Mooners and Shakers: Crypto hacks, bull run catalysts and the Fed talks up tokenised assets

Coinhead

Coinhead

Amid all the ongoing macro uncertainty and the micro, zoomed-in regulatory concerns facing crypto in the US, not to mention more horrendous hacks stealing headlines, Bitcoin and pals are holding up okay.

At the time of writing, Bitcoin (BTC), while yes, having been rejected just above US$27k again last week, is still showing resilience around the US$26k mark, as it has been for many weeks.

Could this mean, despite still many bearish voices around calling for much lower prices, that sellers are largely done in this market?

We’d like to think so, but it’s just one school of unscientific thought. Certainly October and November have historically been much better months for Bitcoin than September.

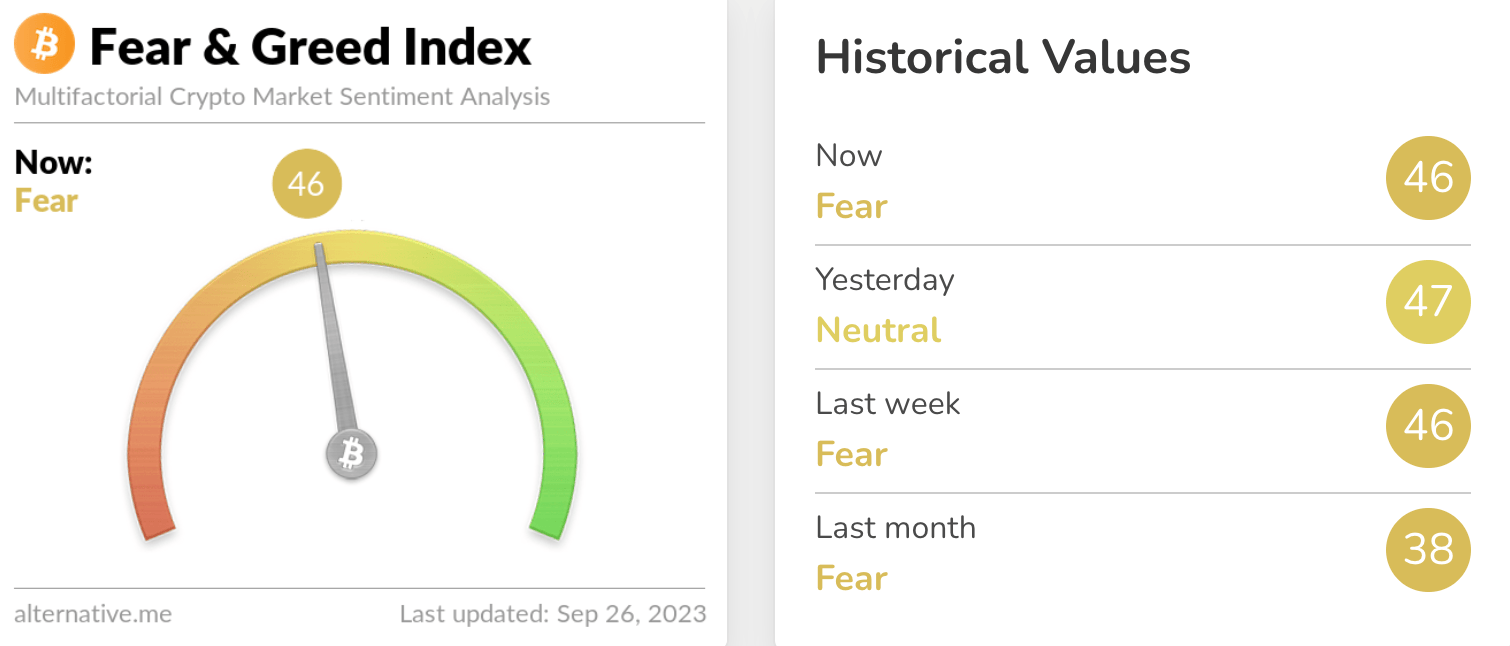

Let’s take a quick squizz at the market’s sentiment reading, before delving into some newsy matters, some potential factors that could spur the next bullish phase for crypto, and some of the latest price action.

From Fear to Neutral and back again. This might indeed sum up the mood reasonably well at the moment, and the choppy, suppressed price action Bitcoin and the rest of the crypto market has been experiencing for several weeks.

What’s making news today/this week? Unfortunately, we have to talk about a couple of hacks first. Well, we don’t have to, but in any case…

• An unfortunate victim of the largest crypto theft this year, Hong Kong firm Mixin Network has confirmed a report from SlowMist, a blockchain security firm, which details a near $200 million hack.

🚨SlowMist Security Alert🚨

On September 23, the Mixin Network cloud service provider database was attacked, the amount of funds involved was ~ $200M.

SlowMist is assisting in the investigation. Please wait for @MixinKernel updates for more information.

— SlowMist (@SlowMist_Team) September 25, 2023

Per a Reuters article, “Mixin describes itself as a network for transferring digital assets. It has one million users, according to its website.

CoinDesk meanwhile describes Mixin as “a service similar to a layer-2 protocol, designed to make cross-chain transfers cheaper and more efficient”.

Mixin noted via Twitter/X, that it has paused withdrawal of funds from its network but that transfers are not affected and that services will re-open once vulnerabilities are fixed. It also said that it will be announcing “how to deal with the lost assets”.

• Crypto exchange Huobi Global was reportedly hacked earlier this week for US$7.9 million, according to blockchain analytics outfit Cyvers Alerts.

Almost 5k of ETH was reportedly drained from a Huobi hot wallet on September 24, with the exploit later confirmed by Huobi Global investor Justin Sun in a tweet, who claimed that user funds are safe.

🚨Red Code🚨Yesterday, our ML-powered system detected a suspicious transaction involving @HuobiGlobal and @HTX_Global.

Despite our attempts to reach out, we received no response. An EOA received 5K $ETH $7.9M from @HuobiGlobal's hot wallet.🔍 This morning, we spotted… pic.twitter.com/3oqHhAVi8P

— 🚨 Cyvers Alerts 🚨 (@CyversAlerts) September 25, 2023

As reported by Cointelegraph, Huobi has revealed it’s apparently located the attacker and is offering the identity a “white hat bonus” of 5% for returning the funds within seven days.

In brighter news, the US Federal Reserve has published a research paper exploring the benefits and use cases of tokenising real-world assets (RWA) on blockchains.

Say what? The Fed? Talking up blockchain? Don’t get too excited, while it does mention “crypto”, it doesn’t namedrop specifics about Ethereum et al, or any assets that tie into the RWA narrative (e.g. Maple Finance and Frax Shares).

Nevertheless, it’s interesting to see, especially considering RWAs and the “tokenisation of everything” is one of BlackRock CEO Larry Fink’s favourite narratives regarding a future digital asset-dominated economy.

Mom wake up, the Fed just dropped a piece on tokenized RWAs in the US pic.twitter.com/nYltDwsP6V

— 0xDomingo 🏠 (@0xDomingo) September 23, 2023

“Tokenizations have the potential to provide a variety of benefits, including granting investors access to markets that are otherwise inaccessible or costly to enter,” wrote the Fed researchers.

“For example, real estate tokenizations might allow for investment in a fraction of the underlying asset, with investors able to purchase shares in specific commercial buildings or residential investments, as opposed to real estate investment trusts (REITs) where investors own shares of a portfolio of real estate investments.

“More generally, the programmability of crypto tokens and the ability to leverage smart contracts, allows for additional features that can be embedded into the tokenized asset which might also benefit markets for the underlying reference assets.

For example, liquidity-saving mechanisms could be implemented in the settlement of the tokenized asset even if they are not implementable for its real-world counterpart.

“These attributes might lower barriers to entry for a wider set of investors, resulting in more competitive and liquid markets, and better price discovery.”

Things that make you go hmmm…

In a recent report, Pantera Capital, a digital assets-focused investment firm, has nominated three things that it thinks could open the gates for the next crypto bull run.

As the industry continues on its path of maturity, we are of the view that the digital asset market today is at an inflection point – that traditional and more fundamental frameworks will be applied to investing in these assets.@cosmo_jiang explains why:https://t.co/ictQ44eraw

— Pantera Capital (@PanteraCapital) September 19, 2023

Pantera portfolio manager Cosmo Kramer Jiang writes that:

• The eventual approval of a spot Bitcoin ETF in the US is likely and will be one of the biggest catalysts for another crypto bull market.

“Most notably are potential spot Bitcoin ETF approvals,” he writes.

“In particular, BlackRock’s filing is a big deal for two reasons. First, as the largest asset manager in the world, BlackRock is subject to intense scrutiny and only makes decisions after careful consideration. BlackRock is choosing to double down on the digital assets industry even amidst the regulatory fog and current market climate.”

• An improving regulatory environment, is potentially taking place. Certainly, recent legal victories by Ripple and Grayscale over the US are reasons to be encouraged.

• And lastly, Jiang notes the scaling capabilities of blockchain as being another factor. That is, the fast development of Ethereum layer-2s, for example.

“Crypto is in what we call its “dial-up-to-broadband moment,” he writes.

“Scaling solutions for Ethereum like Arbitrum or Optimism are making tremendous progress, and we are seeing an increase in transaction speeds at lower cost and the capabilities that come with it.”

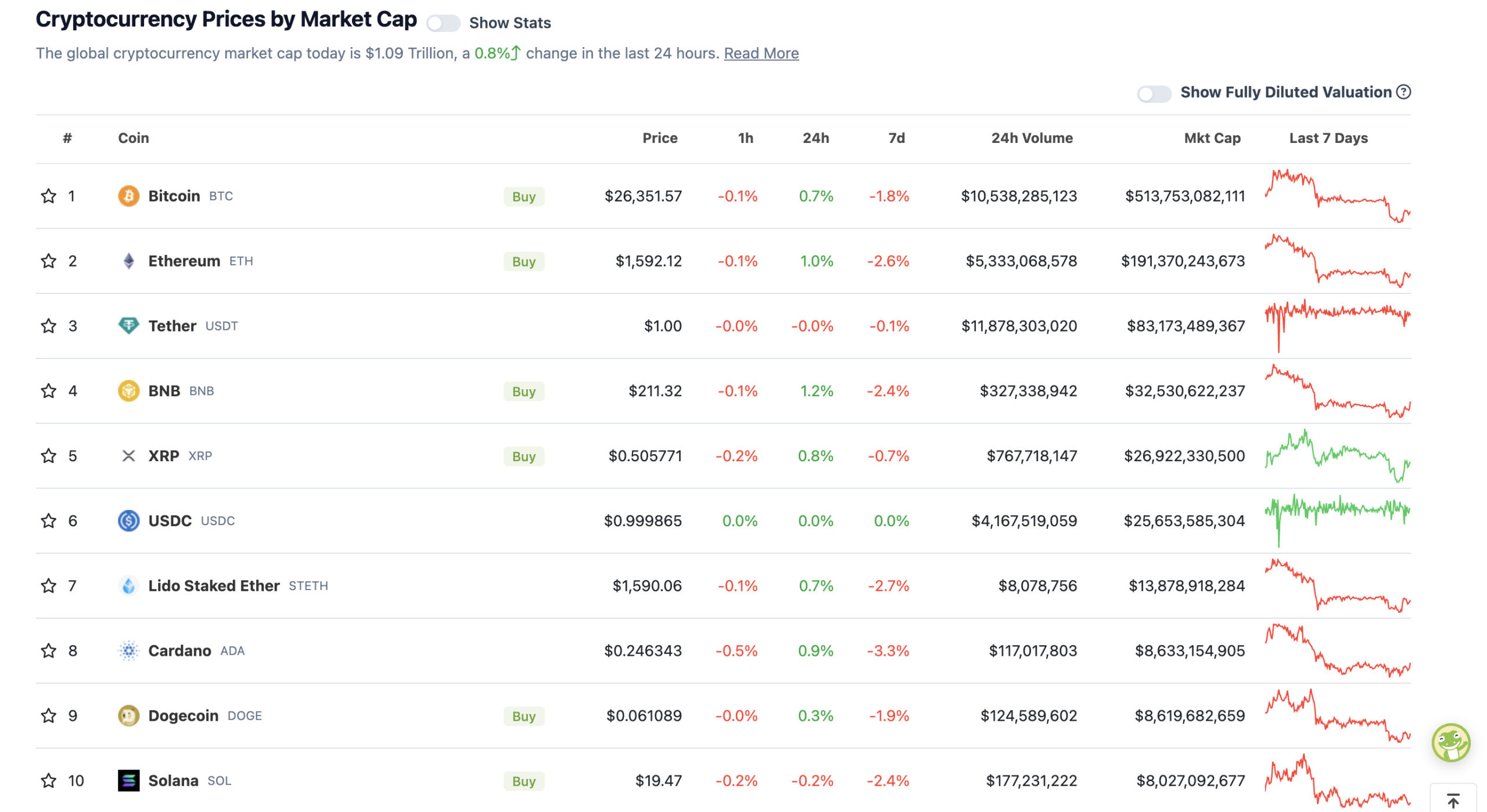

With the overall crypto market cap at US$1.09 trillion, up a fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Chainlink (LINK), (market cap: US$4.14 billion) +8%

• Frax Share (FXS), (market cap: US$417 million) +6%

• Aptos (APT), (market cap: US$1.3 billion) +2%

• Klaytn (KLAY), (market cap: US$365 million) +3%

• Maker (MKR), (market cap: US$1.18 billion) +4%

We’re noticing a lot of positivity for Chainlink (LINK) price action and potential price movement across at the moment.

Here are some takes (below) on the leading “oracle” project in the space. In a nutshell, by the way, Chainlink is a protocol that connects off-chain data to onchain smart contracts. It brings real-world data seamlessly onto the blockchain.

Is $LINK breaking its multi-year Macro Downtrend?#LINK #Crypto #Chainlink pic.twitter.com/vVKu0Efsm4

— Rekt Capital (@rektcapital) September 25, 2023

#Chainlink is probably done with its accumulation and will start its bull cycle in Q4 2023.

Very similar to the rest of the markets, which are starting to wake up.

It's just a matter of time until people start to shift sentiment.

— Michaël van de Poppe (@CryptoMichNL) September 25, 2023

Break $9 and we go to infinity and beyond.#bitcoin #cryptocurrency pic.twitter.com/gkcFqwNRz4

— Roman (@Roman_Trading) September 25, 2023

SLUMPERS

• WEMIX (WEMIX), (market cap: US$339 million) -8%

• Render (RNDR), (market cap: US$553 million) -4%

• Algorand (ALGO), (market cap: US$762 million) -3%

• Rollbit Coin (RLB), (market cap: US$354 million) -3%

• Toncoin (TON), (market cap: US$7.4 billion) -2%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

JUST IN: Bitwise amends its #Bitcoin ETF filing to add point by point rebuttal of its SEC rejection 👏

Your move, Gary Gensler pic.twitter.com/aR3bJ076jQ

— Bitcoin Magazine (@BitcoinMagazine) September 25, 2023

Wow, wait…there’s already a Bitboy movie coming out?😂 pic.twitter.com/HCAWFsBjlZ

— pianomattyb (@pianomattyb) September 25, 2023

MicroStrategy has acquired an additional 5,445 BTC for ~$147.3 million at an average price of $27,053 per #bitcoin. As of 9/24/23 @MicroStrategy hodls 158,245 $BTC acquired for ~$4.68 billion at an average price of $29,582 per bitcoin. $MSTR https://t.co/GbJtUoQfXv

— Michael Saylor⚡️ (@saylor) September 25, 2023

Positive price action today in equity markets.

Generally, when #yields and the #Dollar jump, S&P and NASDAQ sell. That isn't happening today.

This tells me smart money is seeing a pull back in the $DXY and 10 year in the coming days and are positioning themselves.

This… pic.twitter.com/3T6CzZ7b1q

— Gareth Soloway (@GarethSoloway) September 25, 2023