Payments giant PayPal has taken another positive step into the world of crypto, announcing the launch its own US dollar-pegged stablecoin – PayPal USD (PYUSD).

PayPal, as you might already know, has been a staunch supporter of a crypto-based digital payments future for some time now, launching crypto payments in 2020.

Is this the ballast the somewhat flagging market needs right now? There has been a spate of wobbly news lately, particularly based around DeFi and stablecoins, so this doesn’t hurt.

After all, PayPal has some 431 million users across the planet, so in terms of potential crypto adoption, this isn’t a bad narrative at all.

“Designed for digital payments and Web3”, the stablecoin is built on Ethereum, issued by blockchain financial services firm Paxos Trust Co. and is fully backed by US dollar deposits, short-term Treasury bills and other cash equivalents.

And this move is being described as a “watershed moment” (yep, another one, puts on raincoat) for the crypto space. Specifically, Walter Hessert, the head of strategy at Paxos, told CoinDesk those words regarding the new stablecoin.

And he believes that for a few reasons, but primarily because PYUSD is the first regulated stablecoin from a global payments company, with its customers’ assets protected against bankruptcy.

Paxos itself is a trust company that’s regulated by the New York Department of Financial Services (NYDFS).

PYUSD will be redeemable for US dollars, can be exchanged for other cryptocurrencies on PayPal, and will be transferable between PayPal and Venmo. And PayPal says the stablecoin will soon be available as a payment method for various purchases.

“The shift toward digital currencies requires a stable instrument that is both digitally native and easily connected to fiat currency like the U.S. dollar,” PayPal CEO Dan Schulman said in an official statement.

“Our commitment to responsible innovation and compliance, and our track record delivering new experiences to our customers, provides the foundation necessary to contribute to the growth of digital payments through PayPal USD.”

As you can see from some of the tweets/Xes copied into this article, there have been mixed reactions to the PayPal news today…

It seems not everyone is into it. Crypto analyst Adam Cochran, for instance, thinks it’s a “nothing burger” because of its “centralised rails” and its confined use on PayPal and Venmo.

Debbie Downer on that score? Possibly, yeah, because PayPal has also confirmed it plans to eventually facilitate the holding of PYUSD in third-party digital wallets, such as MetaMask.

The further talk around all this, too, is that it could spur regulators and lawmakers, currently mooting a recently proposed stablecoin regulation bill on Capitol Hill, into action to decide how to progress this important aspect of the crypto/blockchain space.

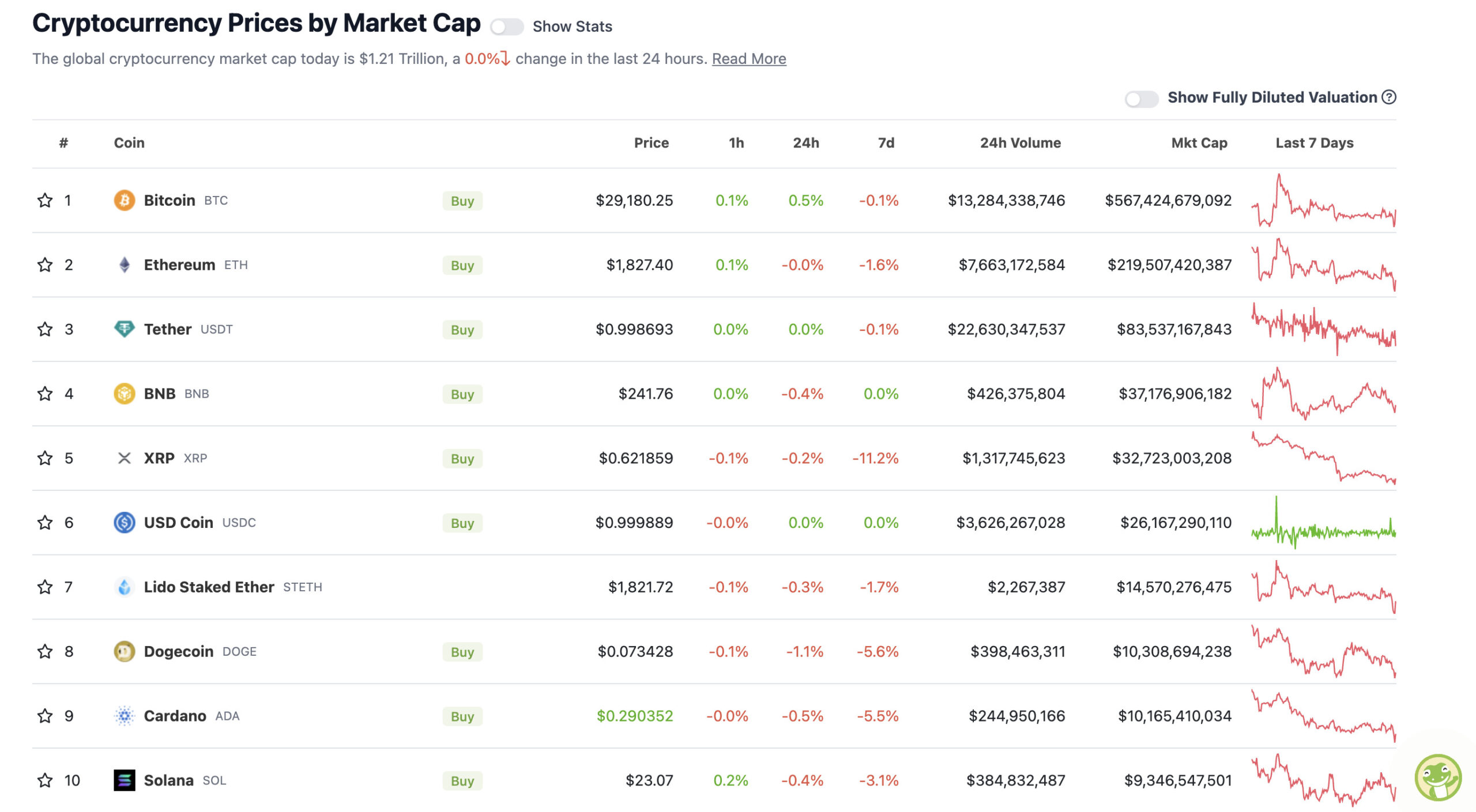

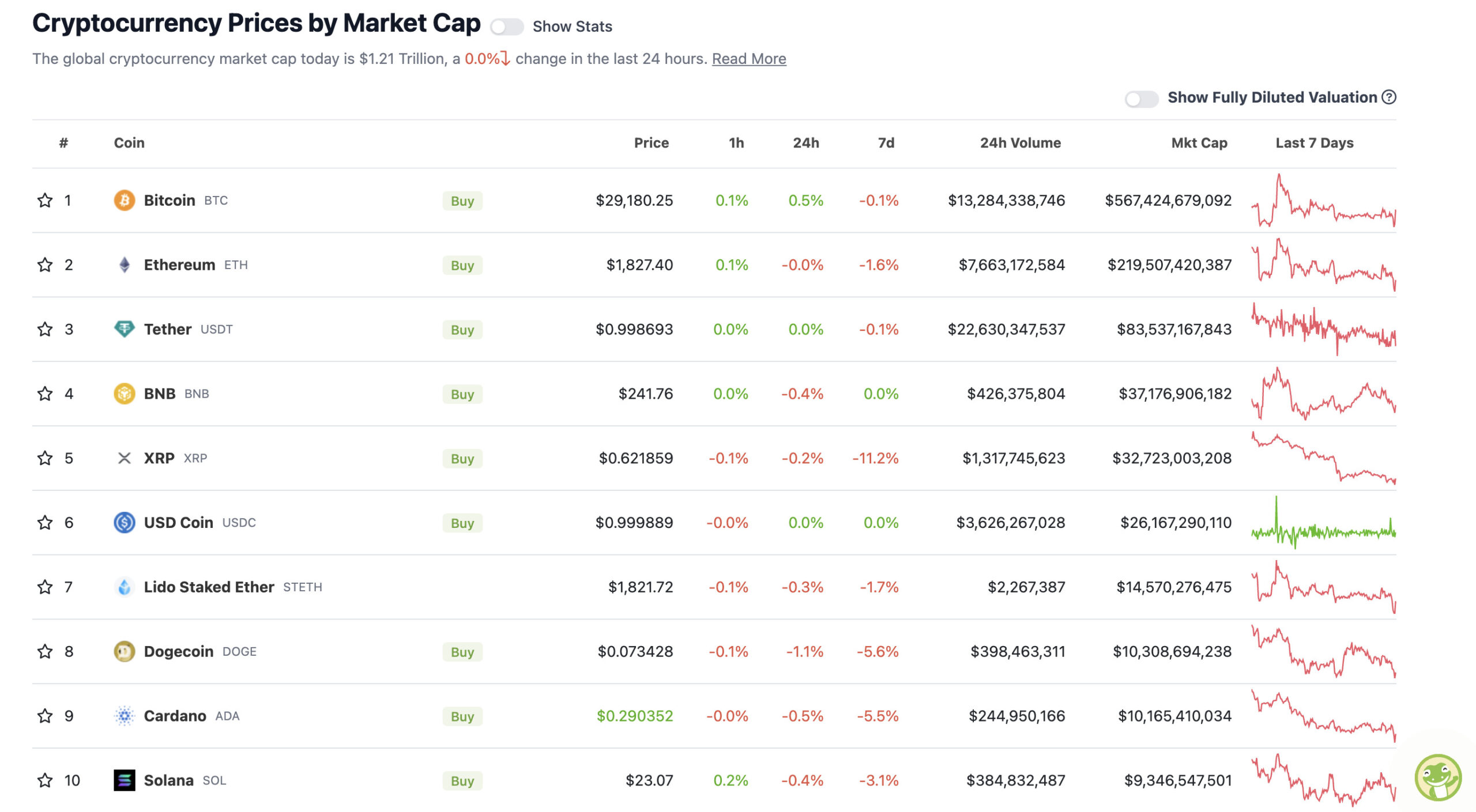

With the overall crypto market cap at US$1.21 trillion, pretty flat since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

As I was checking my crypto portfolio every 10mins or so last night (I was bored), Bitcoin dipped below US$29k for a time. This morning, however, it appears to have stepped on a small spring.

Can this PayPal news propel it further? Wouldn’t bank on it, no, but at least Roman Trading here doesn’t believe the recent stagnant/dippy price action is backed by any volume of significance. Which is a good thing.

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Bitcoin Cash (BCH), (market cap: US$4.63 billion) +7%

• Optimism (OP), (market cap: US$1.28 billion) +6%

• Trust Wallet (TWT), (market cap: US$384 million) +4%

• Stellar (XLM), (market cap: US$3.9 billion) +3%

• Chainlink (LINK), (market cap: US$3.92 billion) +3%

SLUMPERS (11-100 market cap position)

• XDC Network (XDC), (market cap: US$940 million) -10%

• FLEX Coin (FLEX), (market cap: US$646 million) -5%

• Shiba Inu (SHIB), (market cap: US$5.27 billion) -4%

• Rocket Pool (RPL), (market cap: US$526 million) -4%

• Compound (COMP), (market cap: US$372 million) -4%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

You might be interested in