Chain Reactions: Ethereum gains 6% as Bitcoin also pushes higher; LayerZero raises US$120m

Coinhead

Coinhead

Bitcoin and Ethereum have been moving up and slightly to the right, on the whole, this afternoon, fuelling hopium for a broader crypto-market breakout.

That said, woods. Not out of them yet. Macro considerations. Oil prices, inflation, Fed, recession, zealous US regulators, JPMorgan’s Jamie Dimon being a negative Nellie, and so on and so forth. Just keeping it real.

The jury is out on whether the Fed will, in May, ease its inflation-combatting tightening efforts in light of the clear strain being shown by the global banking industry. The fact OPEC has caused the price of oil to surge after a surprise decision to cut supply might yet throw a spanner in the works and give Powell and co reason to keep hiking for a little why yet. Just something to keep in mind.

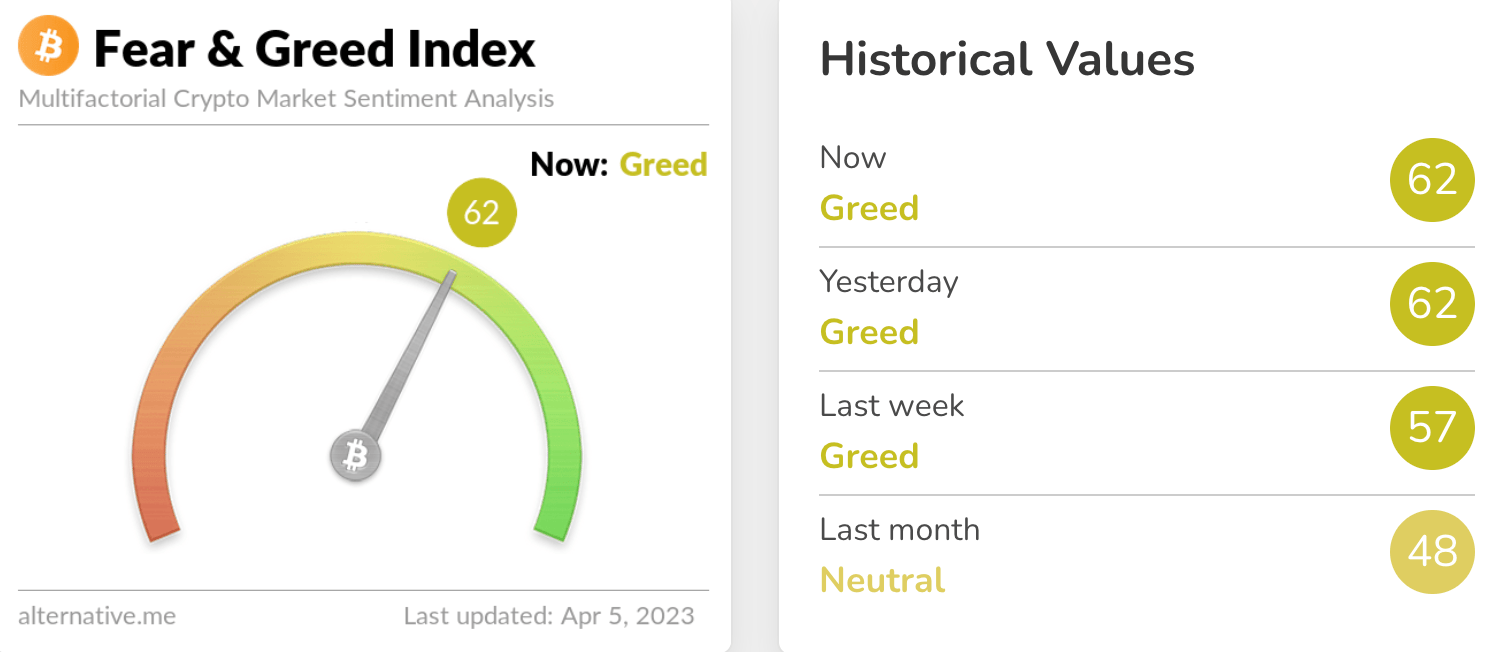

But moving on, let’s see where the Fear & Greed Index is up to. Exactly where it was sitting yesterday as it happens. The market’s sentiment is a soupy mush of emotions, as always, but simmering olive green with just a hint of FOMO. It probably doesn’t need any more salt.

With the overall crypto market cap at US$1.25 trillion, up about 3.3% over the past 24 hours, here’s the current state of play among top 10 tokens – according to CoinGecko.

That’s a solid leap by Ethereum (although it was up 6% earlier, trust us). In fact, moving up over US$1,900 now places ETH at a seven-month price high.

The crypto industry’s leading layer 1 protocol has another huge network upgrade coming up, Actually, two of them – the Shanghai and Capella hard forks.

Together, they’re being referred to as the Shapella upgrade (see what they did there?). All you really need to know is that A) they’re set to occur on or around April 12, and B) will include the implementation of EIP-415, which will allow Ethereum network validators and stakers to withdraw their staked ETH for the first time.

There will also be other implementations that aim to increase transaction speed and reduce transaction costs.

In addition to EIP-4895, there are several other EIPs in the Shanghai fork, most of which aim to lower gas costs for Ethereum developers. The withdrawal of staked ETH has been successfully simulated on the Zhejiang testnet.

— Branimir Stojanović (@branelost) April 4, 2023

Why is it potentially bullish? Well, there’s a case for it being a bearish, sell-the-news event, too, however several analysts, such as venture capitalist Chris Burniske for instance, seem convinced that the influx of capital and ETH liquidity and broader ecosystem activity it will bring, should drive the price of ETH higher.

The builder of a prominently promising and emerging blockchain interoperability protocol, LayerZero Labs, has just finished a Series B funding round, pulling in an impressive US$120 million from several big-name investors and giving the project a US$3 billion valuation.

Triple unicorn, and it’s barely out the gates.

Among those forking out capital for the protocol were auction house Christie’s, Samsung, leading NFT platform OpenSea, Circle (the issuer of the USDC stablecoin), and notable crypto and tech VC firm Andreessen Horowitz (a16z).

In some info shared with Stockhead this morning, Ryan Zarick, co-Founder and CTO of LayerZero Labs, noted: “Imagine a future where a single user-facing application can harness the speed of Solana, the security of Ethereum, and the cheap file storage of Arweave, while also being fully abstracted to the user.

“This is our vision, made possible by the LayerZero protocol that seamlessly connects all blockchains and enables chain-agnostic applications to be built across various blockchains to create a best-in-class user experience. The days of choosing one chain to build on are over; the future is omnichain applications.”

— LayerZero Labs (@LayerZero_Labs) April 4, 2023

Speaking with the New York crypto media site Decrypt, meanwhile, LayerZero co-founder and CEO Bryan Pellegrino explained the protocol like this:

“[It’s] kind of like the internet – it’s a layer below,” he said. “Think about PayPal. PayPal is kind of like a money-bridge application that lives on top of TCP/IP. The internet enabled it, and those applications were built to facilitate financial transfer. LayerZero is not inherently financial. It’s not inherently gaming. It’s nothing. It’s pure transfer of data.”

Sounds tricky to wrap the noggin around, but it certainly doesn’t sound like nothing. Also, there might still be a chance at an airdrop for this one, if you can muster the time and energy to look deeper…

Missed $ARB? Here is how to Interact on @LayerZero_Labs to qualify for the $ZRO token #Airdrop

MAINNET & TESTNET INTERACTIONS.

MEGA AIRDROP STRATEGY 🎯

A thread 🧵 pic.twitter.com/AlHT0pgzM7

— CHASE💀 (@Abrahamchase09) March 19, 2023

• Lido DAO (LDO), (market cap: US$2.34 billion) +13%

• Rocket Pool (RPL), (mc: US$935 million) +12%

• Curve DAO (CRV), (mc: US$810 million) +11%

• Frax Share (FXS), (mc: US$704 million) +11%

• The Graph (GRT), (mc: US$1.37 billion) 9%

Gensler staring at the Doge as he loads up Twitter on his government-issued Thinkpad pic.twitter.com/nv1od7LiFD

— db (@tier10k) April 4, 2023

"I do not respect the SEC. I do not respect them"

– Elon Musk on SEC #Dogecoin #Ethereum #Bitcoin pic.twitter.com/wXFD6b85pJ

— Altcoin Daily (@AltcoinDailyio) April 4, 2023

Is this finally it or do we need to go for another round trip of the scenic route before leaving for real?

— DonAlt (@CryptoDonAlt) April 5, 2023

#Bitcoin follows the path.

Crucial area at $27,900 held and breakout overnight upwards to $28,700.

Consolidation makes it likely that we'll be continuing towards $30,000. pic.twitter.com/0KjNN3lBfX

— Michaël van de Poppe (@CryptoMichNL) April 5, 2023