Mooners and Shakers: Algorand climbs as most of crypto market stumbles

Coinhead

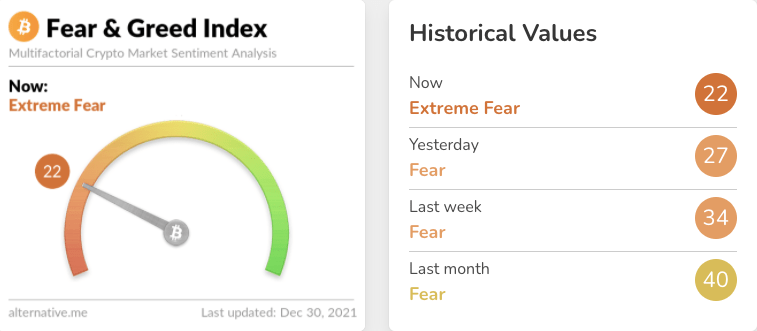

With crypto-market sentiment back in “Extreme Fear” territory as we round out the year, Bitcoin and friends don’t exactly look like they’ve stocked the fridge with champers just at the moment.

But crypto does have a tendency to do the exact opposite of what everyone’s thinking. Which is hardly a scientific thought, but at least it’s something to cling to. And we said “tendency”… so we’re covered.

The Fear & Greed Index has moved back deeper towards the red side of the dial over the past few days – not a bad reflector of where the price action’s at, and a potential buying signal for the particularly brave…

… as well as the true, unerring believers, such as MicroStrategy CEO Michael Saylor…

MicroStrategy has purchased an additional 1,914 bitcoins for ~$94.2 million in cash at an average price of ~$49,229 per #bitcoin. As of 12/29/21 we #hodl ~124,391 bitcoins acquired for ~$3.75 billion at an average price of ~$30,159 per bitcoin. $MSTRhttps://t.co/tNxDwaT8VD

— Michael Saylor⚡️ (@saylor) December 30, 2021

So where are things headed in the short to mid term? Here’s the noted Fantom-ecosystem DeFi architect Andre Cronje’s take…

x/x pic.twitter.com/8gxVIOcsCL

— Andre Cronje 👻 (@AndreCronjeTech) December 30, 2021

… which is probably about as accurate a prediction as you can possibly get.

Both Tom Lee, the co-founder of Fundstrat Global Advisors, and Brock Pierce, the former chief strategy officer with Block One, however, are once again not shy of making a stronger call for 2022. To be precise – a US$200k Bitcoin call.

“So, maybe Bitcoin is in that $200,000 range,” said Lee in a recent Market Rebellion Roundtable discussion. “I mean, I think that’s achievable, and I know it sounds fantastical, but it’s very useful.”

Pierce, meanwhile, told Fox Business on Wednesday that it was conceivable that Bitcoin “could break $200,000 for a moment and come falling back again.”

Both Lee and Pierce had predicted, as did many others, a US$100k Bitcoin for 2021. Let’s hope they’re more on the money this year, but most participants would probably settle for them being 50 per cent correct again.

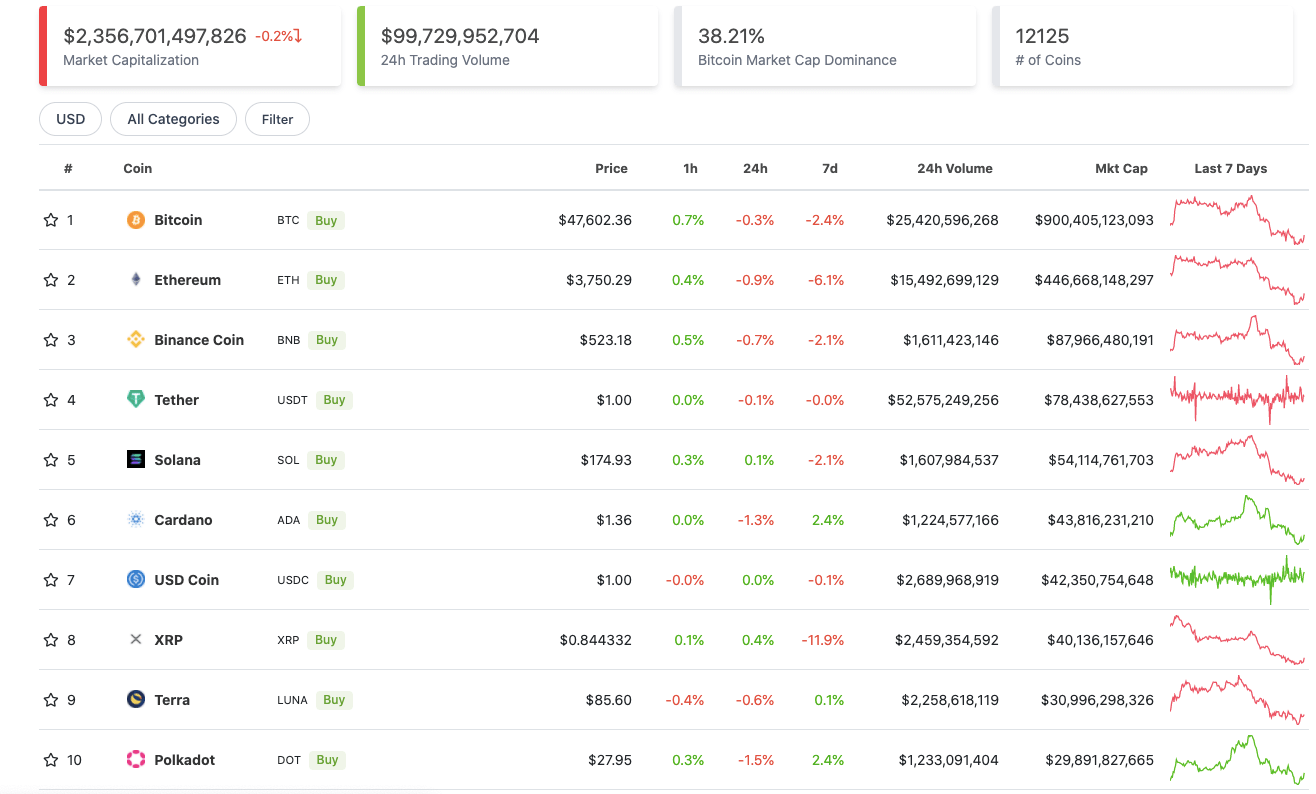

Here’s the state of play in the top 10 by market cap at press time, according to CoinGecko data.

The top 10 is pretty much reflecting the overall crypto market, which is down about 0.2% compared with this time yesterday.

There are no dramatic daily movers here, although all eyes are on BTC and ETH, as usual, to try to ascertain which way it’s all heading.

Here are how two full-time traders, with sometimes quite differing bull/bear views from each other, are seeing the OG crypto and its movements at the moment…

Pretty boring markets lately. Just a process of bottoming out for #Bitcoin.

We're retesting $46K as support, bounced, but we might need to take the liquidity beneath the lows before we're going to make some upwards runs again.

— Michaël van de Poppe (@CryptoMichNL) December 30, 2021

Just want to reiterate this before people call me a perma bear again.

This is the only bullish outlook I can see. It’ll need to break 47-48k by EOW to go back above the 50 WMA.

Please note that Selling pressure is high here.#bitcoin #cryptocurrency #cryptotrading https://t.co/5s3n2nzDq4

— Roman (@Roman_Trading) December 30, 2021

Sweeping a market-cap range of about US$25.3 billion to US$1.3 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Algorand (ALGO), (market cap: US$11b) +17.5%

• Celsisus Network (CEL), (mc: US$1.85b) +10%

• Cosmos (ATOM), (mc: US$8.3b) +7.5%

• Oasis Network (ROSE), (mc: US$1.45b) +7%

• Monero (XMR), (mc: US$4b) +7%

ALGO’s positive surge comes on the back of the Algorand Foundation’s introduction of a US$3 million incentive program for Algofi, a DeFi platform offering low-cost lending and borrowing services to users.

As promised! Congratulations @algofiorg! Another #defi partner launches on @algorand in 2021… https://t.co/ubJ0lWPYGS

— W. Sean Ford (@wsford) December 29, 2021

Fellow layer 1 platform Oasis, meanwhile, can probably attribute its recent momentum to a whopping US$160 million ecosystem fund helping to grow its own network of DeFi and NFT projects. With a considerably smaller market cap than leading smart-contract platforms, the ROSE token is one to watch.

DAILY SLUMPERS

• Radix (XRD), (market cap: US$2.3b) -12.5%

• Convex Finance (CVX), (mc: US$1.96b) -9%

• Olympus (OHM), (mc: US$2.3b) -6%

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• OpenDAO (SOS), (market cap: US$233m) +55%

• Metis (METIS), (mc: US$339m) +39%

• Stake (STAKE), (mc: US$51.6m) +32%

• Maple Finance (MPL), (mc: US$59m) +27%

• Swipe (SXP), (mc: US$366m) +25%

It’s a tail of two airdrops in the lower caps, with OpenDAO’s SOS token faring particularly well today. On Christmas Day, the decentralised project gifted 50% of its entire token supply to all users who’ve traded NFTs and transacted on the OpenSea NFT marketplace platform.

Upcoming listing on FTX: $SOS spot and perpetual future!@The_OpenDAO

Listing details: https://t.co/0pDFNSafc0 pic.twitter.com/tXCI1Ff1pg— FTX (@FTX_Official) December 30, 2021

Gas DAO, on the other hand, which is currently on offer to be claimed by all Ethereum-based wallets, is struggling to build any momentum…

Yes, $gas is safe to claim and trade. There's nothing sus in the contract, but I'd like to take a moment to make a plea that I'm sure will fall mostly on deaf ears:

It is evident that $ens has started a trend – airdropping tokens to "reward" the community, but in actuality…👇

— quit.pcc.eth (@0xQuit) December 29, 2021

DAILY SLUMPERS

• Gas DAO (GAS), (market cap: US$16.8m) -45%

• Polkabridge (PBR), (mc: US$24.8m) -16%

• Glitch Protocol (GLCH), (mc: US$39.6m) -12%