Mooners and Shakers: Ethereum ‘Floppening’ – ETH tumbles; eyes turn to this week’s Fed meeting

Coinhead

Coinhead

It’s a post-Merge world and Ethereum is still trending lower. There were plenty of sell-the-news warnings on Crypto Twitter and elsewhere. But is that really what’s causing the extended hangover?

Some Bitcoiners, the ones who seem to view crypto as something akin to State of Origin, have been calling the post-Merge price action “the Floppening”, in reference to another near-mythologised event – the Ethereum “Flippening”. And that’s the notional day Ethereum surpasses Bitcoin as the world’s biggest cryptocurrency by market cap.

"The biggest event in cRyPtO!"

Friendly reminder: that was, and always will be, the bitcoin white paper.#thefloppening pic.twitter.com/rpaPTVXWE5

— Ben Brannan (@BenjiBrannan) September 18, 2022

Here’s a different take, from Lark “Just a Dude on the Internet Talking About Crypto” Davis…

The #ethereum merge was a great success and a huge moment for the chain!

Shame about the price action, but just like a #bitcoin halving the effect is not instantaneous.

— Lark Davis (@TheCryptoLark) September 18, 2022

The Merge, as you’d know if you’re a crypto tragic and/or have been following Coinhead for a little while, marks Ethereum’s move to the vastly more energy-efficient Proof-of-Stake system, and took years of development.

Perhaps some were expecting the price of ETH to surge on its completion last week, but there might be one or two things in particular placing selling pressure on the no. 2 crypto.

There has been a forking of the chain with the creation of EthereumPoW, a crypto-mining-focused blockchain, and the issuance of its airdropped ETHW token. Any traders/speculators who were specifically buying ETH pre-Merge to capitalise, might now be cashing out and selling off that ETH.

Former ETH miners may also still be selling off their remaining ETH as they move to alternative mining coins such as Ethereum Classic, Ravencoin, or even the new forked ETHW chain.

It’s not like the Merge wasn’t a positive event, though. We’ve spoken with prominent Aussie-based experts, for example, who think it will be hugely impactful in the long run. It not only represents a shift to a huge reduction in carbon emissions but also token issuance reduction as well, as the overall supply becomes deflationary, a la Bitcoin.

Let’s take a look at some daily price action…

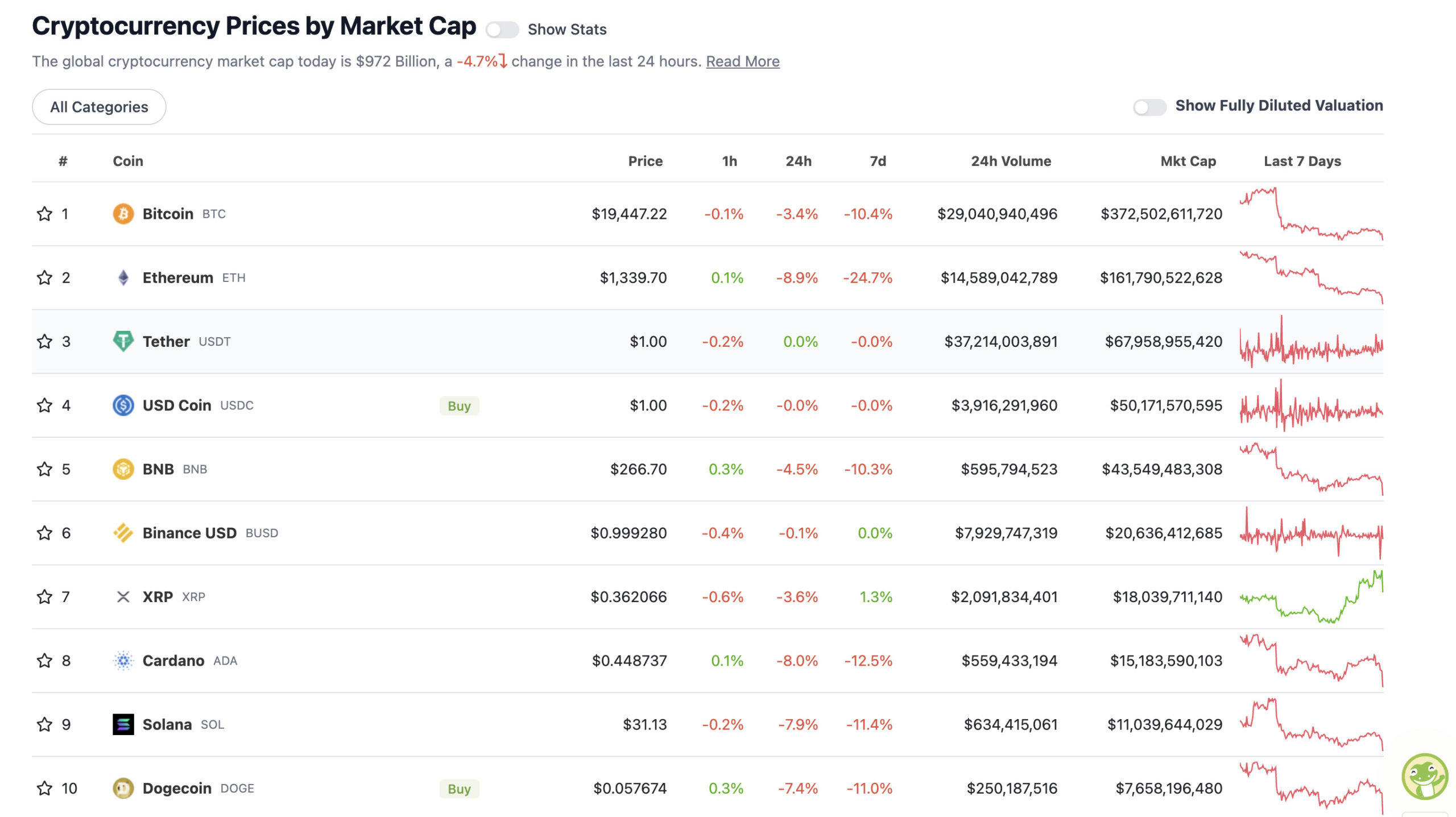

With the overall crypto market cap at US$1 trillion and down about 3.8% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

It has indeed been a pretty brutal weekend and start to the week for ETH hodlers. Just look at that seven-day loss. That said, its major layer 1 rivals, such as Cardano (ADA), Solana (SOL) and, to a lesser extent, BNB, are feeling it, too.

In fact, Polkadot (DOT) has dropped out of the top 10 with a near double-digit loss. Once again, DOGE has jumped back over the fence for a sniff at the majors.

Meanwhile, the Fed’s next FOMC meeting is happening THIS week, midweek. Will the next interest-rate hike come in at 0.75 basis points again, as several pundits are predicting? If so, then this mightn’t be too bad for markets, as many believe last week’s higher-than-expected CPI data has been “priced in”.

If Jerome Powell comes out with both guns blazing and delivers a 100 bps announcement, however, then this could be problematic for hopium addicts.

The FedWatch Tool (that’s the CME Group’s Federal Reserve-related tracking metric, not a Roger Federer stalker) is currently showing an 18% probability of a 100 bps hike.

Stay tuned.

Bear markets suck, but they lead to such great opportunities

— Benjamin Cowen (@intocryptoverse) September 18, 2022

Sweeping a market-cap range of about US$7.7 billion to about US$409 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Tokenize Xchange (TKX), (market cap: US$479 million) +16%

• Chiliz (CHZ), (mc: US$1.24 billion) +5%

• XRP (XRP), (mc: US$19.1 billion) +3%

• Tether Gold (XAUT), (mc: US$421 million) +1%

• Chain (XCN), (mc: US$1.38 billion) +1%

DAILY SLUMPERS

• Ravencoin (RVN), (market cap: US$483 million) -14%

• EOS (EOS), (mc: US$1.29 billion) -13%

• Ethereum Classic (ETC), (mc: US$4.15 million) -12%

• Terra (LUNA), (mc: US$439 million) -11%

• Celsius Network (CEL), (mc: US$610 million) -11%

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Digital Currency Group CEO Barry Silbert looks to be trying for some reverse psychology on the market here:

— Cryptowatch (@cryptowat_ch) September 18, 2022

Meanwhile, over at Bloomberg, its Senior Commodity Strategist Mike McGlone still has sights set on a US$100k Bitcoin (although not till 2025, and not before the macro environment potentially slams prices down even further).

💥BLOOMBERG: Bitcoin adoption and demand are increasing. It’s only a matter of time before it hits $100,000.

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) September 17, 2022

'Fed sledgehammer' to cause crash worse than 2008, but Bitcoin & Ether t… https://t.co/nltWZpo6vj via @YouTube

— Mike McGlone (@mikemcglone11) September 18, 2022

After party packed, LFG @cshift_io @AusCryptoCon @AusCryptoCon pic.twitter.com/NM2NzwpZtj

— Ben Simpson @ Aus Crypto Con 📍 (@bensimpsonau) September 18, 2022

Great to see @GregOakford at #Auscryptocon2022. He nailed it as expected. Remember @NFTFestAus is 23/24 Nov. Greg co-founded this conference and from what I’ve heard from him already, the lineup will be 🔥 pic.twitter.com/AWAcxQwZBf

— Slabber Dan | 🏴☠️dan.eth (@SlabberDan) September 17, 2022

#Bitcoin pic.twitter.com/u43Twzz2ay

— naiive (@naiivememe) September 18, 2022