Pilot sets course for new energy future with wind beneath its wings

Energy

Special Report: Well-known energy industry executive Brad Lingo took a consulting gig earlier this year that involved him identifying the top 10 oil and gas assets in the country suitable for repurposing as renewable energy projects. One of his standout picks was the Cliff Head oil field, 12km off the coast of Dongara in Western Australia’s hot and windy Mid-West region, and its associated production infrastructure.

Fast forward a few months and Lingo is spearheading a push by junior Pilot Energy (ASX: PGY) to establish a large-scale wind and solar project for the Mid-West using Cliff Head as an anchor point that is already attracting interest from big players and appears to have the potential to create serious value for shareholders.

Lingo, the former managing director of Drillsearch, was appointed chairman of Pilot in April after being brought in by major shareholders to advise on the future direction of the struggling company.

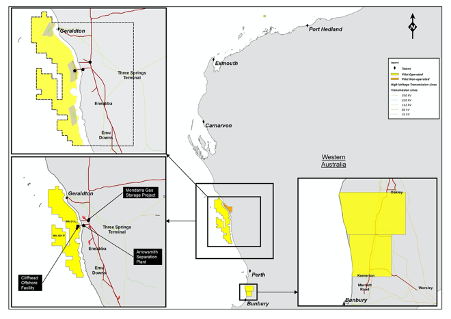

It just so happened that Pilot’s main asset at that time was a 60% operating interest in WA-481-P in the Perth Basin, one of the largest offshore exploration blocks in the country, which surrounds the comparatively small Cliff Head production licence.

Despite the prospectivity of WA-481-P, Lingo felt it would be difficult for Pilot to continue its existence as a junior focused purely on conventional oil and gas exploration; knowing what he did about the potential for renewables in the Mid-West region, he recommended the company hang on to WA-481-P but also look at positioning itself to participate in a meaningful way in Australia’s energy transition.

Since then, Lingo and his team have been putting the building blocks in place for Pilot to become a leading player in the renewable energy space through wind and solar, whilst also gaining access to cashflow from oil production at Cliff Head and retaining the significant conventional oil and gas exploration upside within WA-481-P.

In August, Pilot was notified that the WA-481 permit, which covers 8,600km2 along approximately 250km of the WA coast, had been renewed for a term of five years, an important development guaranteeing security of tenure.

About a month later, the company announced it was commencing a detailed feasibility study to pursue the development of an offshore wind and onshore wind and solar power project in the Mid-West.

The announcement noted that the renewable energy potential of the Mid-West had been well documented by the likes of the World Bank and Geoscience Australia and that WA-481 had all the attributes to support a successful offshore wind project including the most highly rated offshore wind resource in the country with an annual mean wind speed greater than 9-10 metres per second (higher speeds equal better project economics) and an ideal water depth of 20-50m across 80% of the permit.

It also emphasised that Pilot would assess the feasibility of accessing and utilising existing offshore and onshore gas infrastructure in any development, following the model seen in many offshore wind farms in Europe.

Shortly after the feasibility announcement, Pilot acquired Key Petroleum’s 40% interest in WA-481, giving it 100% ownership of the permit.

Then at the end of September, the company announced the acquisition of privately owned Royal Energy, which owns an indirect 21.25% interest in the Cliff Head Oil Field JV through its 50% ownership of Triangle Energy (Operations) Pty Ltd (TEO), the operator of the Cliff Head JV.

Through its interest in TEO, Royal holds joint operational control of the CHJV and has 50% representation on the board of the operating company.

Cliff Head has produced 14.8 million barrels of oil since starting up in May 2006 and currently produces 800-900 barrels of oil per day. Based on current reserves, it has about another 10 years of production left in it.

But as Lingo states, the opportunity Pilot is now investigating – linking a major renewable energy project into the existing Cliff Head infrastructure – has the potential to give new value and meaning to the assets.

Based on an analysis completed by BVG Associates, a leading consultant in the renewable energy space, Pilot estimates that reconfiguring the offshore Cliff Head A Production Platform as an offshore substation for the wind farm could deliver a capital saving of more than $150 million for a notional 1.1 GW project.

Cliff Head also carries a gross abandonment liability of approximately $40 million that Lingo describes as previously being “lead in the saddle bags” for Triangle Energy, the ASX-listed company that has a 78.75% interest in Cliff Head and is Royal’s equal partner in TEO.

As such, Triangle has been more than open to discussions around opportunities that may help extend the life of the operation, including the wind farm project and farming into WA-481 to follow up numerous exploration prospects that could be easily connected back into the Cliff Head platform if commercial quantities of hydrocarbons were discovered.

“Pilot will make a major focus of the Mid West Wind and Solar Project feasibility study to identify all of the opportunities to integrate the offshore wind project into the existing Cliff Head Oil Field offshore and onshore facilities and operations,” the company said when the Royal acquisition was announced.

“The company believes that the potential integration synergies and cost savings both in development and operation of the offshore wind project are likely to be significant and have the potential to materially improve the project’s overall economic attractiveness.”

Once the Royal transaction is completed, Royal managing director Tony Strasser will join Pilot as managing director responsible for upstream activities, while Lingo will remain in the chairman’s role principally focused on the renewables business. The two men have known each other for 17 years and have together been involved in several successful energy ventures.

Lingo sees several options for commercialising wind power in the Mid-West including supplying into the grid (all of WA-481 is within 100km of a 300kV transmission line); supplying proponents of “green” hydrogen export projects in the Mid-West such as Infinite Blue Energy; and supplying proponents of “green” or “fossil fuel free” iron ore beneficiation or steel-making projects.

Aiding Pilot in respect to the latter, the WA government has demonstrated its eagerness to transform Oakajee north of Geraldton into a Strategic Industrial Area with a focus on the production of renewable hydrogen.

Expressions of interest from companies with suitable projects are due on Christmas Eve this year and this could result in the emergence of a number of new potential customers for renewable energy from Cliff Head.

Pilot expects to emerge from the completion of a Share Purchase Plan in early November with a market capitalisation of $12-14 million, making it one of the cheapest stocks on the ASX with meaningful exposure to the renewable energy thematic.

The modest market capitalisation might seem like a challenge when assessed against the company’s ambitions, but it also appears to be a big opportunity for investors.

Lingo draws the analogy between the Mid-West renewable industry now and the Queensland coal seam gas industry in 2005 where a number of junior companies with sub-$10 million market capitalisations developed a world-class resource that ultimately found a market and led to a huge value creation event.

He also says completing a full blown feasibility study on an offshore wind project is much cheaper than doing the same for a conventional oil and gas project, while the company is likely to look at accessing grant funding through the Australian Renewable Energy Agency (ARENA).

Ultimately though, it appears logical that Pilot will look to bring in a larger partner on the wind and solar. Lingo says the company has had approaches from three majors already, but has more work to do to unlock value for its shareholders before entertaining a partner.

This story was developed in collaboration with Pilot Energy, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.