Mooners and Shakers: ‘The outrage is justified’ – crypto market pushes back on SEC vs Coinbase news

Coinhead

Coinhead

Ding! Ding! Round two. The SEC has doubled down in the space of two days, charging America’s biggest crypto exchange, Coinbase, with securities violations, a day after throwing similar accusations at Binance.

What fun for crypto HODLers everywhere, never mind just in the US, of A, eh? Good one, Gazza Gensler. Thanks a bleeding lot. And yet… and yet… the bleeding out on this one hasn’t yet come.

In fact, if you thought Bitcoin and the crypto market had held on bravely to a crucial level of support yesterday you’d be right, but it’s somehow, epically, managed to climb to a higher branch while being pelted with a fresh batch of rocks.

Well either that, or it’s gone something like this…

That there is John James Crypto what jumped off of that cliff into that tree and threw that rock, hitting that SEC chopper, that is. “They drew first blood… they drew first blood…”

Sorry, daydreaming…

So what actually has happened with the SEC and Coinbase overnight, then? Frankly, in spite of the perversely positive price action on the back of it all, it’s pretty crap news for the crypto industry in the US. At least in the short to midterm.

Following its similar action against the Binance exchange in America yesterday, the United States Securities and Exchange Commission (SEC) has filed a lawsuit against the nation’s biggest crypto exchange – Coinbase – for allegedly offering unregistered securities on its platform.

Damn. The SEC has now filed a lawsuit against Coinbase as well…

They allege the following coins are securities:

$SOL, $ADA, $MATIC, $FIL, $SAND, $AXS, $CHZ, $FLOW, $ICP, $NEAR, $VGX, $DASH & $NEXO. pic.twitter.com/WxMx0Zy1zE— Coin Bureau (@coinbureau) June 6, 2023

Gary Gensler and pals contend that Coinbase is acting as an unregistered broker, national securities exchange and clearing agency, and is offering its customers in the US several unregistered securities in the form of tokens that it says includes:

Solana (SOL); Polygon (MATIC); Cardano (ADA); Filecoin (FIL); The Sandbox (SAND); Axie Infinity (AXS); Chiliz (CHZ); Flow (FLOW); Internet Computer (ICP); Near (NEAR); Voyager Token (VGX); Dash (DASH) and Nexo (NEXO).

Coinbase’s alleged failures deprive investors of critical protections, including rulebooks that prevent fraud and manipulation, proper disclosure, safeguards against conflicts of interest, and routine inspection by the SEC. https://t.co/FwpdmENvoL

— Gary Gensler (@GaryGensler) June 6, 2023

Why mention that lot and not Ethereum and XRP, for instance? That might have something to do with the agency not wishing to muddy the waters in its litigation case with Ripple.

That lawsuit focuses on the sale of XRP as an alleged unregistered security but also brings into play Ethereum, which could prove to be a crucial part of that plotline, with regards to former high-ranking SEC exec William Hinman’s 2018 speech in which he claimed ETH was not, in fact, a security.

In any case, the crypto industry across Twitter has been abuzz with the Coinbase-related body blow on the back of the left hook to Binance.

If you have the time, this Twitter Spaces “townhall” hosted by Scott “The Wolf of All Streets” Melker is worth tuning into, although it was on in the wee hours last night in Australia and this writer fell asleep listening.

The #CryptoTownHall is live and approaching 20,000 live listeners. Absolutely epic. https://t.co/UemSxfrTva

— The Wolf Of All Streets (@scottmelker) June 6, 2023

Here’s a couple of bits and pieces of what we did catch:

• Wolf of All Streets: “It’s all-out war on crypto in the United States.”

• Former Goldman Sachs man turned macro/crypto analyst Raoul Pal: “We knew this was coming, there’s nothing new here. It’s designed to slow everything down, but ultimately the market will go higher.

“Their [the SEC’s] tactic is to create as much uncertainty as possible. It’s done on purpose. The last thing they want is to give regularity clarity.

“But I think it’s still a bull market, and it looks just like all the others at this point.”

Meanwhile, here’s crypto commentator Chris Blec bringing the probable truth…

— Chris Blec (@ChrisBlec) June 6, 2023

And here’s crypto/tech-friendly lawyer Jake Chervinsky with another insightful take, referring to the fact that Coinbase, under the current SEC bosses’ watch, became a registered IPO allowing it to be listed on the Nasdaq stock exchange and selling its COIN stock to retail investors.

SEC: our mission is to protect investors

Also SEC: reviews Coinbase's business model, approves Coinbase to go public, allows Coinbase to sell stock to retail investors

Then SEC: alleges Coinbase's business model is illegal and tanks stock by 20% causing losses to investors

???

— Jake Chervinsky (@jchervinsky) June 6, 2023

“The outrage is justified,” noted Chervinsky. “But the relief is justified, too,” he added, possibly referring to the surprising positive price action on the back of this latest news.

But the relief is justified too.

Anticipation is often worse than reality, and that feels true here. It's good to get past the "will they or won't they" phase and finally into the fight.

The SEC doesn't make the law. It only makes allegations, and can (and will) lose in court.

— Jake Chervinsky (@jchervinsky) June 6, 2023

Here are some more crypto-community-at-large reactions we caught late last night…

Instead of working constructively with U.S. market participants to come up with a working model, and knowing that Congress is actively considering legislation to do the same, SEC sues. No allegations of fraud, just accusing @coinbase of failing to do the impossible.

— TuongVy Le 🍎🗽🛡️ (@TuongvyLe12) June 6, 2023

1) World of difference in the claims between Binance and Coinbase from the SEC.

2) SEC is claiming they allowed an unregistered broker-dealer to be reviewed, IPO and public trade for years without action or guidance…🤡

Time to get Gensler in front of Congress again.

— Adam Cochran (adamscochran.eth) (@adamscochran) June 6, 2023

So, let me get this straight.

The SEC says that “Coinbase has operated as an unregistered broker since 2019”.

Yet Coinbase IPOd in April 2021.

So you’re telling me that the SEC let an "unregistered broker" IPO – after carrying out due diligence?

Well done Gary. 👏

— Miles Deutscher (@milesdeutscher) June 6, 2023

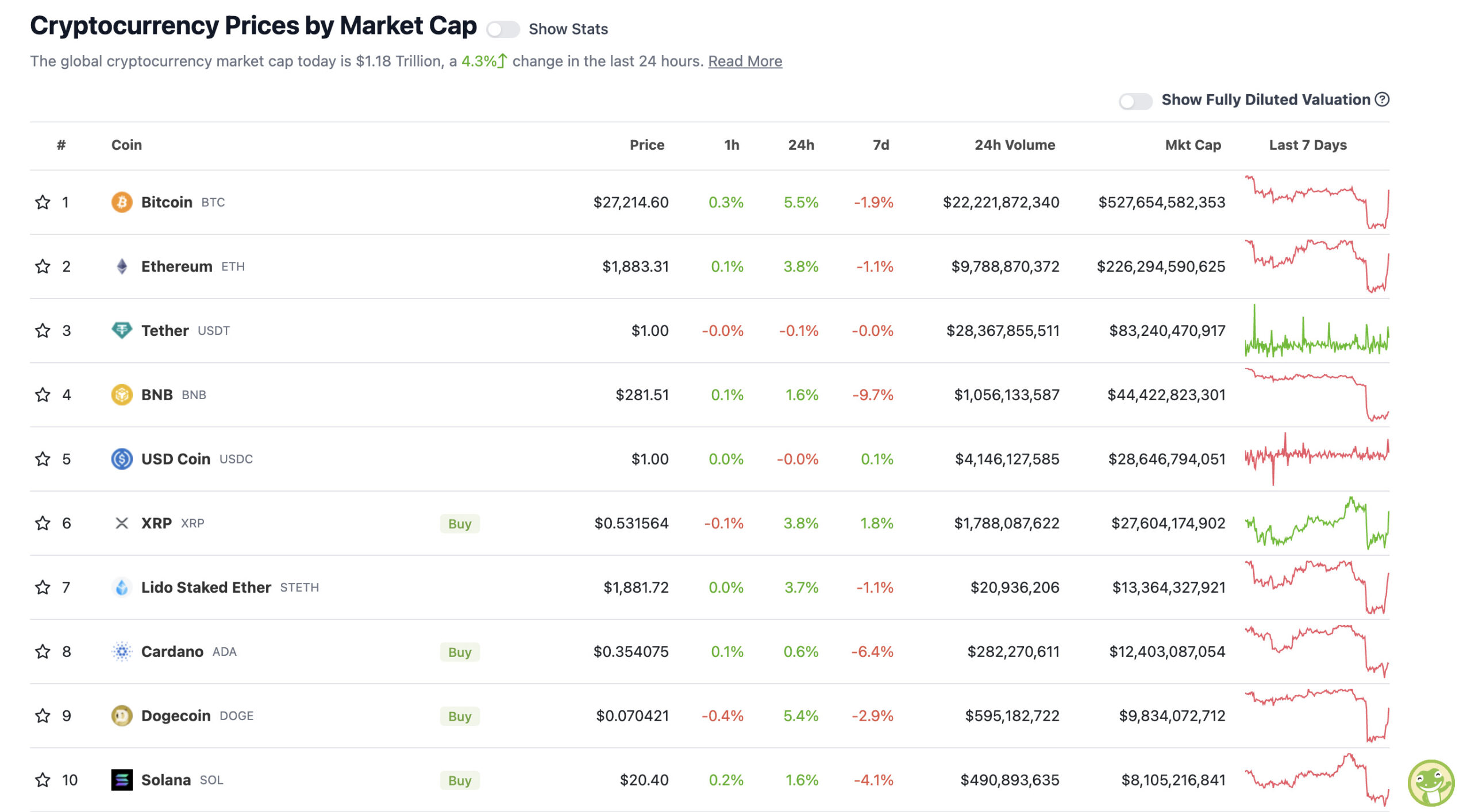

With the overall crypto market cap at US$1.18 trillion, miraculously up about 4.3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

It’s slightly surprising to see the market somewhat rally, although a quick check of Eddy’s Market Highlights this morn tells us Wall Street closed in the green with some techy stocks faring quite well.

What’s less surprising within that context, is the fact that decentralised-tastic Bitcoin (BTC), which is the ONLY crypto asset that the SEC pretty much cannot claim to be a security (largely based on the fact they have absolutely no Bitcoin CEO to serve their pernickety papers to), is the best performer in the majors today so far.

That said, Dogecoin (DOGE) is not far behind it, hilariously enough. And why would that be? Oh yeah, a certain Tweet-happy tech billionaire. Again. (See below.)

Doge ftw

— Elon Musk (@elonmusk) June 6, 2023

Meanwhile, what are some “told-you-so” Crypto Twittering technical analytical traders seeing in the tea leaves now?

It truly is magnificent seeing an entire timeline of overconfident shorters get absolutely rekt knowing we dumped on below average volume driven by a news event.

Yesterday you should have taken profits with this information but instead many criticized and told me how wrong I was https://t.co/6kE2acbRW9

— Roman (@Roman_Trading) June 6, 2023

What’s hilarious is same $BTC bears that came out of the closet yesterday are completely silent today.

Thanks again for adding fuel to the short squeeze. #bitcoin #cryptocurrency #cryptotrading #cryptonews

— Roman (@Roman_Trading) June 6, 2023

Back to $27K.

Great bounce from the 200-Week MA.

Time to start the new uptrend to $38-42K on #Bitcoin.

— Michaël van de Poppe (@CryptoMichNL) June 6, 2023

#BTC has retested the 200-week MA as support

Downside wicking below the MA has taken place but $BTC has managed to hold above it#Crypto #Bitcoin https://t.co/BOhlbnipxu pic.twitter.com/VDm9OJXEeG

— Rekt Capital (@rektcapital) June 6, 2023

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Pepe (PEPE), (market cap: US$508 million) +16%

• ApeCoin (APE), (market cap: US$1.14 billion) +10%

• Stacks (STX), (market cap: US$827 million) +8%

• Lido DAO (LDO), (market cap: US$2.12 billion) +8%

• Radix (XRD), (market cap: US$713 million) +8%

• Optimism (OP), (market cap: US$962 million) +8%

SLUMPERS

• BitTorrent (BTT), (market cap: US$511 million) -2%

• Algorand (ALGO), (mc: US$998 million) -1%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

The numbers don't lie. pic.twitter.com/lec4wkp6RO

— Coinbase 🛡️ (@coinbase) June 6, 2023

USA trying to nuke crypto?

Pump it

— DonAlt (@CryptoDonAlt) June 6, 2023

— Bearjesus.eth (@thebearjesus) June 6, 2023

Place your bets for SEC Lawsuit of the Day.

Who will it be tomorrow?

— Michaël van de Poppe (@CryptoMichNL) June 6, 2023

USA trying to nuke crypto?

Pump it

— DonAlt (@CryptoDonAlt) June 6, 2023

The FED simultaneously bails out the banking sector while the SEC declares war on the solution: Crypto

All while FTX 2.0 prepares for launch

SOMETHING DOESN'T ADD UP pic.twitter.com/7tx5Ykliwy

— Mario Nawfal (@MarioNawfal) June 6, 2023