Mooners and Shakers: Bitcoin holds steady ahead of Fed’s next rates decision

Coinhead

Coinhead

Bitcoin is holding steady as we head into a week with another critical interest rates decision meeting looming with the US Fed. Yep – it’s the most important one ever. Since the last one and the one before that.

And that’d be the FOMC meeting, the results of which later this week (Wednesday US time) will leave Federal Reserve boss Jerome Powell’s mouth to be anxiously absorbed by anyone with a risk assets portfolio.

Interest rates are widely tipped to remain at current levels in the US for now, so we’ll just have to wait and see how hawkish the Fed sounds on top of that in terms of outlook for the rest of the year.

For what it’s worth “Crypto Santa” certainly isn’t expecting any resulting price change for Bitcoin outside the US$25k-$27k range.

Market pretty boring and sideways for the most part tbh…

Next weeks FOMC and Interest Rate decisions should induce some volatility, but #BTC will likely continue to trade within $25k – $27k in the short-term…🤷♀️#Bitcoin pic.twitter.com/ZyNan85PLC

— Crypto Santa (@Blockchainsanta) September 16, 2023

• This is a few days old, hitting late last week, but it’s worth sharing here now. According to Reuters and other outlets, Deutsche Bank has partnered with Swiss crypto firm Taurus to provide custody services for institutional clients’ crypto and tokenised assets.

Deutsche Bank will reportedly now be able to hold a small amount of top cryptos for its clients, as well as tokenised versions of traditional financial assets.

BREAKING: $800 billion asset manager Deutsche Bank partners to offer #Bitcoin custody for institutions

The bank can now hold crypto directly for clients 👏 pic.twitter.com/MsCLyhMX6l

— Bitcoin Magazine (@BitcoinMagazine) September 14, 2023

• The House Financial Services Committee in the US has the CBDC (central bank digital currency) concept in its sites.

It’s currently marking up two bills with the aim of blocking a potential US digital dollar, according to an announcement from the committe’s chair, the Republican Patrick McHenry, who is also known to be extremely Bitcoin/crypto-innovation friendly.

#NEW: Chairman @PatrickMcHenry announces a markup of legislation to strengthen American national security and prevent the issuance of a central bank digital currency.

📖 Read more 🔗https://t.co/oy3oASJYkA

— Financial Services GOP (@FinancialCmte) September 16, 2023

• At the same time, Elizabeth Warren – one of the crypto haters in chief in the US political sphere, is pushing her own bill, backed by nine other senators, called the Digital Asset Anti-Money Laundering Act.

The bill aims to “close loopholes in current law and bring cryptocurrency companies into greater compliance with the anti-money laundering and countering the financing of terrorism (AMF/CFT) frameworks that govern much of the financial system,” notes the anti-crypto cronies.

Warren’s moves to bring cryptocurrencies/digital assets under tighter-policed control are largely viewed by the industry as more than that – a concerted campaign to completely kill off the industry in the States.

Just in: Elizabeth Warren's anti crypto bill gets support from 9 more senators. pic.twitter.com/g7Rg4m7kXv

— CILLIONAIRE.COM (@cillionaire_com) September 15, 2023

The biggest crypto conference of the year happened across the weekend – at Token 2049 at the Marina Bay Sands in Singapore.

Sporting 10,000 attendees and 300 exhibitors, it was a who’s who of the crypto industry, all largely espousing “building through the bear market” vibes and talking up 2024 and 2025 as THE years Bitcoin, Ethereum and the market truly make a comeback.

You certainly wouldn't know it's a bear market being at Token2049.

Conference hall is buzzing, packed with projects and speakers, amazing side events + enthusiasm.

Asia is embracing crypto with open arms.

Reaffirmed my conviction for the future of this space. pic.twitter.com/9MPuWChtZl

— Miles Deutscher (@milesdeutscher) September 14, 2023

We didn’t make it there ourselves, but we know a few people who did – including Caroline Bowler, CEO of one of Australia’s oldest, most prominent crypto exchanges, BTC Markets.

Here’s some of what she had to say about it all, in key highlights bullet-point form (lightly edited):

Oh, and this, too, which has hopefully surely got to be a sign of an evolving industry:

“The tone of crypto is maturing – the prevalence of ‘scantily clad dancing girls’ were far less prominent than it was years ago.”

WHAT'S GOING TO POWER THE NEXT BULL RUN?

At #TOKEN2049, I interviewed industry experts and they've shared crypto's best kept secrets with me!

WATCH THE VIDEO NOW👇https://t.co/5wIU3cfMrL pic.twitter.com/kiuTOcC2iH

— Ran Neuner (@cryptomanran) September 17, 2023

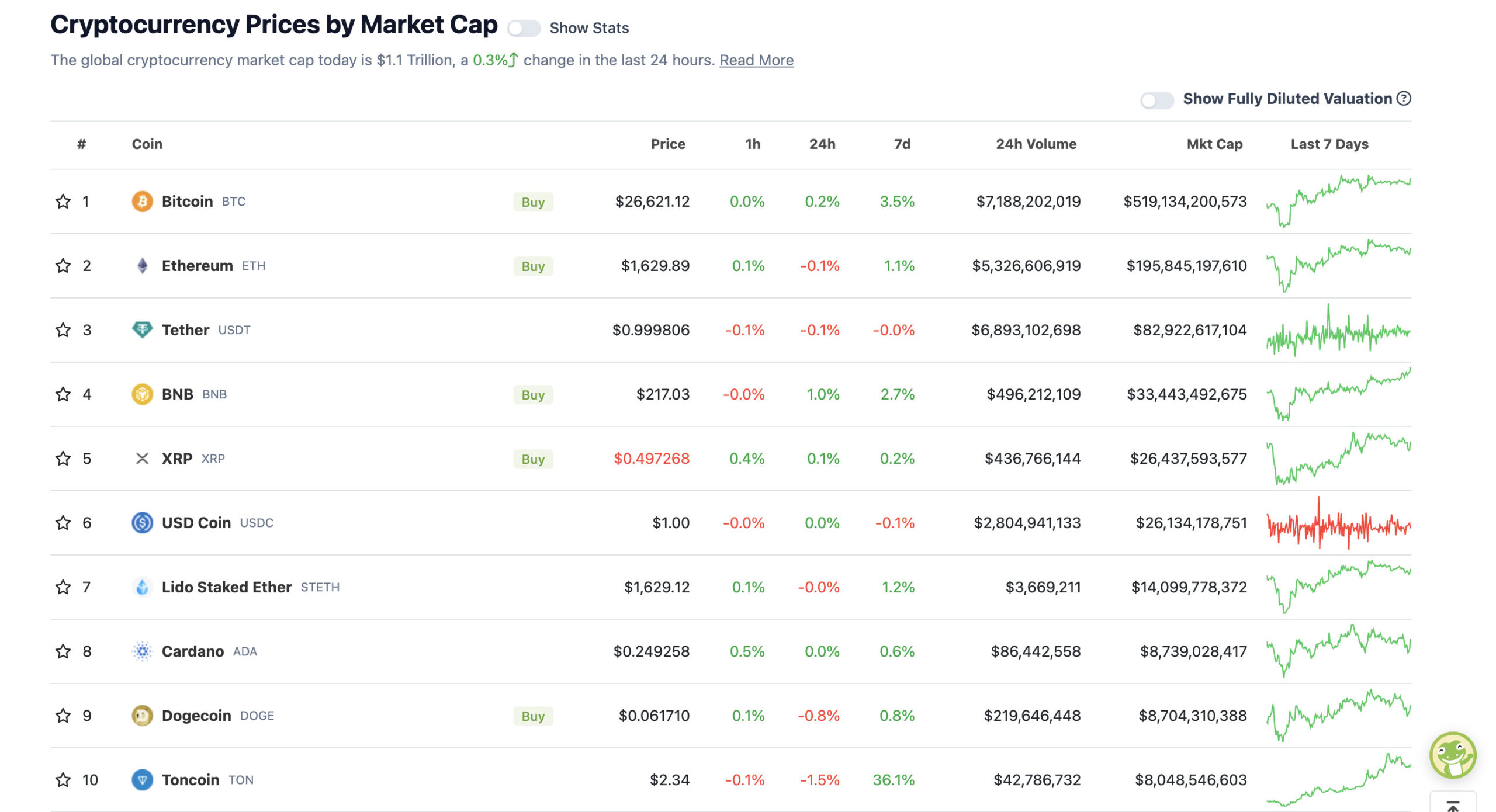

With the overall crypto market cap at US$1.1 trillion, up a fraction of a fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Chainlink (LINK), (market cap: US$3.54 billion) +6%

• Kaspa (KAS), (market cap: US$985 million) +5%

• ApeCoin (APE), (market cap: US$418 million) +4%

• Casper Network (CSPR), (market cap: US$394 million) +3%

• Filecoin (FIL), (market cap: US$1.5 billion) +2%

SLUMPERS

• Rollbit Coin (RLB), (market cap: US$432 million) -9%

• IOTA (MIOTA), (market cap: US$415 million) -4%

• Kava (KAVA), (market cap: US$485 million) -4%

• Sui (SUI), (market cap: US$348 million) -3%

• Gala (GALA), (market cap: US$374 million) -2%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Bitcoin still in stage 1, accumulation, on track!

Ps I changed the stage names into more intuitive ones:

🔵 stage 1 – accumulation

🟢 stage 2 – bull market

🟡 stage 3 – bear market

🔴 stage 4 – liquidation pic.twitter.com/QEdkGT5Xpe— PlanB (@100trillionUSD) September 17, 2023

Make no mistake – Bitcoin is in an early stage Bull Market

Long-term the outlook is bullish

Mid-term?

Over the next 7 months, we may or may not get 1 last major correction

Will it happen?

It would be wise to at least be ready for it if it does$BTC #Crypto #Bitcoin pic.twitter.com/SOTGJfR0VN

— Rekt Capital (@rektcapital) September 17, 2023

The boring part of the cycle is the current part.

In the upcoming months, many exciting events are coming up that will change the cycle.

Just sit on your hands and be ready.

— Michaël van de Poppe (@CryptoMichNL) September 17, 2023

Hmm… haven’t seen a big-budget crypto ad in a while. They all pretty much marked a cycle top last time around… Let’s hope this one marks the bottom.

Fact-check: Stashing cash, waiting for remittances, unnecessary overdraft fees, and lack of economic access should not be the norm.

You know what’s broken; the Stellar network has the toolbox.

Build better with Stellar. pic.twitter.com/1ZjQ6mZZB7

— Stellar (@StellarOrg) September 12, 2023