Think NFTs are a fast way to lose money? Cool, now you can bet on that by short selling them

Coinhead

Coinhead

It’d be nice if your NFTs could make you money no matter the state of the market, wouldn’t it? Upcoming new NFT finance protocol Dyve thinks so, too.

If it’s true, as American entrepreneur Gary Vaynerchuk has said, that “99% of NFT projects are gonna be garbage“, then the majority of NFT buyers right now, and in the future, have a problem.

And that’s namely: what the hell do they do with the multitudes of value-deteriorating NFTs sitting in their digital wallets? The ones that don’t have any utility they currently need, or even those they’re waiting for to rise in price before selling. And there are plenty of those.

The solution? It could very well lie within NFTfi – a new sector of decentralised finance focused on non-fungible token markets.

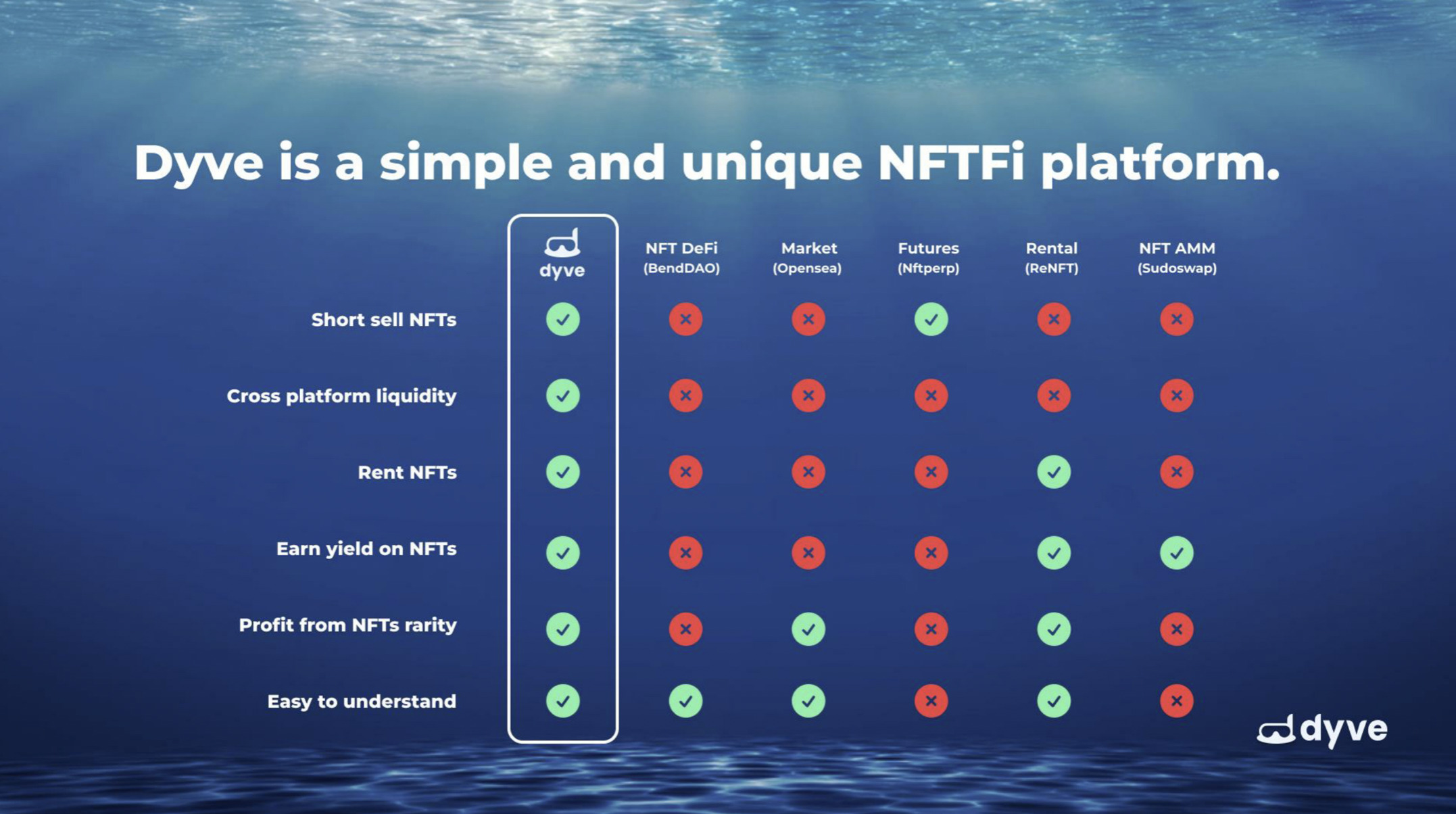

One NFTfi project in particular has caught our attention and it’s set to roll out in its beta launch soon. It’s called Dyve, and it’s designed to simply and easily enable NFT users/traders to lend, borrow and short sell NFTs.

If this concept takes off, what it will essentially do is bring bulk liquidity into a market where there are billions of dollars sitting around in unproductive capital.

To learn more, we met with the project’s doxed founder Ulticrypto over a webcam chat…

Hi Ulti. First up, before we, er, dive (that quite obviously had to be done) into your project’s specifics, can you please give me the overview of the problem Dyve aims to solve?

Absolutely. We think that NFT markets are broken. So far there’s been no way to profit from collections going down in price. Holders of NFTs tend to hate that they can’t do anything with them, until they sell. Meanwhile, traders wish they could profit from price corrections, as well as market volatility.

Right now, everyone can only buy and hold and try to sell high. And all of that means there are tons of idle NFTs, just sitting there doing nothing, and lots of unproductive capital, with no way to profit.

How’s Dyve going to improve this situation?

So we want to help with bringing easy-to-use short-selling capability to NFT markets and create new opportunities for everyone to profit in all kinds of different ways – and not just when things are bullish.

We want holders and traders to both be able to earn during times of collection volatility, and give people the ability to use new trading strategies, and have better risk management, hedging abilities and capital efficiency.

In order to short sell on Dyve, as we understand it there are two essential sides of the trade – NFT lenders and borrowers, is that right?

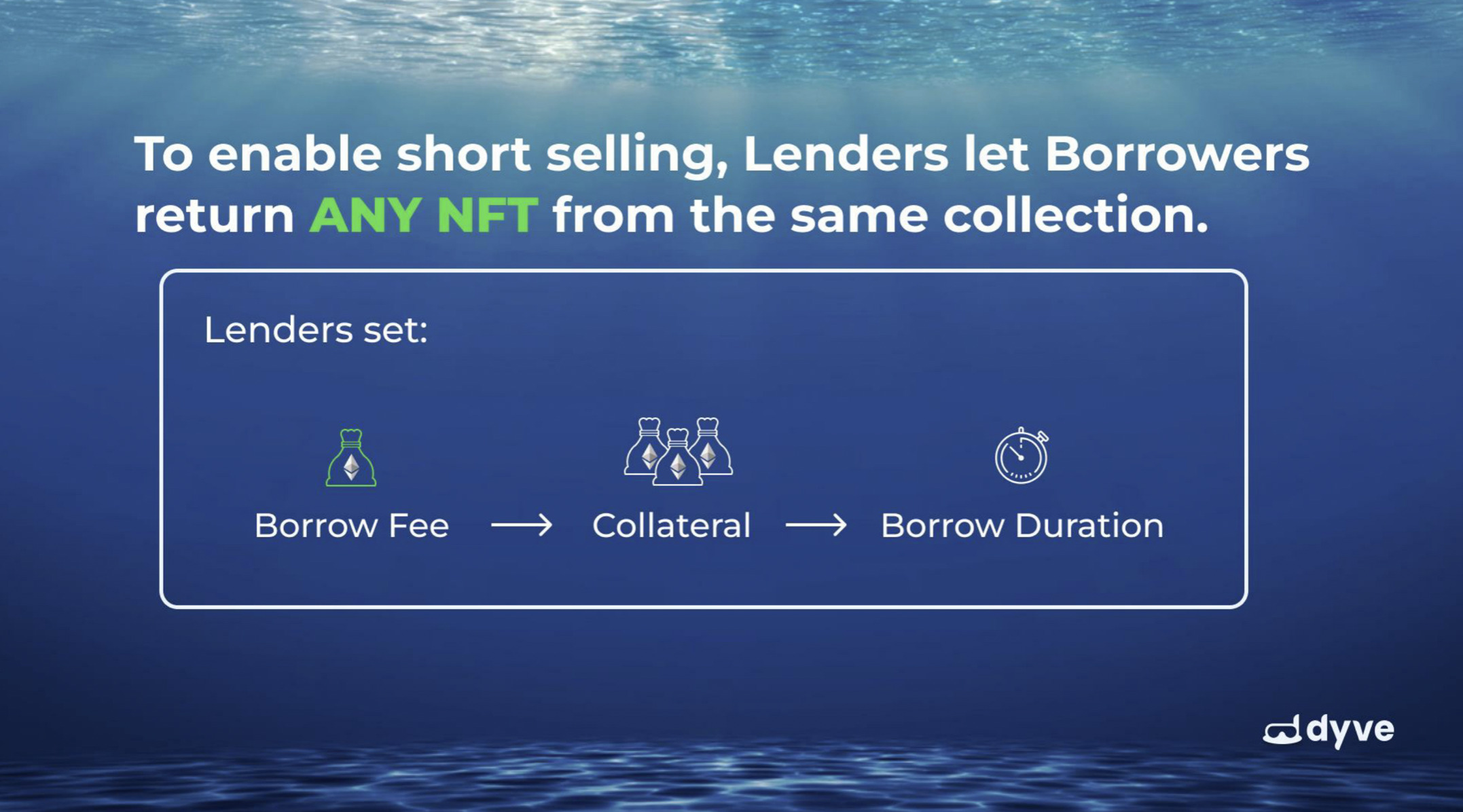

Yep, the way it works for Dyve lenders is that they allow borrowers to return any NFT from the same collection [e.g. Cool Cats, Doodles, whatever] and then that enables the short selling.

And so the lender sets a few simple steps…

Firstly, they set an amount they want to be paid in order to lend their NFT. They then set a collateral amount above the floor price of the collection, which is essentially them asking themselves, “If the borrower never gives me anything back, then what’s the amount that I’m gonna keep?” And then lastly they determine how long the borrower is going to be able to borrow the NFT for.

Is it correct that the NFT lenders are the more bullish side of the equation here?

Yes, because they want to stay long-term holders and believe in that NFT community, but essentially they would also like to get some value from their NFTs that would otherwise be sitting dormant and doing nothing for them.

And lenders can think of it like this – wouldn’t it be amazing for them to take profits along the way on NFTs without selling out of collections they like? It’s a whole new opportunity.

Okay, so continuing the other side of the process, what do borrowers need to do?

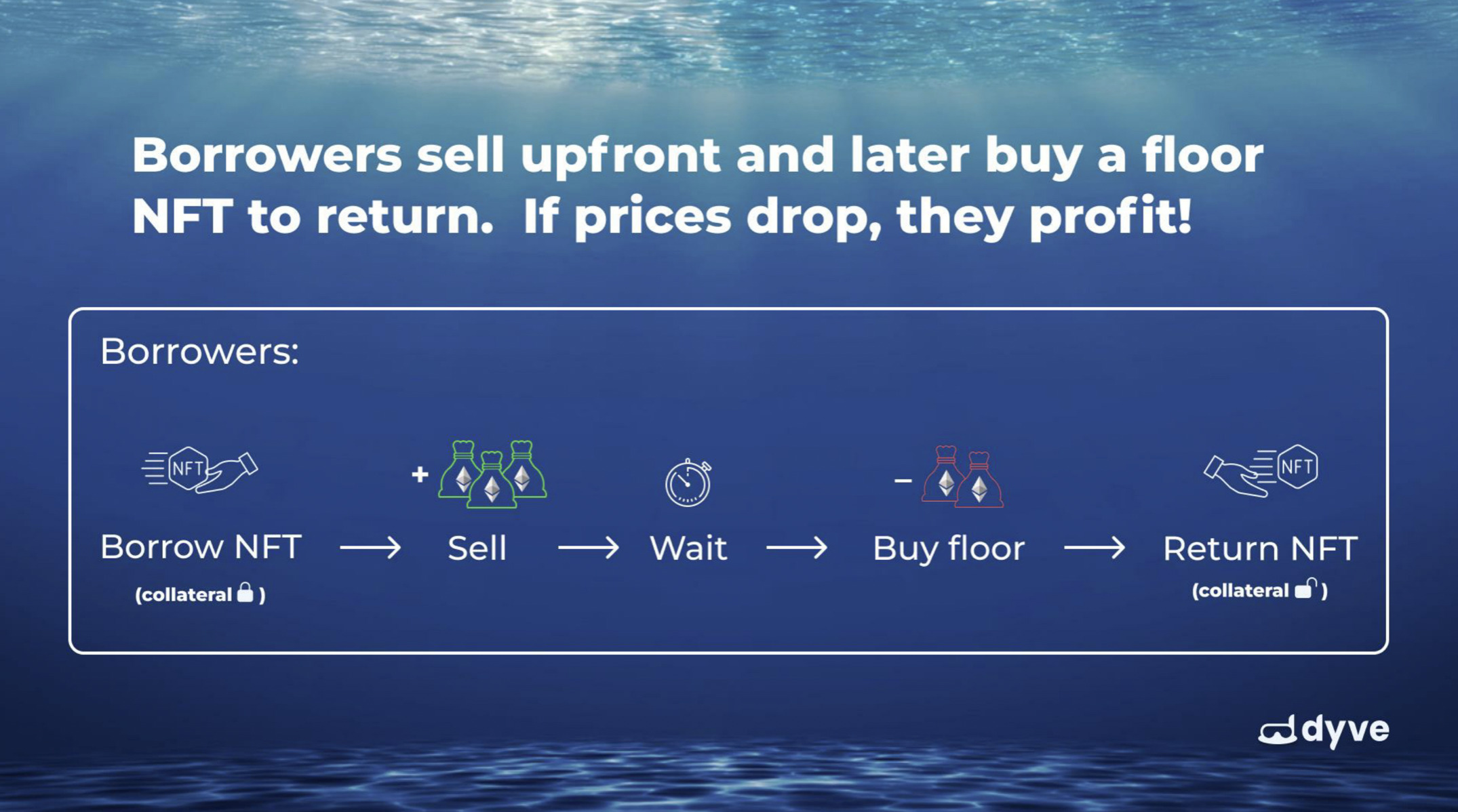

So a borrower is more bearish on a collection – they will think it’s overpriced. They’ll pay the fee, post the collateral, and they’ll borrow the NFT. Then they go to the market and they can choose to sell it straight away.

And then, any time it’s due, they can watch the floor price of the collection, and choose when to buy one to return and get back their collateral.

So what’s the winning short-selling scenario for the borrowers, then?

If the floor price was lower than what they sold their borrowed NFT for, they made a profit. Borrowers are incentivised to buy and replace the NFT when the price of a new one is less than the collateral they posted.

But… the other side is, they’re not going to buy something more expensive than they’ll get back, so instead will walk away and forfeit their collateral to the lender. This also means the borrower’s maximum loss is capped to the difference between their collateral and how much they sold the borrowed NFT for.

For lenders, there’s a risk then that an NFT might not be returned and they’re faced with a higher/rising floor price in a collection they still wanted to be in?

There is that risk, and it’s exactly why lenders set the collateral to an amount they’re happy keeping if they never get a replacement NFT, which again should be above the floor price or amount they could have sold it for when they made it available to be borrowed.

You also have the case of people with multiple NFTs of the same collection, like a moderator we spoke with recently on a Twitter Space who has two Sappy Seals. One of which is her “forever seal” that she’d be unlikely to use, but the other she’d love to be able to use Dyve to do something with in this way.

In other words, she’s a long-term holder, but still wants to be able to make use of the one she plans to sell eventually.

You’ve explained the short-selling aspect really well. Do you think there will be an aha! moment for those willing to give this a shot, who really don’t know much about what that term means, and trading in general?

Yeah, that’s how I feel about it. I think there will definitely be that moment for people who think they don’t know what short selling is, and then realise, “Oh, it just happened”. Because all that’s really describing in this instance is borrowing to sell upfront, and then looking to buy again if you bought cheaper. That’s a short sale – “Oh, I made money!” When that happens, I think it should make total sense to them.

And do you think the user experience will be easy for non-traders to get their heads around?

Yeah, we’re really trying to build the simplest user experience possible.

Adding to that, some of the biggest functions beyond our beta will be around helping automate the entire process. I can’t reveal too much yet, but it will include things like set-and-forget situations where we help automatically generate the right values, meaning an even easier user experience.

That sounds like an option I’d use. Let’s talk about a few other things, such as team, backers and roadmap…

I know you’ve got backing from Illuvium’s Kieran Warwick as an initial investor, but who else have you managed to capture interest from so far?

Yeah, we initially turned down a VC offer and accepted one from Kieran instead. He’s fantastic, both as a leader in the NFT and GameFi space, but also in supporting what we’re building.

He was extremely helpful in closing our strategic round, connecting us with our other investors like the founding members of Synthetix and bodhi.ventures, as well as 1inch’s co-founder – all very well known DeFi industry leaders.

So in terms of backers, it’s an incredible beginning for us, and it’s meant we were able to hit our initial strategic round goals quickly. And now that we’re further along in our journey, we’re looking to get started with a seed-round raise.

We also have strategic backing from two really strong NFT and gaming-focused DAO entities – Ethlizards, which initially sprung up from Illuvium’s Discord, and WolvesDAO, a GameFi research group where I was COO.

WolvesDAO has influential members from everywhere inside and outside of crypto – a16z, Delphi Digital, and major game studios. One of the execs from Activision just joined us, for example.

Please tell us a bit about yourself and the Dyve team.

Okay, so my background is in traditional finance experience in capital markets, leading large-scale teams in risk management and tech initiatives, plus I’m experienced in Web3 and NFTs through the WolvesDAO connection.

The rest of the team – we’ve got a few people who specialise in NFTs, a full stack developer and we brought on a chief marketing officer who has done incredible things in social media marketing.

Right now we’re currently being audited and tested. And our beta launch is looking to go ahead in the next two to three weeks – that’s our target timeline. And that’s to get early users and early feedback.

Because our platform is one that needs both lenders and borrowers, we need to have enough people with something to do on the platform. So we’re looking to have the bigger trading communities get involved in the beta and then basically scale from there.

Also, beyond Ethereum, a launch on Polygon is a no brainer for us as we love so many of the NFT and GameFi projects they’ve been onboarding, and we’re exploring other blockchains where there’s lots of NFT activity as well.

Do you need a bull market in order to grow?

No, we just need volatility. So bear market – great, bull market – great, and a crab market – that can also be great, because everyone wants the ability to do something and make something happen.

And what about a Dyve token? Will we see one in the works?

One of our goals is to eventually launch a token and reward early users. But more immediately we want to bring in traders – people to be early testers – and give out OG roles in our Discord as a way to track the people that we know will be active traders and good users.

Dyve is in the process of starting a seed round raise of US$2.5 million, but for those interested in the project, you should check out Dyve’s Twitter page and consider joining its Discord community to see if you can grab yourself an OG role.

Ulti gave us a special limited invite code for Dyve’s private Discord, which you can link to here.

The Q&A component of this article has been lightly edited for clarity. None of the contents should be construed as financial advice. The author is not a seed investor in Dyve.