Mooners and Shakers: Solana slumps amid FTX turmoil; crypto market eyes US midterms and CPI data

Coinhead

Coinhead

Making news in Cloud Cuckoo Crypto Land today: yesterday’s FTX-related drama seems to have negatively affected Solana’s SOL token, and the entire crypto market has dipped as narratives shift to US midterm elections and more CPI data.

Apparently it’s another crucial week for Bitcoin and the wider crypto market. Who’da thunk it, eh?

Coming up this week, the US has its midterm elections, which will decide the composition and balance of power in Congress. Some reports are suggesting that Republicans could take back a majority in both the House and Senate, which could help the crypto industry’s cause.

According to a Bloomberg report:

“A Republican-controlled Congress would also likely put pressure on agencies, like the SEC — which the industry has charged with regulating through enforcement — to ease their aggressive posture against crypto firms.”

Meanwhile, the next lot of US Consumer Price Index (CPI) data relating to inflation figures hits at the end of this week. As noted yesterday, this could also have a significant bearing on which way the markets trend short term, as, once again, it’ll affect what the US Federal Reserve does next in terms of interest-rate hikes.

Probably the most important week in crypto coming up

Mid term elections Tuesday

CPI – Thursday

These events can be catalyst for $BTC to trend higher towards $28k or retest $18k

— Johnny (@CryptoGodJohn) November 5, 2022

The only way I'll be convinced that the $DXY is losing momentum is if it starts closing below 109.30 … it's still too constructive to say the trend is over.

Fed is expecting "stubborn inflation."

I think rates go higher and stay higher than expected and $DXY gets supported pic.twitter.com/5aF00BOdqS

— Kevin Svenson (@KevinSvenson_) November 7, 2022

Meanwhile, there’s been a win for the US Securities Exchange Commission (SEC) in a case against a crypto company that has more than a few watchers on edge about the precedent it potentially sets. And no, the firm isn’t Ripple, it’s a US blockchain publishing outfit called LBRY Credits.

A touch more on that, further below. Let’s check in on the crypto majors price action first.

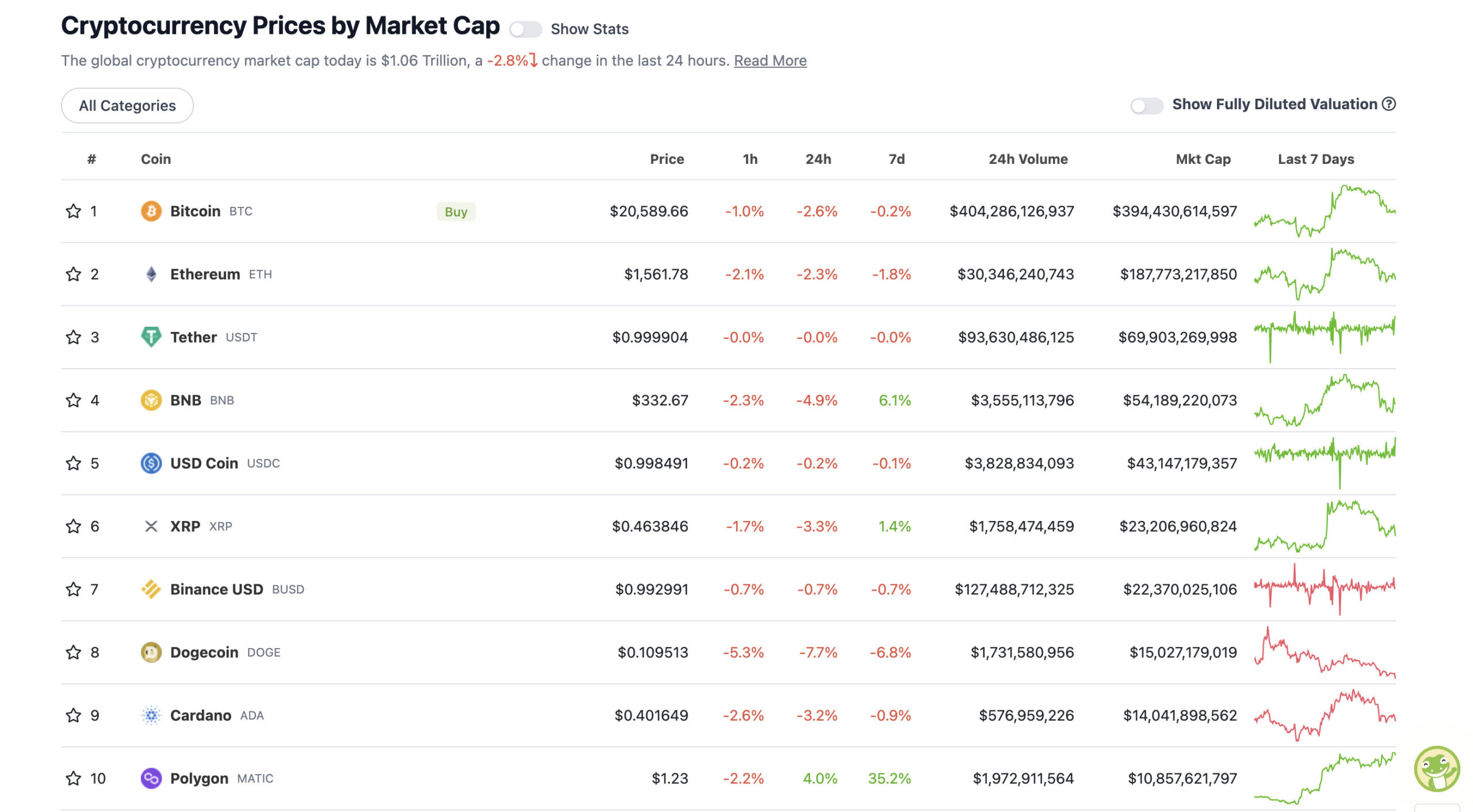

With the overall crypto market cap at US$1.06 trillion, down almost 3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

On a 24-hour timeframe and mostly a weekly one, too, it’s red x 9, then a touch of green for new top-10 entrant Polygon (MATIC), which is still trading off some pretty incredible adoption news just lately.

What’s it supplanted on this chart? Solana (SOL), which, despite some recent positivity of its own over the weekend (involving Google Cloud), is suffering. And that’s seemingly on the back of the negativity and rumours swirling around the FTX exchange owned and run by crypto billionaire Sam Bankman-Fried.

Bankman-Fried, his trading and venture investment firm Alameda Research and the FTX exchange are tied to Solana through significant long-term, early-stage investment and support.

SOL has currently plunged nearly 13% over the past 24 hours, and there’s a theory that Alameda could be looking to dump its SOL tokens in a bid to raise liquidity and defend its FTT token.

All up, FTX reportedly has about US$1.2 billion worth of SOL tokens at the time of writing, according to a News.BTC.com report.

Pay attention to #Solana , ftx will have to sell to cover expenses. If they are having issues

— the BERG (@ADAMBERGMANshow) November 7, 2022

Just to reiterate – the FTX SOL sell-off theory, is simply speculation at this stage that we’re seeing bandied about on Crypto Twitter and sections of the crypto media.

Perhaps something to keep in mind, though, is that Solana does have a lot of fans, a lot of development and big partnerships/ties beyond FTX – it’s Ethereum’s biggest rival for layer 1 network effect.

Meanwhile, all this uncertainty swirling around FTX, partly fuelled by Binance CEO CZ’s fighting words and stance – it is a little concerning. A cascading effect on another huge crypto platform is not what the industry needs right now. As this Santiment post notes, FTX’s Ethereum reserves have dramatically collapsed, causing further angst and speculation regarding the firm’s financial stability.

😮 In just two days, the amount of #Ethereum held in #FTX's main wallet has dropped from 322k to 32k. At one point, the wallet was bleeding 500 $ETH per minute. With the ongoing feud between @SBF_FTX and @cz_binance, expect continued unpredictability. https://t.co/vILMoySIEu pic.twitter.com/ROQt7wxj0c

— Santiment (@santimentfeed) November 7, 2022

Here’s a response or two from Bankman-Fried to all the drama:

2) FTX has enough to cover all client holdings.

We don't invest client assets (even in treasuries).

We have been processing all withdrawals, and will continue to be.

Some details on withdrawal speed: https://t.co/tSjhJW3JlI

(banks and nodes can be slow)

— SBF (@SBF_FTX) November 7, 2022

Seriously doubt FTX is going bust. Think this run on FTX represents opportunity.

— Alex Krüger 🇦🇷 (@krugermacro) November 7, 2022

Sweeping a market-cap range of about US$10.6 billion to about US$424 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Chainlink (LINK), (market cap: US$4.33 billion) +9%

• VeChain (VET), (mc: US$1.94 billion) +8%

• The Open Network (TON), (mc: US$2.6 billion) +6%

• Curve DAO (CRV), (mc: US$571 million) +5%

• Polkadot (DOT), (mc: US$8.3 billion) +4%

DAILY SLUMPERS

• Solana (SOL), (market cap: US$10.6 billion) -10%

• Tokenize Xchange (TKX), (mc: US$1.13 billion) -8%

• WhiteBIT Token (WBT), (mc: US$918 million) -6%

• Chain (XCN), (mc: US$1.08 billion) -4%

• Aptos (APT), (mc: US$902 million) -4%

There’s a lot of chaff the further you delve down the market cap list. Occasional grains of wheat, too, though. Remember to DYOR.

DAILY PUMPERS

• Hashflow (HFT), (mc: US$201 million) +455%

• Kine Protocol (KINE), (market cap: US$2.1 million) +35%

• Reef (REEF), (mc: US$127 million) +22%

• XCAD Network (XCAD), (mc: US$60 million) +21%

• DeXe (DEXE), (mc: US$132 million) +20%

DAILY SLUMPERS

• LBRY Credits (LBC), (mc: US$654 million) -32%

• Goldfinch (GFI), (market cap: US$21 million) -28%

• Phala Network (PHA), (mc: US$90 million) -21%

• Aleph (ALEPH), (mc: US$19.6 million) -17%

• Mask Network (MASK), (mc: US$284 million) -13%

LBRY Credits. What is it? It’s a blockchain-based sharing platform that enables users to publish and monetise published material with an integrated, tokenised payment system.

Why’s it dumping so hard? It just lost its case against the SEC, with the US District Court for New Hampshire ruling that the firm offered its LBRY Credits LBC token as an unregistered security.

We lost. Sorry everyone.

— LBRY 🚀 (@LBRYcom) November 7, 2022

The full ruling in the SEC vs LBRY case can be read here.

The language used here sets an extraordinarily dangerous precedent that makes every cryptocurrency in the US a security, including Ethereum. https://t.co/plLZuzBRpO

— LBRY 🚀 (@LBRYcom) November 7, 2022

It’s a bit concerning, given the similar-but-higher-profile, ongoing battle between XRP’s creator Ripple Labs and the SEC. As US attorney Jeremy Hogan indicates in his tweet below, the LBRY Credits case will very likely be a topic of discussion put forward by the SEC’s lawyers in the final stages of the Ripple/XRP case.

SEC victories in these cases would set a worrying precedent for the regulator to then make life difficult for the vast majority of the crypto industry.

LBRY fought the good fight but lost at summary judgment.

The Judge hung his hat largely on the fact that there was essentially no use for the tokens at the time of the sales.

I would expect this case to make its way into the SEC's final brief in the Ripple case. https://t.co/IDlq8J4RMS

— Jeremy Hogan (@attorneyjeremy1) November 7, 2022

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Looks like the US government has come into a bit of a Bitcoin windfall.

James Zhong stole over $3 billion in #bitcoin from Silk Road by committing wire fraud and possibly faces over 20 years in prison in the latest U.S. seizure.@Fall_Of_Fiat covers the news:https://t.co/8lBWieMWsc

— Bitcoin Magazine (@BitcoinMagazine) November 7, 2022

Things that make you go, hmmm…

dump not pumphttps://t.co/a94XiypauN

— Johnny MEMonic™️ 🐇 | Omen Art Collective (@memonic_johnny) November 7, 2022

Funny memes, media & some people tried to color this as a “fight.” Sorry to disappoint, but I spend my energy building, not fighting. Today I spent my day on our business & our community. I suggest others do the same. Back to building. 4/4

— CZ 🔶 Binance (@cz_binance) November 7, 2022

What would crypto be without the social wars between fierce competitors. https://t.co/d6gOAbwecw

— Kieran.eth ♊️ (@KieranWarwick) November 7, 2022

"Work together for the ecosystem" pic.twitter.com/KnmRKLW0Qs

— À Block 🚁💰 (@aBlock0) November 7, 2022

#Bitcoin is saving lives in Lebanon. Please watch and sharepic.twitter.com/aeIwriztbm

— Documenting Bitcoin 📄 (@DocumentingBTC) November 7, 2022