The Three Ts: Cash is king, downside targets and Bitcoin’s most critical level

Coinhead

Welcome to the Three Ts with CoinJar. Each fortnight we explore a big Theme, an interesting Trade and some good, old-fashioned Technical Analysis (courtesy of Tom from trading gurus FX Evolution).

If you’re new to crypto, the name Arthur Hayes might not mean much to you. Those of us who’ve been around for a while will remember Arthur as the investment banker-turned-crypto entrepreneur who founded Bitmex, the world’s first publicly available crypto derivatives trading platform, and for a long time one of the single most powerful players in the crypto industry.

While Bitmex’s fall from grace has been well documented, Hayes remains one of the crypto space’s most perceptive commentators. So, when he published an article this week entitled ‘Maelstrom’, warning of a dark and bloody start to 2022, people paid attention.

The money printer ain't going BRRR, so #crypto is about to get bludgeoned with a two-by-four studded with rusty nails. Read my essay "Maelstrom" to find out why.https://t.co/qUPq90W4qz pic.twitter.com/sKUA4i9dF5

— Arthur Hayes (@CryptoHayes) January 6, 2022

However, Hayes is merely the latest in a long list of commentators both inside and outside the cryptosphere warning that the Fed’s attempt to stem inflation by raising interest rates could pose a danger to hyper-extended risk-on assets in the midst of record-melting rallies.

It’s impossible to know whether we’re entering a new bear market, a sustained downturn, or, hell, the beginnings of the trip to US$100k. But with the prospect of lower prices looming, the most enticing prospect right now could be cold, hard USD stablecoin – especially while the US dollar is pummelling every other currency out there. Gotta be ready to snap up those bargains, y’know?

Crypto is often seen as a long-only pursuit. It’s either producing outsize gains, or it will if you simply hold for long enough. And that has always proven to be true – as long as you’re willing to wait a few years.

But there’s no denying that the people who sold in December 2017 and bought back in early 2019 have every right to feel a little smug. So, how do you work out where the bottom might actually be?

When corn has lost the weekly 20/50 it always (N3) ended up testing the 200

Weekly 200 currently at 19k

— RJ (@RJ_Killmex) January 10, 2022

With so much weakness in the air, downside bingo has taken over crypto Twitter, with the same level of oneupmanship we’d previously seen afforded to bull market hopium in early 2021.

My general view.

>53K again resumes the bullish case

<42K again puts 28K back in playEverything between the 2 numbers now is ranging chop that will drive traders into a panic.

People will be extremely bullish at 53K and bearish at 42K, if either is reached.

— The Wolf Of All Streets (@scottmelker) December 6, 2021

While the only certainty is that the vast majority of these predictions will turn out to be wrong, it’s still worth looking at a diversity of data points to try and understand what may be in store. Because even if it sucks to see the price plummeting, it could mean that the opportunity of a lifetime is around the corner.

You may just have to wait a few years.

This #Bitcoin ~~ $NASDAQ fractal is terrifying. 😱 pic.twitter.com/yfTtaTvRXs

— Nebraskangooner (@Nebraskangooner) January 10, 2022

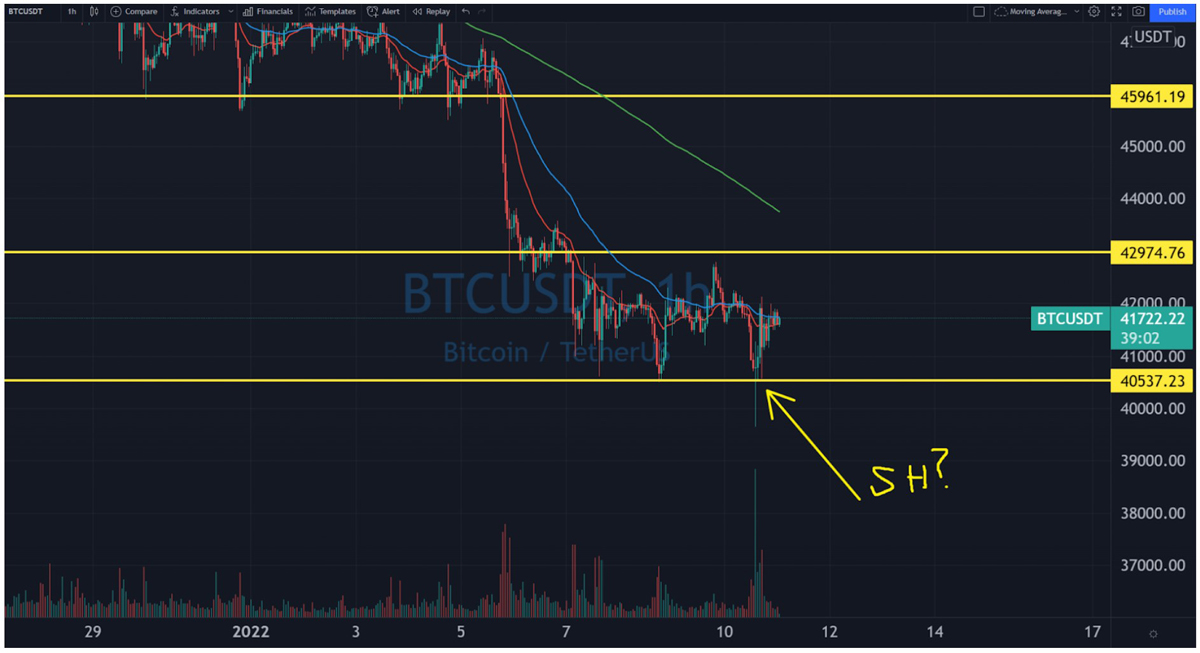

According to Tom from FX Evolution, Bitcoin is currently flirting with one of its most important levels at US$40k. There’s a clear head-and-shoulders being printed on the weekly chart; if the pattern confirms with a weekly close below US$40k, well, gravity will do the rest.

With that said, recent Bitcoin price action looks a little more promising, at least in the short-term. Bitcoin appears to have entered an accumulation zone between US$40–43k. While the price dipped below US$40k briefly on Monday night, the recovery was swift and well-supported, suggesting that it might have simply been a stop hunt. If the price can move above US$43k, a return to US$46k would be the next logical level.

Ethereum similarly finds itself at a significant support level on the weekly. Being a round figure, US$3000 is an important psychological barrier that in this case also happens to coincide with the 50MA – a source of support in previous corrections. Once again, suffice it to say that we definitely want to see this hold.

We see you down there, 200MA.

CoinJar is Australia’s longest-running crypto exchange. Since 2013, CoinJar has helped more than half-a-million Australians buy and sell billions of dollars in cryptocurrency.

FX Evolution is Australia’s premier forex, stock and crypto trading community.