Mooners and Shakers: Crypto market’s latest moon mission aborts as stocks take a dive

Coinhead

Coinhead

“To the moon!” Yeah, maybe not. Yesterday the Fed spoke and markets awoke. But today crypto’s recovery seems to have headbutted a wall in the metaverse.

Yesterday’s 50 basis points interest-rate hike news from the US Federal Reserve did give markets exactly what was widely expected. And markets tend to go okay on a lack of surprise.

One thing that did perhaps raise half an eyebrow, however, was the Fed pretty much ruling out increasing the rate-hiking to 75bps in June. Up until a few days ago, this was widely tipped as a 50/50 possibility.

He's giving a little certainty to the markets by saying 50 bps are on the table the next few meetings, and if things get bumpy, then 25bps. But NOT going up to 75bps. pic.twitter.com/VFAejozlYj

— Blockchain Backer (@BCBacker) May 4, 2022

It was a whiff of positivity for the markets, but a pretty faint one, really. After a half-decent surge on the Fed announcement, stocks have been selling off, as US investor and analyst Sven “Northman Trader” Henrich notes below.

In other news: Yesterday investors chased stocks for a 3% rally on a 50bp rate hike by the Federal Reserve relieved it wasn't 75bp, only to sell stocks today when realizing the Fed just raised rates by 50bp.

— Sven Henrich (@NorthmanTrader) May 5, 2022

And, unfortunately, the highly correlated crypto market does what it’s told. Short-timeframe financial analysts – stocks and crypto – are certainly earning their keep right now.

At this rate of decline in stocks the Fed might literally have to consider completely changing course.

Not being able to keep 1 single up day is a sign of loss of confidence in the market & in policy.

— John Wick (@ZeroHedge_) May 5, 2022

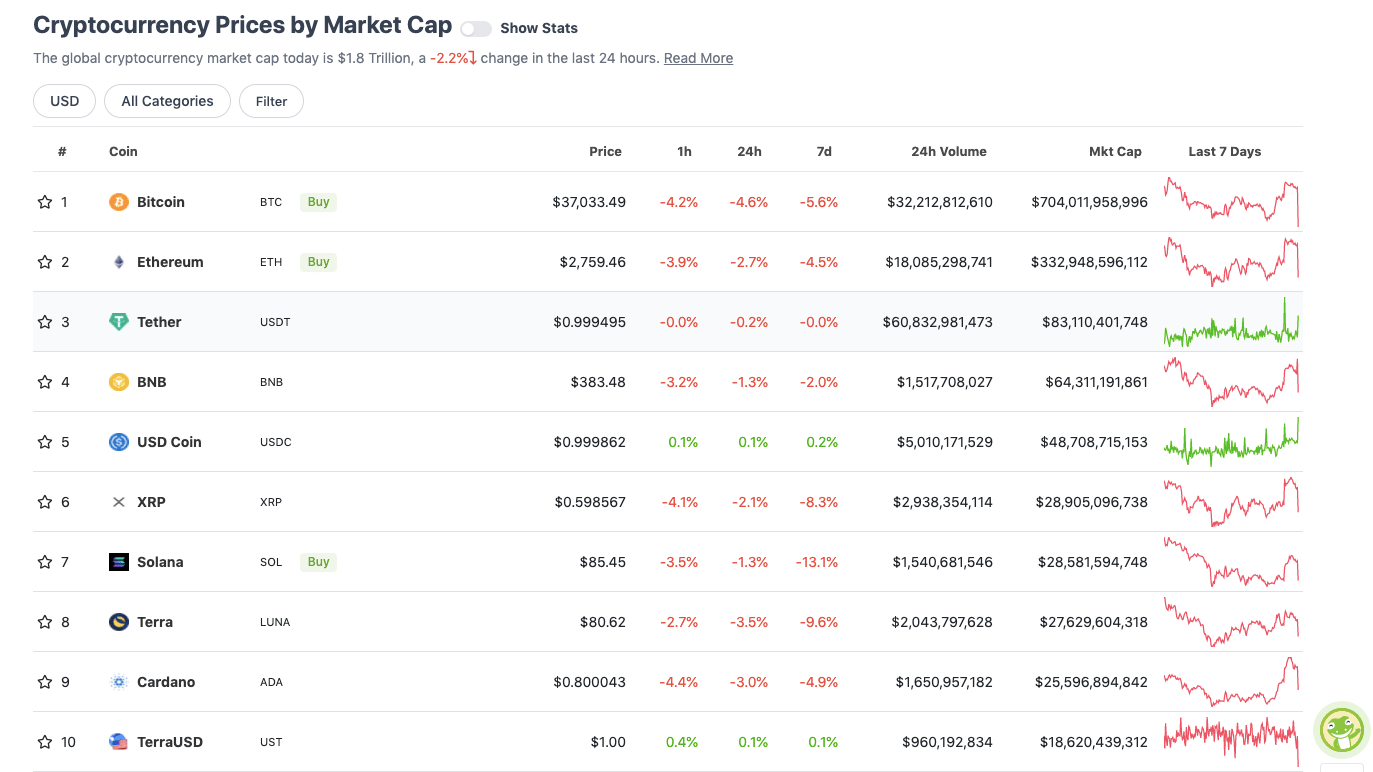

With the overall crypto market cap at roughly US$1.8 trillion, down about 2.2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Led by Bitcoin and Ethereum, the crypto majors generally tend to show the way for the rest of the market. And right now they’re all looking decidedly shakier than this time yesterday.

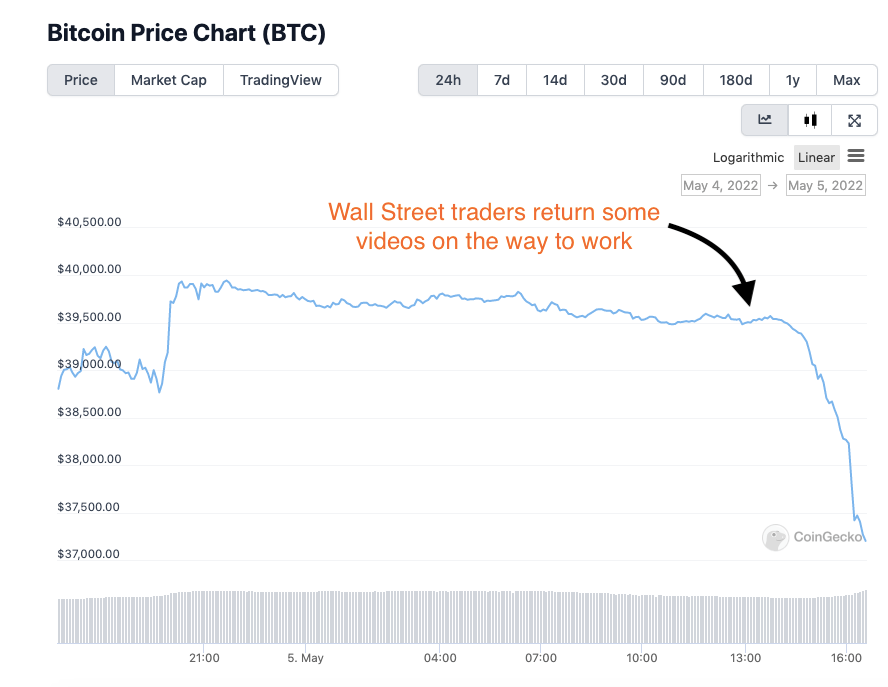

How’s this for a cliff dive? Note the Wall Street opening around 9.30am EDT (1.30pm UTC on the chart).

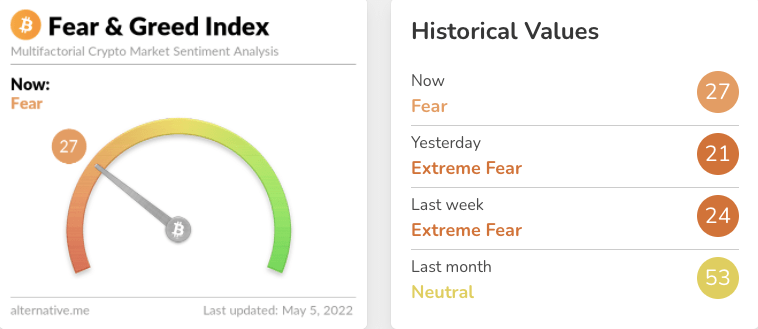

The 24-hour lagging crypto Fear & Greed Index is showing “Fear”, moving up from the “Extreme Fear” it’s been pointing to recently. But if Wall Street keeps panicking, I’ll bet you a tenth of a Bitcoin the sentiment index will be right back into outright horror territory again this time tomorrow.

Are you in fear?#Bitcoin $BTC pic.twitter.com/QyvlS0OP8j

— Crypto Rover (@rovercrc) May 5, 2022

Sweeping a market-cap range of about US$17.7 billion to about US$918 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Zilliqa (ZIL), (market cap: US$1.2 billion) 7%

• Waves (WAVES), (mc: US$1.46 billion) +5%

• TRON (TRX), (mc: US$8.1 billion) +4%

• Uniswap (UNI), (mc: US$3.4 billion) +3%

• Ethereum Classic (ETC), (mc: US$3.86 billion) +3%

DAILY SLUMPERS

• STEPN (GMT), (mc: US$1.72 billion) -12%

• NEXO (NEXO), (mc: US$1.1 billion) -8%

• ApeCoin (APE), (mc: US$4 billion) -7%

• Frax Share (FXS), (mc: US$1.56 million) -6%

• Filecoin (FIL), (mc: US$2.8 billion) -5%

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• FUSION (FSN), (market cap: US$34 million) +26%

• Multichain (MULTI), (mc: US$199m) +19%

• Cult DAO (CULT), (mc: US$105m) +15%

• Steem (STEEM), (mc: US$172m) +14%

• Maple (MPL), (mc: US$294m) +11%

DAILY SLUMPERS

• Perpetual Protocol (PERP), (mc: US$168m) -18%

• Astar (ASTR), (mc: US$484m) -13%

• Tokemak (TOKE), (mc: US$172m) -9%

• Injective Protocol (INJ), (mc: US$221m) -9%

• Ethereum Name Service (ENS), (mc: US$499m) -7%

Who is selling?

Answer, new #Bitcoin long-term holders that have held for 155 day to 365 days. But, the good news is they only hold 6% of the supply.

While the 1+ year holders are not selling and they hold 65% of the supply. #Crypto

— Plan©️ (@TheRealPlanC) May 4, 2022

This dump will fail like all the others pic.twitter.com/Aqbsvw4QOY

— sassal.eth 🦇🔊🐼 (@sassal0x) May 5, 2022

#Bitcoin bear markets are transitory

— Benjamin Cowen (@intocryptoverse) May 5, 2022

#BITCOIN BOLLINGER BANDS INDICATE MASSIVE MARKET VOLATILITY IS IMMINENT! 🚨👇 pic.twitter.com/MXRisie0x9

— Crypto Rover (@rovercrc) May 5, 2022

Stock picker's market. pic.twitter.com/XM3nEpok2H

— Sven Henrich (@NorthmanTrader) May 5, 2022

Meanwhile… here’s something interesting… Binance, the world’s largest crypto exchange by volume, has announced it’s committed US$500 million to invest in Elon Musk’s vision for Twitter…

#Binance has committed $500 million to invest in #Twitter alongside @elonmusk's buyout of the social media service.

"We're excited to be able to help Elon realize a new vision for Twitter" – @cz_binance shares.https://t.co/avsqQDg83t

— Binance (@binance) May 5, 2022

Wonder what Binance will get for its cash. Some extra effort on the Bored Ape trolling and DOGE pumping perhaps? We’ll aim to cover this further in our next bumper “Monday Fund Day” crypto-funding roundup.