Mooners and Shakers: Bitcoin flat amid US macro issues; PayPal invests into crypto wallet firm Magic

Coinhead

Coinhead

Bitcoin hasn’t fallen off a cliff so far this morning. So that’s a bonus. But it’s still trading in a flattish range as traders and investors try to figure out the macro picture stemming from the US.

On that, it seems as if the debt-ceiling deal brokered by Republican House Speaker Kevin McCarthy and Joe Biden is likely to pass, having moved through the House (albeit with a good deal of protest) and onto the Senate.

An extremely simplistic take on the game of Deal or No Deal might be that if it goes through, this will be something of a relief for markets and it’s potentially party-on again, for a little while at least, for risk assets.

A possible fly in the ointment short-midterm, however, is that stronger-than-expected jobs data just came through in the US overnight (AEST) and, according to Eddy’s Market Highlights column this morning, this increases the chances of more Fed rate hikes in coming months, which might keep the markets skating on thin ice for the foreseeable amid the ever-rising risk of recession.

In fact, in full risk-assets party-poopering form, one prominent US Fed official, Federal Reserve Bank of Cleveland President Loretta Mester, said:

“I don’t really see a compelling reason to pause rate hikes,” adding, “I would see more of a compelling case for bringing the rates up and then holding for a while until you get less uncertain about where the economy is going.”

Righto then, what’s the good news? We scrounged around for something and found the following. It’s not so insignificant…

A developing crypto wallet-as-a-service provider called Magic has pulled an impressive US$52 million out of the funding hat in a new strategic round led by PayPal Ventures.

We're thrilled to announce our latest funding of $52M backed by @PayPal @cherubicvc @synchrony @northzoneVC @VoltCapital @KX. Magic is solving web3 onboarding and our mission is to give a wallet to every internet user.

👇 Read morehttps://t.co/9tdZsH3lxH

— Magic (@magic_labs) May 31, 2023

According to a press release, the funding will be used to expand capabilities and uses cases with a focus on the European Union and Asia-Pacific regions.

“Mass adoption of Web3 is a hot topic, and Magic is facilitating this with a safe and simple solution,” said Alan Du, partner at PayPal Ventures. “Magic’s wallet creation service allows companies to reach millions of users on their apps and onboard customers who are new to Web3.”

This news comes after another huge corporate entity, Sony, revealed it has plans to invest heavily into web3, NFT and metaverse startups.

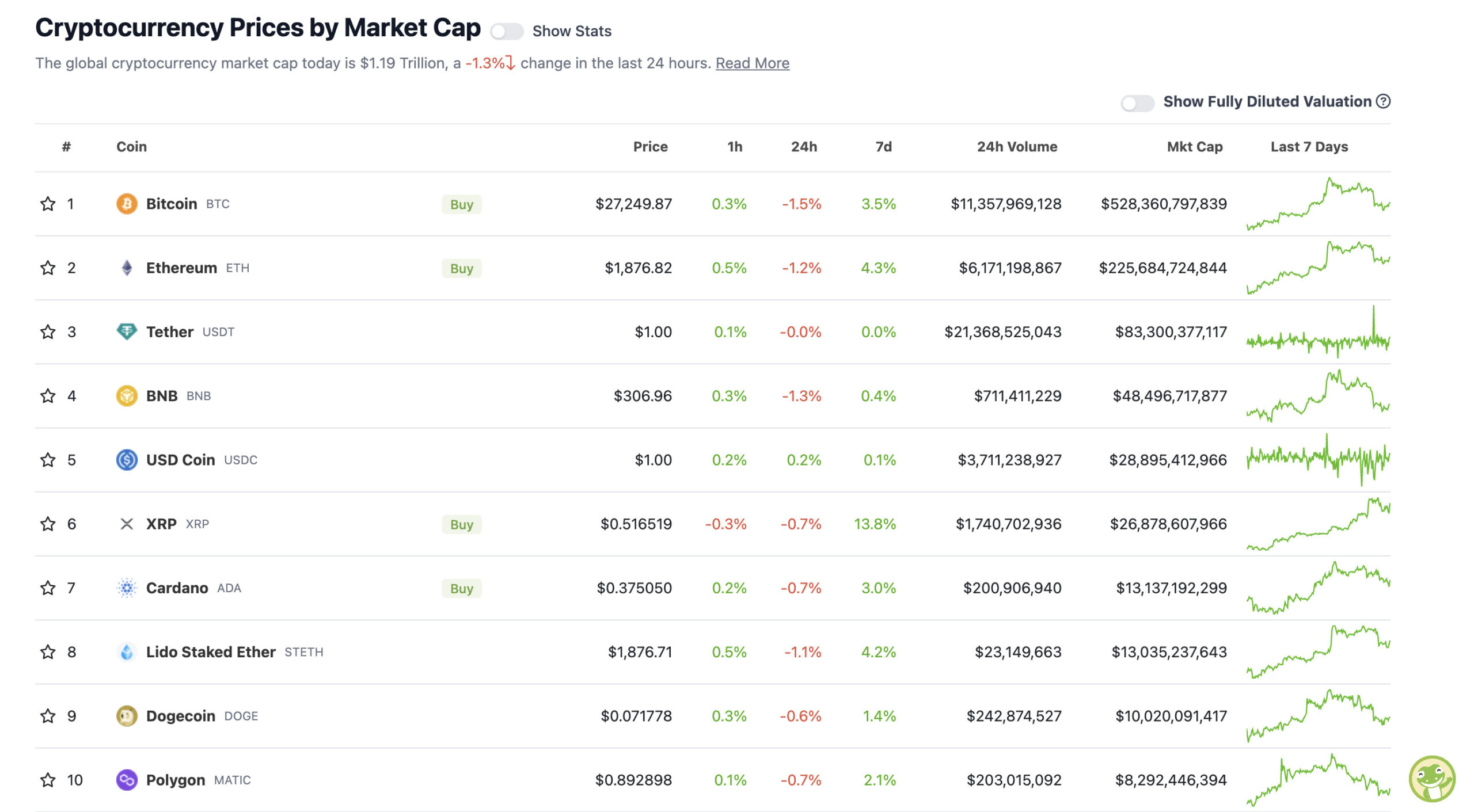

With the overall crypto market cap at US$1.21 trillion, up about 0.4% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

As you can tell, the crypto majors are in something of a holding pattern over the past 24 hours, although XRP is still the big weekly winner, up nearly 14% over the past seven days.

US analyst Roman Trading is still spying low volume on the Bitcoin price ranging chop, which means we could be in for more crabbing sideways, although he’s of the believe it’s in a consolidation zone before a move higher.

$BTC 1D

With all the panic in the air, this is a reminder that we’re still ranging on low volume.

Until support or resistance breaks, it’s a forever sideways move.

I believe it’s consolidation for higher and am looking for longs.#bitcoin #cryptocurrency #cryptotrading pic.twitter.com/fwWWFQ7CAK

— Roman (@Roman_Trading) May 31, 2023

A well-known macro analyst, Alex Krüger, meanwhile told his 153,900 or so Twitter followers the other day that he’s expecting a Fed pivot on its interest-rate hiking by December, but that markets will likely look to frontrun that with a rally as soon as August.

The Fed has delivered 20 x 25bps rate hikes in its fastest and most agressive hiking cycle in history.

Which means at least 90% of the Fed hikes are behind (if not all). That to me is all that matters, and makes it easy to stay long. This has been my view all year.

My base case…

— Alex Krüger (@krugermacro) May 29, 2023

“My base case is a December pivot and a bull market gearing up in early August to front run this,” wrote Krüger. “Why? The economy is cooling and inflation is falling. The Fed is forced to overshoot (hiking) due to its past errors … which increases odds of it pivoting when data rolls over.”

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• XDC Network (XDC), (market cap: US$516 million) +19%

• Stellar (XLM), (market cap: US$2.48 billion) +2%

• The Graph (GRT), (market cap: US$1.2 billion) +2%

PUMPERS (lower, lower caps)

• Parsiq (PRQ), (market cap: US$23 million) +20%

• Cream (CREAM), (market cap: US$22 million) +10%

• Marlin (POND), (market cap: US$79 million) +9%

SLUMPERS

• Conflux (CFX), (market cap: US$603 million) -10%

• Gate (GT), (mc: US$640 million) -6%

• ImmutableX (IMX), (mc: US$727 million) -6%

• Radix (XRD), (mc: US$674 million) -5%

• Injective (INJ), (mc: US$579 million) -5%

SLUMPERS (lower, lower caps)

• Bonk (BONK), (market cap: US$21 million) -22%

• PIVX (PIVX), (market cap: US$18 million) -19%

• Turbo (TURBO), (market cap: US$19 million) -16%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

My God. She has no shame https://t.co/zqVpfXumx0

— John E Deaton (@JohnEDeaton1) May 31, 2023

Coinbase Ventures is a gem finder:

• Compound in 2018

• Opensea in 2018

• Synthetix in 2020

• Uniswap in 2020Let's look at the 4 companies they added to their portfolio this month.

— dLux (@dLuxGMI) May 31, 2023

NEW – Fidelity Director of Global Macro: "#Bitcoin is a unique asset because it has both the supply characteristics of gold and the adoption curve of a disruptive technology." 🚀💥 pic.twitter.com/gbD0F409CI

— Bitcoin Magazine (@BitcoinMagazine) May 31, 2023