Bitcoin is not exactly off to the best start this week, having lost its tenuous grip on the US$30k branch. But at least Doge is leg humping its way up again.

BTC has fallen further down the tree, not quite in Rambo from First Blood style, and has broken its descent at just above US$29k.

Hmm, thought things had been looking up – an XRP/Ripple win over the SEC, Bitcoin ETF applications piling up in Gary Gensler’s in-tray.

So why then? How come this dip? Why did it rain at Old Trafford the other day? Why? It’s. Just. Not. Fair. Daddy.

Well, one reason for the cooling off is very likely (in fact, almost certainly) to do with a pump in the US dollar index (DXY) ahead of this week’s latest MOST IMPORTANT EVER Federal Reserve Open Market Committee (FOMC) meeting.

That’s set to happen in the wee hours on Thursday this week (AEST) and the general market predictions around it appear to suggest a resumption hike from Jerome Powell and mates at the Fed. A likely 25 bps increase, which the CME FedWatch tool gives about oh, a 99.6% possibility of happening. (Insert “so you’re telling me there’s a chance” GIF here.)

So then, are we in for some gloom as rate-hiking season begins once more and recession takes up the narrative in H2? Certainly some analysis seems to be trending that way, with figures sub US$20k being bandied about for BTC again.

Here’s the often very positive Michaël van de Poppe, who is of the belief it could pull back to at least US$27k, but within an overall uptrend still.

And that’s an uptrend that still currently has Bitcoin at +75%, or thereabouts, for the year to date.

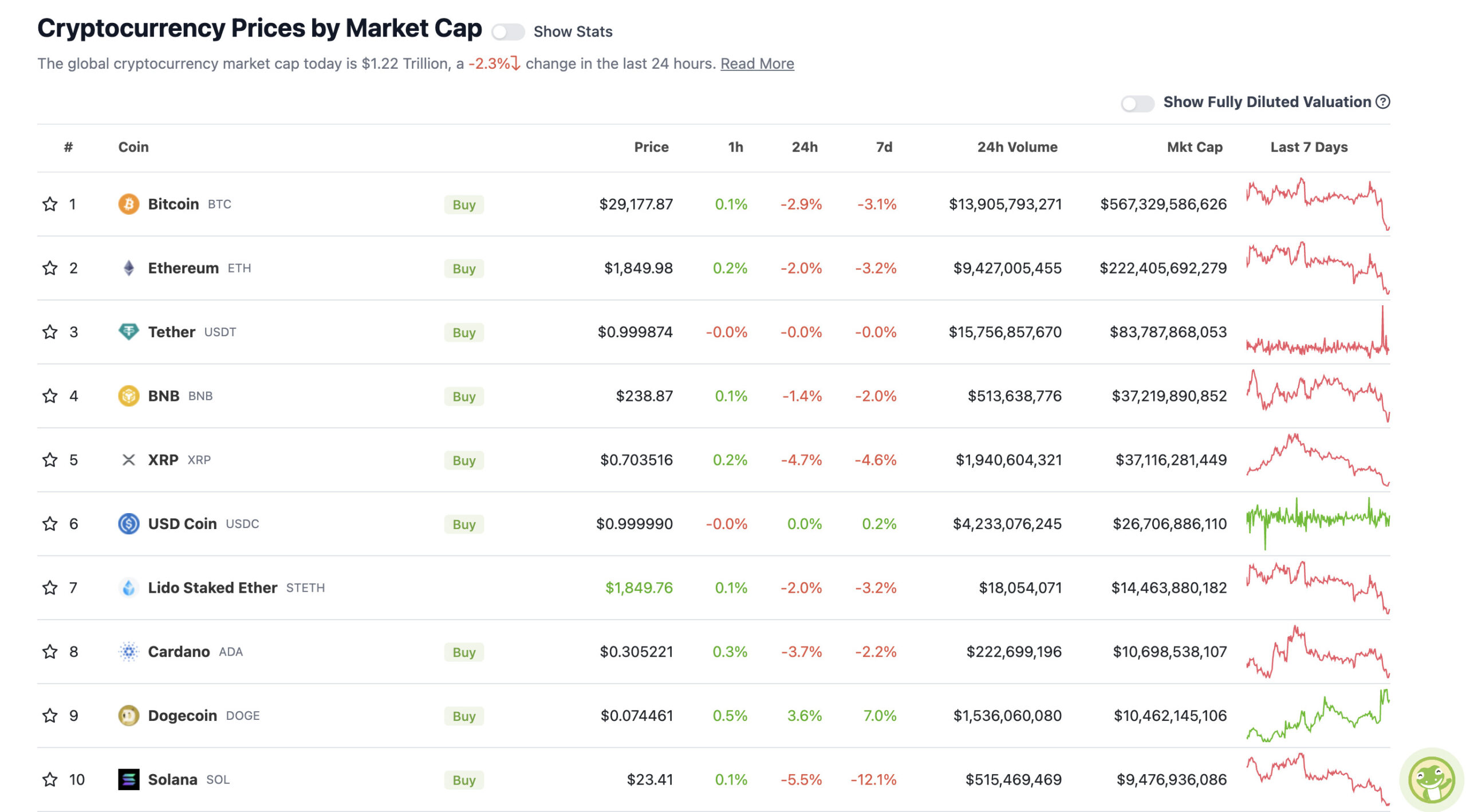

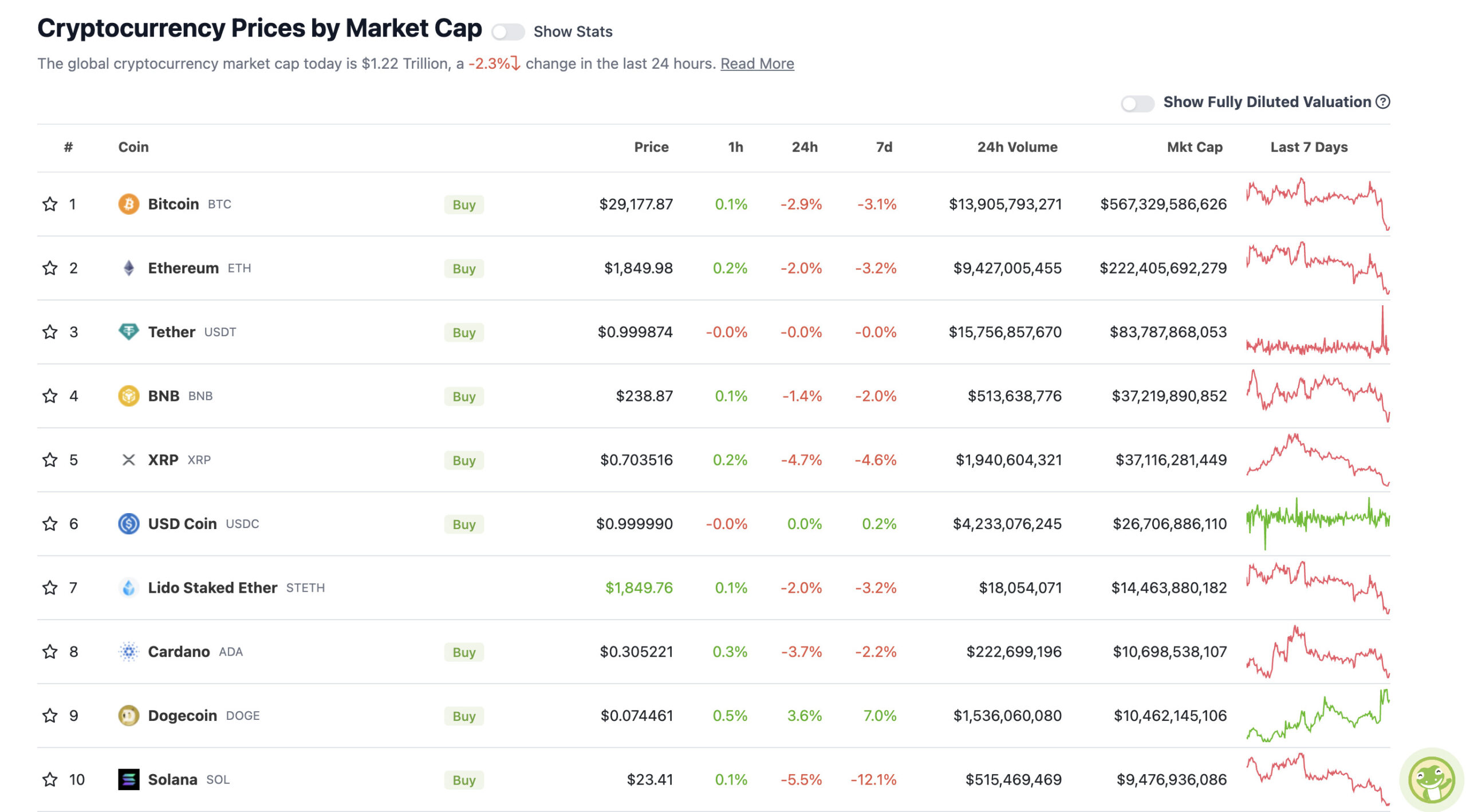

With the overall crypto market cap at US$1.22 trillion, down 2.3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin, for a time did actually dip below US$29k overnight, but has at least recovered that area for now.

There’s not much positivity to tell you elsewhere in the majors, either just at present. Although hang on, Doge is wagging its tail. We can only assume it’s a response to Elon Musk’s Twitter rebrand to X.

Why does that mean a Dogecoin pump? It’s Elon Musk… doing things, and it just does. We don’t make the rules.

But yes, there’s a chance, and actually some level of probability, that Musk will, at some point, give Dogecoin a role to play on his X everything app platform.

He’s already hinted at that several times in the past, and looky here, he’s just updated his X profile location to include a D, for Doge apparently.

There are all sorts of unconfirmed rumours flying about at present (see below), but we’ll keep things updated here once we know more.

eToro’s Market Analyst Josh Gilbert gave us an emailed take on Musk’s ‘X’ Twitter rebrand, and what it might mean for crypto/Bitcoin/Dogecoin…

“This does have implications for crypto in the short-term as it moves markets, and in the long-term as Musk looks to build out payment networks using his own platform that could soon compete with the likes of Ethereum, bitcoin or others,” wrote Gilbert, adding:

“Watchers won’t have missed the news either that bitcoin payments have seemingly been quietly dropped from Tesla, despite dogecoin remaining. While the market reads the tea leaves of Musk’s choices, it’s better for investors not to become distracted by short-term events and focus on the longer and wider trends.”

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Trust Wallet (TWT), (market cap: US$393 million) +8%

• XDC Network (XDC), (market cap: US$754 million) +7%

• GMX (GMX), (market cap: US$471 million) +1%

SLUMPERS (11-100 market cap position)

• Flex Coin (FLEX), (market cap: US$399 million) -37%

• Pepe (PEPE), (market cap: US$566 million) -11%

• Compound (COMP), (market cap: US$436 billion) -9%

• ImmutableX (IMX), (market cap: US$764 million) -8%

• Tezos (XTZ), (market cap: US$754 million) -8%

• GALA (GALA), (market cap: US$610 million) -8%

Around the blocks: Worldcoin hits market

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Have you caught any of the buzz about this Worldcoin thing? It’s a retina-capturing, Universal Basic Income (UBI) crypto project developed by OpenAI CEO Sam Altman and its token, WLD, has just hit the market – available on Binance, KuCoin, Huobi, the DEX Uniswap and a few other exchange locations.

It pumped pretty hard upon market entry, but has pulled back a tad now, still registering a +32% 24-hour gain at time of writing.

As Eddy explained in this morning’s Market Highlights:

“Worldcoin uses a small device called an ‘orb’ to scan people’s eyeballs in order to generate a unique digital identity, which then grants its holder “proof of personhood”.

More unique personal data capture – all for a few dollars worth of a s**tcoin. Things that make you go hmm… scratch chin, and mumble something about a dystopian nightmare. (Then go back to reading about Bitcoin, Ethereum, or lithium, or the women’s FIFA World Cup, or Ashes fifth Test selection possibilities).

You might be interested in