Mooners and Shakers: Axie Infinity pumps 30% – what the actual? Bitcoin steady as US stocks tumble

Coinhead

Coinhead

Strange things are afoot in the Cryptoverse. So what else is new? Sentiment is down, Axie Infinity is pumping, SBF is babbling, and Bitcoin is holding while US stocks take a dip.

We’ll address at least three of those things briefly before belly-flopping into various crypto-market price-action specifics.

Yep, the sentiment is still in “fear” territory on the Crypto Fear & Greed Index. Further FTX contagion fears surrounding significant firms such as Genesis aren’t helping, and neither are crypto firm layoffs from the likes of large exchanges Bybit, and closer to home, Swyftx and CoinJar.

The market’s leading sentiment indicator is certainly down from this time last month when the hopium was starting to spread pre-FTX implosion. That said… “Fear” is better than “Extreme Fear”, which is where things were at for several weeks running, not so long ago.

AXS, the native token for blockchain/NFT play-to-earn game Axie Infinity, shot up about 30% overnight (AEDT) from just under US$7 to almost US$9 at the the time of writing.

Axie has a mixed reputation within the Web3 gaming community, with critics having slammed inflationary aspects of the game’s tokenomics as well as the game itself for being more grind-to-earn than actually being fun to play.

That said, the latter point would certainly describe the majority of Web3 gaming to date, as Illuvium’s Kieran Warwick and BIG Esports’ Chris Smith and others recently attested at Melbourne’s NFT Fest.

But anyway, why’s it pumping all of a sudden? Apparently it’s down to a recent positive development regarding the project’s decentralisation. Here’s a tweet:

Today, a group of over 600 dedicated and impactful community members have been gathered together to help shape the future of @AxieInfinity.

It's been an honor to play a role in this early process. I'm looking forward to being part of whatever comes next! Let's keep building 🛠️ https://t.co/8KfZCl4oiz

— Artic 🦇🔊 (@Axie44) December 5, 2022

The announcement was explained further by the Axie community in a blog post, which details a new governance set-up that’s focused on progressively decentralising the project, giving a greater spread of the control of the game’s future to invested community members.

Embattled former FTX CEO Sam Bankman-Fried was grilled for two hours by The Block‘s Frank Chaparro the other day. And the snippets we’ve seen so far have been hilariously waffly and inscrutable from SBF as he attempts, between awkward pregnant pauses, to navigate The Block journalist’s very direct and straightforward yes-or-no questions.

Here are a few choice highlights. And, as Collective Shift’s Matt Willemsen points out, it seems that part of the reason for SBF’s inarticulate babbling might be down to the possibility he’s multitasking in a League of Legends game or something similar.

Everyone's face when hearing his 3rd attempt to answer essentially the same question pic.twitter.com/uV8Url3Gw7

— Matt Willemsen (@matt_willemsen) December 5, 2022

All the different shades and colours on his face…surely playing League pic.twitter.com/3sLERcGPxX

— Matt Willemsen (@matt_willemsen) December 5, 2022

Meanwhile…on SBFs screen pic.twitter.com/NsdklPrUTz

— dwunk at the gap (@dwunkdwunk) December 5, 2022

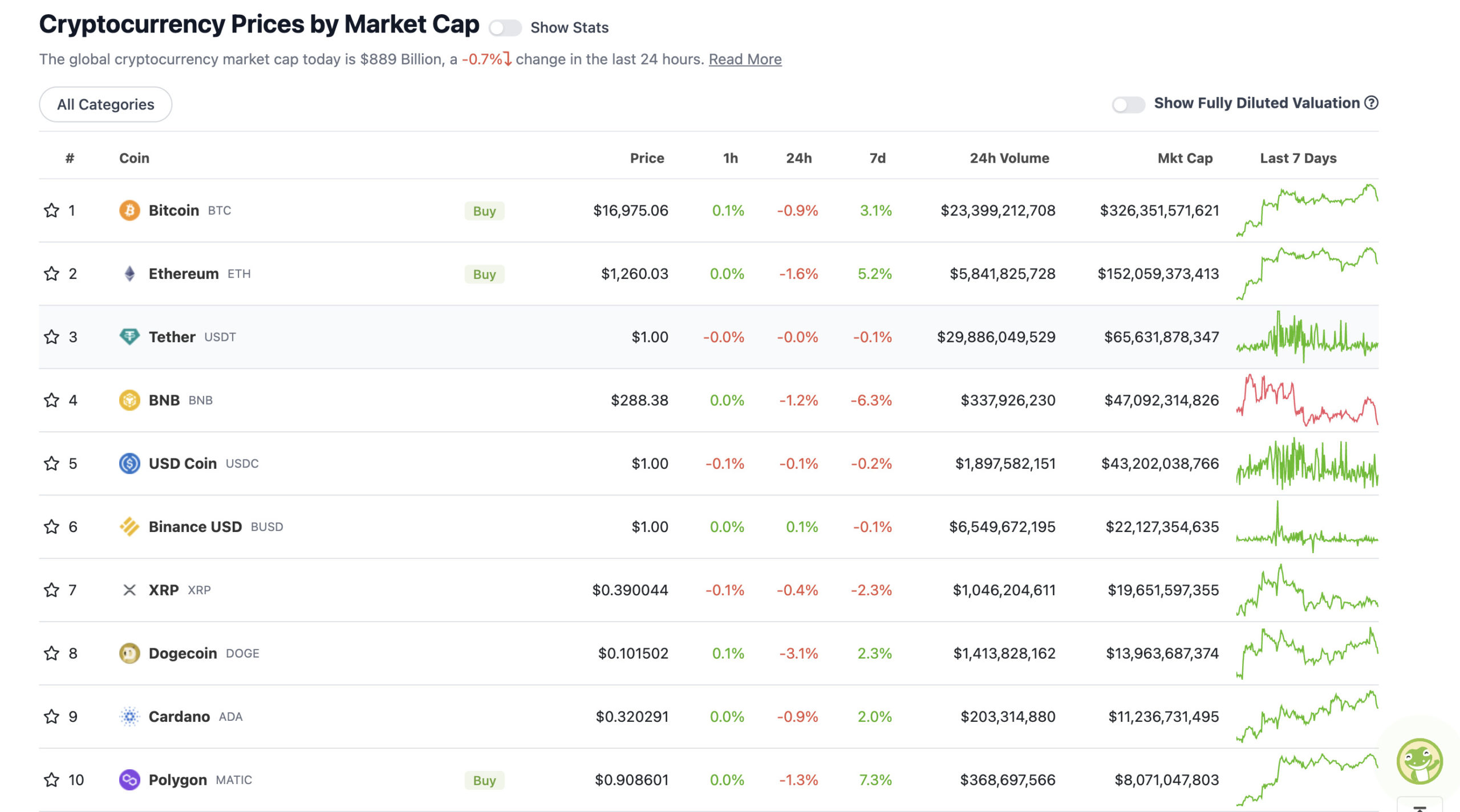

With the overall crypto market cap at US$889 billion, down about 0.7% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Considering the S&P 500 and the Nasdaq are both down close to 2% overnight (AEDT), Bitcoin and the overall crypto market’s performance here is remarkably resilient. For the moment.

Bitcoin, Ethereum and pals usually take that crap-covered hospital pass, and run up the sideline with it a short distance before being gang-tackled violently into touch.

Yes, Bitcoin has presently lost the US$17k mark it was clinging to yesterday, but really not by much. Ethereum is still trading well above US$1,200, meanwhile.

Few things I'd be looking at with #Bitcoin coming days;

– Potential test around $16.5K for longs.

– Potential sweep of the lows and reclaim of $16.9K.

Fow now I'm calm and probably waiting for that HL to happen before triggering positions. pic.twitter.com/cb2MUBBWMl

— Michaël van de Poppe (@CryptoMichNL) December 5, 2022

This recent stabilised price action might possibly be a positive sign that some FTX-contagion sellers’ exhaustion is on the table, although that could easily flip once again with another awesome revelation for the market to overreact to.

But US crypto and forex analyst Justin Bennett is certainly one chart watcher who believes in a possibility for a further relief-rally boost as we head towards the end of the year.

#Bitcoin is again holding up well against today's pullback from stocks.

This #crypto relief rally isn't over, IMO.

— Justin Bennett (@JustinBennettFX) December 5, 2022

Part of that may, of course, very well depend on what the US Federal Reserve does next. Stockhead ed Peter “Guess There’s No One Else To Do It” Farquhar touches on that very subject here in today’s Market Highlights.

Sweeping a market-cap range of about US$6.57 billion to about US$331 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Axie Infinity (AXS), (market cap: US$996 million) +30%

• Synthetix (SNX), (mc: US$459 million) +8%

• Frax Share (FRX), (mc: US$379 million) +7%

• Flow (FLOW), (mc: US$1.76 billion) +7%

• Litecoin (LTC), (mc: US$5.76 billion) +4%

DAILY SLUMPERS

• EthereumPoW (ETHW), (market cap: US$412 million) -5%

• NEXO (NEXO), (market cap: US$368 million) -5%

• Trust Wallet (TWT), (mc: US$962 million) -4%

• ImmutableX (IMX), (mc: US$353 million) -4%

• Chiliz (CHZ), (mc: US$865 million) -3%

A selection of rumour, randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

“Metaverse” has lost out to “goblin mode” for Oxford Language’s Word of the Year. Doesn’t seem like a fair fight, though, seeing as the latter is actually TWO WORDS.

WTF does goblin mode mean, though? Apparently it describes: “a type of behavior which is unapologetically self-indulgent, lazy, slovenly, or greedy.” Sounds like a reasonable fit for a fair amount of what we see on Crypto Twitter.

The quite-popular NFT project goblintown.wtf, which sprung up in the depths of this year’s bear market, digs the news, though.

ₘₐₘᵢ wₑ dᵢd ᵢₜ https://t.co/DQpQaOeHEt

— goblintown.wtf (@goblintown) December 5, 2022

— CryptoPhobiq (@CryptoPhobiq) December 2, 2022

house of cards

— Lawrence Lepard, "fix the money, fix the world" (@LawrenceLepard) December 5, 2022