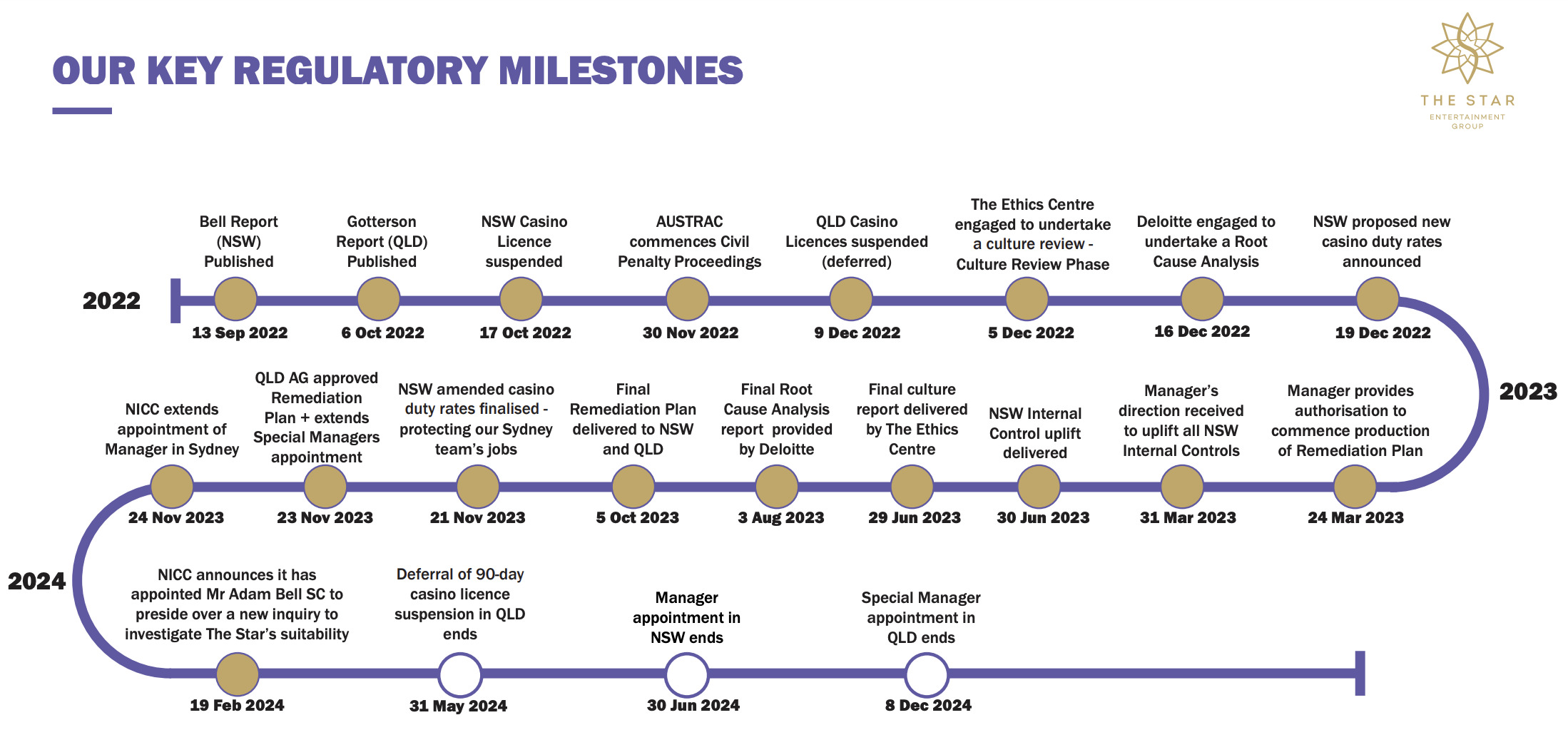

The casino is proving hard to kill despite once again finding itself caught deep in the gears of government – slapped a second time by the state gaming regulator who is now opening up the entertainment group’s entrails in a second inquiry in as many years into whether the company is ethically worthy of running a casino.

I could go into what a company has to do wrong to not seem upright enough to run an establishment wherein patrons imbibe of alcohol and play at games of chance, but why not just glance at the Star’s opening gambit in today’s 1H presso… that’s a lot of ‘regulatory milestones’….

Anyhoo. The Star is up for now.

The buying momentum lifted from mid-morning with Harvey Norman finding 5% despite weaker sales revenue and 1H earnings after executive chair Gerry Harvey talked up a cracking something about AI and how the business was about to make more money.

The other major upside surprise to pick things up ahead of retail sales was the engineering services specialist Worley which also added 5% on stronger revenue.

Random small caps dropped numbers on a bust Thursday as well.

The Aussie 3D printing specialist AML3D have turned in a corker, sucking up $1.5mn in first half revenue, an improvement on the $146k in 1H23, according to my son’s calculator that’s an increase of circa a 940%.

The Adelaide-based company says it’s received orders of $9.5 mn in the first half after getting the attention of the US Defence sector, leading to record cash receipts of $4.83mn.

AML3D’s broader growth strategy includes the ambition to accelerate US sales by establishing US based facilities.

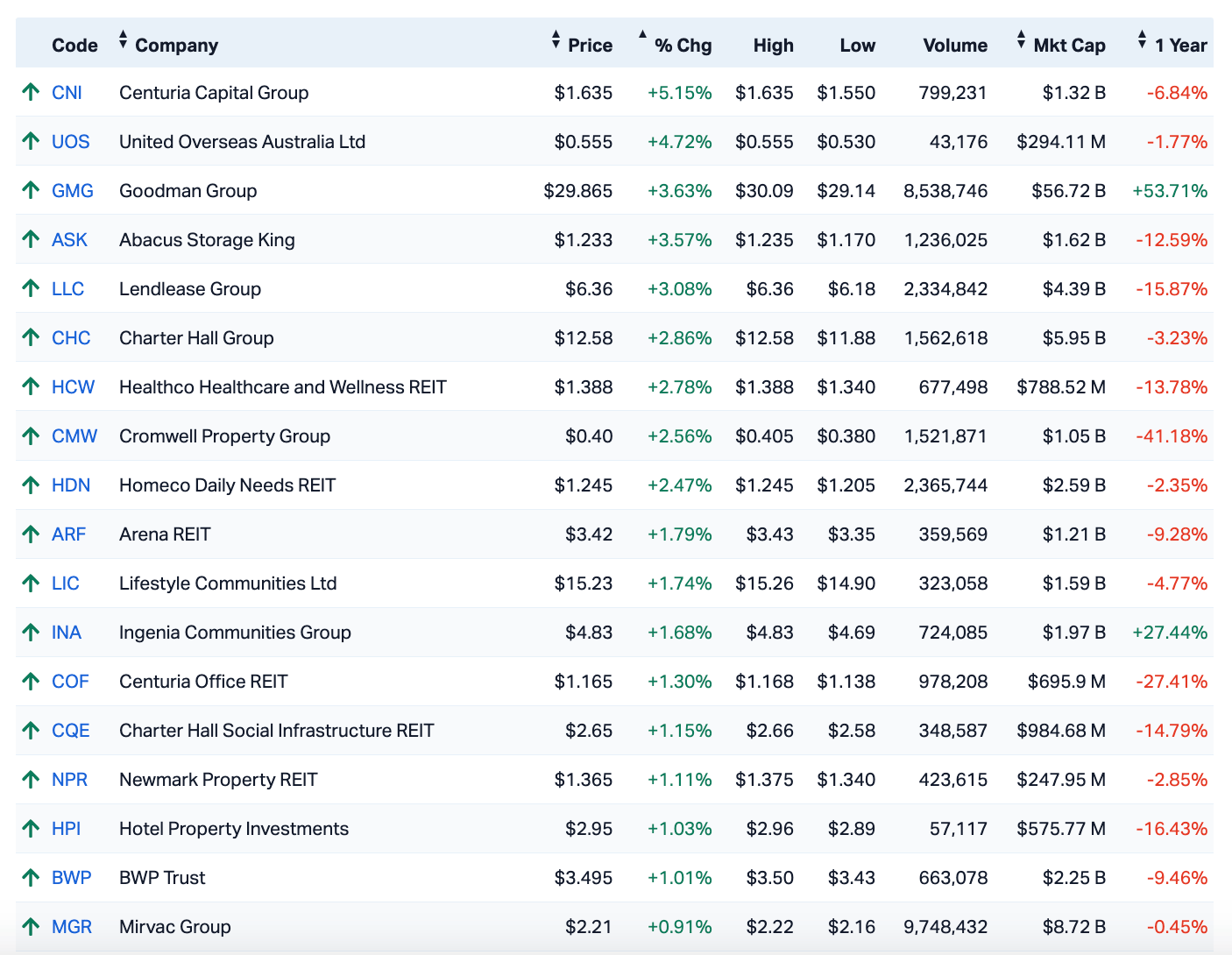

On the sector level the Real Estate stocks and REITS (real estate investment trusts) surged.

with the sector’s shares lifting 1.17 per cent, while miners (down 0.45 per cent) weighed heavily on the local bourse.

Up 1.6% for the day, the S&P/ASX 200 Real Estate (XRE) index has added a handy 12% year-to-date as every inflation easing indicator adds validity to the sector’s cyclical resurgence.

The S&P/ASX 200 Real Estate (XRE) index on Thursday…

One of those indicators to help the cause is January’s retail sales which the Australian Boffins of Statistics report came in well under market expectations of 1.5%, at just 1.1%.

Those unflattering numbers for Aussie inflation support January’s 3.4% monthly gauge which undercut broad expectations of further acceleration.

We’re all good that bad economic activity data is good for getting rates cut earlier – the RBA won’t want to go on tightening to rein in non-threatening inflation. But steady on – we’re far from home yet.

ASX Sectors on Thursday

ASX Ex-Divs on Thursday

AUB Group Ltd (ASX:AUB) is paying 20 cents fully franked

Beacon Lighting Grp (ASX:BLX) is paying 4.1 cents fully franked

Capral Limited (ASX:CAA) is paying 35 cents fully franked

Carlton Investments (ASX:CIN) is paying 41 cents fully franked

Corp Travel Limited (ASX:CTD) is paying 17 cents unfranked

Dalrymple Bay (ASX:DBI) is paying 5.375 cents 68.18 per cent franked

Ebos Group Ltd (ASX:EBO) is paying 47.5581 cents 95.77 per cent franked

Gold Road Res Ltd (ASX:GOR) is paying 1 cents fully franked

Integral Diagnostics (ASX:IDX) is paying 2.5 cents fully franked

Jumbo Interactive (ASX:JIN) is paying 27 cents fully franked

Metrics Income (ASX:MOT) is paying 1.6 cents unfranked

Medibank Private Ltd (ASX:MPL) is paying 7.2 cents fully franked

Metrics Master (ASX:MXT) is paying 1.44 cents unfranked

Pengana Int Equ Ltd (ASX:PIA) is paying 1.35 cents fully franked

Pro Medicus Limited (ASX:PME) is paying 18 cents fully franked

Shape Aust Corp Ltd (ASX:SHA) is paying 8 cents fully franked

Suncorp Group Ltd (ASX:SUN) is paying 34 cents fully franked

Ventia Services Goup (ASX:VNT) is paying 9.41 cents 80 per cent franked

Vulcan Steel (ASX:VSL) is paying 11.16 cents fully franked

Around the ‘hood…

Stocks on the Hang Seng are up almost 1% at lunchtime in Hong Kong, shrugging off Wednesday’s sharp losses and heading toward a stunning monthly gain of around 6 – 7%.

Wednesday’s city budget for the next 12 months revealed an economy which grew over Q4 by the sharpest pace in 2 years at 4.3%, with a decent upswing in tourism and pick up in private consumption. Finnace Hong Kong’s finance czar Paul Chan also pledged on Wednesday to remove the various HK property curbs to try and kick-start the real estate sector.

Mainland markets meanwhile are also looking perkier at near 3-month highs at around lunchtime in Shanghai, buoyed by following a drip-feed of pro-market measures to revive equities and boost investor confidence.

There’s some timid but growing optimism among local investors that Beijing will continue to push for opportunities in equity markets.

Already in 2024, the Chinese government’s rolled out a series of market-focused one-offs like jumping on the short-sellers and and lowering key lending rates.

The upcoming National People’s Congress which kicks off on March 5 could hold a few more carrots.

US Markets…

US stocks trickled lower on a simpering Wednesday of trade in New York as US investors cowered beneath the shadow of Thursday’s (NY time) PCE (personal consumption expenditure).

This one’s the Federal Reserve’s preferred measure of inflation and so much already spent in Mag 7 bets is on the line.

The S&P 500 pulled back 0.17 per cent to close at 5,069.76. The Nasdaq Composite fell 0.55 per cent to 15,947.74. The Dow Jones Industrial Average shed 23.39 points, or 0.06 per cent, to end at 38,949.02 and notch a third straight day of losses.

Speaking of the mystical 7, Google Mom and Pop company Alphabet (GOOG) has copped a post-woke-MAGA-directionless-fury beating to the tune of almost US$100mn since the internet giant had to unplug its infant AI (artificial intelligence) tool – which the hippy’s called Gemini – after mainly white users flagged its apparent bias against white people, who – lets be honest – are also pretty terrible.

Google chose to hit pause on Gemini’s apparently too artificial image generation application late last week and Alphabet shares have fallen almost 6% in the interim taking its market cap from US$1.798 trillion to US$1.702 trillion… so not much of a dent.

UnitedHealth lost nearly 3% to lead the Dow lower, while Urban Outfitters fell 13% after weaker-than-expected 4q numbers.

Real Estate was the best of the US Sectors, Comms Services the worst.

We’re watching crypto…

In crypto news, Bitcoin reached a fresh high of $64,000 Wednesday before turning lower, according to Coin Metrics. This marks the cryptocurrency’s highest level since Nov. 15, 2021, when it rose as much as $66,333.33.

BTC has surged almost 50% year to date and almost 25% this week as supply is shrinking and demand is growing according to our man from Cornwall in Sydney eToro’s Josh Gilbert.

“This feels like the start rather than the end for crypto assets, even as Bitcoin closes in on its all-time high in US dollars.

“We’re seeing huge interest in Bitcoin ETFs, which are garnering substantial trading volumes and billions of dollars of inflows. This milestone highlights a growing trend of institutional investors wanting to get exposure to bitcoin,” Josh told Stockhead.

US Futures in Sydney’s present…

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| VPR | Volt Power Group | 0.002 | 100% | 2,608,575 | $10,716,208 |

| TD1 | Tali Digital Limited | 0.0015 | 50% | 4,093,013 | $3,295,156 |

| CUE | CUE Energy Resource | 0.1 | 49% | 17,385,237 | $46,774,021 |

| MXO | Motio Ltd | 0.027 | 35% | 314,137 | $5,363,967 |

| HLX | Helix Resources | 0.004 | 33% | 6,213,714 | $6,969,438 |

| MCT | Metalicity Limited | 0.002 | 33% | 2,290,000 | $6,727,581 |

| MRD | Mount Ridley Mines | 0.002 | 33% | 1,246,498 | $11,677,324 |

| RR1 | Reach Resources Ltd | 0.002 | 33% | 12,763,300 | $4,815,446 |

| SFG | Seafarms Group Ltd | 0.004 | 33% | 5,814,958 | $14,509,798 |

| NSB | Neuroscientific | 0.048 | 30% | 4,408,923 | $5,350,380 |

| DCC | Digitalx Limited | 0.068 | 28% | 21,362,896 | $41,726,876 |

| EMP | Emperor Energy Ltd | 0.015 | 25% | 2,054,870 | $4,088,850 |

| SOP | Synertec Corporation | 0.12 | 25% | 204,572 | $41,423,610 |

| RWL | Rubicon Water | 0.5 | 25% | 10,000 | $68,754,042 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 200,000 | $12,000,000 |

| LNR | Lanthanein Resources | 0.005 | 25% | 257,852 | $5,159,248 |

| NAE | New Age Exploration | 0.005 | 25% | 2,915,000 | $7,175,596 |

| PAB | Patrys Limited | 0.01 | 25% | 1,262,807 | $16,459,579 |

| SRZ | Stellar Resources | 0.01 | 25% | 4,581,561 | $11,490,264 |

| SRX | Sierra Rutile | 0.084 | 24% | 1,889,239 | $28,848,078 |

| FFF | Forbidden Foods | 0.016 | 23% | 468,750 | $2,624,187 |

| NAG | Nagambie Resources | 0.029 | 21% | 206,007 | $19,119,256 |

| HPR | High Peak Royalties | 0.06 | 20% | 30,000 | $10,402,986 |

| MOV | Move Logistics Group | 0.48 | 20% | 54,097 | $46,554,052 |

| AYT | Austin Metals Ltd | 0.006 | 20% | 2,047,170 | $6,425,957 |

I’m loving this death or glory reaction to local biopharma Nyrada (ASX:NYR) , which this morning piled on another 50% in quick time (to go with yesterday’s 421% bonanza).

Since then, the stock’s come off 53%. So now only 418% up on Tuesday.

A strong run over 1H for Motio has traders diving in. Revenues of $3,675,500 are up 31%.

A chuffed CEO and MD Adam Cadwallader told investors that Motio is growing.

“The business has increased its revenue per location this half across each of its media channels. Motio’s software and payments platform (Spawtz) has achieved all of its growth revenue targets and business development KPI’s this half year, which has been extremely pleasing.”

Struggling Sierra Rutile (ASX:SRX) has swung to a more than $20mn 1H loss, with a nasty combination of weak market conditions and uncertainties around everything from Area 1 fiscal terms to power availability which has left the company betweedn rutile and a hard place.

However the stock has surged after Sierra flagged a suspension of operations from 11 March, and given notice of a redundancy programme “anticipated to impact 25-30% of the workforce.”

We’ve got gains for Cue Energy Resources (ASX:CUE) – up early in the morning after delivering its half-year, with a 22% lift in revenue to $29.3 million, and an underlying EBITDAX of $19.3 million, up 21%, and a 34% NPAT increase to $9.1 million.

Noxopharm (ASX:NOX) is continuing its recent run of good form, up another 28.2% after it banked some happy 1HFY24 results news yesterday.

Ardea Resources (ASX:ARL) and its Japanese consortium partners have reached an agreement on the scope and budget for the Kalgoorlie Nickel Project – Goongarrie Hub Definitive Feasibility Study. The Consortium has advised Ardea that they have completed their due diligence, and a final investment decision is in the works.

Norfolk Metals (ASX:NFL) is also higher after an upbeat projects update for its copper-gold play in Tasmania, and an expansion to its uranium exploration in South Australia.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CMD | Cassius Mining Ltd | 0.01 | -68% | 101,308,707 | $16,802,139 |

| DCX | Discovex Res Ltd | 0.001 | -33% | 311,239 | $4,953,852 |

| DRO | Droneshield Limited | 0.69 | -26% | 24,991,742 | $569,302,858 |

| H2G | Greenhy2 Limited | 0.006 | -25% | 45 | $3,350,047 |

| PKO | Peako Limited | 0.003 | -25% | 3,000 | $2,108,339 |

| HGL | Hudson Investment | 0.15 | -25% | 42 | $11,871,987 |

| MOZ | Mosaic Brands Ltd | 0.15 | -23% | 1,988,534 | $34,808,756 |

| TMG | Trigg Minerals Ltd | 0.007 | -22% | 3,075,923 | $3,372,806 |

| LOM | Lucapa Diamond Ltd | 0.021 | -22% | 6,733,936 | $38,868,117 |

| PLC | Premier1 Lithium Ltd | 0.036 | -20% | 818,454 | $7,855,834 |

| PR1 | Pure Resources | 0.1 | -20% | 539,921 | $3,206,251 |

| AL8 | Alderan Resource Ltd | 0.004 | -20% | 2,028,016 | $5,534,307 |

| MTL | Mantle Minerals Ltd | 0.002 | -20% | 5,163,769 | $15,493,615 |

| WML | Woomera Mining Ltd | 0.004 | -20% | 207,455 | $6,090,695 |

| AGI | Ainsworth Game Tech. | 1.14 | -17% | 46,350 | $463,091,652 |

| PVW | PVW Res Ltd | 0.03 | -17% | 302,224 | $3,650,572 |

| ASR | Asra Minerals Ltd | 0.005 | -17% | 1,887,765 | $9,918,974 |

| CCO | The Calmer Co Int | 0.005 | -17% | 20,088,421 | $6,478,180 |

| DOU | Douugh Limited | 0.005 | -17% | 158,317 | $6,492,414 |

| KRR | King River Resources | 0.01 | -17% | 1,014,131 | $18,642,299 |

| YAR | Yari Minerals Ltd | 0.005 | -17% | 30,000 | $2,894,147 |

| WNR | Wingara Ag Ltd | 0.016 | -16% | 32,110 | $3,335,308 |

| NRX | Noronex Limited | 0.011 | -15% | 227,018 | $4,917,923 |

| VIT | Vitura Health Ltd | 0.14 | -15% | 1,752,370 | $95,019,175 |

| DNA | Donaco International | 0.041 | -15% | 1,138,030 | $59,298,690 |

ICYMI – PM Edition

New Age Exploration (ASX:NAE) is acquiring the Wagyu gold project, located along strike and midway between De Grey Mining’s (ASX:DEG) landmark Hemi and Withnell deposits in the Pilbara.

A resource upgrade could be on the cards for Magnetic Resources (ASX:MAU) at the Lady Julie North 4 deposit near Laverton after reporting a fresh batch of high-grade intersections, including 29.5m @ 2.81g/t gold, from deep drilling which extended to depths of 550m, well below the existing inventory.

Mining has wrapped up at the Selkirk joint venture with more than 35,000t of gold-rich ore now set to be treated via the nearby Gwalia process plant, delivering Brightstar Resources (ASX:BTR) valuable funds for ongoing exploration and development work across its Menzies and Laverton gold projects.

Norwest Minerals (ASX:NWM) has made the most of government and open-file geophysical data to identify 31 prospective targets for carbonatites, IOCG, niobium and rare earths over its recently acquired 360km2 ground package in the emerging West Arunta mineral province.

Ongoing field work at Belararox’s (ASX:BRX) TMT copper-gold project in Argentina has uncovered further evidence that another porphyry system is present, this time at the Malambo target where all the right ingredients have been found in four of the 12 targets tested to date.

Arizona-focused copper developer Eagle Mountain Mining (ASX:EM2) has uncovered several uranium anomalies with elevated thorium in radiogenic pegmatites in the northwest area of its Silver Mountain project.

Norfolk Metals (ASX:NFL) has picked out a 4km-long anomaly at its Roger River copper-gold project in northwest Tasmania following a soil sampling program aimed at improving the company’s understanding of what could lie underneath the surface of the highly-prospective Roger River Fault.

QX Resources (ASX:QXR) has inked a letter of intent with battery-grade lithium products manufacturer Stardust Power for potential offtake of future lithium brine products to be produced from the Liberty project in California.

And a proposed 33kV electricity infrastructure upgrade by SA Power Networks is set to have both immediate and long-term benefits for Renascor Resources (ASX:RNU) and its future Siviour graphite operation in South Australia, as the company progresses development of its larger Battery Anode Material (BAM) project strategy.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.