Mooners and Shakers: ETH ETF filings; Solana and Visa; MetaMask off-ramp… crypto had a week

Coinhead

Coinhead

Yep, that was another week in crypto. If you count that as a five-day working week in Australia, that is. Which any sensible person wouldn’t. Anyway, what happened?

Let’s take a disappointingly short trip back in time to find out. Here were some of the headline acts, not necessarily in chronological order. And, just quietly, all of these items were positive.

(Wait… if that’s the case, why did lines on charts not spring so hard up and to the right that they burst clear through your screen, through the ceiling, putting a low-flying plane in danger? Yeah, you know why… Not. Out. Of. The. Macro. Bear-Crap-Filled. Woods. Yet.)

This is actually kinda huge news. Certainly some of the crypto YouTubers (eg. Lark Davis and EllioTrades) we sometimes dial into believe that to be the case.

While Gary Gensler over at the US Securities and Exchange Commission (SEC) ruminates about what kind of cock’n’bear story he can come up with this time to deny Bitcoin spot ETFs in the US, two prominent applications have now been filed for Ethereum spot exchange-traded funds in America.

The two major asset management firms that have “started the clock” on this particular race are Cathie Wood’s ARK Invest (of course) and VanEck.

“The Spot Ethereum ETF Race is officially on,” said Bloomberg ETF expert James Seyffart, predicting a final deadline for a decision on them coming around May 23, 2024.

BOOM: 19b-4 filing from @vaneck_us AND @ARKInvest/@21co__ for spot Ethereum ETFs.

This is different from the earlier Ark/21shares S-1 filing because this will ultimately start that clock we are so used to following with spot Bitcoin filings. pic.twitter.com/qP7nydc33w

— James Seyffart (@JSeyff) September 6, 2023

How long before we see a 19b-4 from @Grayscale to convert $ETHE into an ETF? https://t.co/078sm9FNlF pic.twitter.com/pzSEcMrtZB

— James Seyffart (@JSeyff) September 6, 2023

Why is this big?

Well, a Bitcoin spot ETF approval would be one thing, and would certainly bring in more institutional investment into that asset than ever before, which ought to create a knock-on effect of positivity for crypto as an asset-class as a whole.

But an Ethereum spot ETF could potentially open the institutional door to a much larger slice of the crypto market.

In any case, the likelihood of crypto’s two top assets being legitimised in the traditional financial world in this way just took a step closer – especially after the precedent set by Grayscale’s recent legal win over the SEC in its fight to turn its GBTC Bitcoin Trust product into an ETF.

Ethereum spot ETFs will be insane.

About 27 million ETH in the staking contract.

14 million left on exchanges. (12% of supply)

A few billion dollars entering ETH from tradfi is likely to have outsized price impact.

Are you ready? pic.twitter.com/C2wOFIKIzE

— Lark Davis (@TheCryptoLark) September 7, 2023

Good news for those who like to sell their crypto and actually convert it into a currency that can currently be widely accepted for use in the real world.

Popular decentralised Ethereum (and Ethereum-blockchain compatible) wallet MetaMask is rolling out a new feature called “Sell”, which will act as the off-ramping counterpoint to the “Buy” functionality it launched earlier this year.

In certain countries (US, the UK, and various parts of Europe) MetaMask wallet users will soon be able to “cash out” of their Ethereum from the wallet, converting their holdings into fiat currency.

For the moment, US dollars, euros, and the British pound are the only fiat currencies supported.

Only ETH will be initially enabled for the sell-to-fiat conversion, but the platform says it plans to expand to layer 2 networks (eg. possibly Arbitrum, Optimism and Polygon) and other assets.

According to a blog post, users in the aforementioned regions can send their newly converted cash to a linked PayPal account or a supporting bank account.

We are beyond thrilled to announce our latest feature: Sell.

Yes, you read that right. Available on MetaMask Portfolio, ‘Sell’ allows you to cash out your crypto for fiat currency easily.

🔗 Discover more at https://t.co/aaSgTswEMo pic.twitter.com/pJa1ZndLQA

— MetaMask 🦊💙 (@MetaMask) September 5, 2023

In somewhat eye-opening news, given its lending-product road-blocking from the SEC in the past, major crypto exchange Coinbase announced this week it will be offering crypto loans to institutions in the US.

As a Bloomberg report this week noted, Coinbase has spied a clear gap in the market opened by the calamitous collapse of firms such as Celsius, Genesis, and Blockfi, and it’s going for it.

#Coinbase enters US institutional crypto lending!

▪️ Attracting $57M in customer investments since launch.

▪️ Post temporary #Coinbase Borrow loan suspension in May.

▪️ Demonstrates commitment to strengthening crypto financial service.#cryptomarket #cryptonewstoday pic.twitter.com/KPWI6uQvD5

— Imaginative Verse (@Imaginativ20951) September 7, 2023

According to a filing with the SEC, some US$57 million has been invested already in the new lending program by customers of Coinbase Prime, the exchange’s institutional gateway brokerage platform.

“With this service, institutions can choose to lend digital assets to Coinbase under standardized terms in a product that qualifies for a Regulation D exemption,” revealed Coinbase in a statement.

The exchange explained it can then use borrowed funds to offer loans to other institutions.

And also in case you missed it, major layer 1 blockchain Ethereum rival Solana has partnered with Visa for USDC stablecoin payments.

This, you would think, is an extremely bullish sign for Solana, which endured a particularly rough time amid the FTX fallout late last year as the disgraced, currently banged-up Sam Bankman Fried and his firms were major backers of the project.

Solana bear market momentum has been nuts. I don't know another community outside of ETH that eats glass and turns it into diamonds during bear markets quite as well as Solana.

Today: Visa stablecoin settlement partnership. pic.twitter.com/IDl86V0eJ1

— Ryan Selkis 🪳 (@twobitidiot) September 5, 2023

9/ It's still early days, but Visa has already settled millions of dollars of USDC over the Ethereum and Solana blockchains between our clients. We are committed to continuing to innovate around how we move money and providing our clients modern options for settlement pic.twitter.com/pbByiMAPAY

— Cuy Sheffield (@cuysheffield) September 5, 2023

Solana has, according to recent Coinshares reports, also been seeing strong accumulation from institutional buyers in recent weeks, indicating it’s a far-from-finished entity and could well be one to watch for the next bull cycle – whenever that makes itself clear (if it hasn’t already).

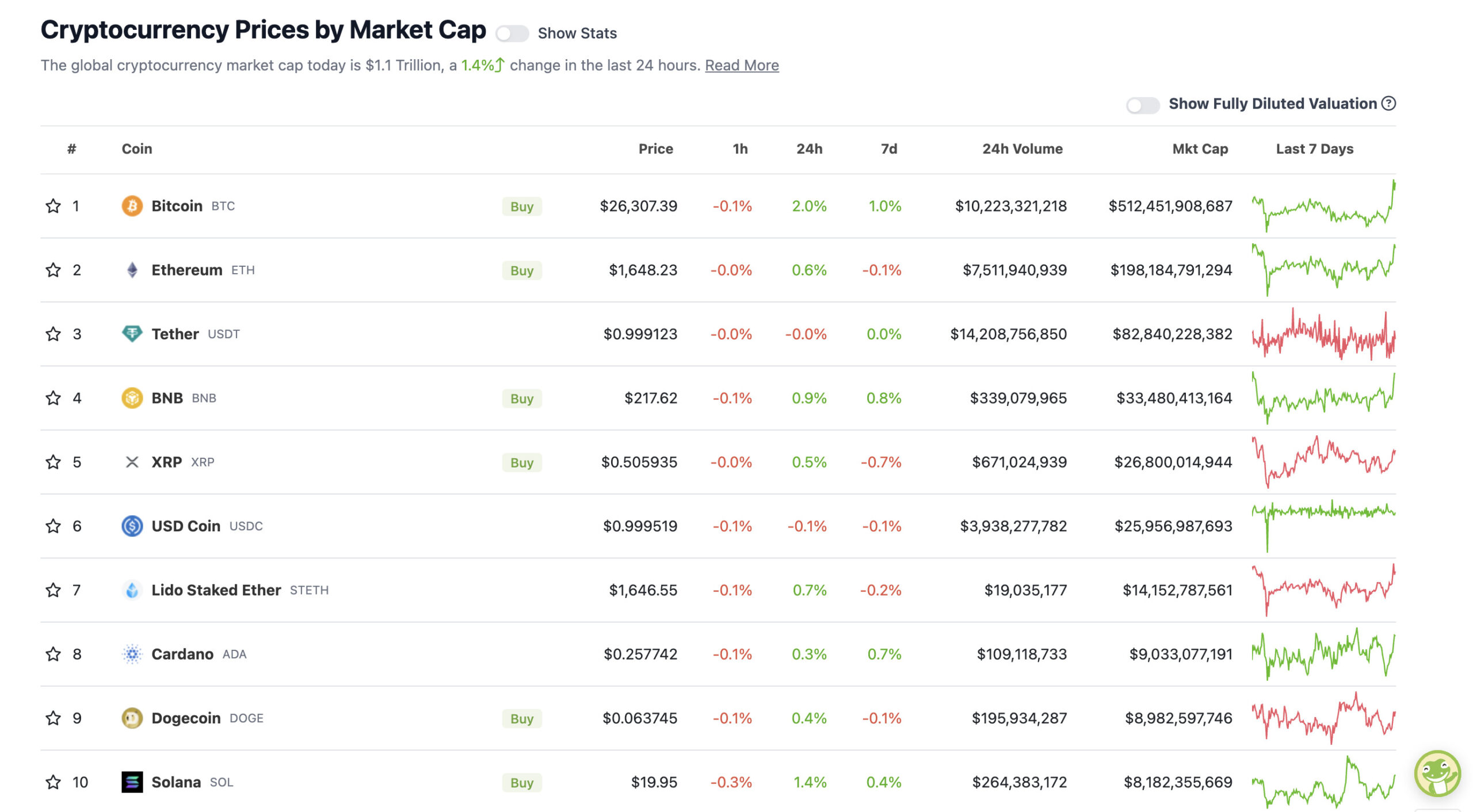

With the overall crypto market cap at US$1.1 trillion, up a bit since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Rollbit Coin (RLB), (market cap: US$533 million) +5%

• XDC Network (XDC), (market cap: US$790 million) +5%

• Radix (XRD), (market cap: US$571 million) +4%

• IOTA (MIOTA), (market cap: US$501 million) +4%

• Render (RNDR), (market cap: US$559 billion) +3%

SLUMPERS

• Kaspa (KAS), (market cap: US$799 million) -4%

• Synthetix (SNX), (market cap: US$724 million) -3%

• Polygon (MATIC), (market cap: US$5.1 billion) -2%

Some pertinence and randomness that stuck with us on our daily moves through the Crypto Twitterverse.

#bitcoin #ethereum #binance #crypto pic.twitter.com/oF3XHaUs2F

— Altcoin Daily (@AltcoinDailyio) September 7, 2023

My favorite Bitcoin chart right now. The relative distance between Bitcoin's price, the historical price floor (Bitcoin Electrical Cost) and fair value (Bitcoin Energy Value). That’s a 5:1 risk-reward assuming no-hype and that price would stop at fair value, which it never has. pic.twitter.com/J2yuGcNX9q

— Charles Edwards (@caprioleio) September 7, 2023

$DXY approaching major resistance at 105 with bear divs H4 and possible bear divs 1D. I also see a potential ascending wedge on H4.

A breakout is possible but with $BTC & #stocks oversold, I believe $DXY rejects here and we see a relief rally.#bitcoin #cryptocurrency pic.twitter.com/mIyBxQncTL

— Roman (@Roman_Trading) September 7, 2023