Everyone in this story: Huge wins in ASX Energy stocks for decades to come, but now’s the time

Energy

Energy

It’s lunchtime on Thursday in Waterloo’s Cauliflower Hotel and as Maqro Capital’s Mark Gardner returns with his trademark Eggplant Bruschetta the benchmark ASX 200 is trading stupidly higher – up 1.80% – and the Energy Sector is leading the way, as per, up a stonking 3%.

Talk turns from weird pub food, the incomplete works of David Mamet and the loneliness of modern life – to Energy stocks – better known as 2022’s BNPL Sector on Steroids, on Rocket Fuel… on The Edge.

As Roger Ebert amusingly said:

“The Edge is like a morally-grey wilderness adventure movie written by Mamet, which is not surprising, since it was written by Mamet.”

And so, self-evidently, is the Energy Sector.

For example, did you know, while the All Ords is down about 15% so far this year, Whitehaven Coal (which added another 4.5% over lunch) is up about 226% in 2022:

Yeah, dead-in-the-water-ish a few years ago, WHC is sitting powerfully pretty as war on the other side of the world wrenches coal prices higher by the week as desperately impacted nations look to find alt energy sources outside of key global producer Russia.

Energy is the single screaming theme right now and will certainly remain dominant for the next few decades. It’s this year’s millionaire’s factory.

The S&P 500′s oil and gas sector has risen by nearly 30% this year while the broader market has been beaten with the Stick of Disgrace.

But it’s hard to ignore the trajectory of least likely to succeed class of ’99… coal.

Reliable energy is required for the energy transition but the supply gap is growing, intensified by the Ukraine conflict – and coal is abundant and burns real good.

According to Wood MacKenzie, some 112Mt of high-CV coal in seaborne markets is under threat by embargoes and restrictions on Russian coal.

Europe and North Asia face a genuinely stiff challenge in replacing Russian coal – not just gas – while sanctions are likely to

divert high-CV Russian coal to markets that do not typically take high volumes of premium coal.

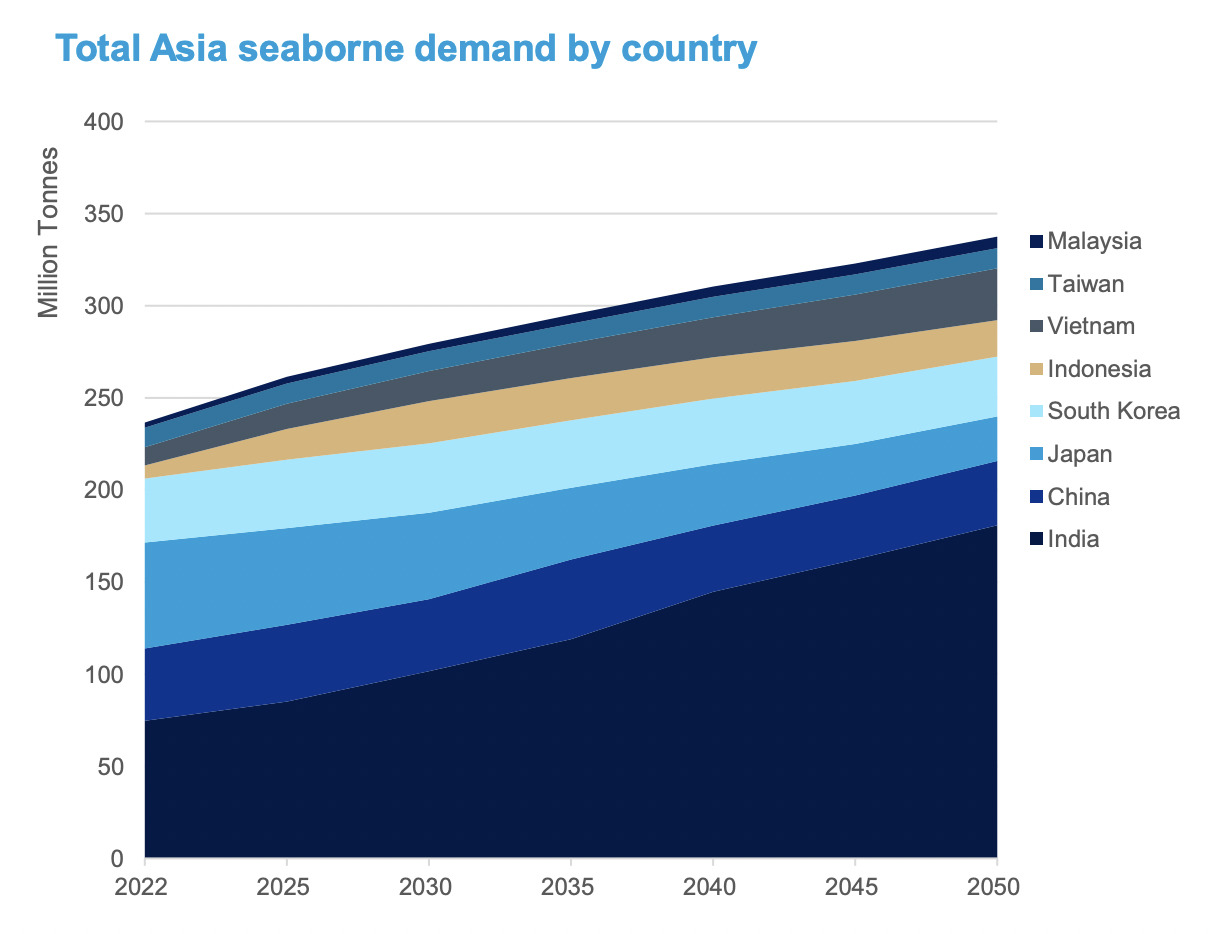

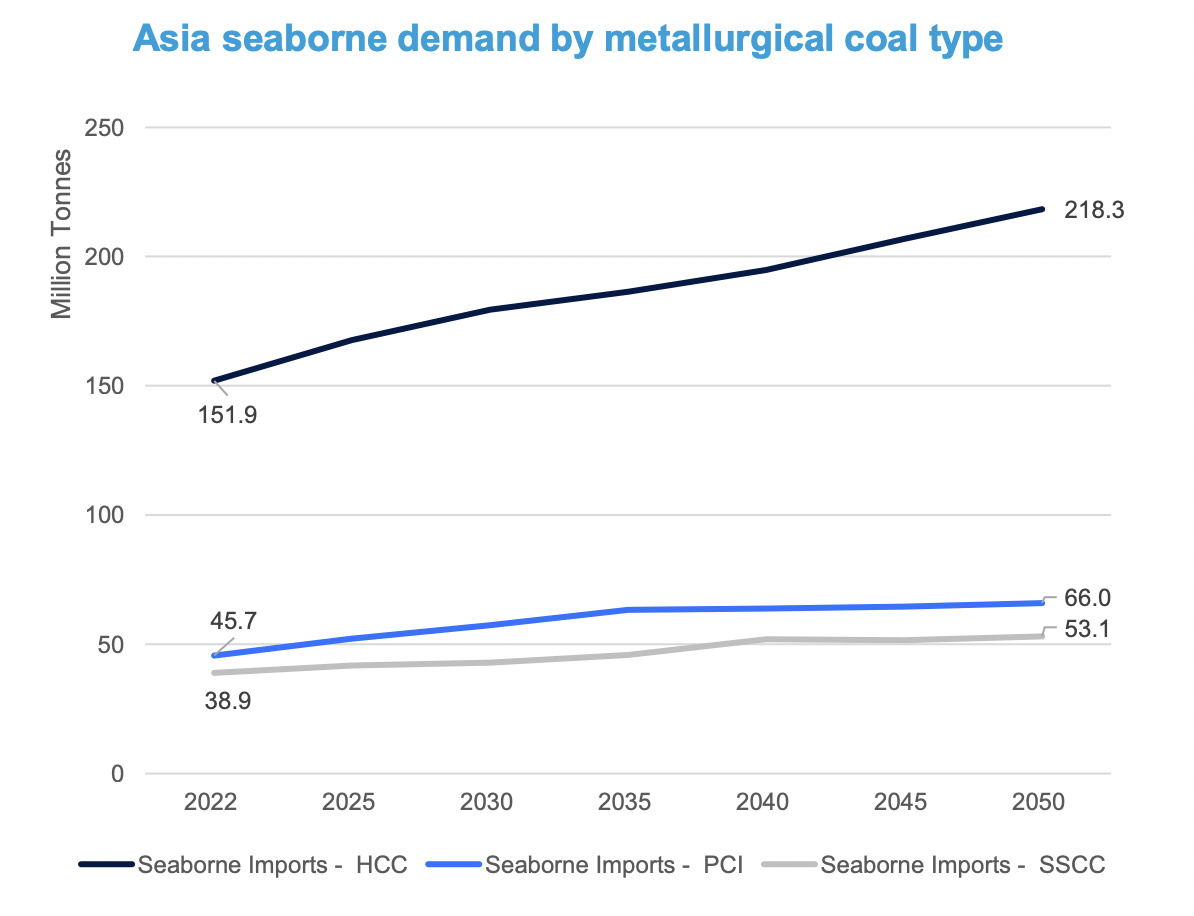

One can say Asian demand for metallurgical coal remains robust over the next three decades.

Shares of WHC and the thermal coal miner New Hope Corp (ASX:NHC) have literally set 2022 alight and according to the commods-team at Macquarie this week, they may even be set for further pyromania, despite co’s like NHC just about tripling in value year-to-date to circa $6.00.

Thermal coal is enjoying a rare purple patch, driven to record levels by a combination of shortages, the war in Ukraine, substitution due to surging gas and oil prices and rising demand as economies and businesses open up post-Covid.

Prices for Newcastle thermal coal, the city that Mereweather Beach made, the Son of Sydney, Studio Melt and gold standard Asian benchmark, are happily pausing at around US$438/t right now, depending on which spot price you’re willing to accept.

This comes as Macquarie’s commodity strategy team hikes the climate changing commodity’s price outlook thanks to a market deficit and the absolutely carefree determination of national governments to pay whatever the premium is to secure their population’s energy supply.

In any case it’s back to the Daaark Side of the Moon as filthy, lovely, dirty, wonderful coal attracts investors who’d sworn off the stuff in favour of more 21st century options.

As my colleague the quietly genius Josh Chiat says – bumps and grinds regardless – it’s an extraordinarily high watermark for a dead end product made by previously walking dead companies.

Futures continue to command over US$250/t for contracts out to 2027.

Despite the big ESG discounts and troubles obtaining finance they face, companies operating in the space are trading at multi-year and in some cases all time highs.

Pure play miners like NHC, WHC, Stanmore (ASX:SMR) and Yancoal (ASX:YAL) are all up close to or more than 100% year to date, and over 200% in the case of sector bellwether WHC.

With all this money, opportunity and panic swirling around as the world lurches and jerks towards net zero, how to know which bloody horse to bet on?

Or even which horse will make be standing, net-zero emissions at the end?

- Coal (both met and the other one) was the devil you knew. That is until the recent energy crisis; now its wicked ways are harder to recognise for all the money they’re making. (Did we mention NHC’s 1146% FY22 profit bump?)

- Oil and;

- Gas are a measure of our current dire straits and have the wildest of ranges to prove it.

- Even as Japan prepares to flood the Pacific with isotope-rich Fukushima juice, Uranium is volunteering itself as the thinking person’s answer for base load electricity and is emerging from a 10-year pit of disgrace.

- Ask a man called Twiggy – and Green Hydrogen is the cleanest option which is likely to be used for industrial, mass storage given its higher efficiency than lithium batteries at scale may rely on government spending to make advances. But (and don’t tell Twiggy) Green Hydrogen just isn’t looking incredibly commercially viable.

- Lithium not an energy source per se, but a decent enough proxy for the energies of the future

So. Over weird bruschetta, I asked Mark the trillion dollar question:

Who do you back?

Way, way, way back in 2019/20, was somehow an also-ran – despite hindsight insisting the bleeding obvious EV thematic would incite a run on producers and demand for fresh exploration and development.

Now all lithium stocks – from the cashed-up majors to the small exploration stocks – are loving life.

But a confluence of factors has Reuben Adams, energy investors and insiders alike all wondering aloud (not if) but when will uranium have its own lithium moment.

Thematic trades like uranium are tricky to play because they are based on sentiment, not results, Mark says.

“And this makes them vulnerable to the downside in highly volatile times. Many of the ASX uranium names, PDN, BOE, BMN, and AGE, fell 40%-60% over the course of the May-June rout this year, then swiftly reversed, went back towards highs and now sit somewhere in the middle.”

Reuben, meanwhile, spoke with uranium producer Lotus Resources’ MD Keith Bowes about uranium’s role in the energy land grab and the advantages of resurrecting formerly defunct nuclear infrastructure.

“All the new announcements about reactors staying online for longer, and bringing old reactors back online – it’s the companies which have assets that were previously operated and are on care and maintenance and can come on relatively quickly that will benefit from those,” Bowes says.

Lotus has one of four restart/under construction projects on the ASX which can come online relatively quickly to meet to initial surge in uranium demand.

The others belong to Boss Energy (ASX:BOE), Paladin Energy (ASX:PDN), and Peninsula Energy (ASX:PEN).

Lotus Resources’ (ASX:LOT) Kayelekera in Malawi is one of the largest uranium projects in the world currently on care and maintenance. It produced 11Mlbs of U3O8 equivalent a year between 2009 and 2014.

A DFS last month confirmed its huge potential, with an ore reserve of 15.9Mt at 660ppm U3O8 for 23Mlbs backing a 10 year mine life, producing 2.4Mlbs annually over its first seven years.

The no-man’s-land of traditional renewables, be it the weather, the fashion or their interminably long lead ins, will likely make most – in their current iterations – something of a technological cul-de-sac. Not quite redundant, but not much more than, say, as a cog in energy storage systems supporting the lithium batteries and hydrogen storages of the near future.

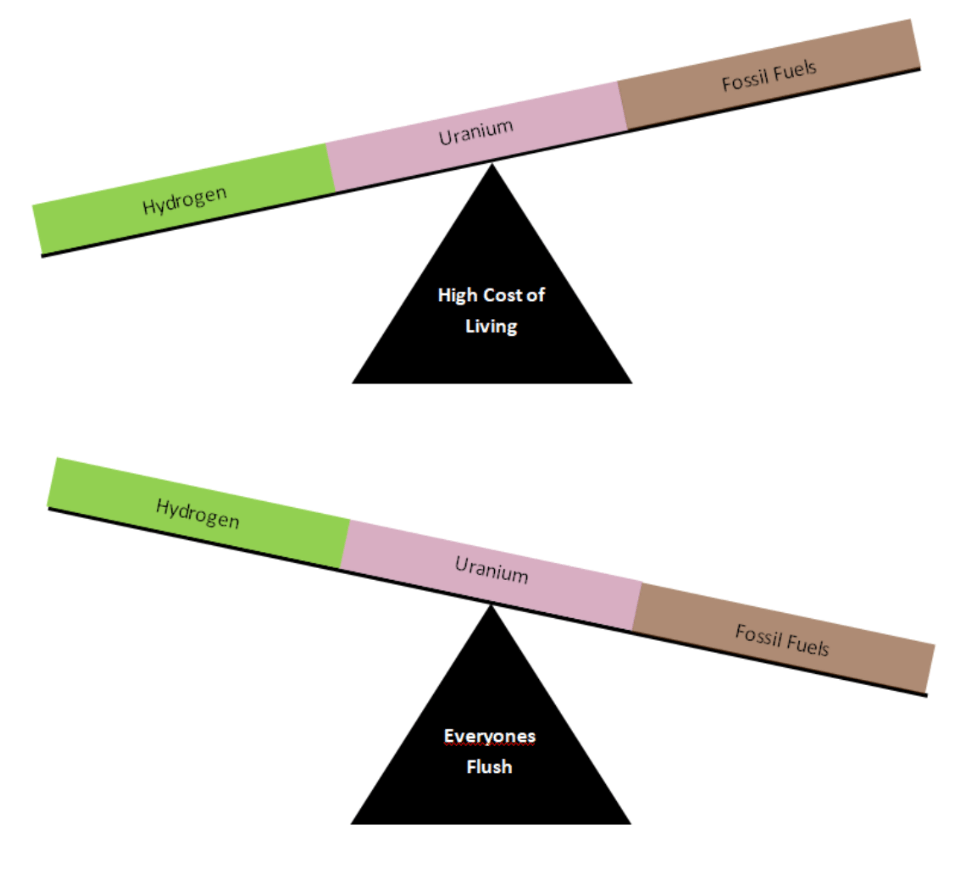

And it’s getting to the pointy end of reality vs theory. Renewables were bullish while we were all flush with government stimuli, but with money being sucked from the system in interest rate hikes, cost of living concerns override greening aspirations which makes investor sentiment hugely important.

Consider the recent potential advances in geothermal and tidal technology. They may well come to the fore in coming years, but until then theory is at the whim of reality – and the current reality is, they’re marching on the streets in Prague – not against fossil fuels but against not having enough of them.

We like this drawing Mark sketched over lunch and then did up on his iThingy on the train. Crude but effective:

The fact is, Mark says – colts, foals or fillies – the field for the Ultimate Energy Cup is wide, wide open.

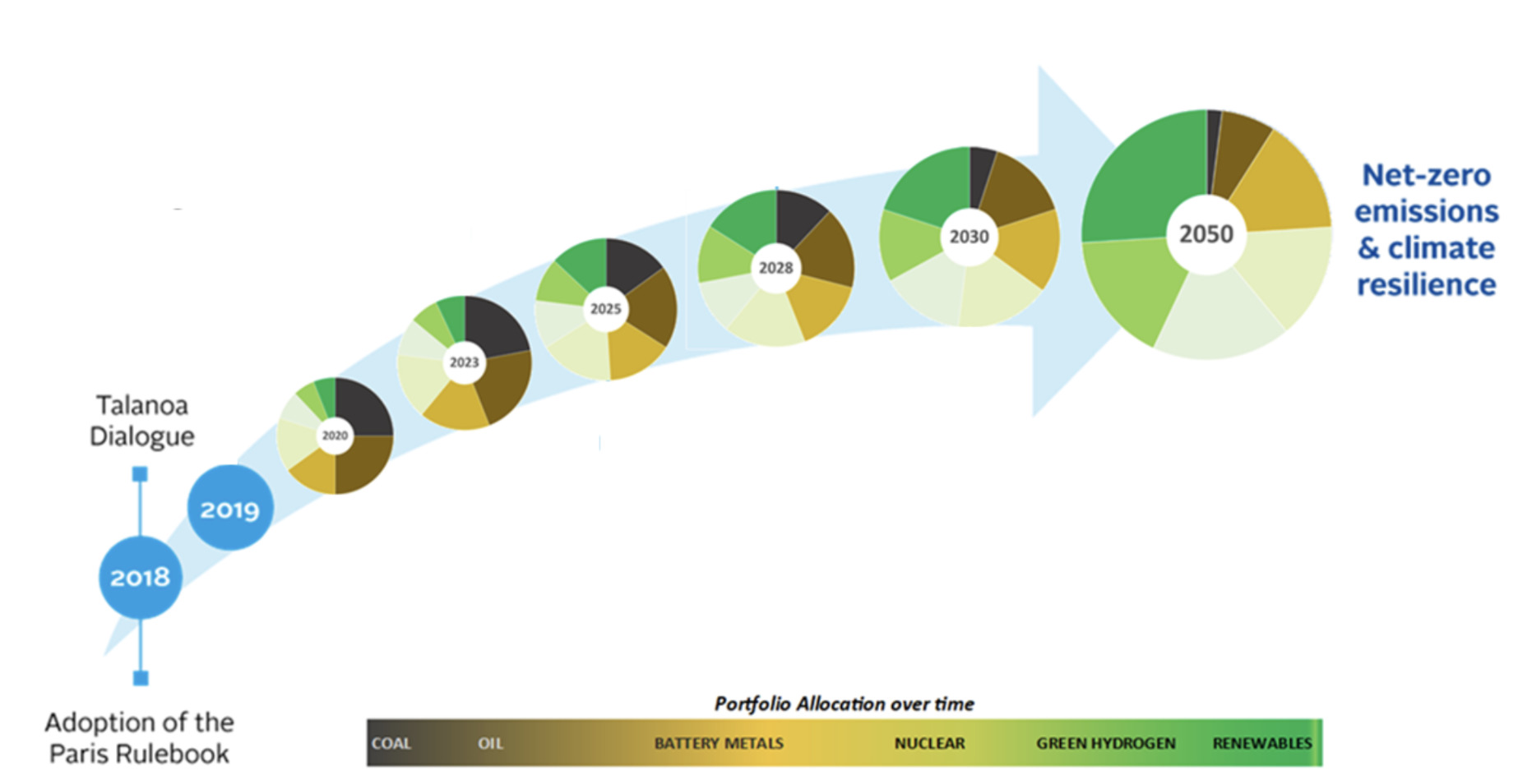

“We believe investors are asking the wrong question and should be more focused on gradual allocation changes of energy sources that will fuel the next 10 years during the transition to Net-Zero.

“It’s easy when reading about articles relating to the future of energy (often the research is industry produced), the investment thesis is skewed to an absolute winner in the space which ironically is the most unlikely outcome,” he told me.

Over the next 10-20 years, too many variables are in-play to be certain of any single technology dominating.

“The reality is, no one really knows how fast or how energy will reinvent itself, so committing to one outcome for energy won’t be the best investment strategy.

“With the internet at our fingertips, the ability to find research that backs your own opinion is super easy these days and there is no shortage of lobby groups from both sides producing “research papers” to push their case (or dismiss another’s).”

In the sage words of Homer Simpson:

“Oh people can come up with statistics to prove anything Kent, 40% of all people know that”.

Cost of living

With the recent rise in inflation, higher rates coming and a potential recession on the horizon, the priorities of the general public have quickly turned from “green at all costs” to “Green at…maybe some costs” as the cost of living has risen.

As we saw with the recent federal election, three months out, green credentials were the single biggest concern for voters, polling at double any other issue.

Enter one Russian President Vlad Putin, runaway inflation, a sprawling energy crisis to name but a few economic challenges and all of a sudden a self-interest quickly became the top priority, leaving “net zero” on the pile of things to do later.

Conclusion: we tend to be Green when we can afford it at home and so will markets.

The news

That’s right. Not just for broken journalists. Take a moment to consider the last 24 hour developments for gas – not even considering the very latest Euro-gas-adventures where the Swedish Coast Guard says Gazprom’s Nord Stream 1 and 2 gas pipelines in the Baltic Sea sprung a new leak – bringing the unprecedented, completely random ruptures to four.

Soaring energy costs across the eastern seaboard begin hitting households.

While WA reserves 15% of its gas production for domestic consumption, Australia’s eastern states are more exposed to energy price swings as most of its production is exported.

And with soaring energy costs across the eastern seaboard beginning to swallow Aussie households, the Albanese government is now forced to decide within days if it will pull the “gas trigger”, a legal mechanism to limit gas exports during periods of shortfall.

At the same time AGL Energy (ASX:AGL) says it will now spend $20bn to shut down its Loy Yang A power station a decade earlier than expected, bowing to pressure from billionaire shareholder Mike Cannon-Brookes.

Sentiment

Be aware of who is winning the PR battles and momentum.

Look at green hydrogen stocks in the lead-up to COP26. Some were up 400% in a month, then swiftly fell off a cliff as buzz from the summit died down.

Lithium fell off a cliff as well in May after Goldman Sachs released a negative forecast for the EV material and now prices are back up some 200%, and yet in this timeframe no scientific, technologic, economic or company data has been released that we didn’t already know.

(Geo and other) politics

Coal. On the nose until the recent energy crisis and the wins from environmental groups in recent years will prevent new supply. There are just three examples of massive price movements based on a “feeling” which doesn’t last forever.

From an investment standpoint. a shifting allocation in a basket of all energy classes is the high percentage play to give investors the best result at the lowest risk.

We also had a starving artist with an iPad sketch this approximation of energy sector allocation in a time of practical reality below…

Adjustments to these will follow any genuine jumps in technology, understanding or if the climate blows up, however betting on one winner will likely mean your returns will fall short or even fail to capitalise at all.

Ignore the noise as much as possible and know that commitment to one energy source is not the answer and adjust your weightings depending on the factors above.

Currently I would be:

- Long oil (WDS, BPT), and uranium Boss Energy (ASX:BOE), Paladin Energy (ASX:PDN), BetaShares Global Uranium ETF – URNM (ASX:URNM)

- Reducing – trimming (or running a trailing stop) in coal/lithium producers as prices are in the stratosphere

- A small allocation of renewables (Pure Hydrogen Corporation

(ASX:PH2), Sparc Technologies (ASX:SPN), Genesis Energy (ASX:GNE) and next up lithium producers Sayona Mining (ASX:SYA), Liontown Resources (ASX:LTR)

Even when it comes to the future of the planet, remember you are a cold, hard, detatched protector of your Whitney Houston. That’s your job. Don’t get involved.

The best long-term strategy is to invest with your head, not your emotions.

Mark Gardner is in active investing and makes trading recommendations for leading Australian investment research, trading and advisory firm, Maqro Capital.

Christian works at Stockhead.

This article contains unsolicited general information only, without regard to an investor’s individual objectives, financial situation or needs. It is not specific advice for any particular investor. Before making any decision about the information provided, you must consider the appropriateness of the information in this document, having regard to your objectives, financial situation and needs and consult your adviser. Investment in financial products involves risk. Past performance of financial products is no assurance of future performance.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.