Bitcoin looks to retest 200-day moving average; Fox Corp makes a crypto move

Coinhead

Coinhead

As Bitcoin (BTC) shuffles anxiously from foot to foot considering a dump, analysts have been looking at the 200-day moving average line as potential support.

That line, which represents Bitcoin’s average price over the past 200 days, is currently sitting at about US$46K. In the past 12 hours, BTC has been chopping around in a range between roughly US$46,600 and $47,600.

If the OG crypto does lose the 200-day MA, then various analysts, including those at Rekt Capital, believe there is a “major demand zone” for buyers in the US$44K zone.

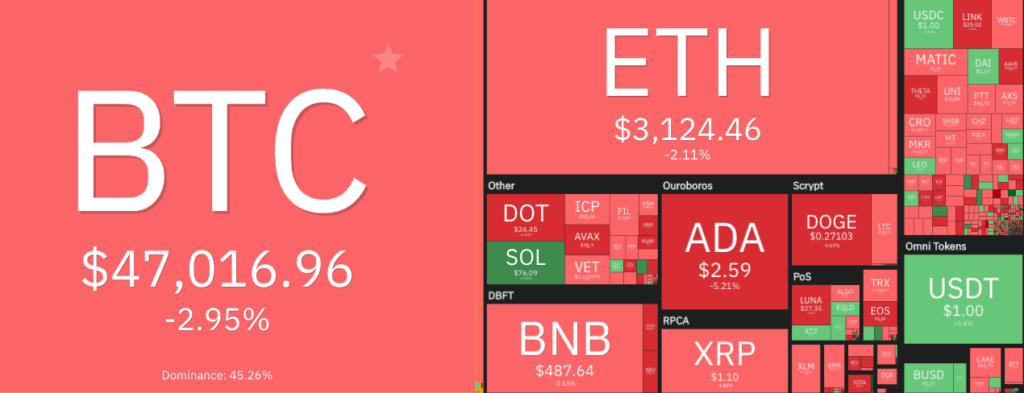

At the time of writing, the state of play for the top coins in the market is this:

The entire crypto market cap reflects the redness of that Coin360.com chart, and is down 1.5% on the day at US$2.08 trillion.

The coins in the top 10 suffering the biggest 24-hour losses include Polkadot (DOT) -5.81%; Dogecoin (DOGE) -5.77%; Cardano (ADA) -5.21%; and XRP -5.18%. Solana (SOL), however, is bucking that trend and is up 6.71% at the time of writing, changing hands for US$75.40.

No.2 coin Ethereum (ETH) has been closely tied to Bitcoin’s chart moves recently, and is currently down 2.11% in the past 24 hours, trading at US$3,124.

It could be looking at some “higher low” support to retest, just under $US3,000.

Meanwhile, outside of the top 10, some of the double-digit percentage losers that caught our eye today include: Veracity (VRA) -14.34%; BEPRO Network (BEPRO) -14.14%; Energy Web Token (EWT) -13.9%; and the fractionalised Feisty Doge NFT (NFD) -12.18%.

Other coins of interest actually doing well today, however, include: the Ethereum-transaction privacy tool Tornado Cash (TORN) +40% (maybe some shadowy super coders are pumping it); decentralised payments protocol COTI +36.29% (it’s had a couple of big exchange listings); Yield Guild Games (YGG) +24.98%; and metaverse project Wilder World (WILD) +14.9%.

What a day!! $COTI getting listed on both @CoinbasePro (ERC20) & @HuobiGlobal (NATIVE) on the same day🥳https://t.co/GA1fNbsa6Ghttps://t.co/dJaZJTw5O2

— L0U7 (@__L0U7__) August 26, 2021

US mega-media brand Fox Corporation has announced it’s made a US$100 million strategic investment into Eluvio, a California-based media-streaming solution that uses blockchain technology.

The motive behind the move is reportedly to “accelerate the adoption of Eluvio’s blockchain/NFT platform” across the media and entertainment industry.

Fox says this marks the completion of Eluvio’s Series A round of funding and, as part of the deal, the blockchain firm will provide the tech platform for Blockchain Labs, which is Fox Entertainment’s and Bento Box Entertainment’s recently launched NFT business.

Additionally, Paul Cheesbrough, Chief Technology Officer and President of Digital at Fox Corp, will join the board of Eluvio.

Here’s what he had to say in a press release:

“At FOX, we believe that the blockchain, and the overall shift towards a more decentralized web, is providing creators with a wealth of opportunities to reach consumers with exciting new experiences.”

We won’t bore with you the rest of the comments from the release, suffice to say those involved are “honoured”, “proud” and “excited” by the deal.

In search of further comments, Stockhead has tried to reach the Eluvio team today, as well as Rupert Murdoch, Homer Simpson and Barney Gumble. At press time, none of them had got back to us.

• Microsoft has won a US patent for a”ledger independent token service”. WTF’s that? It’s a cross-chain crypto token-management system. Interesting move.

• Rumours are circulating, led by Coindesk, that US banking beast Citigroup is awaiting the regulatory green light to trade Bitcoin futures on the Chicago Mercantile Exchange.

• Facebook‘s crypto boss David Marcus told Bloomberg this week that the social-media giant is “in a really good position” to build NFT features. NFTs… probably nothing.

• Morgan Stanley joins JP Morgan and Ark Invest with Grayscale BTC exposure. The US investment bank has bought over 928,000 GBTC shares, according to an SEC filing.

• Japanese exchange Liquid has received a US120 million loan from US exchange FTX to cover its recent hack losses. Sam Bankman-Fried to the rescue.