Mooners and Shakers: Europe’s first spot Bitcoin ETF lists; SEC twiddles thumbs; SEI hits market

Coinhead

Coinhead

Bitcoin and the crypto market, like Wall Street, like the ASX, is down a tad today, partly influenced by China’s shaky economic outlook, which is spooking all markets.

Meanwhile, though, zooming down through the haze, there’s some good news out of Amsterdam, where Europe’s first ever spot Bitcoin ETF has been given the green light for trading on the the Euronext Amsterdam stock exchange.

London-based Jacobi Asset Management is behind this one, and the exchange traded fund is trading under the ticker BCOIN, charging investors a 1.5% annual management fee.

Europe's first spot #Bitcoin ETF listed in Amsterdam today 🇳🇱

Trading under the ticker $BCOIN, investors will pay a 1.5% annual management fee.

Fidelity Digital Assets are the custodians. pic.twitter.com/HVAIiGNzG4

— tedtalksmacro (@tedtalksmacro) August 15, 2023

The ETF, which “physically” holds the BTC asset through Fidelity Digital Assets, will let investors tap into the live Bitcoin price without having to handle or take custody of the digital currency themselves.

This saves investors in the ETF from having to work out how the hell to use a hardware wallet, for instance (honestly, it’s not that hard) as well as potentially absent-mindedly sending BTC to an ETH address instead, thus instantly losing it forever (actually frighteningly easy to do).

So then, Europe has beaten the US in the “race” for a spot Bitcoin ETF. It’s a bloody slow, old race, mind – actually initially started several years ago by Gemini’s Winklevoss twins.

As you might be aware if you’ve been following crypto reasonably closely these past few months, there are more than a handful of investment and asset management firms with spot Bitcoin ETF applications gathering dust in the SEC’s in-tray.

The world’s largest Game of Life and Monopoly winner, BlackRock, is leading the charge – at least in terms of headlines.

ARK invest, led by the co-president of the Bitcoin fan club, Cathie Wood, is also in the mix, but had its filing officially turned into a paper plane and tossed about by Gary Gensler the other day. (It was delayed by another 21 days as the SEC opens the application to public comments as to why or why not they should approve. Je-HEEZus, what a bunch of red-tape baloney, eh?)

The further news today, then, is that the SEC appears to be, according to a Cointelegraph report, exercising its power to extend all of its Bitcoin ETF “set deadline” decisions by up to 240 days, pushing things into 2024. Thanks, Gaz.

🚨SEC delays all Bitcoin ETF decision until next year.

— Crypto Crib (@Crypto_Crib_) August 15, 2023

The SEC approved a leveraged 2x #Bitcoin futures ETF but refuses to approve a spot ETF.

Make it make sense, Gary Gensler. pic.twitter.com/sgFHrSmE8k

— Crypto Madsen ✨⚡️ (@CryptoMadsen) August 15, 2023

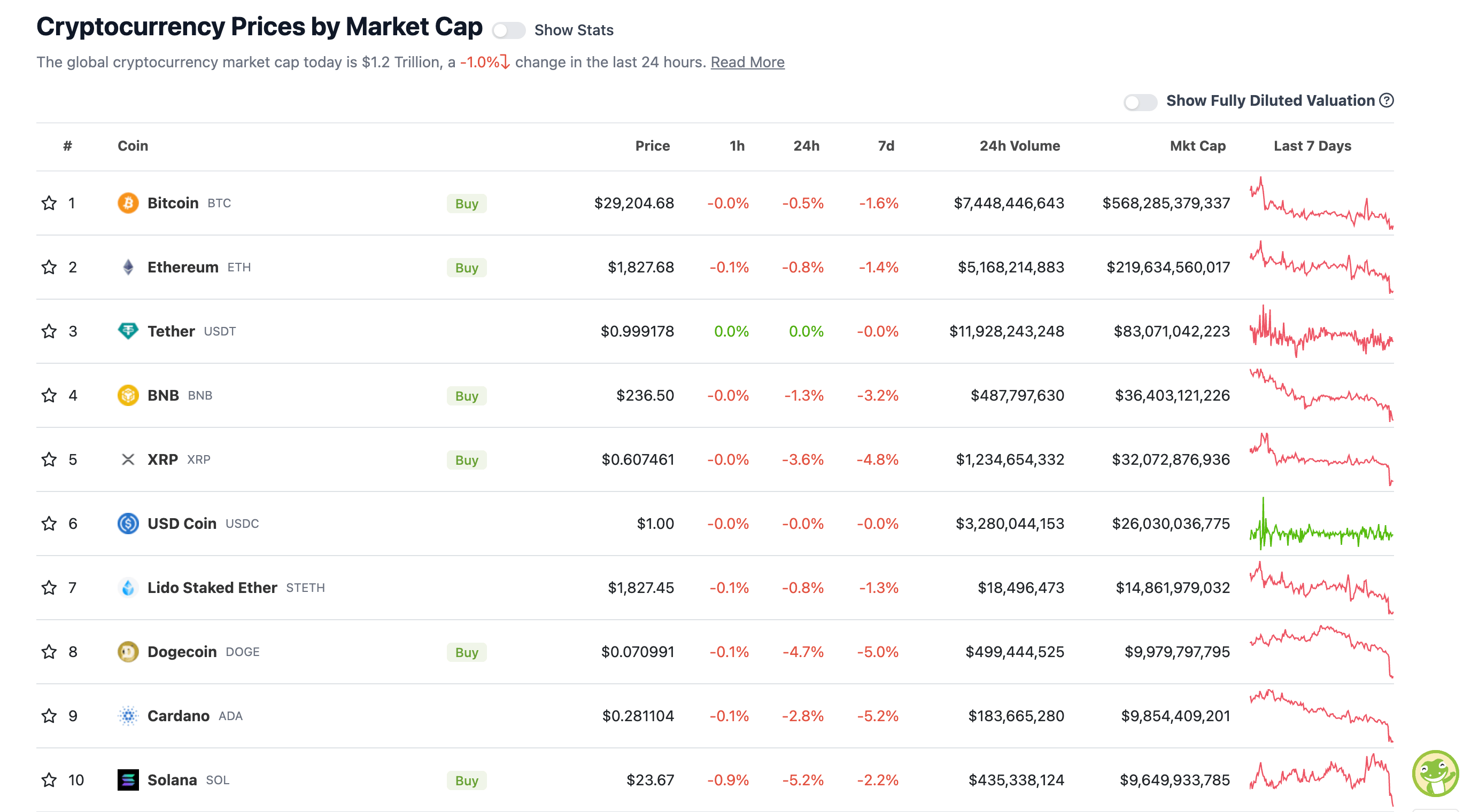

With the overall crypto market cap at US$1.2 trillion, down about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

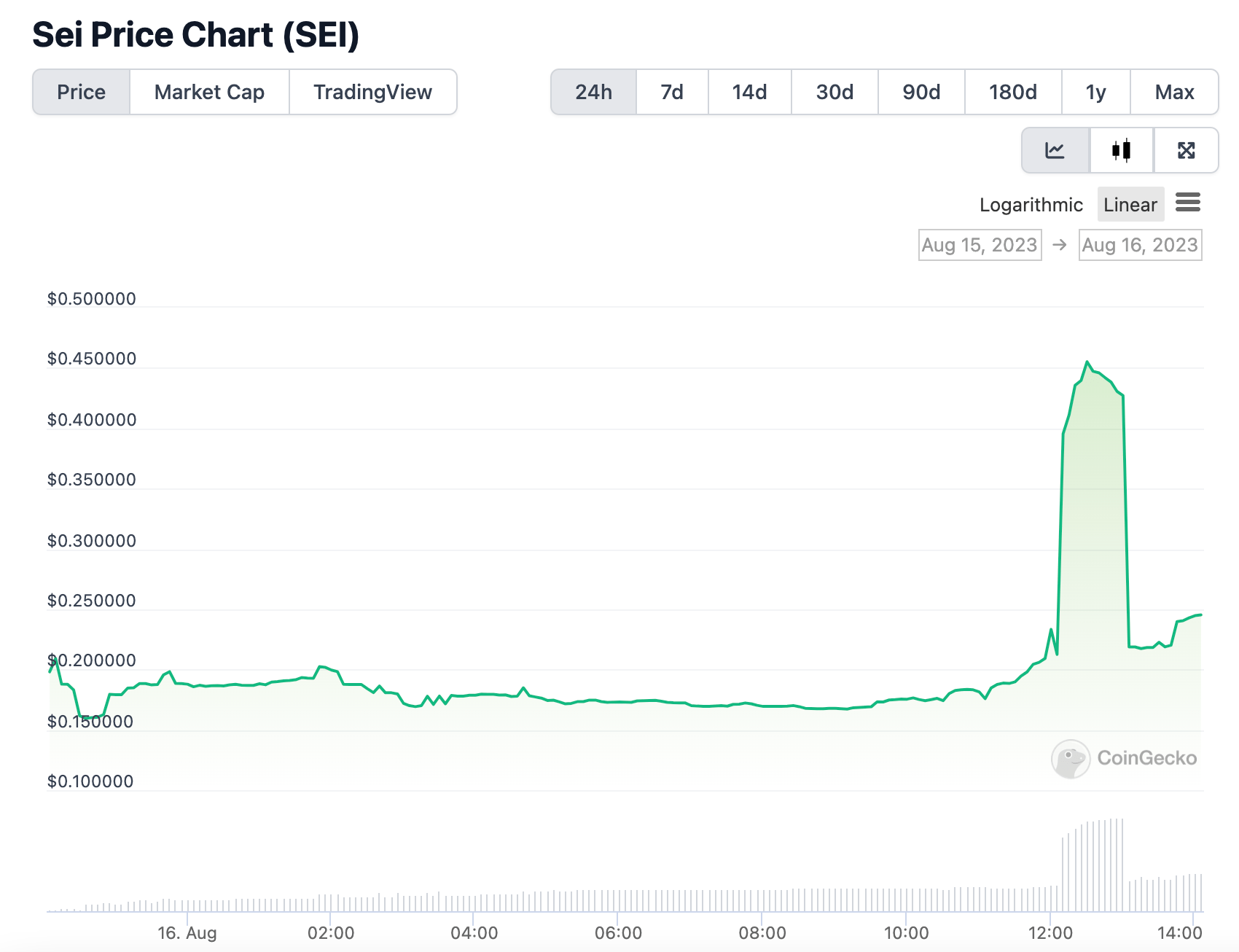

• Sei (SEI), (market cap: US$428 million) +24%

• Hedera (HBAR), (market cap: US$2.27 billion) +6%

• FLEX Coin (FLEX), (market cap: US$698 million) +5%

• THORChain (RUNE), (market cap: US$463 million) +5%

• XDC Network (XDC), (market cap: US$889 million) +4%

• Toncoin (TON), (market cap: US$5.13 billion) +4%

New layer 1 blockchain Ethereum competitor Sei has finally hit the market. In particularly phallic fashion…

Have you been “airdrop farming”? We mentioned this one ages ago, so you might want to check. Olimpio (below) is a reliable source for figuring out what the hell to do…

The SEI airdrop was announced, but people are still a bit confused about how it works.

Season 2 airdrop is coming soon, and you can still qualify to get $SEI.

A @SeiNetwork thread encompassing what we know, and what can be done right now. 🧵 pic.twitter.com/bskCRwob4g

— olimpio (@OlimpioCrypto) August 15, 2023

SLUMPERS (11-100 market cap position)

• ApeCoin (APE), (market cap: US$679 million) -11%

• Pepe (PEPE), (market cap: US$536 million) -9%

• Rollbit Coin (RLB), (market cap: US$554 million) -8%

• GMX (GMX), (market cap: US$391 million) -8%

• Aptos (APT), (market cap: US$1.47 billion) -7%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Imagine, if you will, that you perpetrated a multi-billion dollar fraud with the help of a co-conspirator who happened to be your on-again off-again girlfriend.

And said girlfriend kept a to-do list entitled "Things Sam is Freaking Out About" which is being used in court

NGMI pic.twitter.com/Me4NeiVK2q

— Coin Bureau (@coinbureau) August 15, 2023

#BTC Bull Market Progress:

▓▓░░░░░░░░ 22.3%$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) August 15, 2023

Europe has just launched their own Bitcoin ETF.

Some of the biggest banks in the US have launched their own Crypto Exchange.

PayPal has just launched its own stablecoin

And Australian banks are banning Crypto Payments over $10k.

Brilliant.

— Ben Simpson (@bensimpsonau) August 15, 2023

#Bitcoin pic.twitter.com/noYCsuz44H

— naiive (@naiivememe) August 15, 2023