ASX Director Trades: Insurance builder Johns Lyng Group CEO sells down $25 million worth of stock

Director Trades

Director Trades

Director trades are often considered a good indicator of a company’s future prospects. Our fortnightly ASX Director Trades column informs you who is buying in and who is selling down. Often referred to as insider buying or selling, directors are legally permitted to buy and sell shares of the company and any subsidiaries. However, these transactions must be properly registered and divulged.

Insider buying or selling is not to be confused with insider trading, which is buying shares based on non-public information, a big no-no and illegal.

We troll through the ASX company announcements looking at director trades of interest over the past fortnight. It’s usually the big ones that stand out or those coinciding with company news.

Directors may get shares as part of employee incentive schemes, share purchase plans, rights issues, participate in dividend reinvestment plans or purchase on-market. It’s the on-market trades we think are worth noting, where directors directly or indirectly through entities they are associated either put up cash or cash in a stake.

When a director buys shares on-market, it can signify confidence the share price will rise in the future and if multiple directors are buying, especially at larger amounts, that is even more of an indication. Of course, it’s not a sure win that the share price will rise, so it’s always worth further research on a company.

Directors will often buy company shares after a sharp price decrease. Directors may think the stock has been oversold and represents good value, sometimes they want to show confidence in their company’s prospects, other times they’ve just got another good reason to buy or sell a stock which will be divulged, like paying the good ol’ taxman.

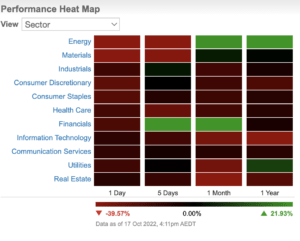

The ASX ended last week fairly flat overall with the S&P ASX/200 finishing down 0.06% for the five days to Friday. But on Monday the ASX did not get off to a good start for the week, with the S&P/ASX 200 diving and closing down 1.4%.

The Aussie bourse took the lead from what Stockhead’s Gregor Stronach aptly described as “a frightful Friday on US markets”. Materials on Monday led all sectors down.

Amidst the continuing stormy markets there continues to be a large number of on-market director trades on the ASX.

| Code | Company | Director | Direct or Indirect | Date | Volume | $ | Nature of change |

|---|---|---|---|---|---|---|---|

| SKT | Sky Network Television | Philip Bowman | Direct | Oct-11 | 125,000 | NZ$277,500 | On-Market |

| APE | Eagers Automotive | Nicholas Politis | Direct & Indirect | Oct 4-10 | 50,000 | $575,005 | On-Market |

| RHC | Ramsay Health Care | Steven Sargent | Indirect | Sep-28 | 5,325 | $299,638 | On-Market |

| IRE | Iress | Marcus Colin Price | Indirect | Oct-04 | 22,396 | $203,259 | On-Market |

| WCG | Webcentral | Joseph Demase | Indirect | Oct 7 & 10 | 1,448,136 | $200,000 | On-Market |

| NCC | Naos Emerging Opportunities Company | Sebastian Evans | Indirect | Sep-30 | 200,000 | $165,500 | On-Market |

| IFM | Infomedia | Jens Monsees | Indirect | Oct 6 & 7 | 122,746 | $149,750 | On-Market |

| TER | TerraCom Limited | Glen Lewis | Indirect | Oct-06 | 77,422 | $78,754 | On-Market |

| TER | TerraCom Limited | Graeme Campbell | Indirect | Oct-06 | 60,893 | $61,502 | On-Market |

Car dealer Eagers Automotive (ASX:APE) has seen rich-lister, director and the company’s largest shareholder Nicholas Politis continue to increase his holding in his trademark series of buying – 10,000 lot purchases over a sustained period. Politis now holds 70,575,321 ordinary shares in APE.

Ramsay Healthcare (ASX:RHC) non-executive director Steven Sargent ponied up for ~almost $300k worth of shares. Sargent is also a non-executive director of Origin Energy (ASX:ORG) and chair of infection prevention company Nanosonics (ASX:NAN).

The RHC share price has fallen ~22% year to date and felt the pressure of a private equity bid walking away. However, the private hospital provider is still a top pick of Jun Bei Liu, lead portfolio manager for the Tribeca Alpha Plus Fund at Tribeca Investment Partners.

| Code | Company | Director | Direct or Indirect | Date | Volume | $ | Nature of change |

|---|---|---|---|---|---|---|---|

| JLG | Johns Lyng Group | Scott Didier | Indirect | Oct-10 | 4,000,000 | $25,000,000 | On-Market |

| WTC | Wisetech Global | Richard White | Indirect | Sept 30-Oct 6 | 118,541 | $6,473,524.01 | On-Market |

The biggest sell for a fortnight on the ASX was insurance builder Johns Lyng Group (ASX:JLG) CEO and managing director Scott Didier sold 4 million shares for $25 million shares on October 10.

No details were been released on the sale. Didier still holds ~49 million shares in the company and according to a substantial shareholder announcement still has a 18.92% voting interest.

News of the sell down rattled the market and saw the JLG share price plunge ~15%. It has since made some recovery and rose ~2% on Monday after announcing it has been appointed by Emergency Recovery Victoria (ERV) to assist those affected by the ongoing flood disaster.

JLG said an estimated 34,000 homes will be inundated or isolated in the coming days and weeks and there are at least 24 local government authorities impacted at this stage.

WiseTech (ASX: WTC) founder, executive director and CEO Richard White is also continuing his large large sell-down in the company he founded in 1994 and listed on the ASX in 2016. White still holds 1,348,991 shares directly and 121,042,366 shares indirectly in WTC.