Mooners and Shakers: Crypto market slips lower, even as Ukraine legalises Bitcoin

Coinhead

Coinhead

It’s been a bloody 24 hours in the crypto market with the bears firmly in control as Bitcoin and friends struggle to find support.

Things appeared to be potentially coiling up for a possible BTC breakout beyond US$45k a couple of days ago. But it probably should come as no surprise that macroeconomic forces du jour (namely the US Fed) plus geopolitical tensions are still whispering in the collective ears of markets, helping to keep prices suppressed.

Yesterday the FOMC (America’s Federal Open Market Committee) released its minutes from its last big meeting, held in January. Although those details carried no shocks (yep, interest-rate hikes coming in March, yada yada, got it), what it probably did do, is maintain the status quo of uncertainty.

The guessing game surrounding levels of inflation combatting that the Fed will be prepared to go to… that’s still as prevalent as it was at the beginning of the year.

But anyway, here’s how the S&P 500 has opened today, and naturally the crypto market is in copycat mode (-3%)…

Taking the good with the bad, bad with the good, here’s something that seems quite big, though…

Amid rising tensions with its powerful neighbour to the north-east, Ukraine has reportedly just legalised Bitcoin and other cryptocurrencies.

Ukraine just legalized #bitcoin.

Eventually every country will.

Bitcoin is inevitable.

— Pomp 🌪 (@APompliano) February 17, 2022

The country’s vice prime minister Mykhailo Fedorov confirmed the news in a tweet that read: “Ukraine is already in top-5 countries on cryptocurrency usage. Today we made one more step forward: Parliament adopted law on virtual assets! This will legalize crypto exchangers and cryptocurrencies, and Ukrainians could protect their assets from possible abuse or fraud.”

What impact this will have (if any) on the price of Bitcoin remains to be seen. It’s certainly got the notoriously one-eyed “Bitcoin maxi” Max Keiser thinking, though…

https://twitter.com/maxkeiser/status/1494332112807231497

But enough of all that, let’s zoom in on today’s actual market “mooners and shakers”. Spoiler alert… most moon missions could be currently experiencing delays.

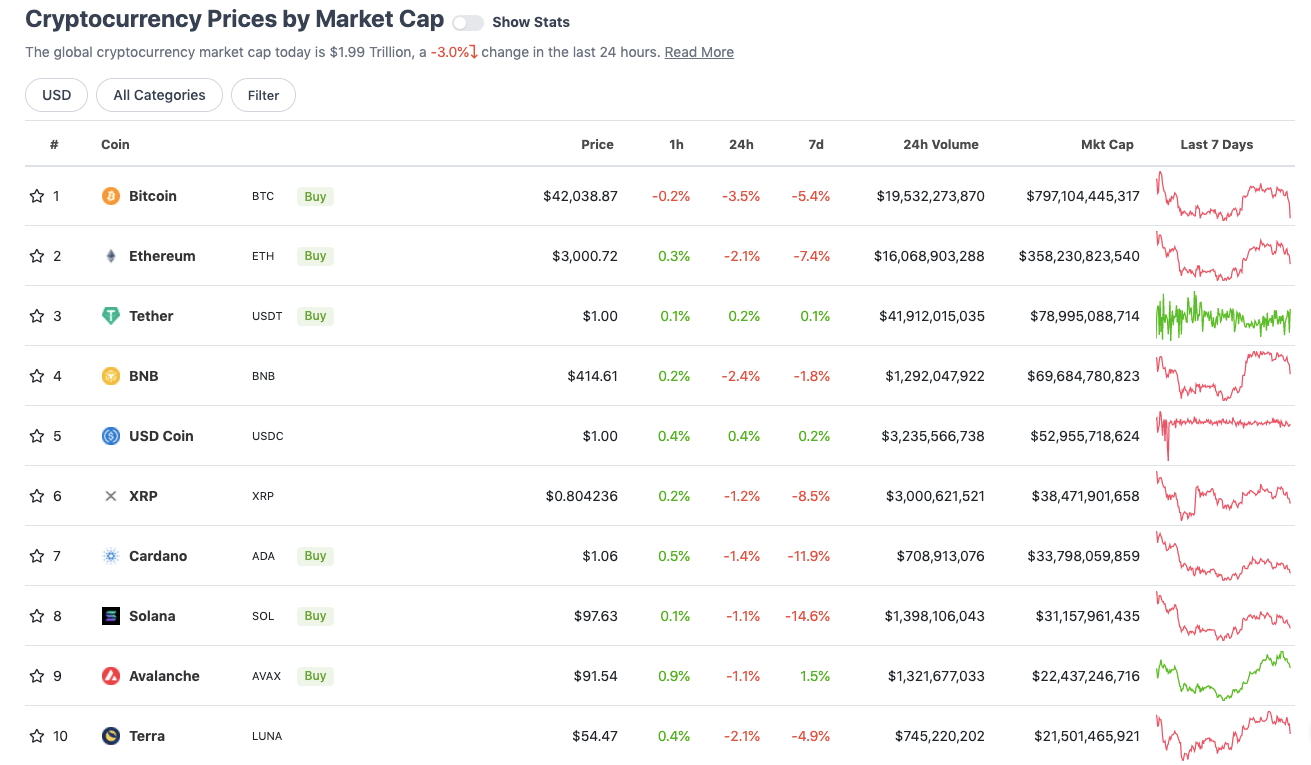

With the overall crypto market cap down about 3% over the past 24 hours, here’s the state of play in the top 10 by market cap right now – according to CoinGecko data.

Perhaps slightly unusually, Bitcoin (BTC) is leading the losses in the top 10 on the daily timeframe right now. As most Coinheads know, it’s usually the altcoins that bleed out a bit harder and faster.

Give it time, or perhaps the blood is already being stemmed as this is typed. Pass the hopium pipe, would ya?

Sweeping a market-cap range of about US$20.2 billion to about US$1 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• JUNO (JUNO), (market cap: US$1.35 billion) +10%

• Cosmos (ATOM), (mc: US$8.6b) +7.5%

• Osmosis (OSMO), (mc: US$2.75b) +5%

• Decentraland (MANA), (mc: US$5b) +4.5%

• Dash (DASH), (mc: US$1.16b) +2.5%

DAILY SLUMPERS

• Theta Network (THETA), (market cap: US$3.6 billion) -7%

• Arweave (AR), (mc: US$1.58b) -6%

• Radix (XRD), (mc: US$1.6b) -5.6%

• Axie Infinity (AXS), (mc: US$4.2b) -5.5%

• The Graph (GRT), (mc: US$2.8b) -5%

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Onston (ONSTON), (market cap: US$22.5m) +82%

• Tornado Cash (TORN), (mc: US$112m) +28%

• mStable (MTA), (mc: US$21m) +20%

• Measurable Data Token (MDT), (mc: US$50m) +19%

• Klima DAO (KLIMA), (mc: US$98m) +19%

DAILY SLUMPERS

• ShibaDoge (SHIBDOGE), (market cap: US$38 million) -34%

• Popsicle Finance (ICE), (mc: US$11m) -19%

• Rally (RLY), (mc: US$777m) -18%

• Fancy Games (FNC), (mc: US$23m) -18%

• LooksRare (LOOKS), (mc: US$426m) -16%

Russia’s Finance Minister says banning #bitcoin is like banning the internet.

At least someone is paying attention!🔥

— Layah Heilpern 🎙 (@LayahHeilpern) February 16, 2022

I find it fascinating which one of these #Bitcoin tweets is getting more attention. pic.twitter.com/TKlE3jD45n

— Evan Prim 🇺🇦 (@EvanPrim) February 17, 2022

Pain Pal

— Crypto Tea (@CryptoTea_) February 17, 2022