Elon Musk’s X platform obtains the licence needed for adding crypto payments

Coinhead

Coinhead

On a day in crypto when Grayscale dominated headlines (although Bitboy’s doing his best), Elon Musk figured he’d also step up to the plate, with some X-related news.

This may well have slipped under the radar of most observers, but it’s pretty interesting – quite possibly mostly for holders of Dogecoin (DOGE), which we’ll get to in a sec.

Essentially, it’s come to light that The Zuck-taunting billionaire and current owner/CEO of the X (do we need to keep saying formerly Twitter?) platform has obtained a Rhode Island “currency transmitter” licence.

Say what?

It’s a licence that’s needed for operating crypto payments and trading in the US of A, and, thanks to info being spread across various X accounts, we can tell you it was approved for X the other day, on August 28.

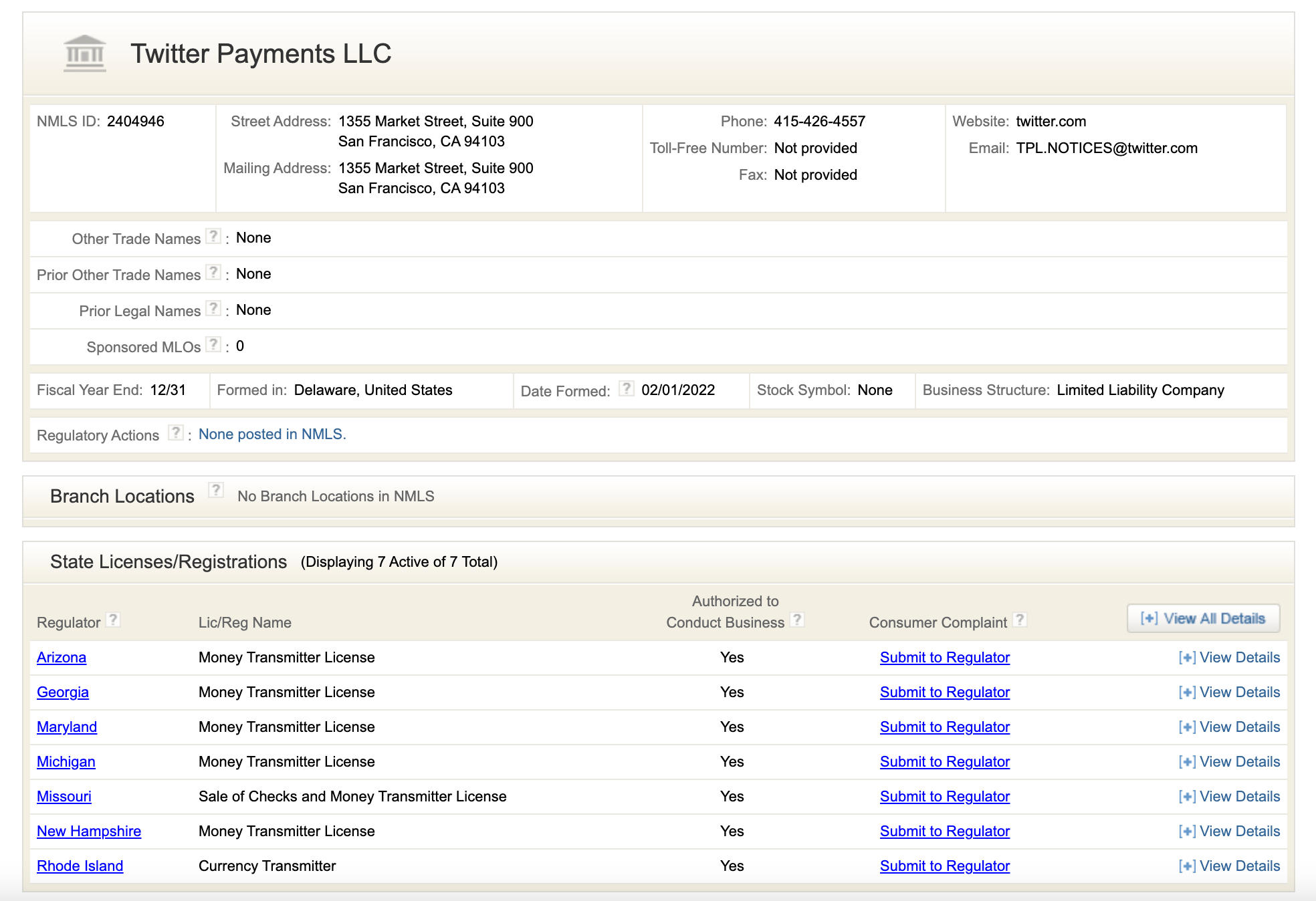

And, more precisely, that’s backed up by data shown on an American website known as NMLS (Nationwide Mortgage Licensing System) Consumer Access. See below.

The licence would also enable the social media platform to store, transfer and exchange digital assets for its humungously large user base.

As Musk has pointed out on more than several occasions, he has some history when it comes to the electronic payments business, having co-founded PayPal with venture capitalist Peter Thiel back in 2000. And it’s well known he has plans to turn X into an “everything app”.

The rumours have been strong for months now that crypto is very much part of his plans for the app’s payments functionality.

In terms of which cryptos will likely be front and centre in this potential integration, you’d be mad not to think Bitcoin (BTC), probably Ethereum (ETH) and very much DOGE (Musk’s personal favourite) would be the hot top-three contenders.

🚨 BREAKING: Elon is building a crypto wallet for Twitter

He has just gotten the license required for crypto payments in US

The writing is on the walls. Crypto is coming to X in a big way

The possibilities can revolutionize social media

Imagine these scenarios:…

— NFT God (@NFT_GOD) August 29, 2023

Earlier in the day, we were sent some commentary from BTC Markets CEO Caroline Bowler on Grayscale’s court win over the SEC regarding the crypto asset manager’s quest to turn its GBTC Trust into a spot Bitcoin ETF.

The crypto exchange boss also gave us her thoughts on this latest Musk/X payments development…

On Grayscale

“Grayscale’s recent legal victory against the US Securities and Exchange Commission (SEC) marks a significant shift in digital assets.

It’s important to clarify it is not a ruling in favour of converting its fund into a Spot Bitcoin ETF, as some might have anticipated.

Instead, the presiding judge granted Grayscale’s petition for review and simultaneously vacating the commission’s order. This development underscores the complexity of regulatory dynamics in the crypto space, where legal battles can shape the path of innovative financial instruments.”

On the X licence

“Simultaneously, the news of Elon Musk’s X (formerly Twitter), obtaining a license to facilitate US crypto payments amplifies the ongoing transformation of the crypto landscape.

“Endorsements from prominent figures like Musk lend credibility to the sector and hold implications for international markets, including Australia.

“The impact is likely to fuel interest and confidence in cryptocurrencies, potentially inspiring similar initiatives in the Australian context.

“Announcements by global institutional players, such as Blackrock, Fidelity Digital Assets, Charles Schwab, and Citadel Securities, signifies a notable shift towards the widespread acceptance of digital assets as an investment class.

“The escalating involvement of these well-established financial entities highlights the growing demand for cryptocurrencies.”