You might be interested in

Coinhead

Animoca Brands reveals strong financial position as it looks to capitalise on a big web3 year

Coinhead

The Bitcoin Halving: This Time it’s Institutional – coming to a crypto portfolio near you

News

Coinhead

The Perth Heat pro baseball club recently announced its players and staff can now all be paid in Bitcoin. Stockhead caught up with the Heat’s CEO and Chief Bitcoin Officer to find out why they’re now calling themselves “The Bitcoin Baseball Team”.

First at bat then, is CEO Steven Nelkovski…

Hi Steven. As we reported a few days ago, the Perth Heat will be operating on a “Bitcoin Standard”. Tell us what that is again?

It means we’re using Bitcoin as a standard for payments and payouts right across our organisation. It means we’re completely embracing the underlying values of the Bitcoin protocol.

Is it optional? Can staff and players still choose to receive inferior fiat money – Aussie dollars?

Yep, through our partnership with OpenNode [a leading BTC payments processor] each player and staff member is at liberty to receive Bitcoin or any number of currencies, depending on their unique circumstances.

So if a player only wants to be paid in dollars, they can simply direct OpenNode to automatically transfer their salary to AUD and forward to their traditional bank account as with any other direct debit process.

If they want to take half in Bitcoin and half in AUD (or any other combination) they can do that via the OpenNode application at any time and they are set.

We’re giving the players the freedom to decide what’s best for them. The entire process is very similar to the traditional payments process, with one added variable, which is how much of their salary they’d like to keep in Bitcoin.

Are you considering any other types of crypto payments at this point?

Only BTC.

How long have you had a Chief Bitcoin Officer on the payroll?

Twelve months. Patrick’s role up until now has been centred around working with our partners as we transition from the legacy system to the Bitcoin network.

He has a strong background and understanding of the inner workings of the Bitcoin network, the community, and the monetary principles that form the core of the protocol and his guidance has been instrumental in this process.

And moving forward, he’ll be responsible for ensuring the club is in the best shape possible to take advantage of the increasing efficiencies the team can leverage with our Bitcoin partners and the network at large.

Do you expect other sporting teams in Australia to follow suit? Is this just the beginning? You’re clearly aiming to be a trailblazer here…

Absolutely. We’re definitely proud to be the pioneers and the first team in world sport to be operating on a Bitcoin standard. And we expect a tsunami of teams from around the world to follow suit.

This is the future of sport. Get ready!

So regarding your plans to enable fans to purchase Heat tickets and merch using BTC…

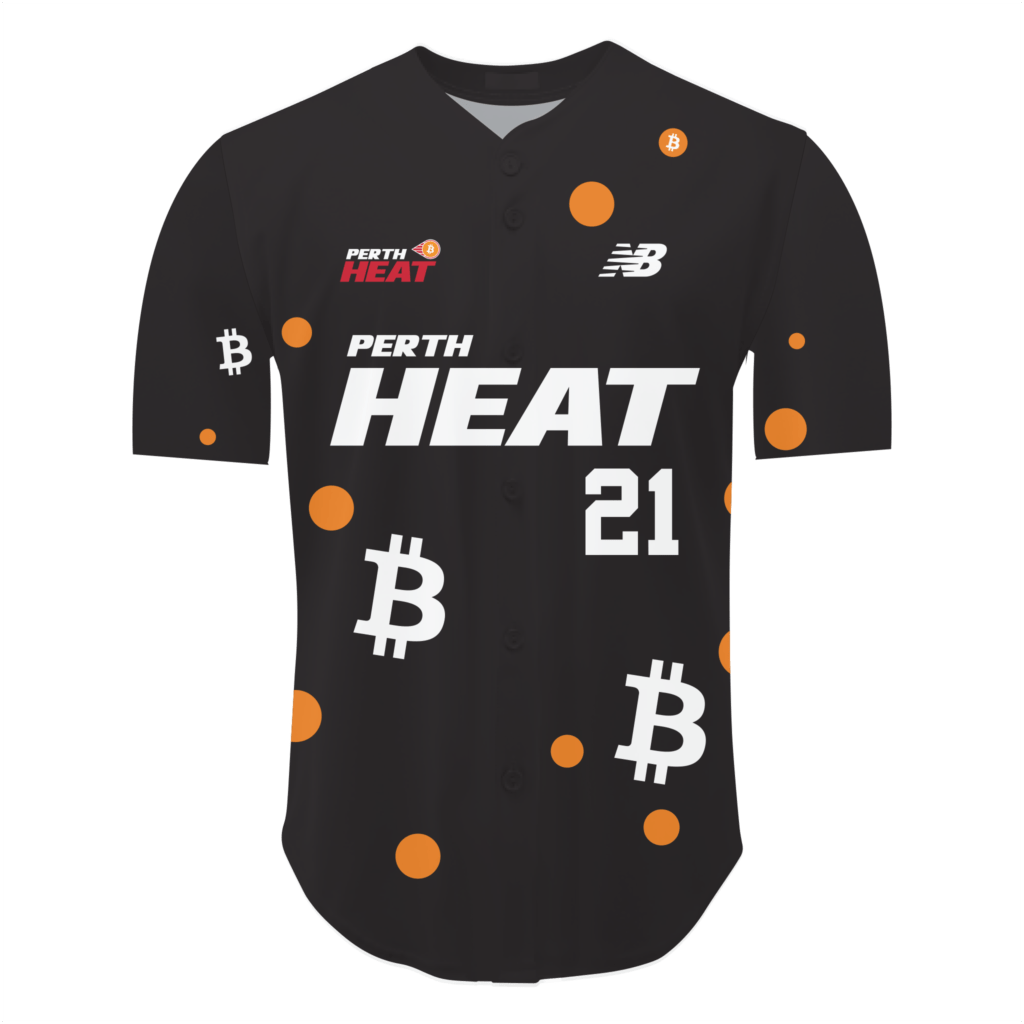

They’re not plans – we’re already live with that! Check it out – here… jerseys, hats, a Bitcoin membership and tickets for our movie night. All items can be purchased with BTC via the Lightning Network [a super-fast Bitcoin payments rail].

Nice! Oh… and one more thing… WAGMI?

100,000,000 per cent.

Stepping up to the plate next (last obvious metaphor… honest), is Perth Heat Chief Bitcoin Officer Patrick O’Sullivan…

Hey Patrick. Chief Bitcoin Officer is definitely the best job title we’ve heard this week. Are you a world-first CBO?

I’ve yet to come across another dedicated CBO, but as other organisations begin to see the writing on the wall, I think the position will become vital to companies around the world. Bitcoin is complex and that’s a strength and a weakness.

So, it’s like a CFO… but Bitcoin?

I’ll describe it like this… the role of the CBO is to bring the organisation’s decision makers up to speed with Bitcoin and ensure the business is in a position of strength going forward.

Should every sporting organisation or big company look to employ a CBO? Can you see it becoming a trend?

If companies want to tap into the full potential of the biggest wealth transfer in 5,000 years, they would do well to start trying to attract talent for this sort of role now!

From the conversations we’ve had with other companies interested in following our lead I think you will be pleasantly surprised by the number of announcements in the coming months.

What led you to the position? What makes you right for the role?

As with any emerging sector, it comes down to having a strong grasp of multiple different fields and an ability to be able to quickly synthesise complex topics… and then translate them into easily understandable chunks of information that I can pass on to the leadership team so as to best move the team forward.

So… I’d say a forward-thinking mindset and the ability to spot divergences in new information is the most critical component for the day-to-day success of a CBO. And that’s because the Bitcoin landscape is in a constant state of flux.

The ability to reason from first principles is a skill I rely on heavily to make the best use of my time when dealing with the organisation and our roadmap for the future.

Your job title might suggest you’re a “Bitcoin maxi”… is this the case? Or are you open to other cryptos and a broad decentralised crypto economy?

Easy answer. Bitcoin maximalist. And that’s because the discovery of absolute scarcity is a one-time achievement.

I am always looking at other projects through a technical lens, but if the goal is to leverage the world’s next global reserve asset, there can be only one – and the market decided on Bitcoin for a number of reasons.

So we won’t expect to see any NFT-style engagement happening from the Perth Heat, then?

There are no current plans outside of our all-in push on a Bitcoin Standard. We firmly believe the future of sports will be powered by Bitcoin and are looking forward to leading that charge.

Got it! I’ll stop asking about other cryptos…

Regarding the “all-in push” on the Bitcoin Standard – does this mean you’re looking to adopt a MicroStrategy-style, extremely heavy allocation to Bitcoin with the club’s treasury?

History has shown that first-mover advantage and adding to your winners is the winning formula in any investment. So, we are all in on Bitcoin and will continue to be going forward.

Got any tips for investors looking to get into Bitcoin?

The world of Bitcoin education has taken monumental leaps forward in the last 24 months. The quality of the content and the conversations that people can access now for free is staggering. There is no excuse not to get educated on Bitcoin.

So, that’s my tip, essentially. It is the most valuable use of time and energy that is available to any investor.

The fact is, though, the Bitcoin train has left the station. And you had 12 years to book a ticket.

Wait, left the station? We suppose US$60k is pretty high…

I’m just saying that if you missed that particular window, you had better start running right now, or you will be telling your grandkids you missed the most asymmetric investment opportunity ever presented to market.

With the education aspect, start with The Bitcoin Standard and don’t stop until you can explain Bitcoin to a five-year-old. Get off of zero as soon as you can. And learn by using.

Are there any particular Bitcoin investing strategies that you or the club are following?

Buy Bitcoin and HODL. Forever.

Echoes of Bitcoin bull Michael Saylor, there! And finally… think I can guess your answer to this, but has Bitcoin’s dip over the past week concerned you at all?

Dips are gifts for stackers. I love a good fire sale.

The Perth Heat is a foundational member of the Australian Baseball League and is the most successful club in ABL history, having won the Claxton Shield 15 times.

The 2021/22 Australian Baseball League season was cancelled by Baseball Australia in October, due to the uncertainty around Australia’s ongoing COVID-related restrictions.

This interview has been edited lightly for clarity. At the time of writing, the author hodls BTC and other crypto assets.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.