Chain Reactions: Crypto market sentiment slips into ‘Neutral’ as Bitcoin price fades ahead of CPI report

Coinhead

Coinhead

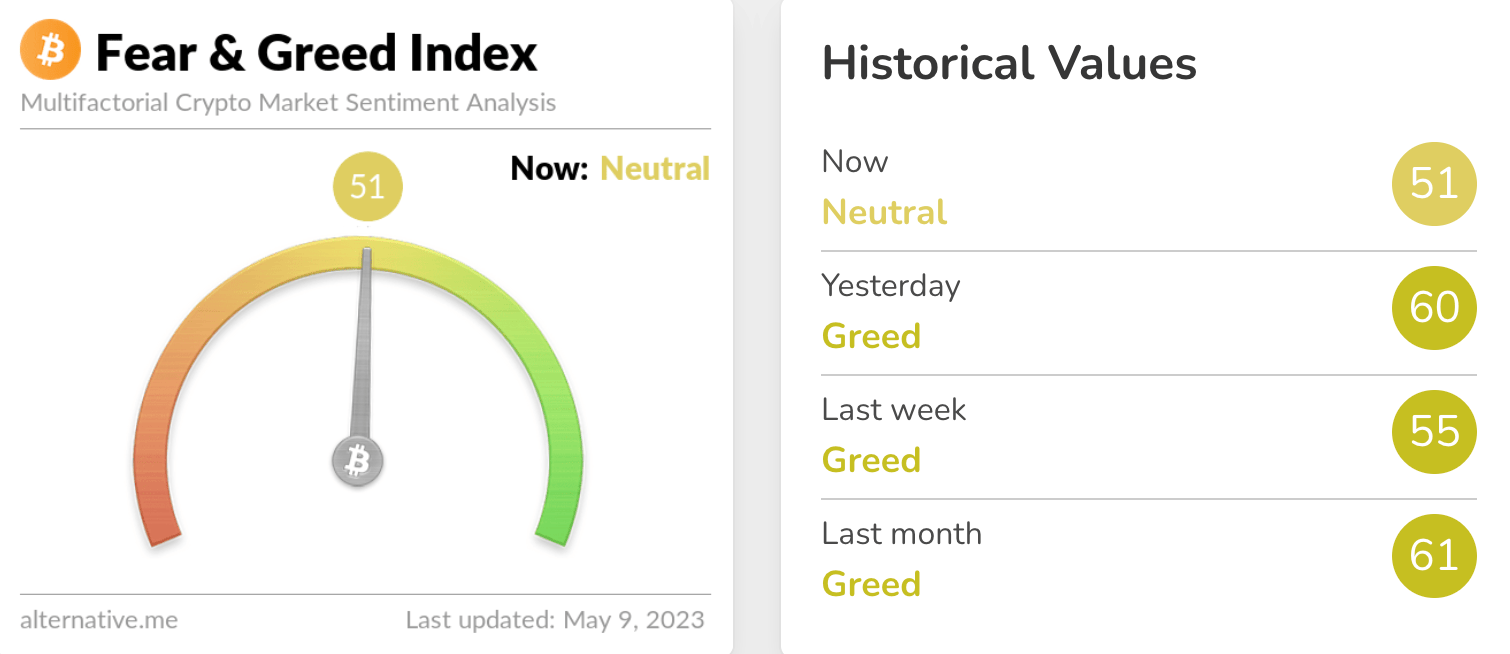

Bitcoin and the crypto market cap at large have slipped a tad since this time yesterday, as the market shifts from a Greed-focused sentiment to a more cautious Neutral area.

That’s according to the latest reading on the Crypto Fear & Greed Index dial registered earlier today.

The index, which takes its data from a mix of market momentum and volatility statistics, transactional volume, social media, surveys and more, has dialled back to the Neutral position after weeks of greedy sentiment.

The latter has certainly been representative of the frothy FOMO for memecoins such as $PEPE, $WOJAK and $MONG, that’s been dominating the crypto-trading conversation of late.

Another reason for some caution creeping in could well be the upcoming US CPI (Consumer Price Index) data report for April that’ll be revealed later this week.

The index tracks price movements across a broad range of goods and services and this monthly data-reveal occurrence has been something of a catalyst for short-term BTC price movement for what seems like forever now – certainly all the way through the bear market that began early last year.

If the CPI data comes in “cool”, as in lower than expected, or even just as the market anticipates, then this could provide the boost Bitcoin and pals would appear to need right now.

If it goes the other direction – “hot”, then more dippage will likely be on the cards as it will increase the possibility of the US Federal Reserve sticking to its rate-hiking guns for a while longer this year.

All right, #Bitcoin is still trending down, $27,400 reached.

Probably we'll test $26,800 even, but these are the zones for potential longs (going into CPI).

Question will be whether we'll provide a bullish div and such for such a long.

Patience. pic.twitter.com/GzqZmiH1Yj

— Michaël van de Poppe (@CryptoMichNL) May 8, 2023

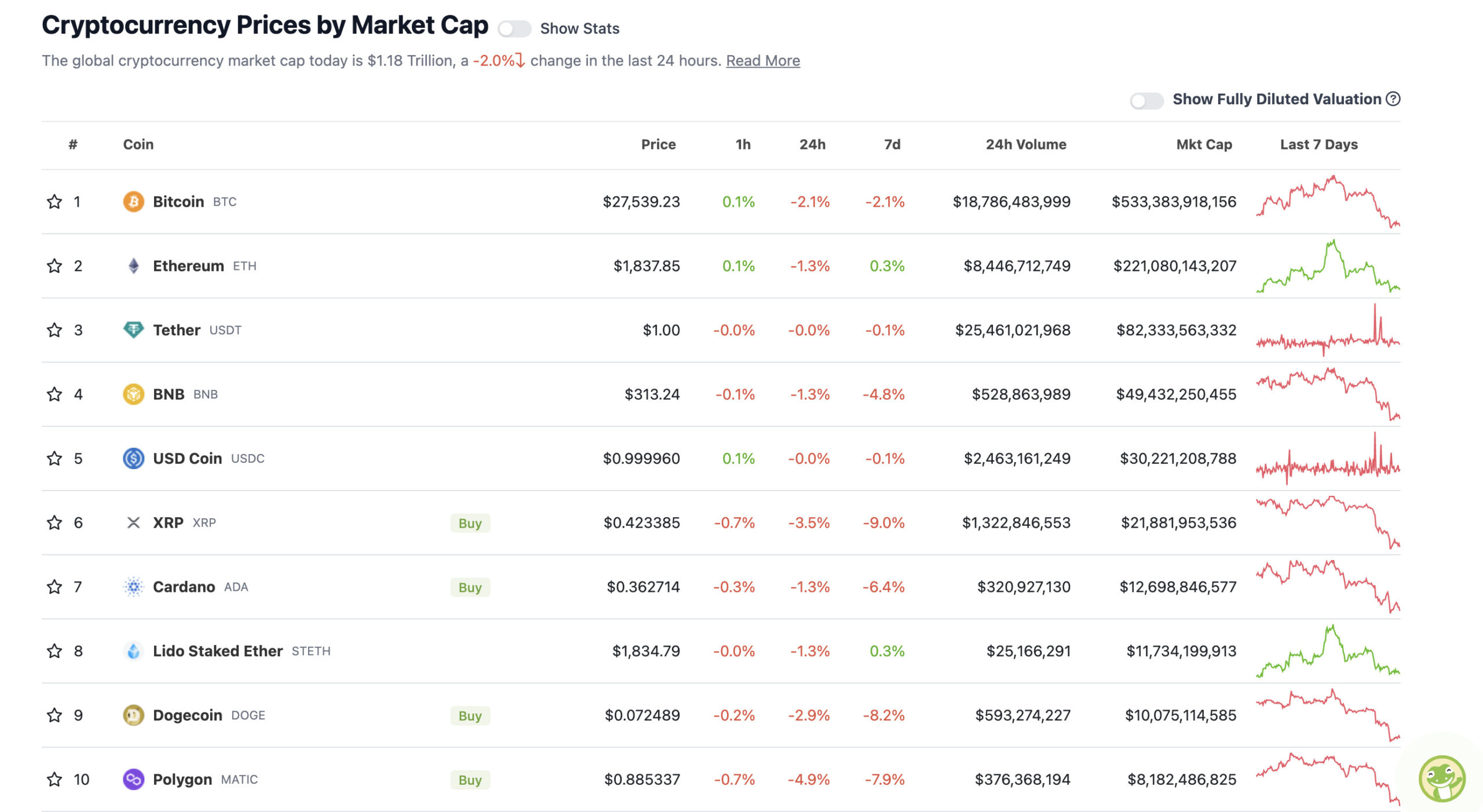

With the overall crypto market cap at US$1.18 trillion, down about 2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin and Ethereum have been clinging on around these levels for most of the day today after a fairly hefty dip in the wee hours this morning (AEST).

Not much else to say about the top 10 majors right now other than Layer 2 Ethereum chain Polygon (MATIC) is currently the biggest dipper there with a -4.9% 24-hour bleed.

Here’s something interesting from the widely followed Crypto Twitterer Kevin Svenson, though, regarding former top 10 stalwart BCH.

With heavy congestion on the Bitcoin network causing some angst here and there (such as on the Binance exchange, for instance), it seems the Bitcoin fork known as Bitcoin Cash (BCH) is receiving some unusually high volume/activity.

People are saying that this is “Block Wars Part 2” as we see $BTC network congested. $BCH narrative might return.

🤷♂️ guess we’ll see

— Kevin Svenson (@KevinSvenson_) May 9, 2023

Bitcoin Cash has always pitched itself as a currency that aims for fast processing times, something the crypto’s proponents claim that the main Bitcoin can’t achieve or scale to a satisfactory level.

Why Svenson thinks this has potential to translate into “altcoin season” is a little unclear, but if Bitcoin’s market dominance decreases, that has been a signal for funds to potentially flow to alts in the past, which has been known to beget froth and FOMO.

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Gas prices fluctuate and go up, transactions get stuck, fees go up, people complain. Bull market issues… 🤷♂️

Look on the bright side though, still faster and cheaper than fiat. 🙏 https://t.co/BMed7EPkAi

— CZ 🔶 Binance (@cz_binance) May 8, 2023

🫣 As #altcoins continue to flush while #Bitcoin & #Ethereum manage to stay afloat in their ranges, we see tons beginning to creep into opportunity zones. Assets where traders are in particular pain & may be bottoming out in the near future include $LTC, $SRM, $RAD, $VIDT, $HIGH. pic.twitter.com/rPy3lPUGJI

— Santiment (@santimentfeed) May 9, 2023

#Binance adds $FLOKI & $PEPE on Cross Margin.https://t.co/USJSdZpPf9

— Binance (@binance) May 9, 2023

Wait for coins to setup then ape.

Not ape and wait for coins to setup.

— Eunice D Wong 🦄 (@Eunicedwong) May 9, 2023