Layer 1 levelling up: How Cardano is building, partnering and expanding

Coinhead

Now that smart contracts have launched on Cardano (ADA), what’s been happening with the “layer 1” crypto?

Plenty. At least, plenty behind the scenes of its current stagnant price action.

With a huge and loyal community of HODLers validating its network, Cardano is a beast of a blockchain. And this is reflected in its overall market cap, which stands at a bit over US$67 billion, just recently pipped by Tether (USDT) at the time of writing.

This makes the project the highest valued proof-of-stake blockchain in existence, seeing as Ethereum (ETH) is still in the process of transitioning from its current proof-of-work consensus to becoming a full-on staking chain. And that’s something which may not happen till early next year at this stage.

But Cardano, in the meantime, has become one of the most decentralised cryptos around – certainly among the big-cap smart-contract platforms – with 71.91 per cent of its current total supply staked by holders, earning them around five to eight per cent APY, on average, on their ADA.

The number of $ADA Hodlers reached a new ATH this month of 243 thousand addresses holding an aggregated volume of 5.49b ADA.

And at the current price, over 70% of the addresses currently holding ADA are in a state of profithttps://t.co/8ME8STegu5 pic.twitter.com/MnghWKB66X

— IntoTheBlock (@intotheblock) September 27, 2021

A passionate and growing community, strong fundamentals, a building ecosystem and a reputation for some of the most rigorously tested, scientifically peer-reviewed technology in the business… it all makes Cardano increasingly attractive to big investors looking for solid bets a short drop down the market cap list from Bitcoin and Ethereum.

Here’s just some of what’s been happening with Cardano in recent months and weeks, some of which was discussed at length at the Cardano Summit 2021, held a few weeks ago in late September.

The Alonzo hard fork, completed in early September, released the project’s loooonnnng-awaited smart-contract capability into the wild – and thus, the ability to build dApps (decentralised applications) on top of the layer 1 blockchain.

Cardano is now swiftly seeing its ecosystem grow and build out into some of crypto’s brightest sub-sectors, including DeFi, oracles, gaming, NFTs and more.

It’s still a long way from making a significant dent in the network-effect advantage that Ethereum possesses, but in expansion terms, it’s beginning to rival other building layer 1 ecosystems, such as Solana, Polkadot and Avalanche.

In March, Cardano founder Charles Hoskinson told Bloomberg that it’s his goal to “run countries on this blockchain”. The man thinks big.

And, while Hoskinson said he doesn’t care about the likes of “Uniswap, CryptoKitties and other things”, he did say back then that at least 100 companies currently on Ethereum were “in the pipeline” to transition over to Cardano’s blockchain.

Cardano has in-built porting functionality designed to allow Ethereum-built smart-contract applications to transition over with relative ease.

And speaking of running countries on Cardano, Hoskinson and his team at IOHK (Input Output Hong Kong), as well as the project’s commercially focused arm, Emurgo, have a strong focus on building crypto and blockchain-technology adoption across the African continent.

Cardano is unequivocally one of the leading blockchains at the forefront of an African crypto-tech push.

In one of crypto’s most underrated but significant partnerships, IOHK and the Ethopian government announced earlier this year they are working together to track the performance of school students in the country.

The partnership involves five million secondary school students and 750,000 teachers, all using Cardano’s Atala PRISM decentralised identity solution to create tamper-proof student records and help identify areas of educational under-achievement.

It’s a big deal for blockchain adoption – but perhaps more likely a longer game in terms of price-moving action for ADA holders.

There is good potential for consequential transactional volume to be driven into the network on the back of this in the long run, however, and it’s just one of several partnerships IOHK and Cardano has brewing on the African continent.

5/ Earlier this year we saw IOG announce the biggest blockchain deal ever with the Ethiopian government to help set up a tamper-proof system of educational records for 5m students. We’re a contender to run the entire national digital identity system toohttps://t.co/7b1ae6hXFq

— ADA whale (@cardano_whale) October 10, 2021

While the likes of Arbitrum and Optimism are independently built “layer 2” scaling solutions that are designed to help optimise the Ethereum network as it continues to grow and expand, Cardano has its own scaling solution baked into its protocol as part of the blockchain’s overall design.

It’s called Hydra, and it’s natively built to deal with any issues that arise from attempting to run a seamless high-throughput blockchain network.

As a recent IOHK blog post explains, Hydra is designed to help strike the balance required between maintaining low network transactional fees to satisfy users, and keeping them at a level that “deters potential Denial-of-Service (DoS) attacks”. The solution is also designed to ensure the network avoids storage-based issues as transactional history logs grow over time.

Hydra works via a concept known as “isomorphic state channels”, which are “off-chain ledger siblings” that IOHK calls “Heads”, connected both to each other and to the main chain.

If that’s all getting a bit technical, no worries. Just know that Cardano has an in-built solution to help its blockchain scale as it grows, and it’s named after a multi-headed mythological beast. Cool.

Think of the body of the hydra beast as Cardano’s main chain. Then think of all the heads being able to offer 1000 transactions per second of throughput. And think of each Hydra head representing a validator/staking pool on the network. If Cardano has, for example, 1000 of these heads, in theory, its blockchain will be able to scale up to handle one million transactions per second. And that is… fast.

Presuming Hydra, which is still being tested at the time of writing, is released without a hitch, it could be a potentially groundbreaking development in the world of blockchain. You can read more about it here.

Stablecoins are a key component of decentralised finance – so no surprises that some have now sprung up within the Cardano ecosystem.

Djed (pronounced “jed”) is one such enterprise, which self describes on its website as “a crypto-backed algorithmic stablecoin that acts as an autonomous bank developed by IOG [Input Output Global] and issued by COTI.”

COTI, by the way, is a decentralised payments platform that has partnered with Cardano this year to act as a payment rail for the ADA Pay application.

COTI is the official issuer of Cardano’s stablecoin!

As just revealed during the @CardanoStiftung summit by none other than Charles Hoskinson, COTI will become the official Djed issuer, Cardano's new stablecoin!

Read more: https://t.co/omAxVZUOow$COTI $ADA @IOHK_Charles pic.twitter.com/yschC9wdbd

— COTI (@COTInetwork) September 26, 2021

Algorithmic stablecoins use smart contracts to maintain price stability and work effectively and smoothly within DeFi transactions, and these are ultimately the core aims of Djed.

You can read more about it here, and learn why IOHK calls it the “first stablecoin to use formal verification to eliminate price volatility”.

There’s also another interesting stablecoin project designed for Cardano that’s just been announced by the DeFi liquidity protocol MELD.

Interesting, because this one’s backed by gold, stored securely in a vault, and then tokenised and fractionalised.

It relies on gold’s generally stable value, and is enabled as part of a three-way partnership with Tingo Holdings, Nigeria’s largest mobile network, and Ubuntu Tribe, an ethical crypto company that tokenises natural resources.

Announcement from @MELD_labs and Tingo Mobile looking to bring 9m customers across Nigeria to Cardano.

As part of this partnership, there will also be a gold-backed stable coin to the protocol.#CityAMSummit @CityAM_Crypto #Cardano #CardanoCommunity @tingomobileng #Blockchain pic.twitter.com/G6zqggzBLF

— DT (@I_Am_DTaylor) September 30, 2021

Some other pretty significant partnership bombshells were dropped at the Cardano Summit 2021. Here are three of them…

• The Ethereum rival has cut a deal with major US TV and wireless service provider Dish Network to integrate the Cardano blockchain into the widespread telecom business. Cardano will also apparently be providing its digital identity services to Dish Network consumers.

Here's the Dish/Boost announcement: https://t.co/bzk35RbcaM

— Charles Hoskinson (@IOHK_Charles) September 25, 2021

• Cardano has also partnered with esports and gaming platform Rival to develop “agnostic NFT marketplaces, fan rewards, and more for Rival and its partners”, according to a recent press release.

• Chainlink and Cardano, together at last. The layer 1’s developer IOHK has now teamed up with crypto’s leading “oracle” to help Cardano developers build smart contracts for secure DeFi applications.

Announcement: we partnered with @chainlink to help Cardano developers build smart contracts for secure DeFi applications. For press release, DM us or email [email protected] #CardanoSummit2021 pic.twitter.com/1qOs0WdLtq

— Input Output Media (@IOHKMedia) September 25, 2021

The Cardano ecosystem, by the way, does have at least one other oracle solution that we know of, called Charli3 (C3), sitting all the way down at number 924 on the CoinGecko list, with a market-cap valuation of just US$17.5 million at the time of writing.

You’ll find it somewhere on the following overview. This is just a screenshot of a clickable version maintained by the Pool Germany ADA stake pool, which can be viewed in all its interactive glory here.

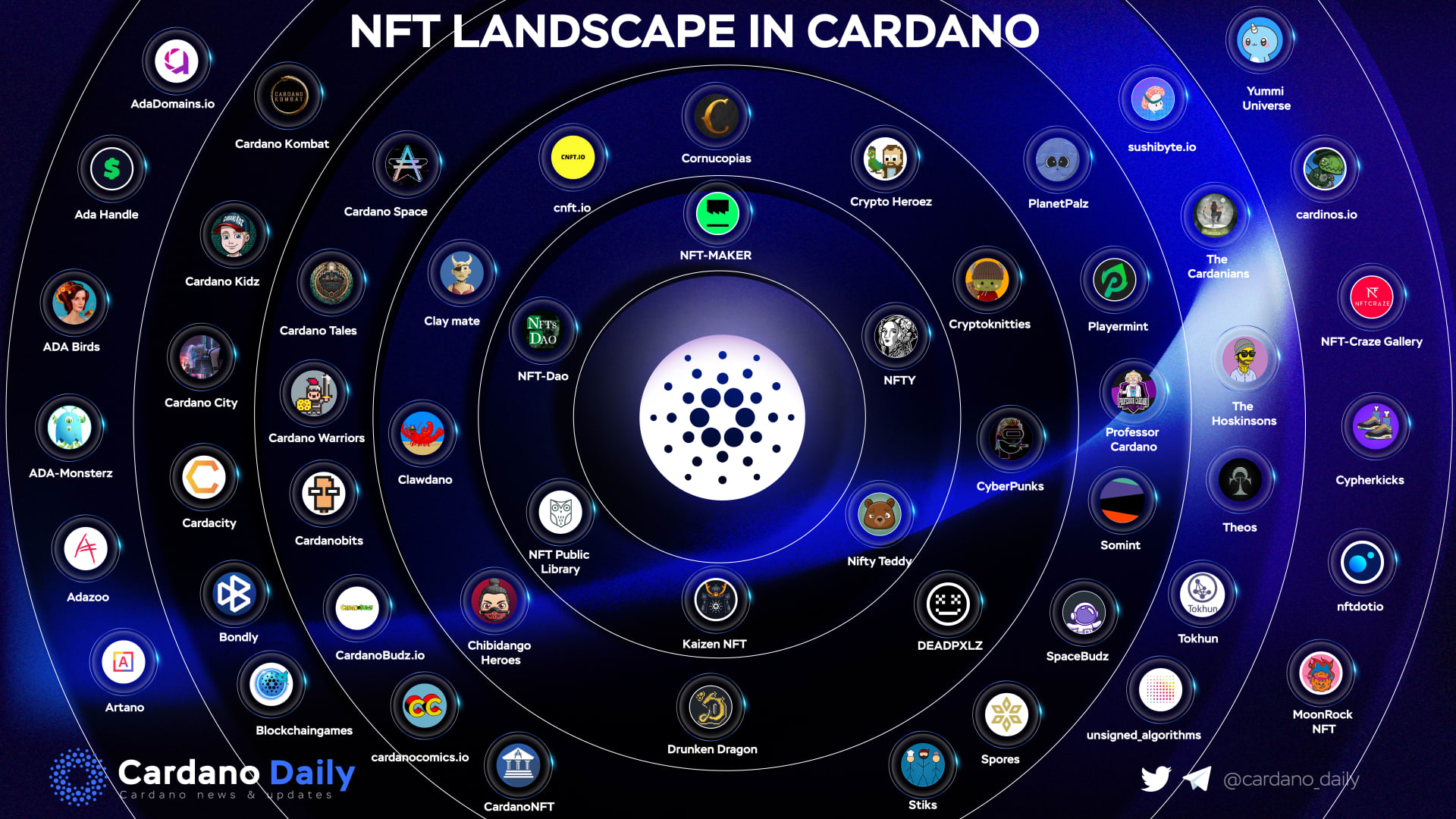

And, for a more focused look at the Cardano NFT landscape, this next chart comes courtesy of Cardano Daily. This will most likely be subject to change pretty swiftly, as nonfungible token projects are being created and minted thick and fast on every available blockchain, and Cardano is no exception.