Token Up: Reddit NFTs prove sceptics wrong; Judge thinks NBA Top Shots could be securities

Coinhead

Coinhead

What’s making non-fungible news this week? Among many other things, a new report indicates very solid performance from Reddit NFTs so far, and a spoilsport US judge reckons NBA Top Shots assets could be classified as securities.

A newly compiled report from Paul Hoffman of the broker reviews and trading-info site BestBrokers.com has focused on the performance of Reddit Collectible Avatars NFTs ever since they launched to a slightly sceptical (and bruised) market some eight months ago.

And the overall assessment? Actually pretty damn good, all crypto-bear-market things considered.

Here are some key takeaways from the BestBrokers study, which leveraged data from on-chain gurus Dune Analytics to draw its conclusions:

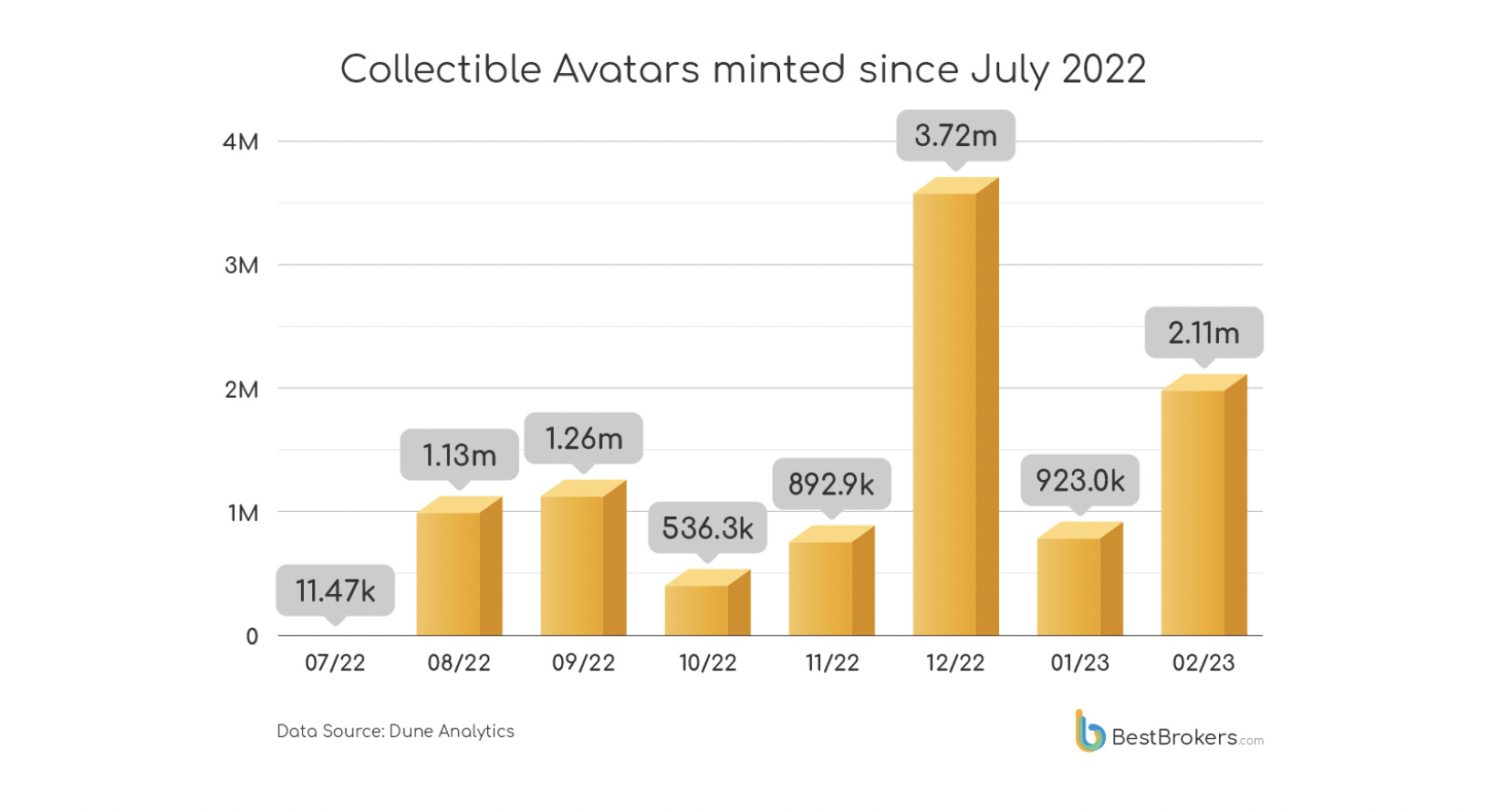

• There have been more than 10.6 million minted Reddit avatar NFTs so far.

• The entire collection of Reddit NFTs now exceeds a US$36 million market cap.

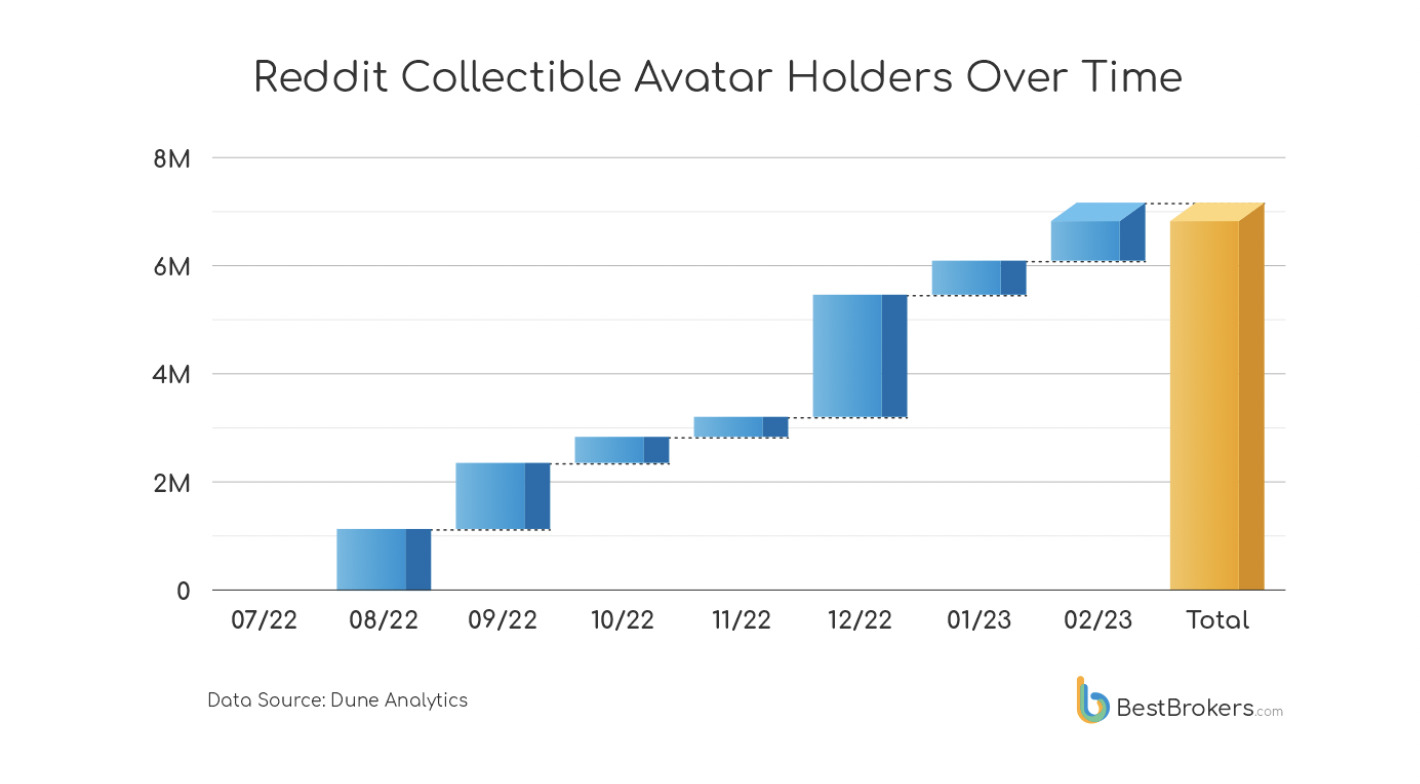

• The number of unique holders exceeds 7.18 million.

• The “Hands #1” is the most expensive Reddit avatar – sold initially for 30 ETH (US$40,472 at the time) and is currently listed for 150 ETH (about US$250k).

As Hoffman notes, “the launch of Reddit’s Polygon-based collectible avatar marketplace back in July 2022 raised a lot of eyebrows. With an ongoing crypto winter and an overall bearish market, let alone the Ukraine war, a lot of investors and analysts predicted nothing good for Reddit’s new venture.”

And yet, he adds, Reddit has proved the many NFT sceptics wrong, gaining a market cap of more than US$36m and 10.6m minted assets since the marketplace’s launch in mid 2022.

“Reddit started their NFT venture in very harsh times for both cryptocurrencies and NFTs,” added another BestBrokers analyst – Alan Goldberg. “However, the over 330-million user base Reddit already had surely helped them reach this rather impressive market cap.

“Additionally, we should commend the company for the marketing efforts and the effective plan to present the NFTs as ‘Digital Collectives’ to make anti-NFT redditors less discontent.”

Good point! Digital Collectives or Collectibles is a semantics shift we’ve been noticing more and more just recently. The somewhat farcial DigiDaigaku Super Bowl ad, for instance certainly didn’t dare use the NFT acronym, lest it immediately alienate an already probably largely sceptical audience after last year’s crypto-marketing assault.

“The collections ‘Reddit Cup 2022’, ‘Reddit Recap 2022’, and ‘Super Bowl LVII’ account for most of the minted NFTs,” added Goldberg. “With almost the entire 2023 still ahead of us, we can expect more similar spikes and respectively way more Collectible Avatars minted.”

Dapper Labs, the creators of the once extremely popular NBA Top Shot NFT digital-video-clip “Moments” series is being forced to face a lawsuit from none other than the good ol’ US Securities and Exchange Commission (SEC).

The allegation it will attempt to quash is that the non-fungible tokens sold on its platform are unregistered securities under the 80+year-old “Howey Test” ruling the SEC is a stickler for.

This follows a federal judge’s ruling this week that essentially left the door open for Gary Gensler’s SEC to make its next assault on another sector of the crypto industry.

The judge, Victor Marrero, wrote in his ruling:

“Ultimately, the Court’s conclusion that what Dapper Labs offered was an investment contract under Howey is narrow.”

And part of what makes the SEC’s allegations “facially plausible”, according to the judge, is that they’re housed on the Flow blockchain – a private network owned and operated by Dapper Labs.

Part of the Howey Test criteria for a security is third-party efforts to promote and uphold an investment’s value. Dapper Labs is deemed by the judge to plausibly be that third party.

NBA Top Shot NFTs appear to be unregistered securities, judge rules in Dapper Labs lawsuit. 🤦 pic.twitter.com/tKCMp8vwqB

— Altcoin Daily (@AltcoinDailyio) February 22, 2023

Hmm, not so fast “Altcoin Daily”… (see tweet above). It ain’t over till a weighty woman with a viking helmet sings. Because at this stage, all that’s happened is that a judge has thrown out Dapper’s notion to entirely dismiss the SEC’s case against it.

Like some of the other SEC targeting (namely Ripple Labs), we’ll have to wait and see what transpires.

Yes, if Gensler and co. get their way it would not be a good moment for the NFT industry in the US. That said, much of the NFT activity globally is looking more and more to take place on decentralised rails that could ultimately prove harder for the SEC to pin down.

And the following words, too, might offer some encouragment…

“Courts have repeatedly found that consumer goods – including art and collectibles like basketball cards – are not securities under federal law,” said Dapper Labs spokesperson Stephanie Martin in a statement, according to Bloomberg.