The Three Ts: It’s all about energy, sell the rip and the Ethereum bouncing ball

Coinhead

Coinhead

Welcome to the Three Ts with CoinJar. Each fortnight we explore a big Theme, an interesting Trade and some good, old-fashioned Technical Analysis (courtesy of Tom from trading gurus FX Evolution).

The current geopolitical bin fire is a reminder that nothing in this world means as much as energy. We’ve been living in an age of abundant energy (hello, climate change!) so the basic mechanics of the energy economy haven’t featured too heavily in our day-to-day reckonings.

But throw together a supply chain crisis, climate-driven underinvestment in oil and gas and a brutal conflict involving one of the world’s major suppliers of both oil and gas and you have the recipe for, well, an absolute s..tstorm.

Yeah, I get that this isn’t 100% crypto related per se, but energy is the question from which all else flows: who has it, where’s it going and how much does it cost? And right now, oil prices are pretty close to the highest they’ve ever been, while the price of gas surged 80% in a single day.

People talking about BTC losing X level and then it’s light out…

While the gas prices are so high the lights may actually go out for real

— DonAlt (@CryptoDonAlt) March 4, 2022

We all know Bitcoin requires loads of energy. It’s the most perfect distillation of the idea that energy expenditure equals value that’s ever existed. But if energy shortages put upwards pressure on the cost of producing Bitcoin, while a global risk-off environment sends the price crashing even further, then, well, it could be a bumpy road ahead.

On the other hand, if you’re worried about Bitcoin’s actual carbon contribution, there’s this.

Clothes dryers use more energy than #bitcoin pic.twitter.com/a9uE2L6fD9

— Documenting Bitcoin 📄 (@DocumentingBTC) March 7, 2022

I’ve written before about how trading has become a real blood sport at this point. The market has zero conviction, the narratives are bad and most moves in either direction are reversed within 48 hours.

In short, if I could make one suggestion it would be to trade a whole lot less than you did in 2021.

However, this kind of range-bound chop doesn’t have to be a total ordeal, as long as you’re ultra disciplined and emotionless – which is not something most of us are capable of being. (God knows I’m like 0-for-7 so far this year.)

$BTC – Sell zone worked like a charm. Of course I’m selling right when Twitter is back to screaming bull run. Now I’ll be buying when they start saying we are going to $20k. pic.twitter.com/Kf2gE0RLNp

— IncomeSharks (@IncomeSharks) March 5, 2022

The secret? Play the range. Buy at the bottom, sell at the top and set a stop-loss that will allow you to walk away from the computer and not think about it.

If you’re having trouble on that last part then you’re trading with too much size. This isn’t the time to make your fortune. This is your time to survive.

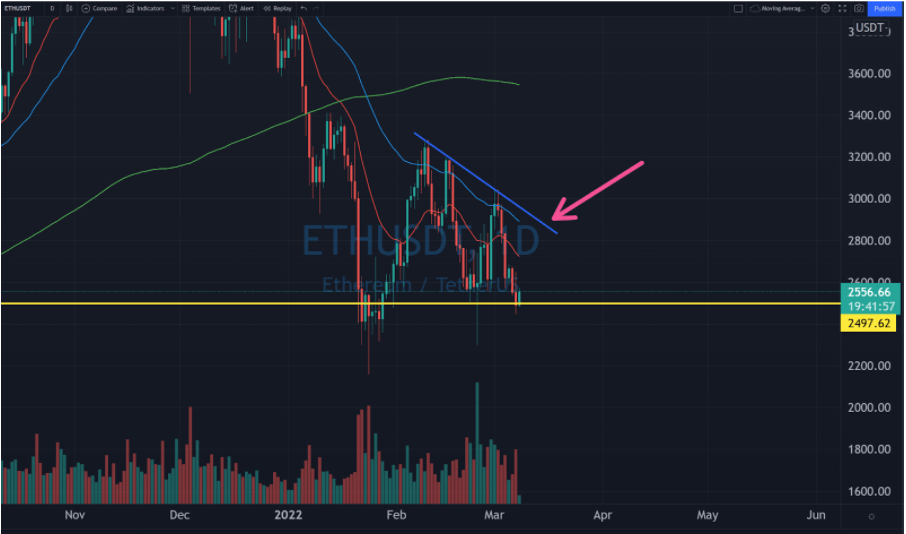

As the market viciously retraced the most recent upswing, Ethereum had yet another date with the resistance at US$2500. According to Tom from FX Evolution, this sequence of lower highs makes a breakthrough and subsequent descent towards US$2000 look increasingly inevitable. A bouncing ball can only bounce so many times…

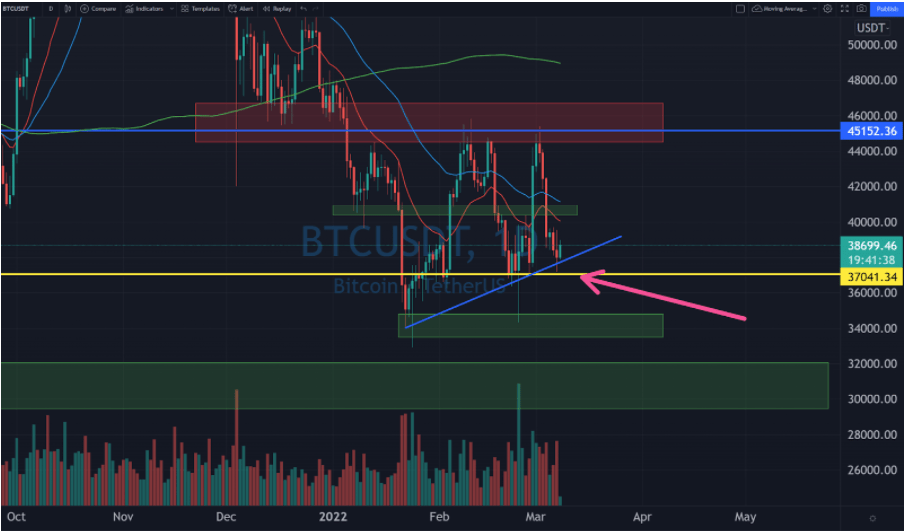

Meanwhile, the best that can be said about Bitcoin is that it’s holding up better than most. While the Russia sanctions-driven run to US$45k was rejected with no small amount of violence, its ability to hold above US$37k provides some hope that this could be the latest in a sequence of higher lows.

The two most important lines remain the support at US$37k and the resistance at US$45k. Lose the former and the next stops are US$34k and US$30k. Regain the latter and this phase of the bear market could be over.

CoinJar is Australia’s longest-running crypto exchange. Since 2013, CoinJar has helped more than half-a-million Australians buy and sell billions of dollars in cryptocurrency.

FX Evolution is Australia’s premier forex, stock and crypto trading community.