You might be interested in

Coinhead

Animoca Brands reveals strong financial position as it looks to capitalise on a big web3 year

Coinhead

The Bitcoin Halving: This Time it’s Institutional – coming to a crypto portfolio near you

News

Coinhead

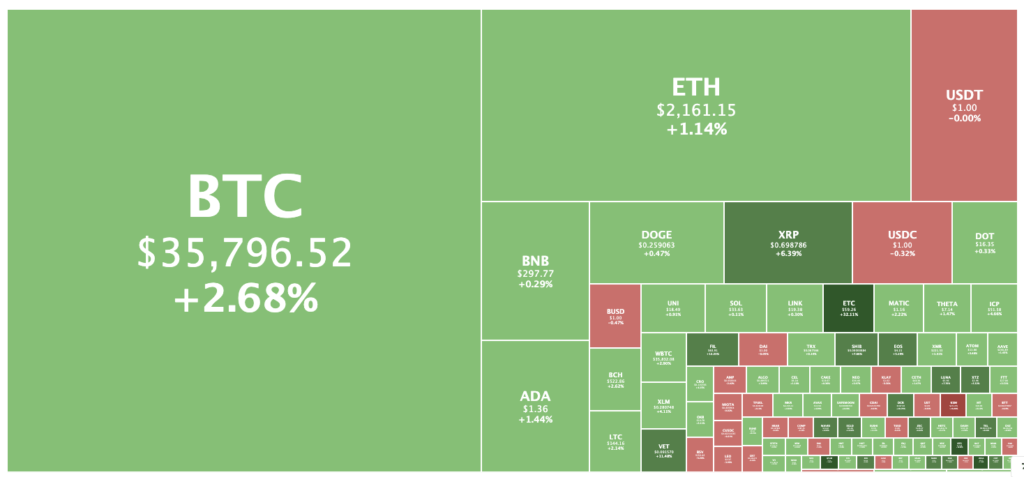

Crypto is up for a third straight day this morning, with Bitcoin hitting an 11-day high overnight and the overall market rising by 3.0 per cent to US$1.45 trillion.

Bitcoin was trading at US$35,845 at noon AEST, up 3.5 per cent from yesterday, and reached as high as US$36,500 around 3am — the first time since June 19 it was changing hands for over $36,000.

“We can see Bitcoin is currently crawling upwards, there’s some momentum, which means that altcoins are also getting some momentum again,” Dutch trader Michael Michaël van de Poppe said in a YouTube update.

The Twitter account Bitcoin Charts posted that Bitcoin’s daily close (at 10am AEST/midnight UTC) was BTC’s first since June 16 above its eight, 13 and 21 daily exponential moving averages. “This is a great indication of the bullish momentum in the near short-term,” the account wrote.

The Crypto Fear and Greed index was at its highest level since June 17, although the 28 on the 1-100 scale was still indicating “fear”.

And just like that, everyone is bullish on #Bitcoin again.

Remember those who stayed bullish when it wasn’t popular to do so.

— Ben Armstrong (@Bitboy_Crypto) June 29, 2021

Ethereum was up 1.7 per cent to US$2,160, while Ethereum Classic was the biggest gainer in the top 100, rising 30 per cent to US$58.81 after developers announced its “Magneto” protocol upgrade would take place in late July.

Bitcoin Gold, Qtum, Elrond, Filecoin, Decred and VeChain had also posted double-digit gains, while yesterday’s top gainer, Kusama, was today’s biggest decliner out of the top 100 coins.

Meanwhile, American sports legend Tom Brady and his supermodel wife Gisele Bündchen have taken an equity stake in crypto billionaire Sam Bankman-Fried’s FTX Trading, the company behind the FTX crypto exchange and the Blockfolio crypto portfolio tracking app.

They’ll also both receive an undisclosed amount of crypto in exchange for Brady becoming an FTX ambassador and Bündchen becoming an advisor for environmental and social initiatives.

“It’s an incredibly exciting time in the crypto-world and Sam and the revolutionary FTX team continue to open my eyes to the endless possibilities,” Brady, the quarterback of the Tampa Bay Buccaneers and a seven-time Super Bowl champion, said in a statement.

“This particular opportunity showed us the importance of educating people about the power of crypto while simultaneously giving back to our communities and planet. We have the chance to create something really special here, and I can’t wait to see what we’re able to do together.”

Bündchen said in the statement that “it was fascinating getting to know more about the crypto universe! Cryptocurrency will become more and more familiar to all of us as time goes on”.

“What attracted me most about this partnership was the potential to apply resources to help regenerate the Earth, and enable people to lead better lives, therefore generating real transformation in our society.”

FTX has made a big push into sports, spending US$135 million for the long-term naming rights to the arena where the Miami Heat basketball team play; paying Major League Baseball for umpires to wear FTX branding; and spending US$210 million to sponsor the esports team TSM.

FTX also bought Blockfolio for US$150 million last August.

Stoked to partner with @SBF_Alameda and @FTX_Official as we continue building the future of crypto. I hear we’re headed to the moon? pic.twitter.com/BdReBkNfxg

— Tom Brady (@TomBrady) June 29, 2021

‘

USD Coin will soon become much more widely available.

Centre, the consortium behind the stablecoin, has announced it will be launched on Avalanche, Celo, Flow, Hedera, Kava, Nervos, Polkadot, Stacks, Tezos, and Tron “in the coming months”.

USDC launched on Ethereum in 2018 and on Stellar, Allgorand and Solana in the second half of last year.

“From inception, our vision was to support USDC on multiple blockchain platforms,” Centre said in a statement. “Bringing USDC to multiple chains enables users to take advantage of the speed, scalability and cost-efficiency provided by next-generation public chains.”

Centre was founded by Coinbase and the payments company Circle. Accounting firm Grant Thornton LLP attests each month that each USD Coin is backed by US dollars. As of Wednesday, USDC was the No. 8 crypto with a market capitalisation of US$25 billion, up from $20 billion in late May. It’s the No. 2 stablecoin, behind Tether, which has a market cap of US$65 billion.