Mooners and Shakers: Bitcoin chops up and down as shorts increase on Bitfinex exchange

Coinhead

Coinhead

Bitcoin jerked above US$40k today on the back of some half-hearted hope around improved Russian/Ukrainian negotiations. Unfortunately, all of that proved pretty short lived.

The now sadly familiar factors – war, inflation, global recession speculation – might well keep markets particularly volatile and unpredictable for the foreseeable.

And that US Federal Open Market Committee (FOMC) meeting next week on March 15 – it’s the next big thing to watch in terms of a potential major market-moving catalyst.

Will the Fed’s Jerome Powell and mates hike up interest rates more aggressively than expected, sending markets into a free fall? Or will we get something far more… “dovish” or “priced in”? Beware the ides of March, eh? Hmm… let’s see if Bitcoin and other cryptos can make it through the weekend relatively unscathed first.

According to several reports, short positions (bearish bets) on Bitcoin have been increasing significantly just lately on one of the most influential crypto-trading exchanges – Bitfinex. Capitulation incoming?

But wait, hopium-hit time. There’s always the possibility of a short squeeze… right? “Credible Crypto” isn’t ruling it out…

About 3,000 $BTC opened short on Finex here at the lows. Can we squeeze him? https://t.co/uwIX4rRNC9 pic.twitter.com/9Ly51Oj6V3

— Credible Crypto (@CredibleCrypto) March 11, 2022

I have a ton of patience. Spent 13 months in the womb. Just built different. Know where this market is going long term pic.twitter.com/22cpm5NfAv

— Pentoshi 🟠🐧 Goblinomics Professor (@Pentosh1) March 11, 2022

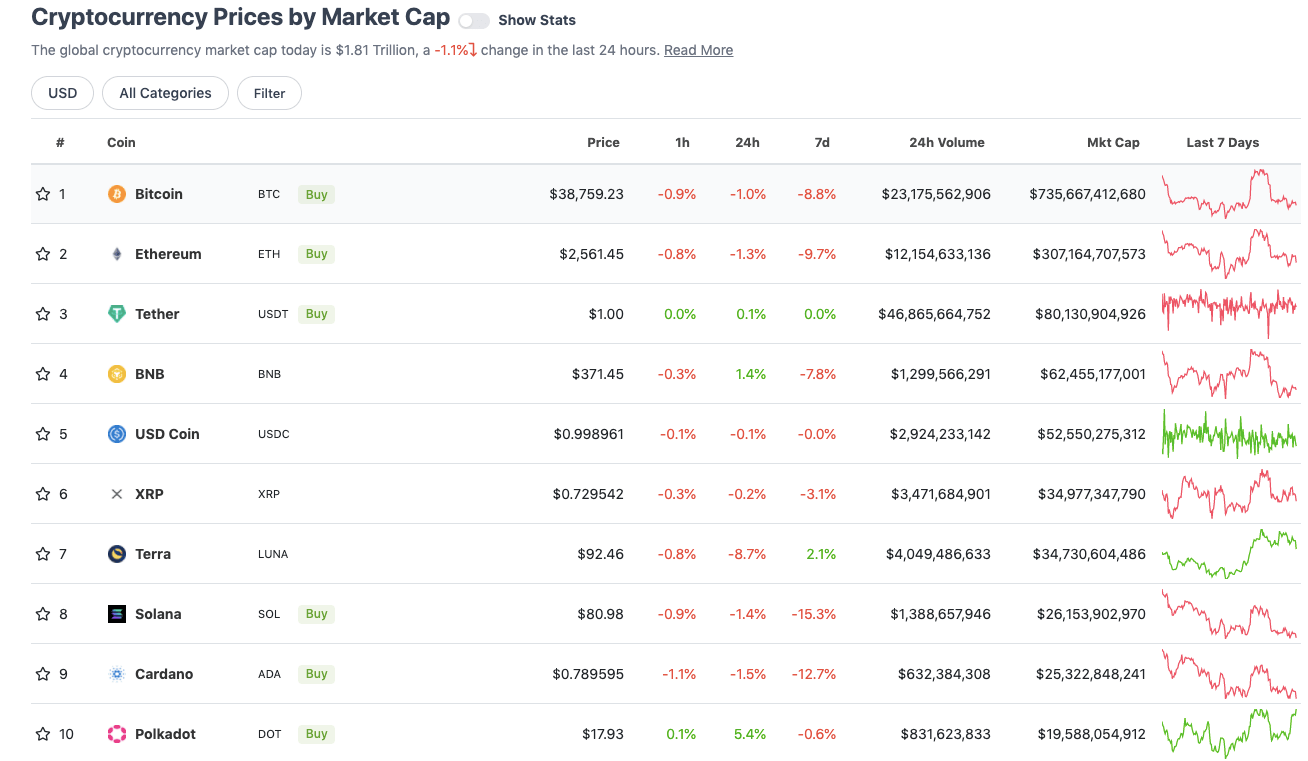

With the overall crypto market cap at about US$1.81 trillion, down about a percentage point from this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Two main points to note looking at that Coingecko list… the Terra blockchain’s LUNA token has finally run out of some steam today. It’s still the best-performing top-tenner over the past week, though, due to various factors, including increasing support for Terra’s stablecoin UST.

And Polkadot… flipping back up into the 10 and bumping Avalanche to 11. what’s going on with DOT today? Its parachain auctions have been overshadowed by pretty much everything lately. But they’re ongoing and the overall network keeps gaining strength the more DOT is staked.

Congratulations to @NodleNetwork on winning Polkadot's 11th auction!

Nodle will be onboarded at block #9,388,800 [roughly March 11,2022] at the beginning of lease 7 with the other winners from auctions 6-11. Over 4.7K network stakeholders locked up DOT in favor! pic.twitter.com/lZWrGiPYK2

— Polkadot (@Polkadot) March 10, 2022

Sidenote, it’s also been revealed that Polkadot was the top crypto held by venture capital and hedge funds in Q4 of 2021, according to Messari’s fund analysis data.

Sweeping a market-cap range of about US$19.2 billion to about US$838 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• THORChain (RUNE), (mc: US$1.76b) +13%

• Kadena (KDA), (mc: US$1.88b) +11%

• Zcash (ZEC), (mc: US$1.84 billion) +6%

• Theta Fuel (TFUEL), (mc: US$1.1 billion) +5%

• Celsius Network (CEL), (mc: US$1.36 billion) +4%

DAILY SLUMPERS

• Humans.ai (HEART), (market cap: US$1.21 billion) -13%

• Anchor Protocol (ANC), (mc: US$911 million) -12.5%

• Stacks (STX), (mc: US$1.49b) -12%

• Synthetx (SNX), (mc: US$902m) -8%

• Near (NEAR), (mc: US$6.75b) -7%

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• DEUS Finance (DEUS), (market cap: US$41m) +91%

• Alpine F1 Team Fan Token (ALPINE), (mc: US$108m) +59%

• Lazio Fan Token (LAZIO), (mc: US$24m) +39%

• Haven (XHV), (mc: US$49m) +38%

• STEPN (GMT), (mc: US$95m) +30%

DAILY SLUMPERS

• Redacted Cartel (BTRFLY), (market cap: US$70 million) -16%

• Adappter Token (ADP), (mc: US$49m) -11%

• REN (REN), (mc: US$352m) -10%

• Tomb Shares (TSHARE), (mc: US$137m) -9%

• Victoria VR (VR), (mc: US$105m) -9%

This just in before this columnist grabs a Friday beer… an unnerving story from Reuters regarding Russians reportedly looking to the UAE to unload billions in crypto.

The story mentions an unnamed crypto executive in the UAE who claims to have received a number of recent requests from Swiss brokers to liquidate billions in Bitcoin on behalf of Russian clients, with one apparently planning to “send it to a company in Australia”.

Prominent British cryptographer, OG Bitcoin-development contributor and Blockstream CEO Adam Back is calling BS on it, though. Also, not sure where Austriala is, but it sounds strict…

Calling a hard fake news on this one https://t.co/1ghIzs6E3A makes no sense. Austriala is not a place to evade sanctions. "Cool story bro"

— Adam Back (@adam3us) March 11, 2022