Mooners and Shakers: Bitcoin smashes it to yearly high as ETF hopes surge; $135k BTC is ‘next stop’?

Coinhead

Coinhead

Are you keeping half an eye on crypto? Maybe you should. Because something is brewing here, something big. And according to an EY analyst it’s a herd of institutional interest itching to rush into Bitcoin as the spot BTC ETF narrative heats up big time.

Meanwhile prominent price predictions are turning heads again. Maybe there really is something to this whole “Uptober” malarkey.

Robert “Rich Dad, Poor Dad” Kiyosaki, for instance, believes BTC is heading to US$135k “next stop”, while also predicting big moves for gold and silver amid the macro turmoil. Reckon it might have a few more stops at various stations on the way to that figure, but still, the positivity for “flight-to-safety” assets is noted…

Gold will soon break through $2,100 and then take off. You will wish you had bought gold below $2,000. Next stop gold $3,700. Bitcoin testing $30,000. Next stop Bitcoin $135,000. Silver from $23 to $68 an ounce. Savers of fake dollars F’d. Please tell your friends to “Wake up.”…

— Robert Kiyosaki (@theRealKiyosaki) October 20, 2023

Bitcoin is getting ready to roar 🦁

— Tyler Winklevoss (@tyler) October 23, 2023

We’ll hop onto further notable takes presently. But first, a quick glance at price and sentiment.

At the time of writing, Bitcoin (BTC), the messiah of cryptos, has surged to nearly US$35k – a whopping $5k up, roughly, from where it was flirting at a bar of resistance near US$30k about this time yesterday.

This is a massive daily move (+15%) for an asset with a US$681bn market cap.

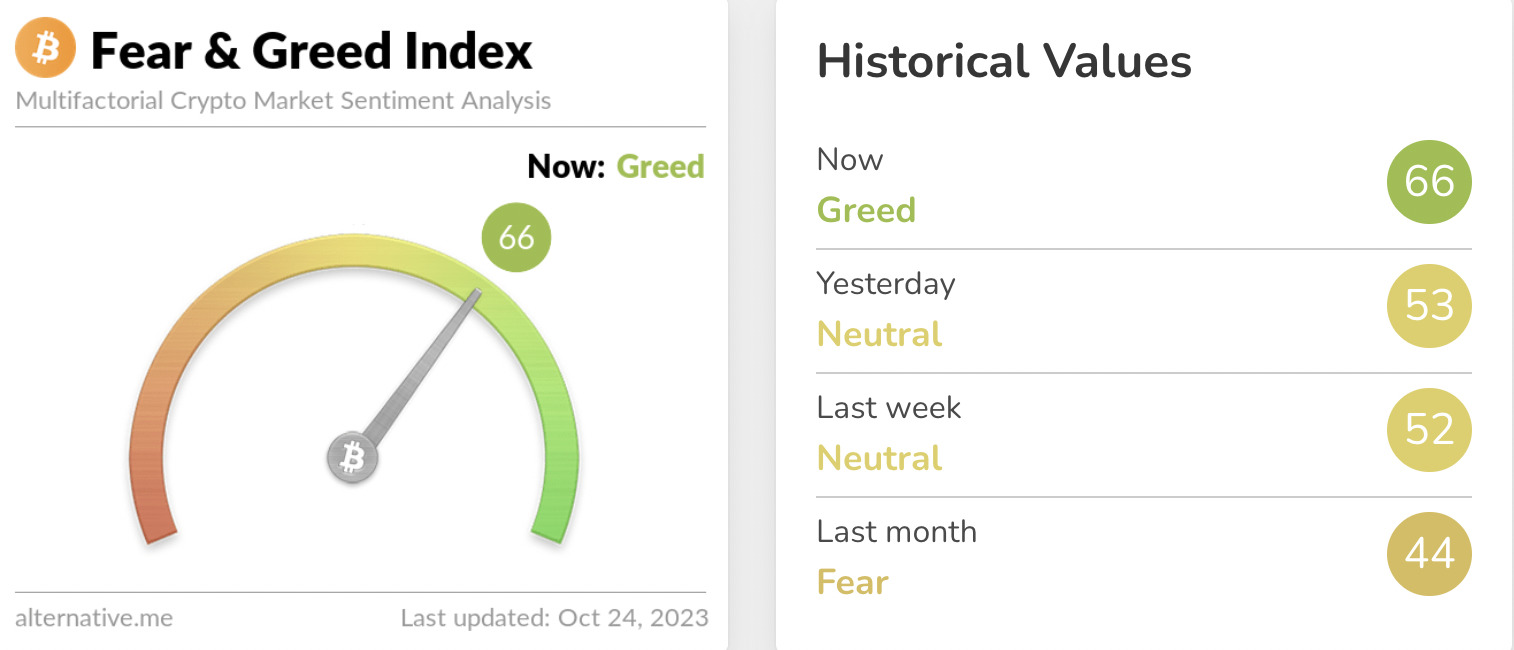

The market’s leading sentiment tracker, the Fear & Greed Index, is showing, for the first time in yonks, Greed. It’s been ticking up day by day, bit by bit lately as positivity around, and hopes for, a highly coveted spot BTC ETF grows.

Paul Brody, who is the ‘Global Blockchain Leader’ at Ernst & Young, one of the ‘big four’ accounting firms, believes Bitcoin faces a lot of ‘pent-up demand’ from institutions due to a spot Bitcoin ETF being coveted in the US for years but facing consistent roadblocking from regulators.

And yes, EY has a global blockchain leader.

Brody was speaking with US financial media outlet CNBC and noted that trillions of dollars of institutional money is waiting to move into Bitcoin once a spot ETF is approved for the asset.

NEW: $200 Trillion of Institutional assets that can't touch #Bitcoin until an ETF is approved – Top 4 global consulting giant Ernst & Young

Bitcoin market cap is $600 billion.

Barely 0.5% of institutional assets.There’s a flood of money coming…

🌊🌊🌊— Bitcoin Archive (@BTC_Archive) October 23, 2023

“Any of these other institutional funds, they can’t touch this stuff unless it’s an ETF or some other kind of regulatory blessed activity,” said Brody, adding:

“If you look at people who are buying Bitcoin, they are buying it as an asset. They are not buying it as a payment tool. Those who are buying Ethereum, are buying it as a computing platform for business transactions and DeFi [decentralised finance] services.”

And, speaking of potential regulatory blessings…

It seems to have, yes. At least that’s the feeling going around based on a some listings movement. And this will be going a long way towards why the BTC price has busted its way up this morning.

Essentially, the iShares Bitcoin Trust, which is BlackRock’s spot BTC ETF application currently under SEC review, has been listed on the DTCC (Depository Trust & Clearing Corporation), which is the body that clears NASDAQ trades. According to Bloomberg’s ETF expert Eric Balchunas, this is a step in the process of bringing ETFs to market…

— Gabor Gurbacs (@gaborgurbacs) October 23, 2023

Jeff Yew, CEO of Australian firm Monochrome Asset Management also notes that: “Being listed on the DTCC usually signals that an ETF launch is imminent. Based on this, BlackRock’s Bitcoin ETF is currently the race leader in the US.”

Being listed on the DTCC usually signals that an ETF launch is imminent.

Based on this, BlackRock’s Bitcoin ETF is currently the race leader in the US.

In Australia, @MonochromeAsset is moving towards having the Monochrome Bitcoin Trust (IBTC) quoted on the Australian… https://t.co/vS3M1FnmCv

— Jeff (@jeffyew_) October 23, 2023

Additionally, another analyst, financial lawyer Scott Johnsson posted on X that Blackrock has secured what’s known as a “CUSIP” licence and may soon begin “seeding” its spot ETF product with cash as early as this month.

It’s again, all apparently part of the process towards ETF listing. To this, Balchunas noted that seeding an ETF is “typically not a lot of money” and would be “just enough to get an ETF going”. He also described it as a good, and “noteworthy” sign.

BlackRock stating in their recent spot Bitcoin ETF amendment that they are seeding the ETF in October. Don’t want to read that much into it but it is new info not in original filing so noteworthy (esp bc they BlackRock). Great catch by Scott. https://t.co/CGBmuTJ7W0

— Eric Balchunas (@EricBalchunas) October 23, 2023

And hang on, there’s this, too, regarding Grayscale’s recent fight with the SEC to get its GBTC investment product turned into a spot BTC ETF in the US.

Everything appears to be lining up today, because overnight (AEDT) the US Court of Appeals has reportedly ordered the SEC to review Grayscale’s spot BTC application. Your move, Gazza Gensler.

BREAKING: 🇺🇸 US Court of Appeals orders SEC to review Grayscale's spot #Bitcoin ETF application. pic.twitter.com/RiyHU8Mpcp

— Bitcoin Archive (@BTC_Archive) October 23, 2023

One word of caution amid the euphoria today, though, from British cryptographer and Bitcoiner Adam Back…

not to be the pourer of coldwater, but i don't think the IBTC ticker registered with DTCC means a spot #bitcoin ETF is approved, and neither does @blackrock planning to seed it with a nominal amount of $.

— Adam Back (@adam3us) October 23, 2023

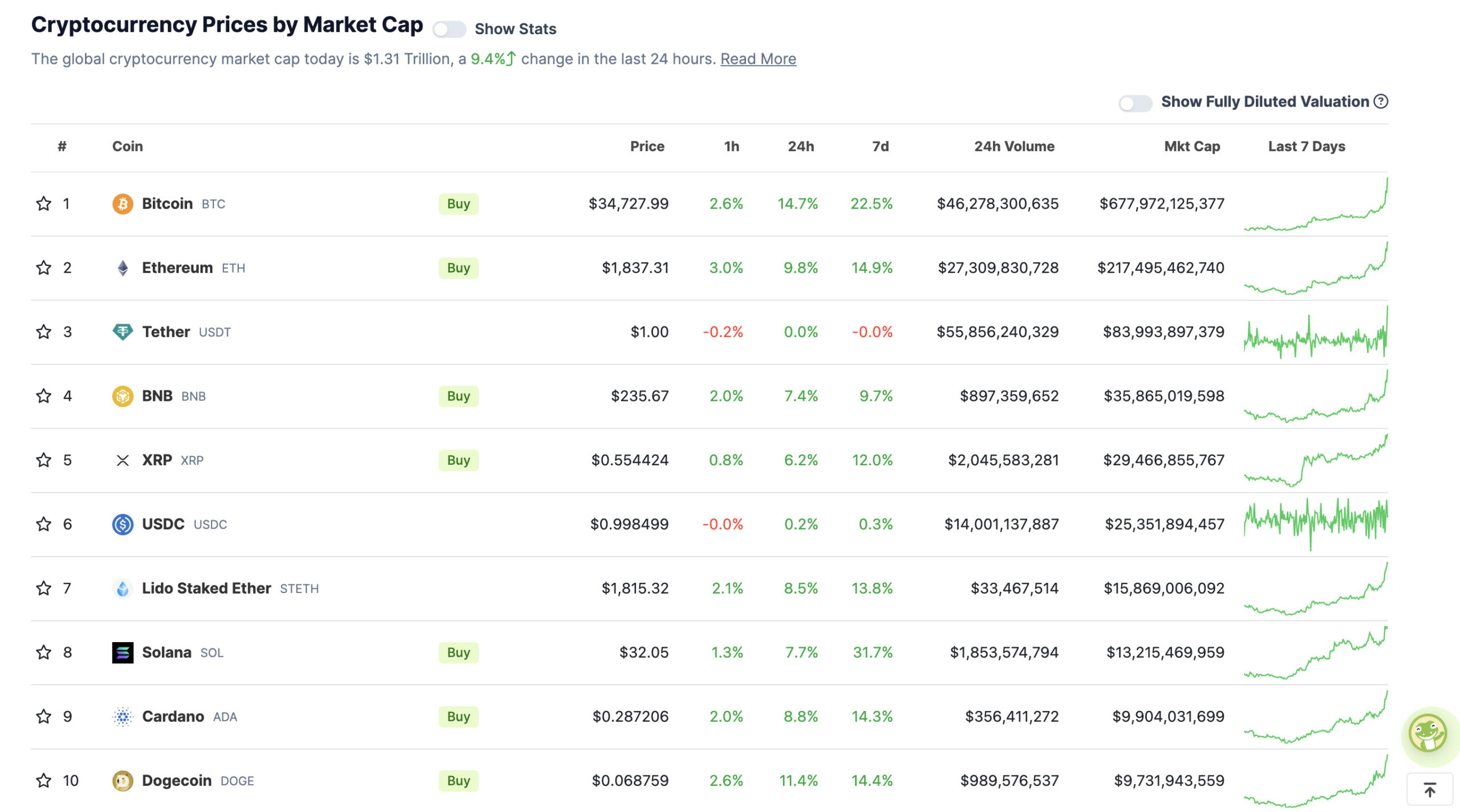

With the overall crypto market cap at US$1.31 trillion, up 9.4% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Not going to lie, it’s pretty excellent to see the no.1 crypto smashing it for a daily gains lead in the crypto majors today.

Salty salty salty bears & recession predictors.

You deserve this.

Enjoy the most hated rally.#bitcoin #cryptocurrency #cryptonews

— Roman (@Roman_Trading) October 23, 2023

It’s a green scene across the board, however, with smart contract layer 1s Ethereum, Solana and Cardano all faring particularly well.

(11-100 market cap position)

• Pepe (PEPE), (market cap: US$430 million) +32%

• Rollbit Coin (RLB), (market cap: US$598 million) +28%

• Injective (INJ), (market cap: US$972 million) +24%

• Rocket Pool (RPL), (market cap: US$467 million) +21%

• Mina Protocol (MINA), (market cap: US$478 million) +16%

Wait, what the heck just happened? pic.twitter.com/JFX0pr9fFI

— Autism Capital 🧩 (@AutismCapital) October 23, 2023

Bulls right now: pic.twitter.com/YzT96bnMo4

— VanGoya (@vangoyaa) October 24, 2023

JPMorgan Says Bitcoin Spot ETF Approval Is Imminent

JPMorgan analysts predict that the U.S. Securities and Exchange Commission (SEC) is likely to approve multiple spot Bitcoin ETFs in the coming months, possibly before the final deadline for the Ark 21Shares applications on… pic.twitter.com/o6Bt9ylGBv

— The Wolf Of All Streets (@scottmelker) October 20, 2023