The crypto market landed somewhere below whelmed last week, but the price action is so far trying to evolve from its stagnant pool this week, with Bitcoin trading around US$29.4k.

The less-than-inspiring crypto market action right now will have something to do with macro machinations, what with the US Federal Reserve raising interest rates by 25bps last week. Although that was expected and seemed largely priced in.

US interest rates are the highest they’ve been in 22 years, but, as our very own non-fungible Eddy Sunarto points out in his Market Highlights column this morning, at least the PCE data has come in positive:

“Wall Street lifted after personal income and consumption (PCE) data release in the US came in at its lowest level in nearly two years, bolstering the case of a peak in inflation.”

Curve DeFi protocol hacked

The main news hitting the crypto market this morning, however, is an unfortunate old chestnut – DeFi hacks. This time, it’s Curve’s turn – one of the biggest and most widely used Ethereum-based decentralised finance “automated market makers” in the industry.

Curve is essentially a set of stablecoin exchange pools, and more than Curve appears to be at risk here, with other protocols that use the alternative, third-party Ethereum programming language Vyper, potentially affected.

The DeFi protocol was targeted across the weekend by attackers who, according to various reports, have been able to, at the time of writing, make away with more than US$41 million, with potentially more than double that at risk.

The hackers have reportedly taken advantage of a vulnerability in Curve’s liquidity pools – a weak point Curve has identified as a “malfunctioning reentrancy lock”.

Curve has noted that other liquidity pools that don’t leverage the Vyper smart-contract programming language (instead using the more common Solidity, for example) are fine.

At the time of writing, the Curve token (CRV) has taken the biggest hit over the past 24 hours of all cryptos in the top 100 by market cap, with a -15% dump.

Meanwhile, how’s the rest of the market faring? Let’s have a look through the… triangular window today…

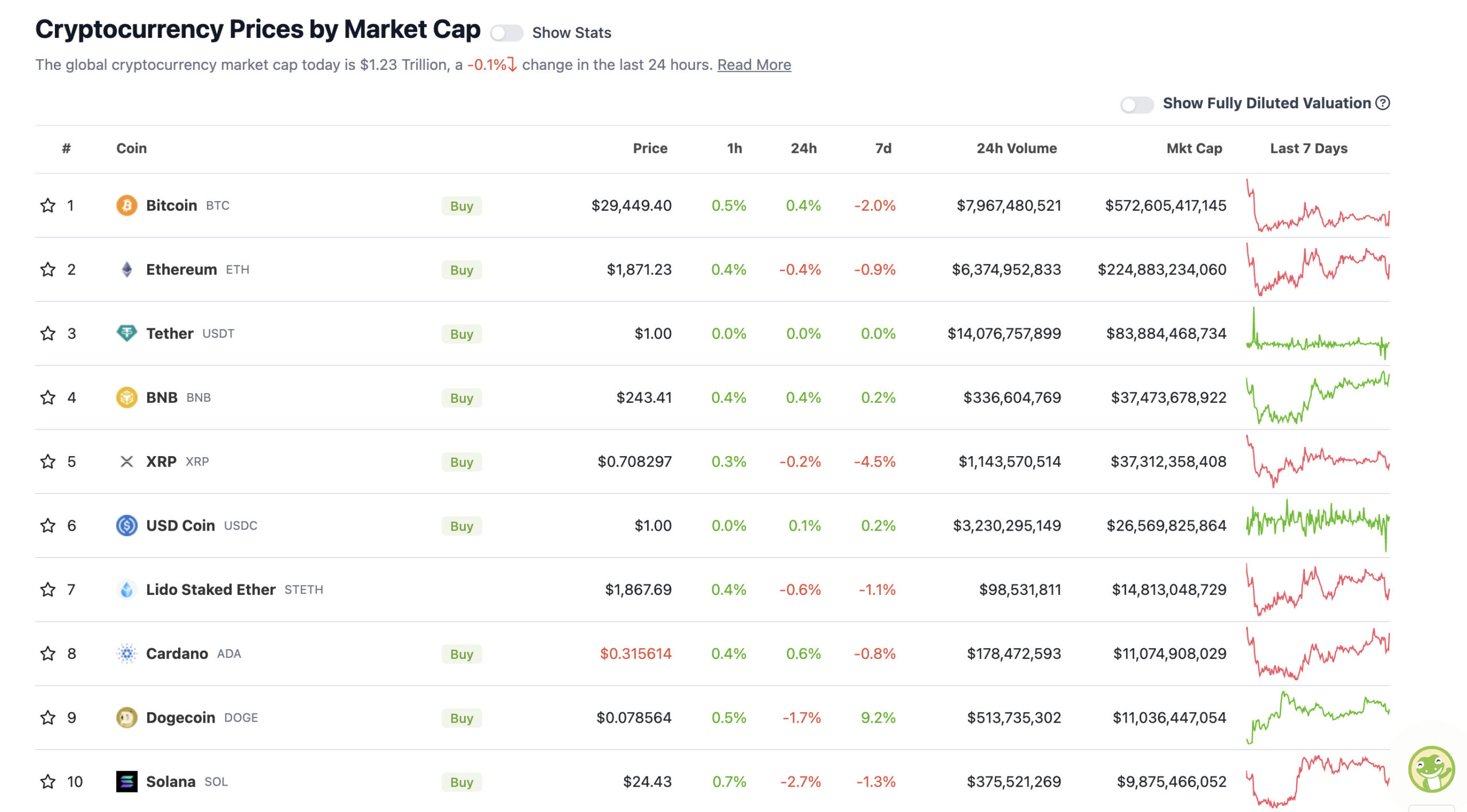

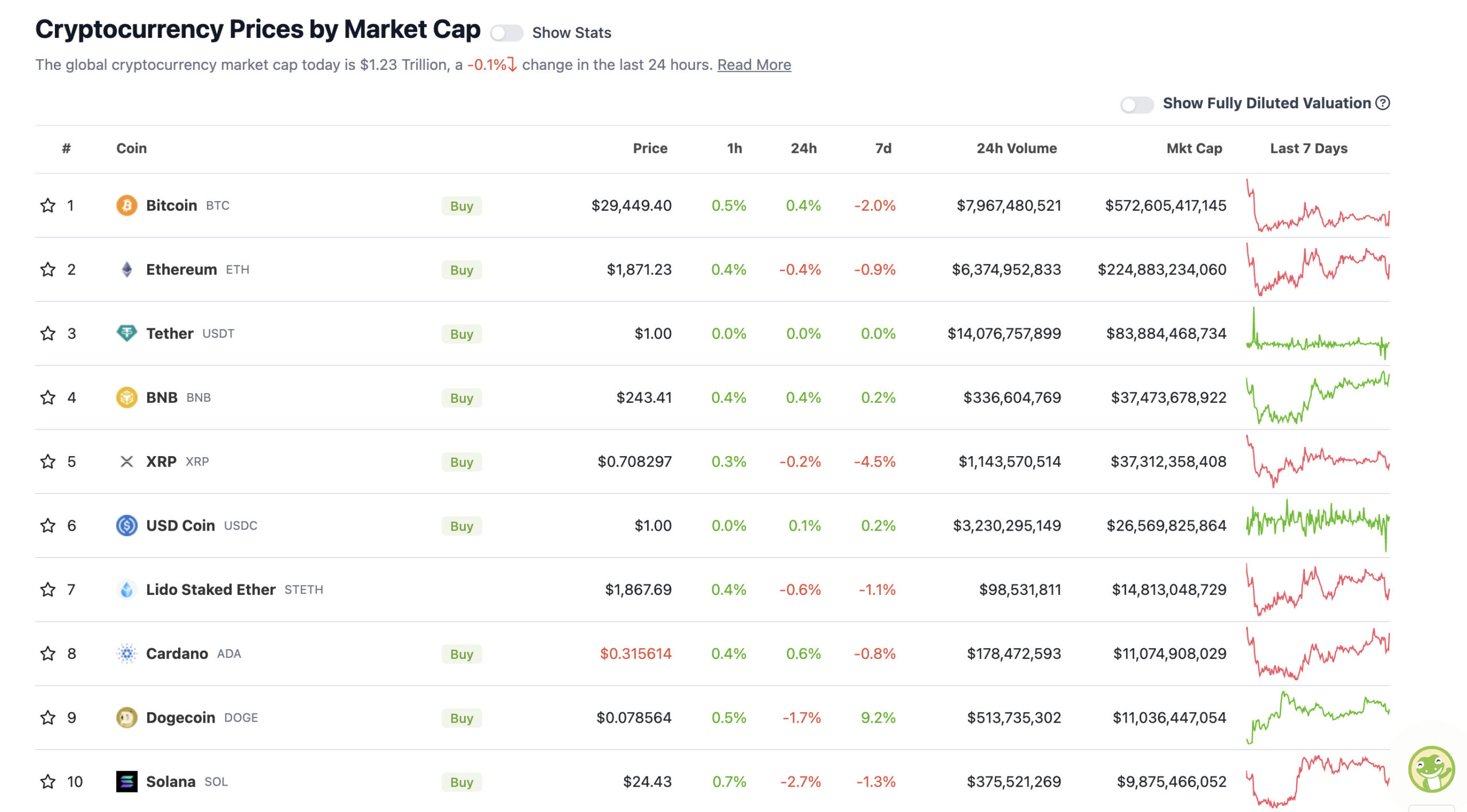

With the overall crypto market cap at US$1.23 trillion, pretty flat since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Earlier, when we began writing this column but were then distracted when we realised we also had another column to bang out in a different part of the Stockhead galaxy, Bitcoin was languishing closer to US$29k.

It’s since made about a $300 resurgence – something we’ll be hoping Khawaja and co can replicate in runs this evening (AEST) at The Oval, although precisely $249 would do. But we digress again.

The question is, did Ethereum take much of a dive amid the Curve DeFi drama? No, not really – it’ll take a lot more than that to blow a hole in Ethereum’s bow as it sails beyond the crypto-winter icebergs.

In fact, that reminds us, happy 8th birthday, Ethereum. Staying power: proved.

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Optimism (OP), (market cap: US$1.13 billion) +11%

• Bitcoin SV (BSV), (market cap: US$753 million) +9%

• Kaspa (KAS), (market cap: US$754 million) +7%

• Bitcoin Cash (BCH), (market cap: US$5 billion) +6%

• Compound (COMP), (market cap: US$505 million) +4%

SLUMPERS (11-100 market cap position)

• Curve DAO (CRV), (market cap: US$557 million) -15%

• Frax Share (FXS), (market cap: US$447 million) -7%

• Aave (AAVE), (market cap: US$1.03 billion) -4%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

You might be interested in